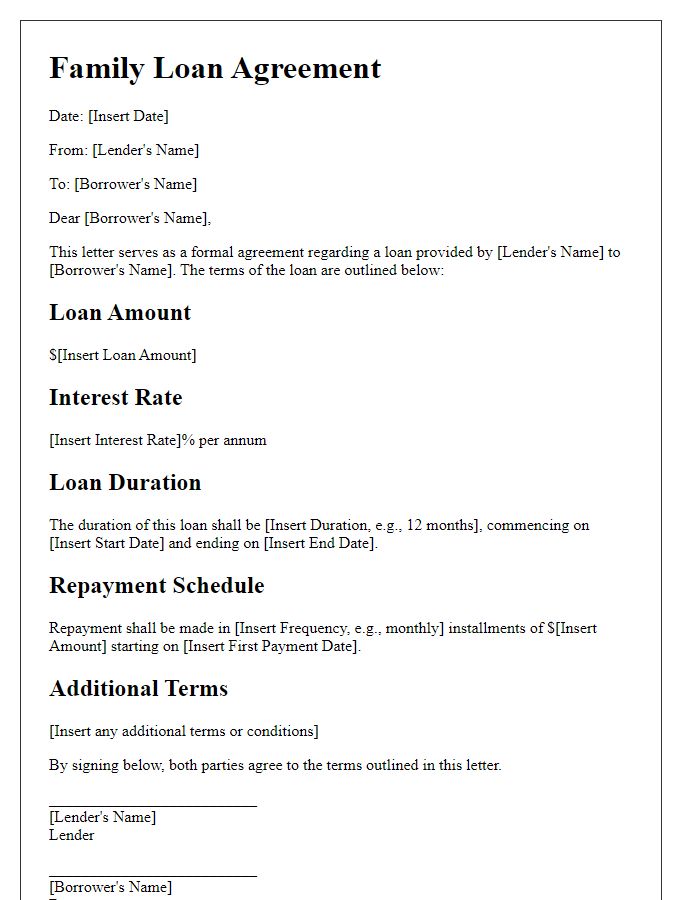

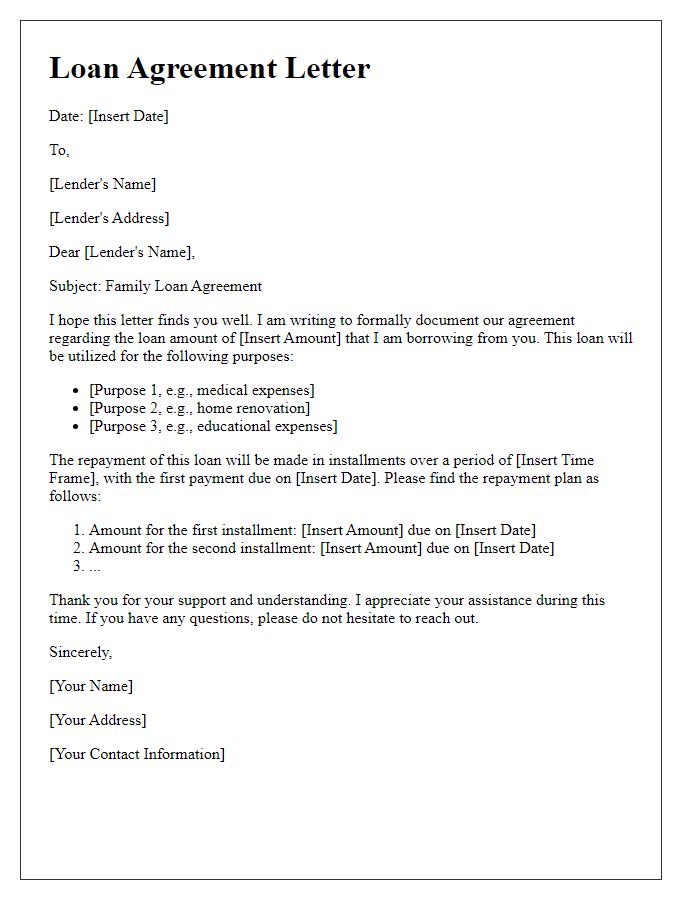

Are you considering a family loan arrangement and unsure how to formalize the agreement? Whether it's to help a relative through a tough time or to fund a dream project, setting clear terms is crucial for maintaining healthy relationships. In this article, we'll walk you through a simple letter template that outlines the essential components of a family loan agreement, ensuring everyone is on the same page. Let's dive in and explore how you can create a fair and transparent arrangement!

