Are you considering a multi-purpose loan but unsure about how to effectively utilize it? Understanding the various ways you can allocate these funds can make a significant difference in your financial strategy. Whether you're looking to consolidate debt, finance a home renovation, or cover unexpected expenses, knowing the ins and outs of your loan can empower you to make informed decisions. Join me as we explore the advantages and best practices for using your multi-purpose loan to its fullest potential!

Applicant Information

The multi-purpose loan offers financial flexibility for various uses, such as home renovations, debt consolidation, or educational expenses. Applicants, typically individuals aged 18 and above, need to provide personal details like full name, address (including city and zip code), employment status, and annual income. Financial institutions, including banks like JPMorgan Chase or credit unions, may also require information about existing debts and credit scores to assess eligibility. Clarifying intended loan usage helps lenders evaluate risk and tailor loan terms effectively, ensuring both parties understand the loan's purpose.

Loan Purpose Description

Multi-purpose loans are versatile financial products that allow borrowers to utilize funds for various needs, such as home renovations, debt consolidation, or purchasing a vehicle. These loans typically range from $1,000 to $50,000 and can have repayment terms between one to five years, depending on the lender's policies and the borrower's creditworthiness. Borrowers often seek these loans to improve their financial situation by reducing high-interest debts or enhancing their living spaces, thereby increasing property value. Understanding the specific purpose of the loan helps lenders assess risk and tailor repayment options, ensuring a mutually beneficial agreement. Additionally, factors such as interest rates, credit scores, and personal income play crucial roles in determining the loan amount approved and the overall borrowing experience.

Financial Details and Sources

A multi-purpose loan can serve various financial needs, such as home renovations (improvements or expansions to a property), educational expenses (tuition fees, books, or materials), and debt consolidation (combining multiple debts into one loan to potentially reduce interest rates). Financial institutions often require detailed documentation to clarify the intended use of funds. Proper sourcing of income (including salary, bonuses, or investment returns) ensures borrowers can meet repayment terms. Lenders typically assess credit scores (numerical representation of creditworthiness) and analyze existing liabilities (any outstanding debts) to determine loan eligibility and risk. Clear communication about the loan's purpose enhances transparency and trust between borrowers and lenders.

Supporting Documents

Supporting documents for multi-purpose loan usage provide essential evidence for various expenditures, such as home renovations, vehicle purchases, or debt consolidation. These documents include receipts for services rendered, contracts for construction projects, and invoices for purchased goods. A well-prepared submission may involve bank statements reflecting loan utilization, pay stubs validating borrower income, and tax returns demonstrating financial stability. Additionally, it is beneficial to present a detailed loan proposal outlining intended uses and expected financial benefits, enhancing the clarity and purpose of the loan application process. Providing comprehensive and organized supporting documentation ensures a smoother review process by the lending institution.

Acknowledgment and Consent

A multi-purpose loan, a financial product allowing borrowers to utilize funds for various needs, can greatly enhance personal finance flexibility. Borrowers must understand the intended use of funds to ensure optimal repayment strategy. Common purposes for such loans include home improvements to increase property value, debt consolidation to manage multiple debts effectively, and unexpected medical expenses that help maintain health stability. Clarity in loan usage can also positively impact credit scores and future borrowing potential. Responsible management of these funds emphasizes the importance of a well-defined budget and timely repayments, minimizing financial strain. Understanding the terms, interest rates, and repayment schedules associated with multi-purpose loans helps borrowers make informed decisions.

