Are you considering taking out a specialized career loan but feeling overwhelmed by the options? You're not aloneânavigating the world of student loans and financial aid can be daunting. This guide will break down essential tips and strategies to help you make informed decisions for your future. So, let's dive in and discover how you can secure the funding you need to achieve your career goals!

Comprehensive Loan Terms

Comprehensive loan terms encompass a variety of critical elements that borrowers must consider when seeking financial assistance for higher education or career development. Key components include the interest rate, which may vary significantly between federal (typically lower and fixed rates) and private loans (potentially variable rates). The loan term duration often ranges from 5 to 30 years, influencing monthly repayment amounts and total interest paid. Additionally, the loan amount can significantly impact the borrower's financial future, with some programs offering amounts exceeding $100,000. Borrowers should be aware of applicable fees, such as origination fees or late payment penalties, as these can add to the overall cost of borrowing. Repayment plans, including options for deferment or income-driven repayment, provide flexibility based on individual financial circumstances. Understanding these terms plays a crucial role in making informed decisions regarding educational financing.

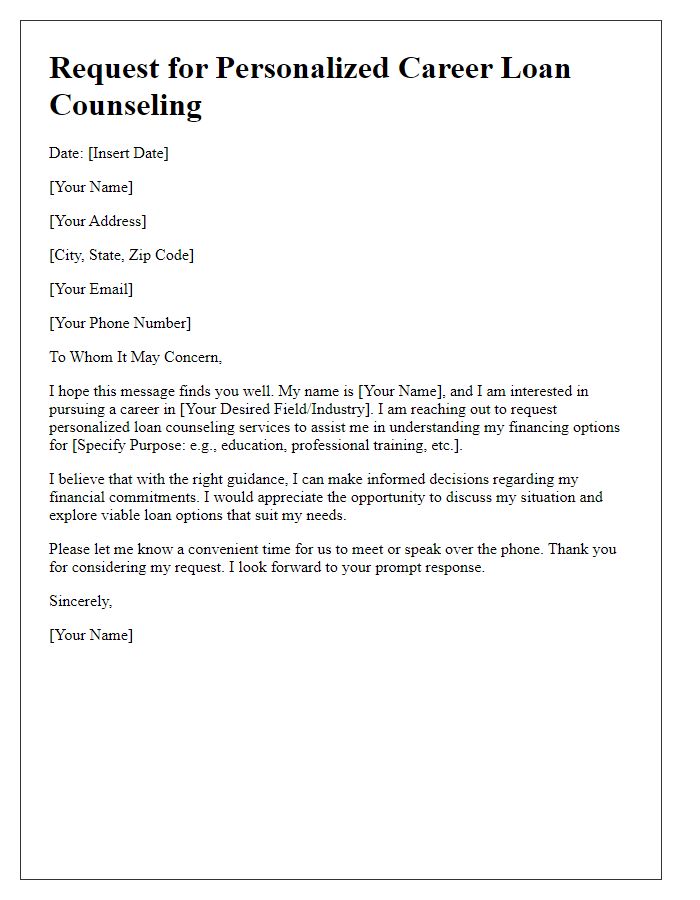

Personalized Financial Strategies

Personalized financial strategies provide tailored solutions for individuals seeking specialized career loan counseling. This service assesses the unique financial landscape of each client, considering factors like credit score, income level, and existing debt. Career-focused loans, often associated with fields like healthcare, education, and technology, can impact financial decisions significantly. Clients may benefit from detailed budgeting techniques or repayment plans suited to their career trajectories. Additionally, counseling sessions can include information about potential loan forgiveness programs, which vary by profession and can alleviate long-term financial burdens. Understanding the landscape of interest rates and repayment terms is crucial, particularly in dynamic markets.

