Hey there! If you've ever found yourself staring at your bank statement, scratching your head over unfamiliar charges, you're definitely not alone. Unauthorized transactions can be frustrating and alarming, leaving you questioning your security and the integrity of your financial information. In this article, we'll walk you through the essential steps to investigate these discrepancies and safeguard your accounts from future issues. So, grab a cup of coffee and let's dive deeper into how to tackle unauthorized transactions effectively!

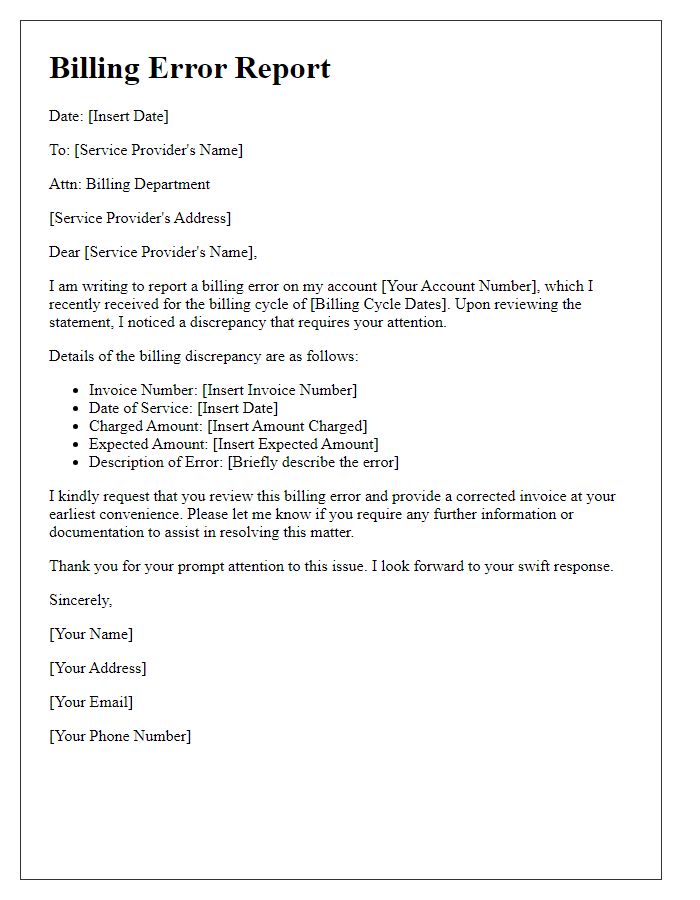

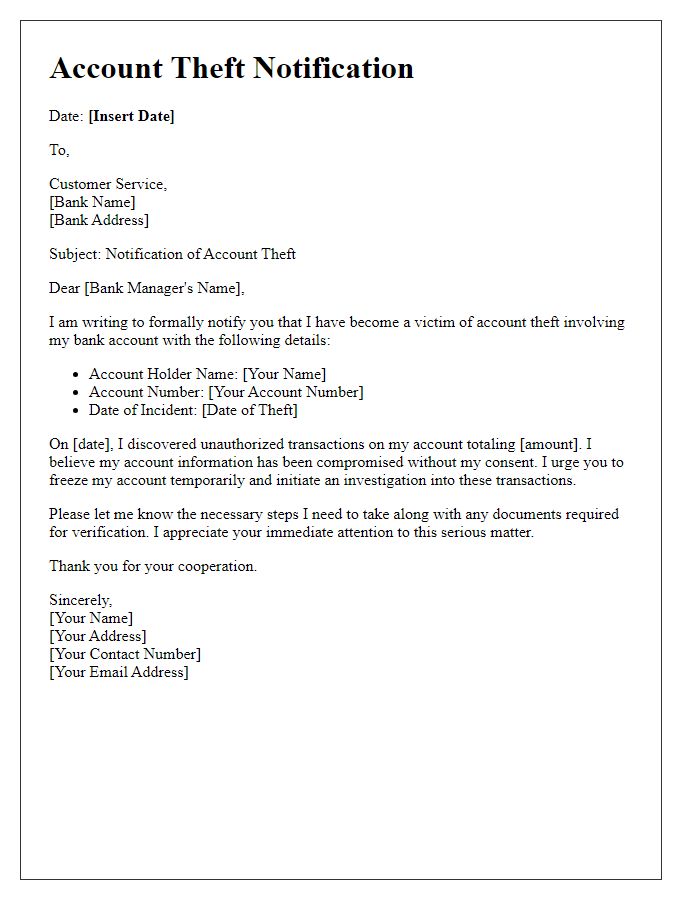

Account Information

Unauthorized transactions in bank accounts can lead to significant financial loss and distress. Victims often realize these discrepancies upon reviewing their account statements, revealing unexpected charges. Financial institutions typically require account holders to provide personal identification details such as account number and transaction dates for a thorough investigation. For example, recent unauthorized transactions may include charges from locations such as online retailers or foreign entities that are unrecognized by the account holder. Immediate reporting to the bank, often within 30 days of noticing the issue, aids in quick resolution and potential recovery of lost funds. Investigative departments may also analyze transaction patterns, flagging suspicious activities that deviate from established spending behaviors.

