Are you feeling overwhelmed by the complexities of loan terms and conditions? You're not alone; many people find navigating the fine print daunting. Understanding these terms can empower you to make informed decisions about your financial future. So, let's dive into the essential aspects that you should know, and I invite you to read more for a clearer picture!

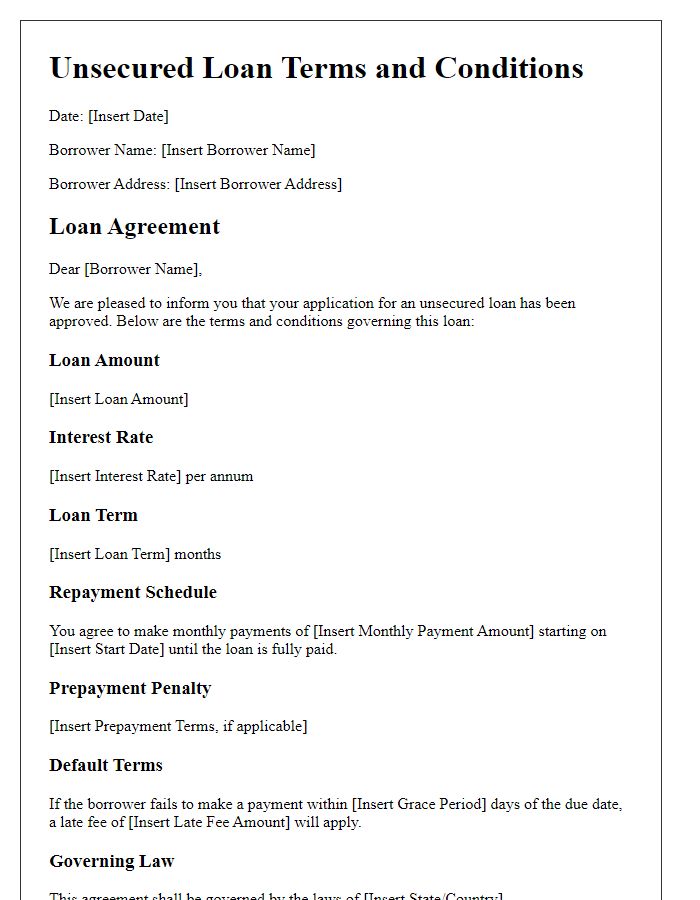

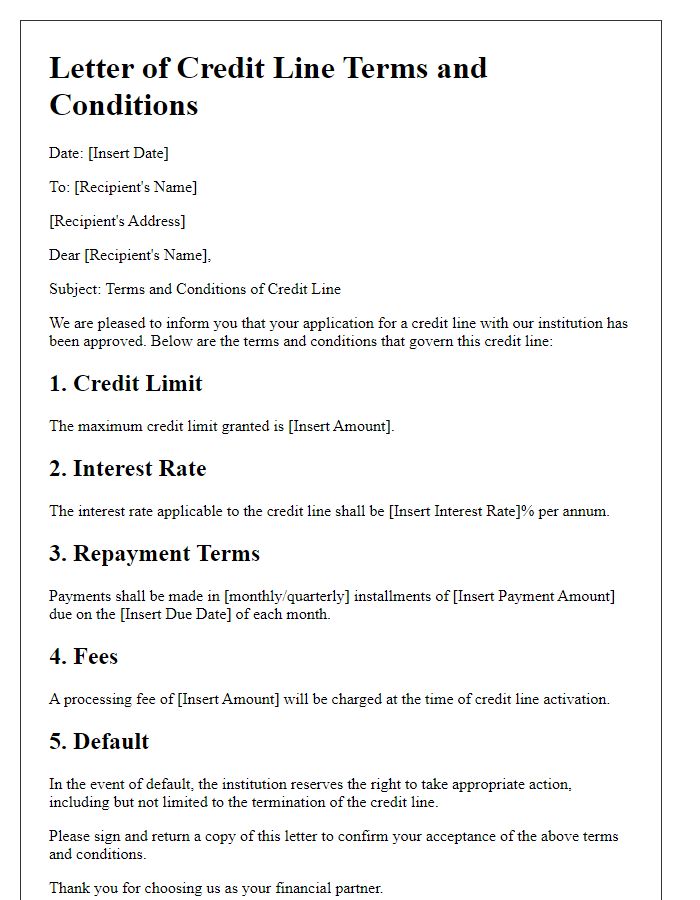

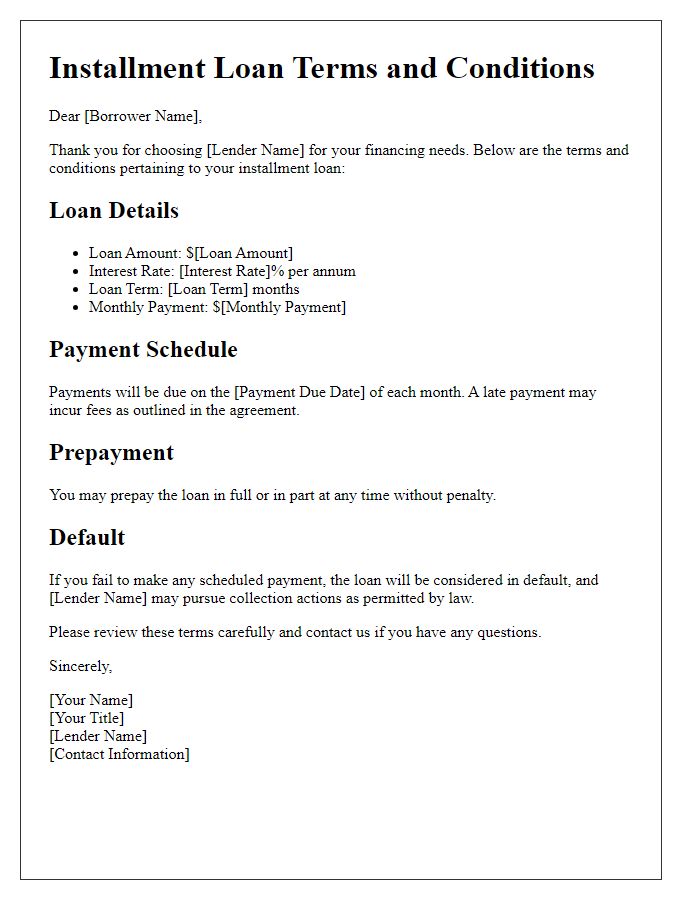

Loan Amount and Disbursement Details

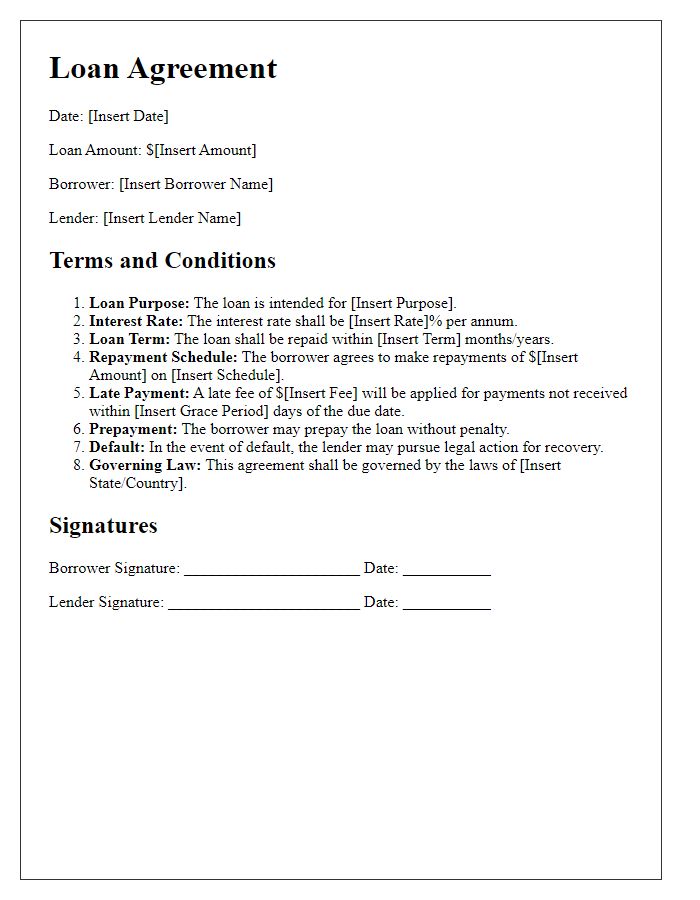

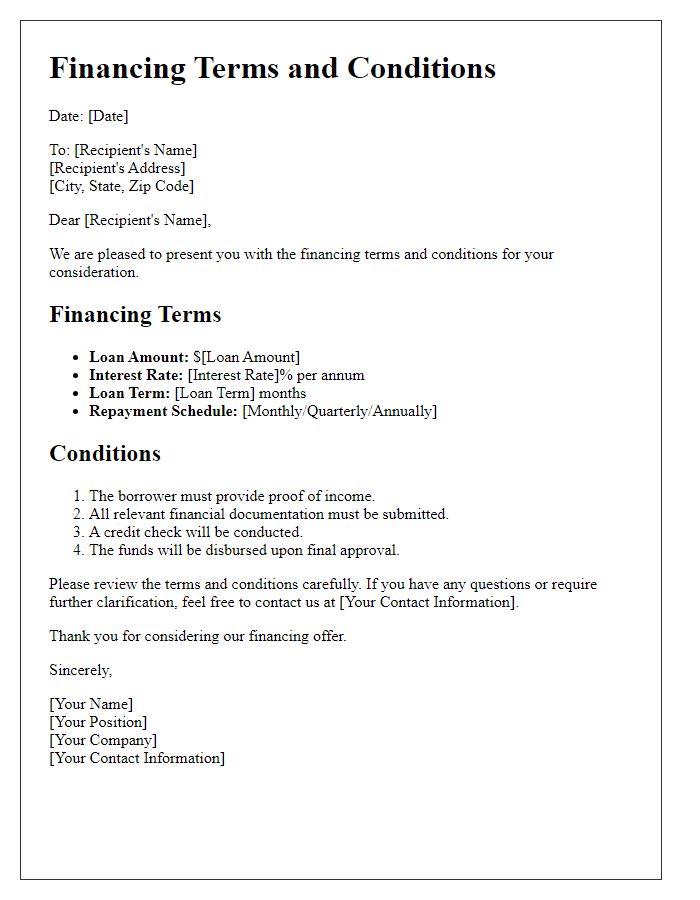

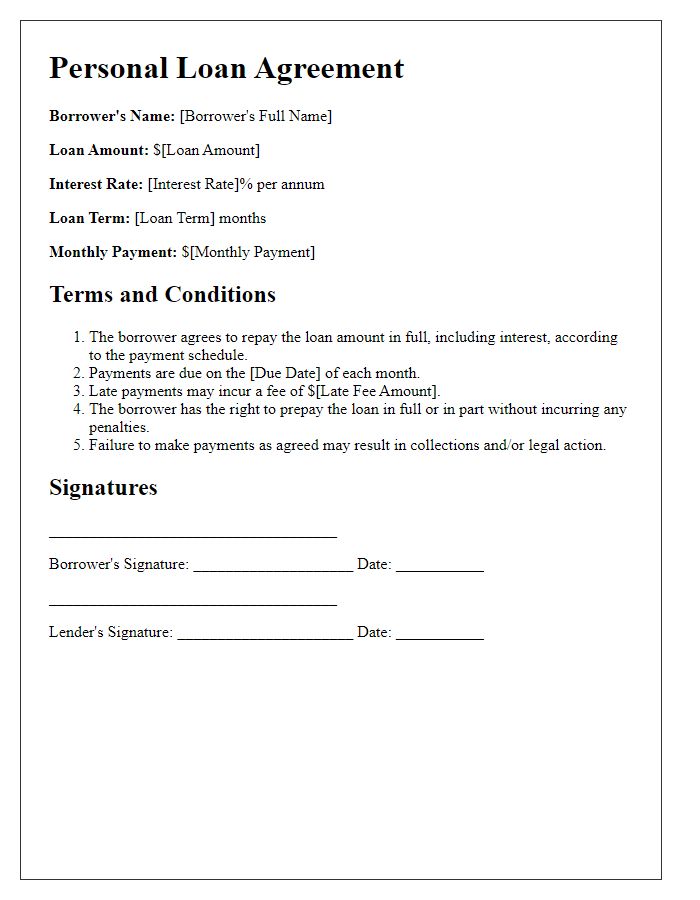

Loan agreements typically stipulate specific terms and conditions surrounding the loan amount and disbursement details. For instance, a personal loan of $10,000 may have an interest rate of 5% per annum, with a repayment period of 36 months. Disbursement may occur within 3 business days after loan approval, deposited directly into the borrower's designated bank account. The borrower may also be subject to additional fees, such as origination fees ranging between 1% to 5% of the loan amount. Conditions for disbursement could include verification of income, credit checks, and collateral requirements depending on the lender's policies.