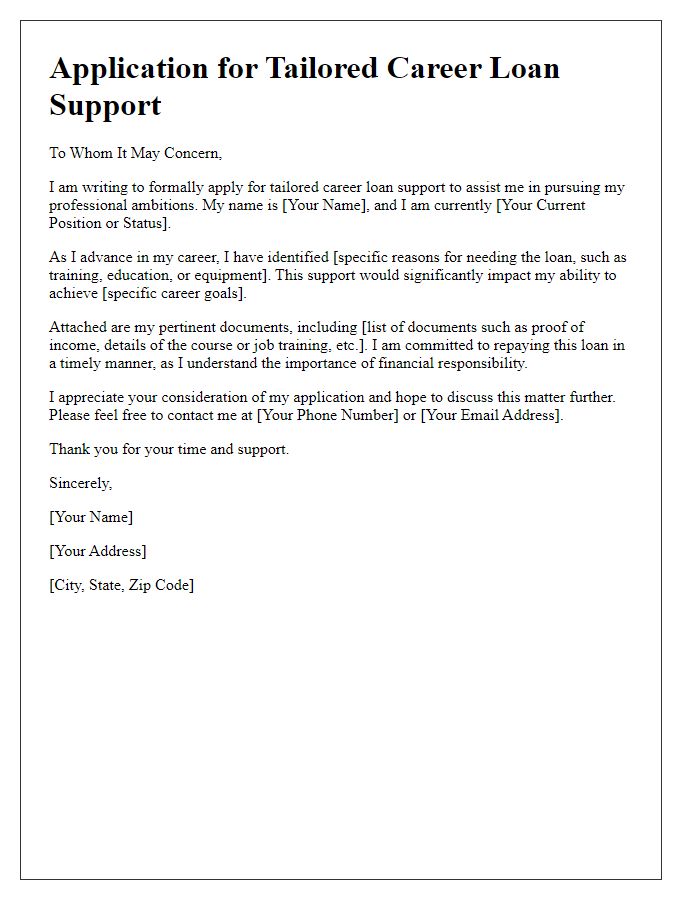

Detailed Repayment Plans

Specialized career loan counseling offers tailored repayment plans designed to assist borrowers in managing their educational debt effectively. One-on-one consultations explore various options, including Income-Driven Repayment Plans (IDR) that adjust monthly payments based on individual income levels, ensuring affordability. Public Service Loan Forgiveness (PSLF) programs provide paths for loan forgiveness after ten years of qualifying payments for individuals dedicated to non-profit or government roles. Fixed and variable interest rates impact repayment terms significantly, with loans often ranging from $5,000 to $200,000 for professional degrees in fields such as medicine or law. Comprehensive financial assessments take into account current living expenses and future income potential, facilitating the creation of sustainable budgets that prioritize financial health while advancing career goals.

Loan Impact Analysis

Specialized career loan counseling often involves a meticulous loan impact analysis, crucial for individuals pursuing education or vocational training in high-demand fields such as healthcare or technology. The analysis includes evaluating federal student loan options, like the Direct Subsidized Loan, which offers low interest rates (around 3.73% as of July 2021) and potential forgiveness programs for public service careers. It also assesses the implications of private loans, which may come with higher rates and variable terms. Key considerations include projected salary ranges for specific careers, for instance, registered nurses earning an average annual salary of $75,330 in the United States, and potential student debt to income ratios. Tracking these financial metrics ensures informed decision-making and strategic planning, leading to successful career outcomes while minimizing long-term financial burdens.

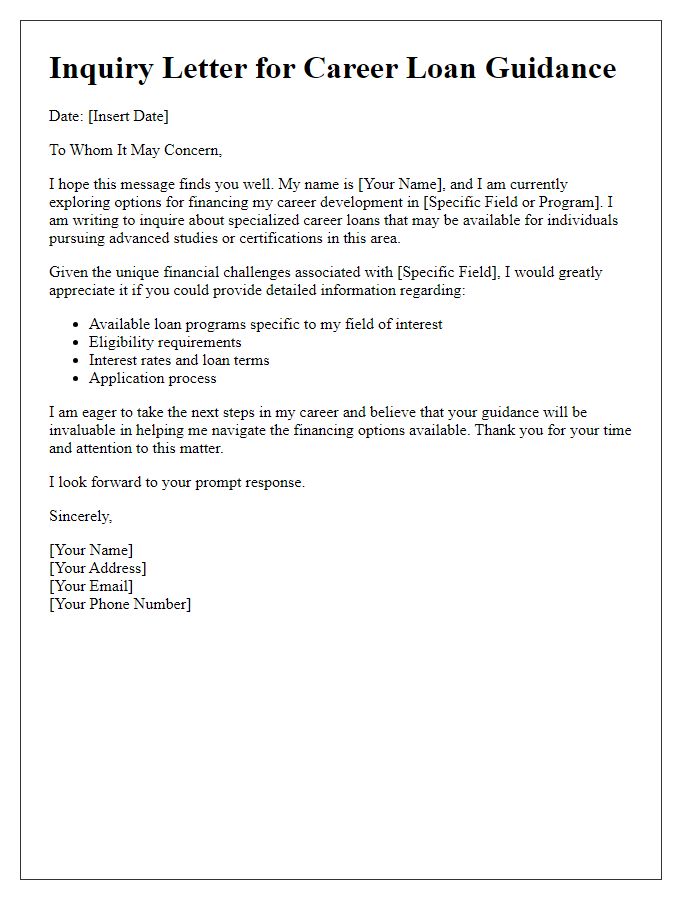

Industry-Specific Advice

Specialized career loan counseling services provide tailored guidance for individuals seeking financial assistance in pursuing their unique career paths. These services often address diverse industries, such as healthcare, technology, and the arts, each requiring specific strategies for loan management and career development. For instance, healthcare professionals may need to consider loans for advanced degrees and residency programs, with varying costs often exceeding $200,000 in total debt. Conversely, technology sector employees might explore loan options for coding boot camps, which can range from $10,000 to $20,000, with a focus on rapid skills acquisition. Moreover, individuals in the arts may seek grants and low-interest loans, aimed at funding creative projects, often needing financial literacy training specific to project budgeting and management. Each industry demands a personalized approach, ensuring comprehensive financial advice tailored to the unique challenges and opportunities presented.

Comments