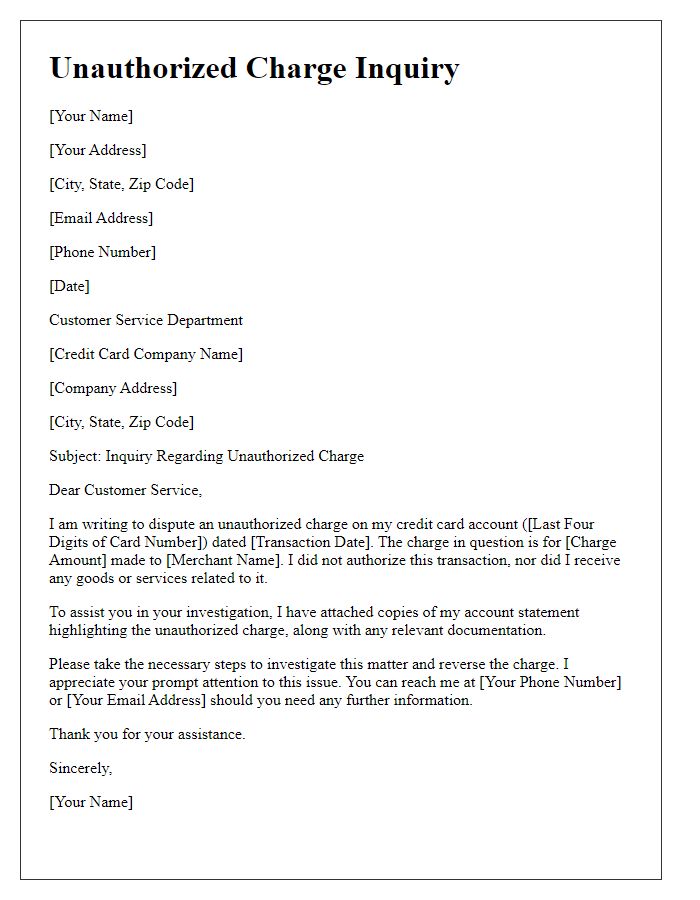

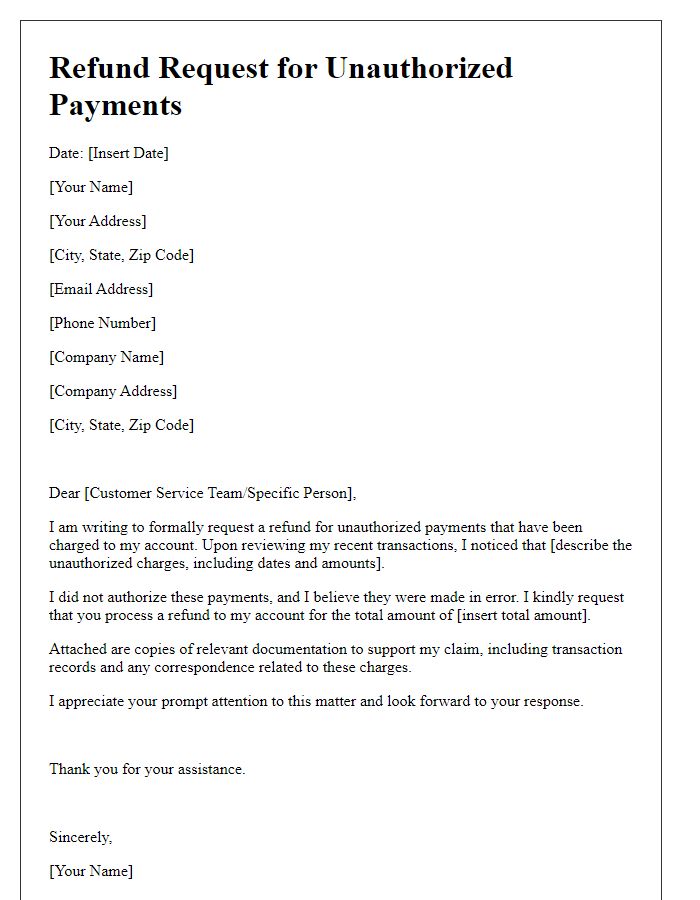

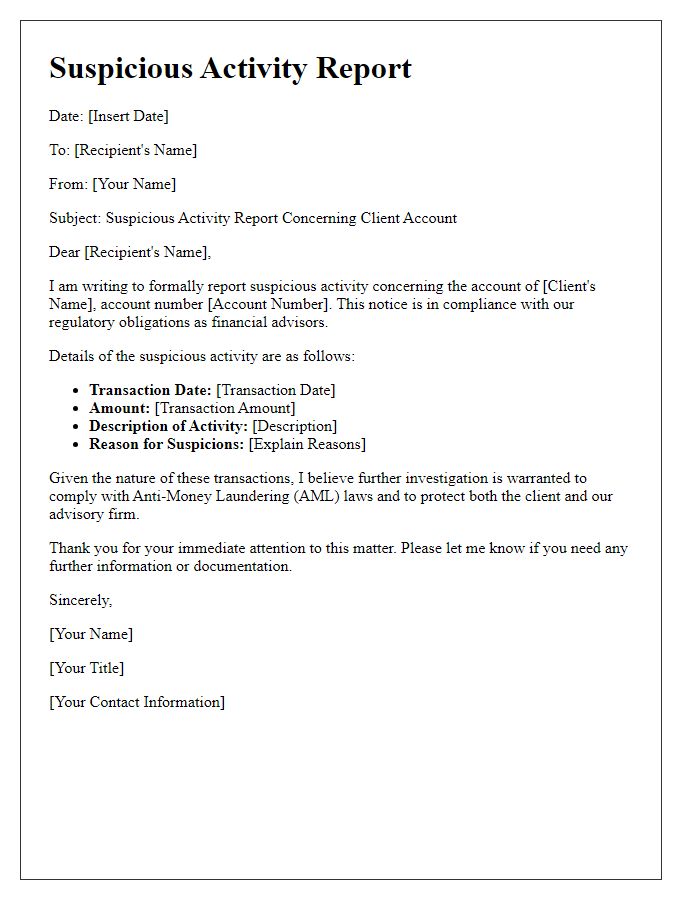

Transaction Details

Unauthorized transactions can significantly impact individuals and businesses, leading to financial losses and compromised security. In 2023, financial institutions reported an increase of 24% in such cases, emphasizing the importance of prompt investigation. Transaction details include critical information such as transaction ID (a unique identifier often consisting of 16 alphanumeric characters), date and time (usually recorded in UTC), merchant name (often found on statements, potentially linked to online platforms like PayPal or eBay), and the amount (which can range from a few cents to thousands of dollars). These details facilitate the investigation process, allowing auditors to trace the origin and nature of unauthorized activities effectively.