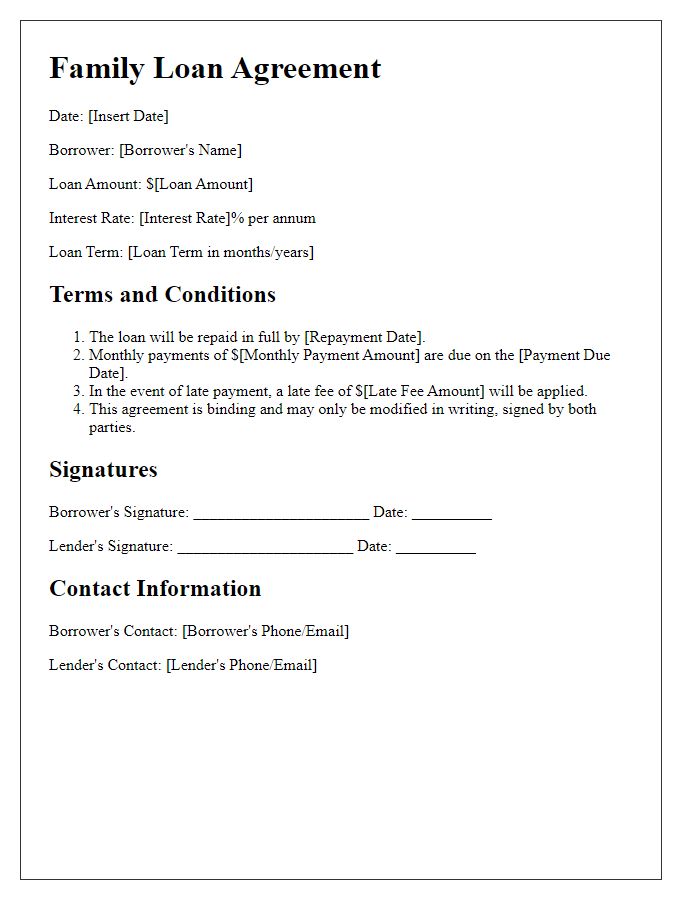

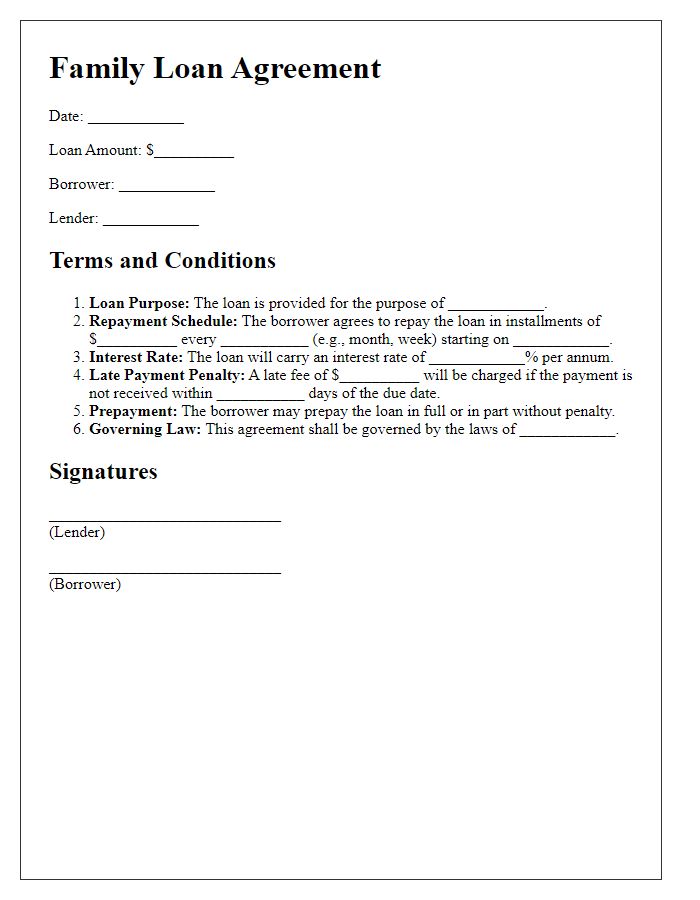

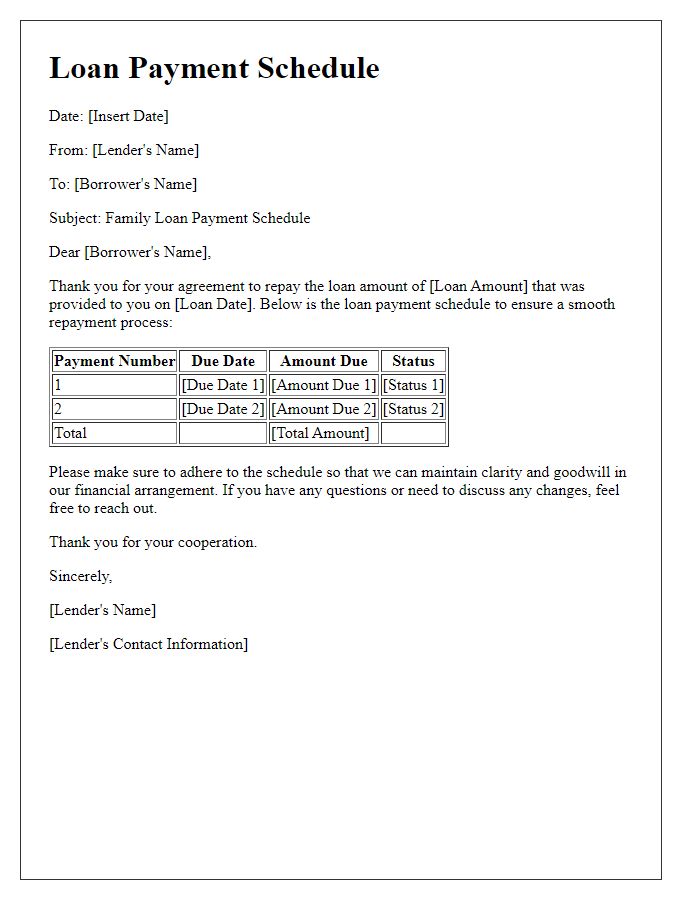

Loan Amount and Repayment Schedule

A family loan arrangement often includes essential terms such as the loan amount, which specifies the total monetary assistance being provided, and a repayment schedule, detailing the timeline and frequency of payments. For instance, a loan amount of $5,000 may be agreed upon for funding education costs. The repayment schedule could stipulate monthly payments over a two-year period, with each installment amounting to approximately $208. This structure ensures clarity regarding expectations, making financial management easier for both parties, while fostering trust in familial financial interactions. Key details like interest rates, payment methods, and reminders must also be included to maintain clear communication.

Interest Rate and Fee Structure

When arranging a family loan, it's essential to clearly outline the interest rate and fee structure to maintain transparency and avoid misunderstandings. Interest rates may vary; for example, a typically low family loan interest rate might hover around 2% to 5%, which is often significantly lower than standard bank rates. Additionally, specify whether there are any origination fees (usually a percentage of the total loan amount) or late payment fees (commonly ranging from $15 to $50) that could apply. Flexibility in repayment