Letter Template For Multi-Purpose Loan Usage Clarification Samples

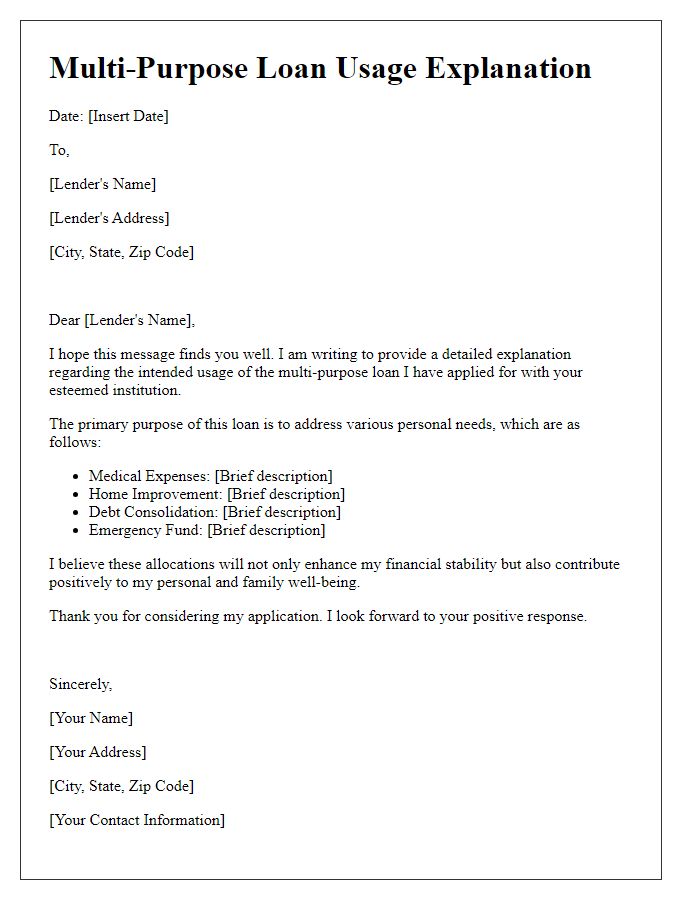

Letter template of multi-purpose loan usage explanation for personal needs.

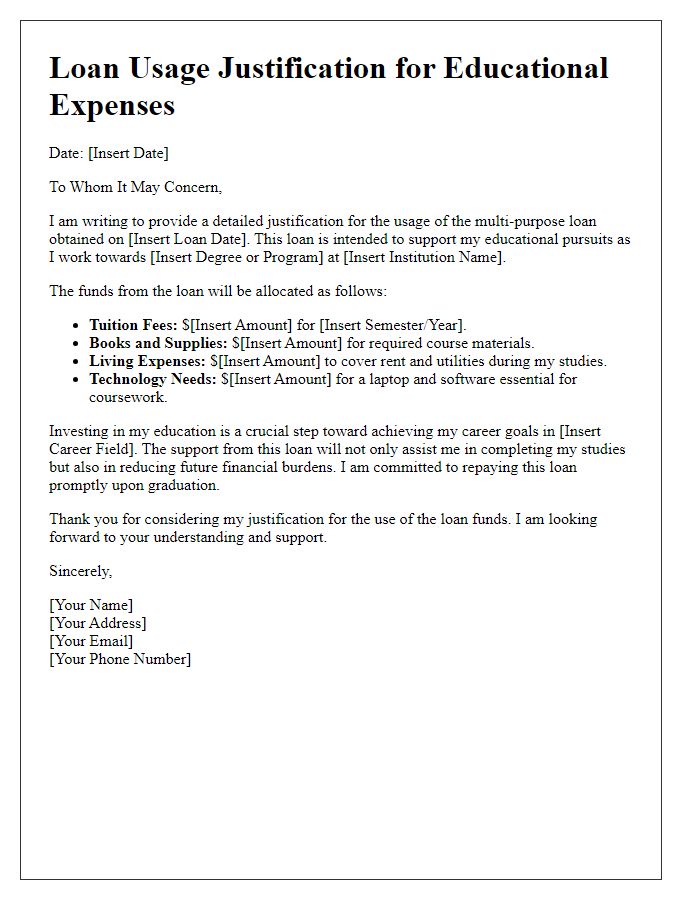

Letter template of multi-purpose loan usage justification for educational expenses.