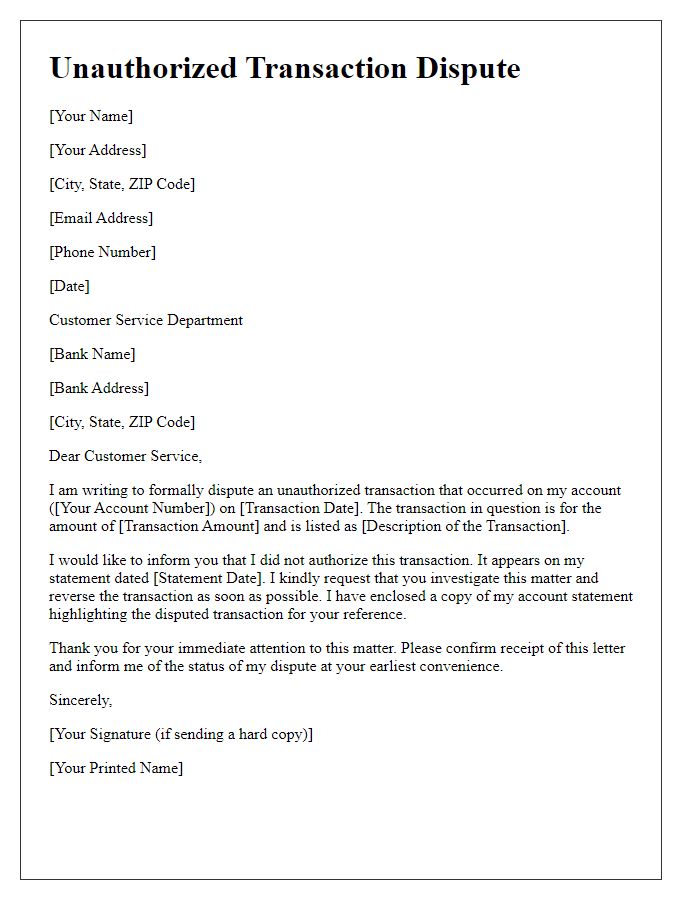

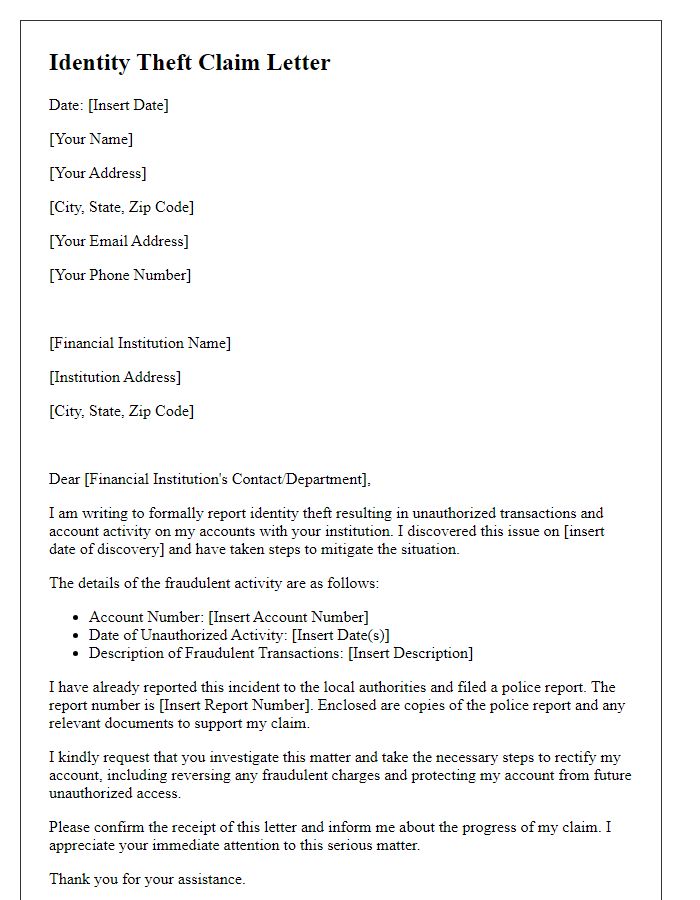

Statement of Dispute

Unauthorized transactions can lead to significant financial loss and breach of trust in banking institutions. When a consumer notices a transaction that they did not authorize, such as a withdrawal or purchase from a credit or debit card, immediate action is required. The affected individual should contact their bank, typically a major institution like Chase or Bank of America, to report the discrepancy. Following this, the consumer must fill out a Statement of Dispute, outlining essential details such as transaction date, amount, and merchant name, with supporting documentation like account statements. Legal statutes, such as the Fair Credit Billing Act (FCBA), provide protections and establish a timeline for the investigation, usually requiring banks to investigate complaints within 30 days. Maintaining detailed records of all communications can assist in resolving disputes efficiently and protecting the consumer's rights.