Interest Rate and Repayment Schedule

The interest rate for a personal loan, typically ranging between 5% and 36%, significantly impacts the overall cost of borrowing. Borrowers with higher credit scores can secure lower rates, while those with subprime ratings may face elevated interest levels. Repayment schedules, which may vary from 12 to 84 months, outline the frequency of payments, often bimonthly or monthly, which can affect financial planning. Late payment penalties, typically around 5% of the missed installment amount, can increase the debt burden. A comprehensive understanding of these terms is essential for making informed financial decisions regarding loan management and budget allocation.

Collateral and Security Requirements

Collateral requirements for securing loans often include tangible assets such as property or vehicles. Lenders generally assess the fair market value of collateral to determine loan-to-value (LTV) ratios, which can range from 70% to 90% based on asset type. Common security requirements may involve legal documentation, such as a lien or mortgage agreement, ensuring the lender's interest is protected. In addition, personal guarantees from borrowers can serve as additional security, providing reassurance to lenders. Regulatory compliance may necessitate thorough appraisals and credit assessments, focusing on the borrower's financial stability and repayment capacity.

Late Payment Penalties and Fees

Late payment penalties and fees significantly impact borrowers' financial obligations. Typically, lenders impose a late fee, often calculated as a percentage of the outstanding payment or a fixed dollar amount, starting 15 days post-due date. In many cases, this fee can range from $25 to $50, depending on the loan agreement specifics and state regulations. Additionally, continuous late payments may lead to increased penalties and a potential rise in the interest rate, altering monthly repayment amounts, as well as overall loan cost. Borrowers who experience repeated late payments could also face consequences such as damaged credit scores, hindering future borrowing capabilities, particularly within financial institutions like banks or credit unions. Understanding the loan terms regarding late payment penalties ensures better financial planning and adherence to repayment schedules.

Borrower Obligations and Lender Rights

Loan agreements outline Borrower obligations and Lender rights. Borrowers are required to make timely payments as stipulated in the loan agreement, typically monthly installments over a specified period, such as five years for personal loans or thirty years for mortgages. Payment schedules must be adhered to, including principal and interest amounts, which are predetermined by the interest rate, either fixed or variable, agreed upon at the loan's inception. Borrowers also bear the responsibility of maintaining collateral, such as real estate or vehicles, ensuring they remain in good condition to protect Lender interests. Lenders reserve rights to enforce penalties for late payments, which might include late fees or increased interest rates, as specified in the agreement. Additionally, Lenders maintain the authority to initiate foreclosure or repossession processes if Borrowers default on their obligations, ensuring recovery of outstanding debts. Compliance with all terms within the loan documentation is crucial for maintaining a constructive Borrower-Lender relationship.

Comments