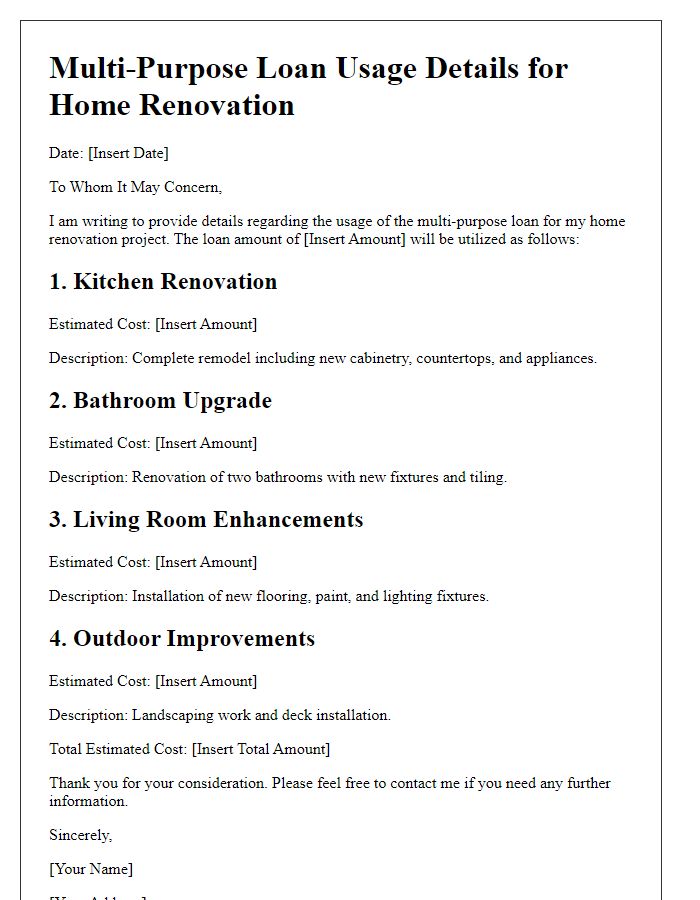

Letter template of multi-purpose loan usage details for home renovation projects.

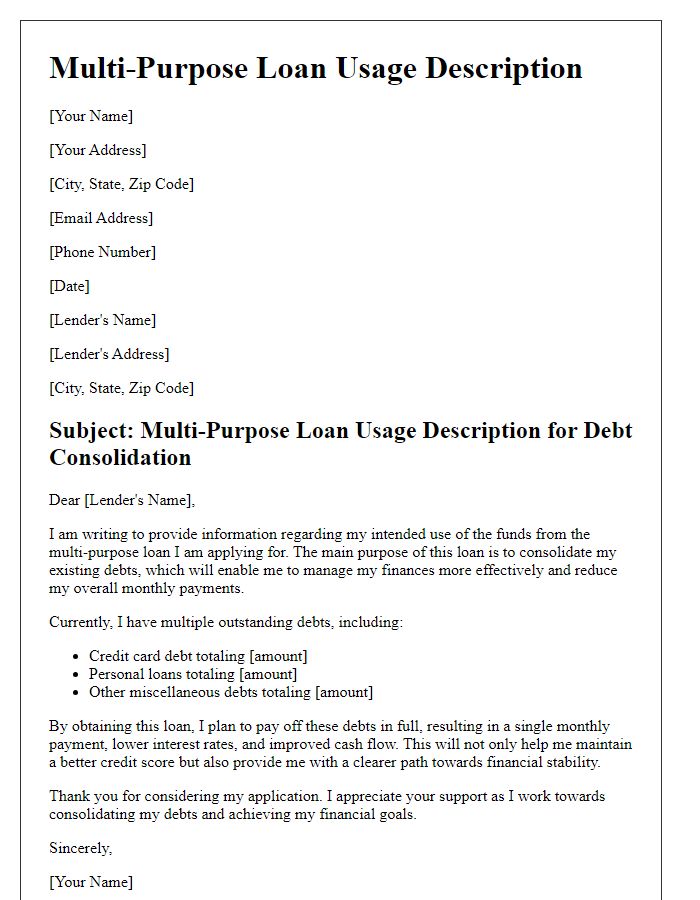

Letter template of multi-purpose loan usage description for debt consolidation.

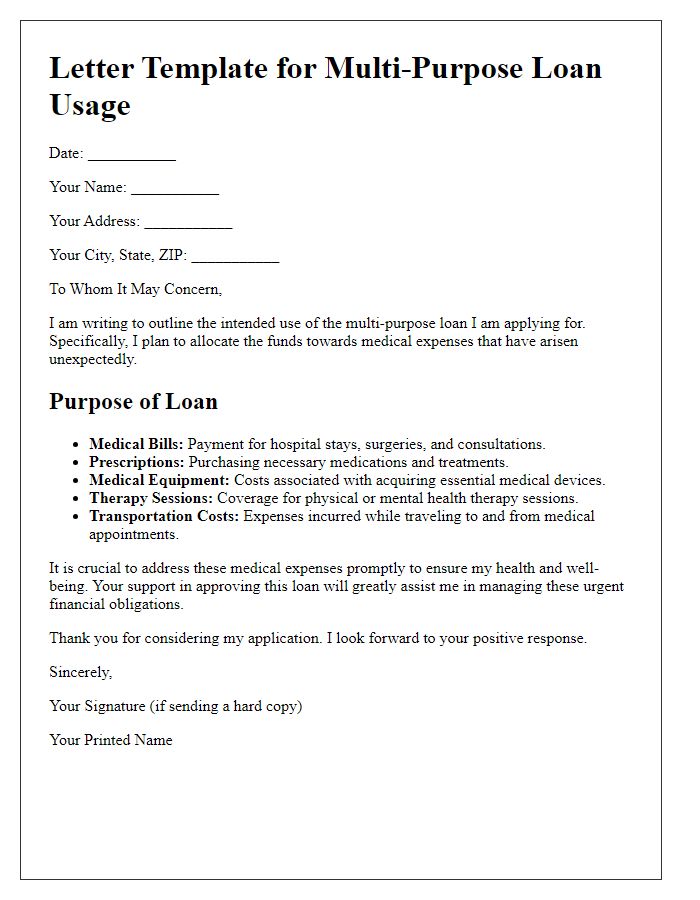

Letter template of multi-purpose loan usage outline for medical expenses.