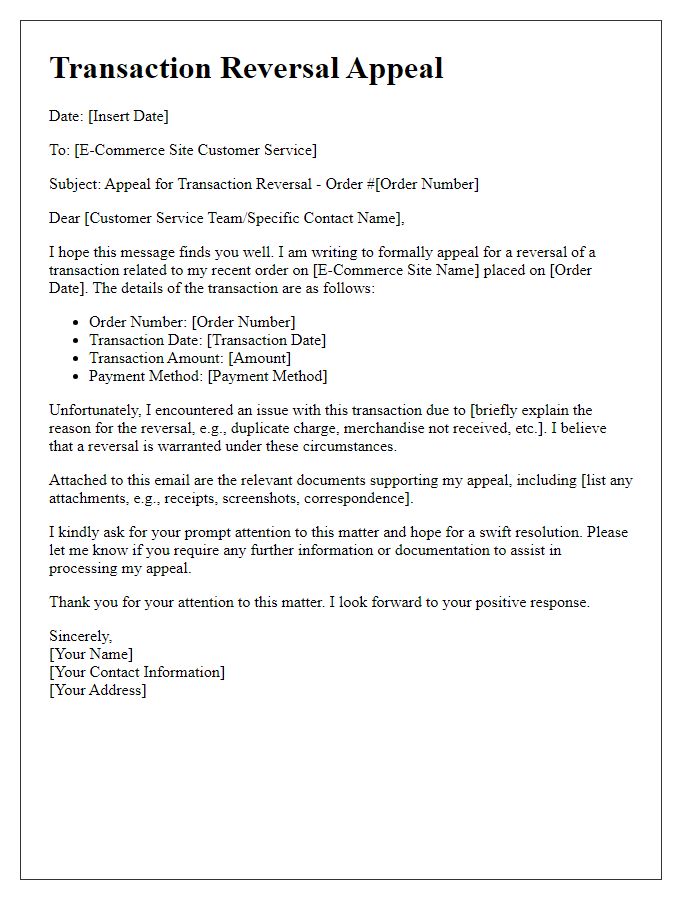

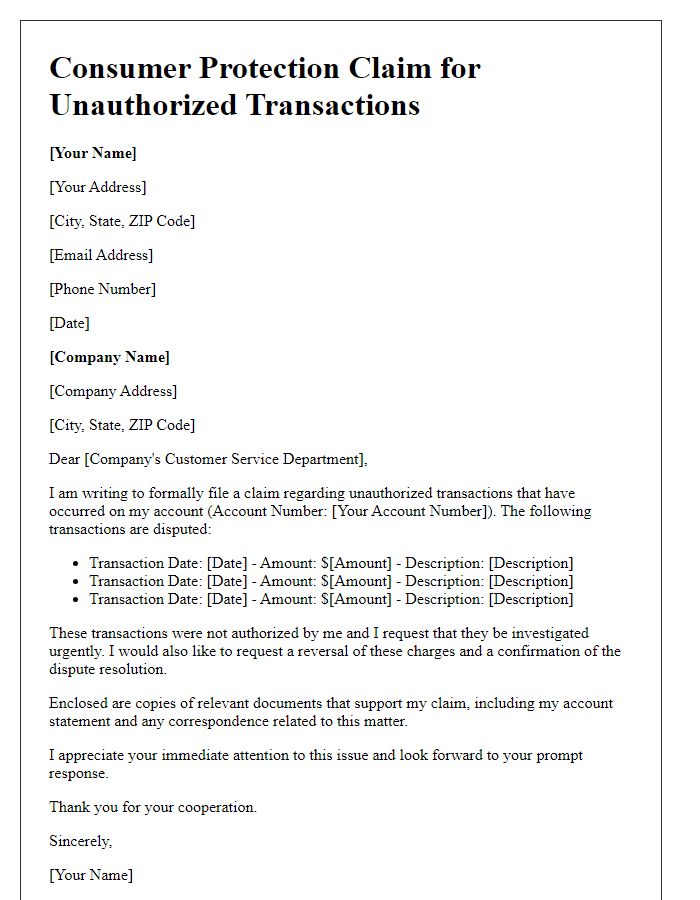

Requested Action

Unauthorized transactions can lead to significant financial distress for individuals and businesses. Each year, millions of reported cases of fraud account for billions of dollars lost, highlighting the importance of swift investigation (typically initiated within 30 days of detection). Affected parties must promptly notify financial institutions, such as banks or credit card companies, to ensure the protection of their accounts. During this investigation, institutions often freeze compromised accounts, preventing further unauthorized access. Additionally, documentation of transaction details, including timestamps, amounts, and merchant names, is crucial for supporting claims. If necessary, law enforcement agencies may get involved to trace fraudulent activities, providing victims with crucial insights into safeguarding against future incidents.

Contact Information