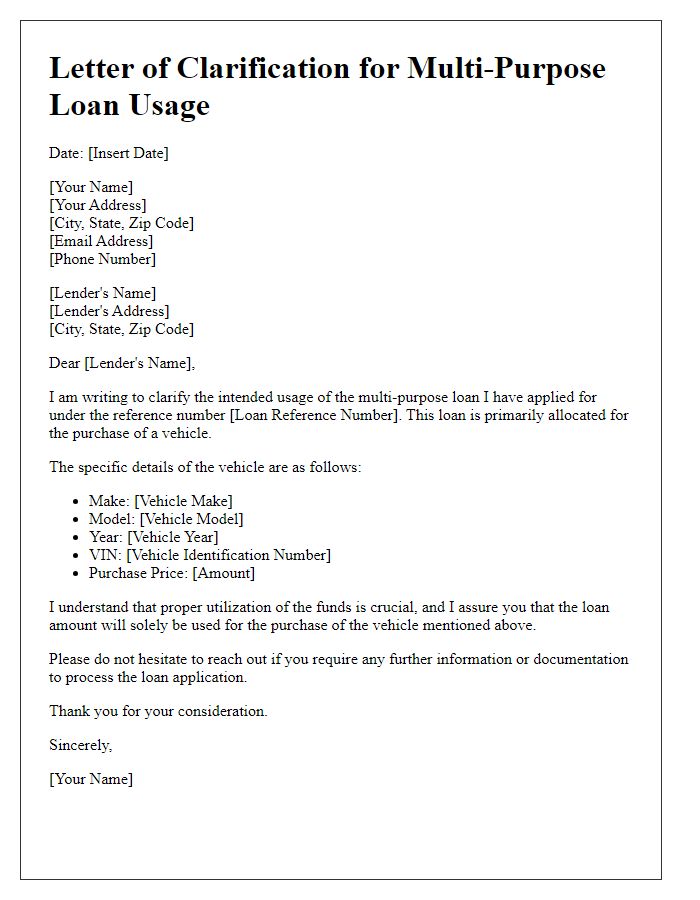

Letter template of multi-purpose loan usage clarification for vehicle purchase.

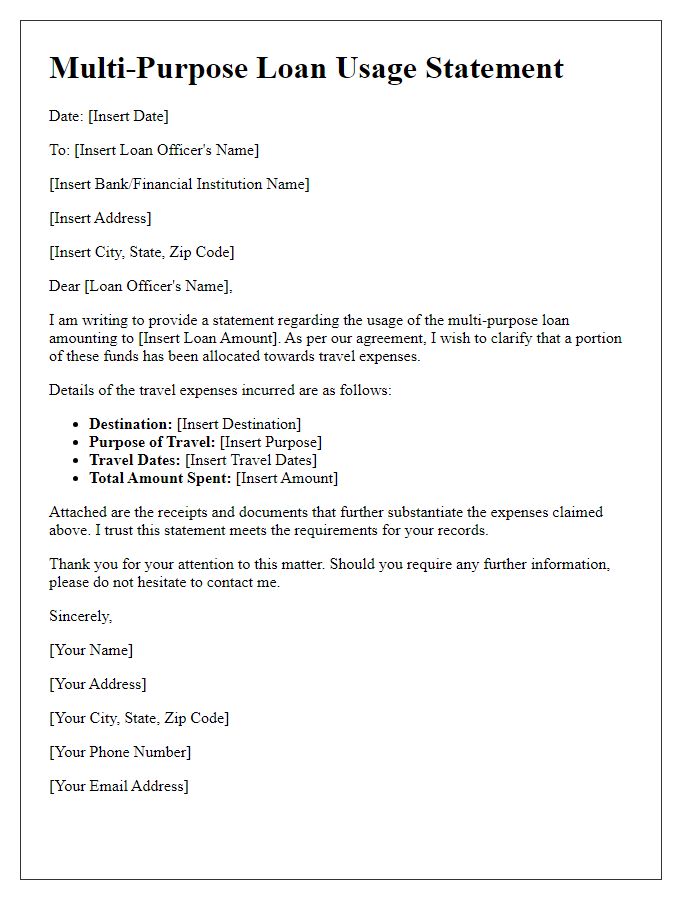

Letter template of multi-purpose loan usage statement for travel expenses.

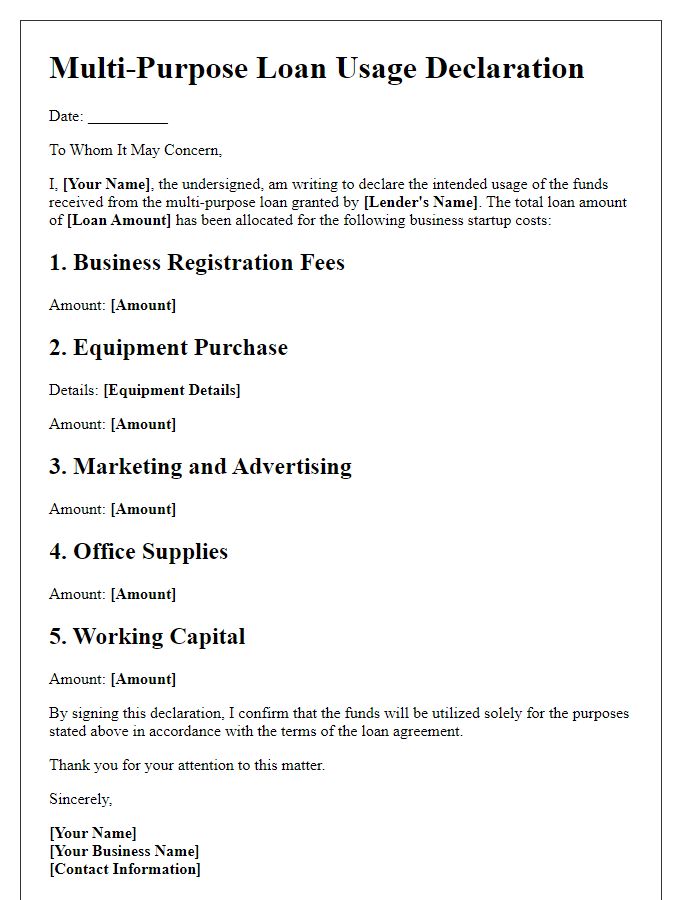

Letter template of multi-purpose loan usage declaration for business startup costs.

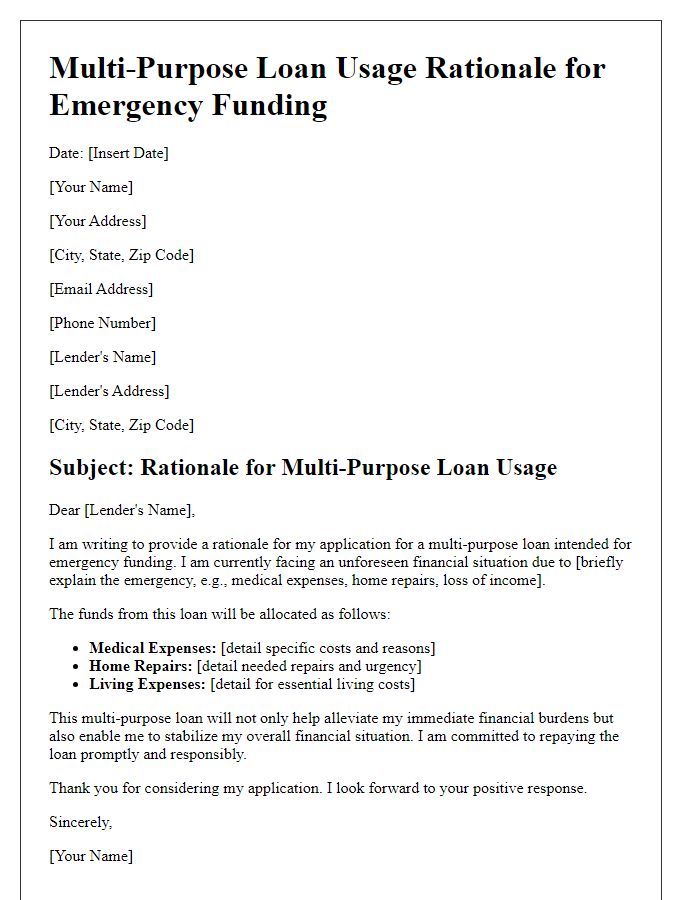

Letter template of multi-purpose loan usage rationale for emergency funding.

Comments