Unauthorized transactions frequently lead to significant financial concerns among consumers. In cases like these, individuals should gather vital contact information, including their bank's customer service number, found on the back of debit or credit cards, and email addresses assigned to fraud departments of financial institutions such as Chase or Bank of America. Important documents must also be collected, such as bank statements reflecting the disputed charges, transaction dates, and amounts. Keeping a record of any previous communication, including dates of discussions and names of representatives, enhances the investigation process. Additionally, noting the date of the unauthorized transaction often aids in timely fraud reporting, as many banks have specific deadlines for disputing charges. Active email accounts can be used for submitting claims digitally for faster processing, while personal identification documents may be required for identity verification purposes, speeding up the resolution.

Letter Template For Unauthorized Transaction Investigation Samples

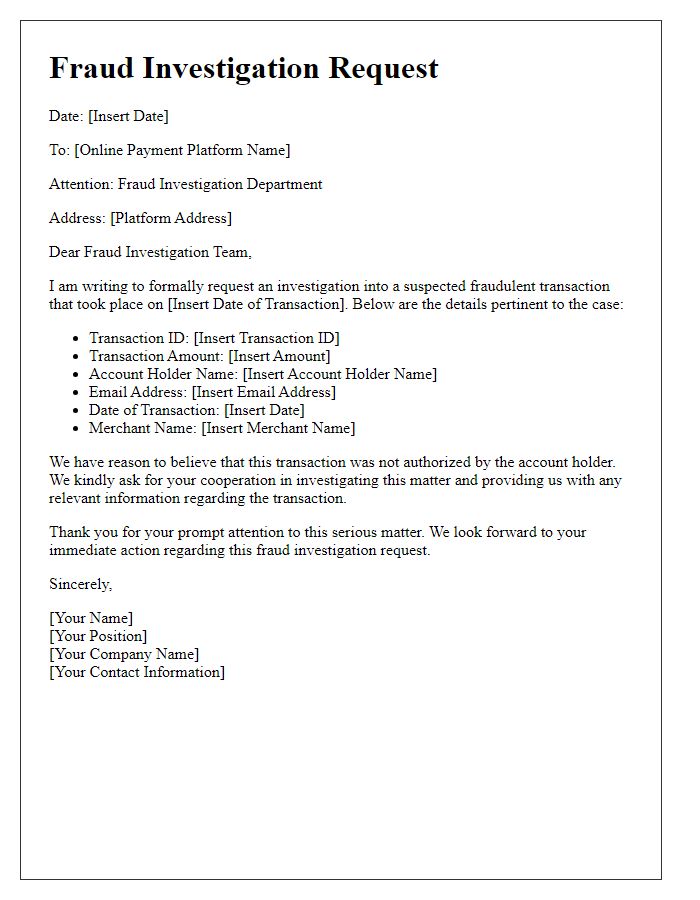

Letter template of fraud investigation request for online payment platforms.

Comments