terms can be beneficial, with options for monthly or bi-weekly payments, helping to accommodate different financial situations among family members. Recording these terms in a written agreement can foster trust and clarity in the family dynamic.

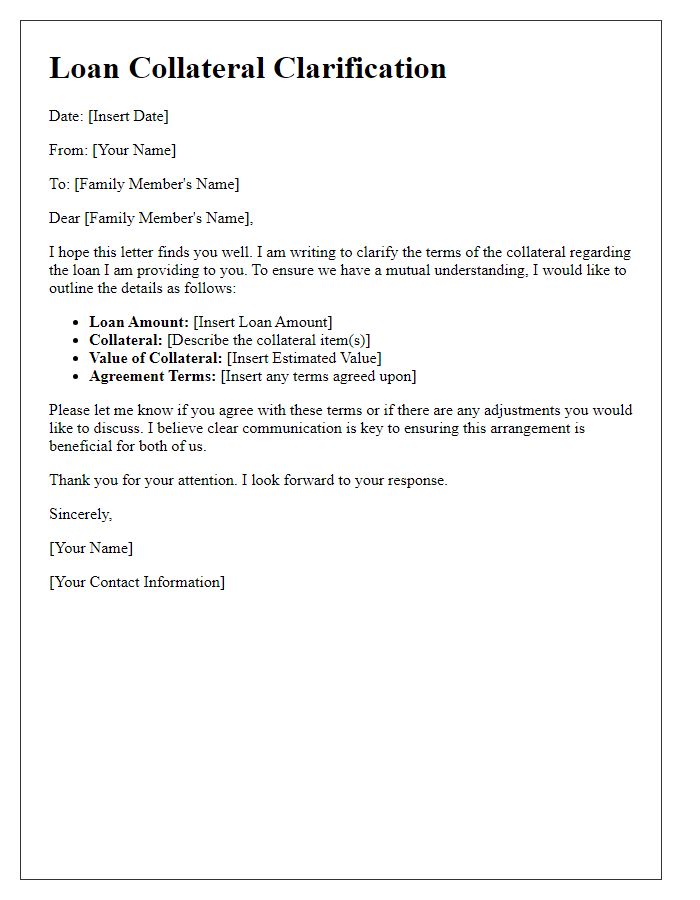

Collateral or Security Arrangements

When securing a family loan, collateral or security arrangements provide protection for the lender, ensuring that the borrowed amount is recoverable if repayment issues arise. Common forms of collateral include real estate, such as family homes or investment properties, which typically hold significant value--often in the hundreds of thousands to millions of dollars. Other options include vehicles (e.g., cars, trucks) valued based on market conditions, jewelry with appraisals listing them at several thousand dollars, or even financial assets such as savings accounts, certificates of deposit, or stocks. Clear documentation of the agreed collateral, including property deeds or asset valuations and a formal written agreement outlining repayment terms and conditions, creates transparency. Establishing a reasonable interest rate--typically lower than traditional lenders--further ensures fairness while maintaining family bonds. Additionally, this formalizes expectations regarding default scenarios, clarifying the process for liquidating collateral if repayment fails, thus safeguarding both parties involved.

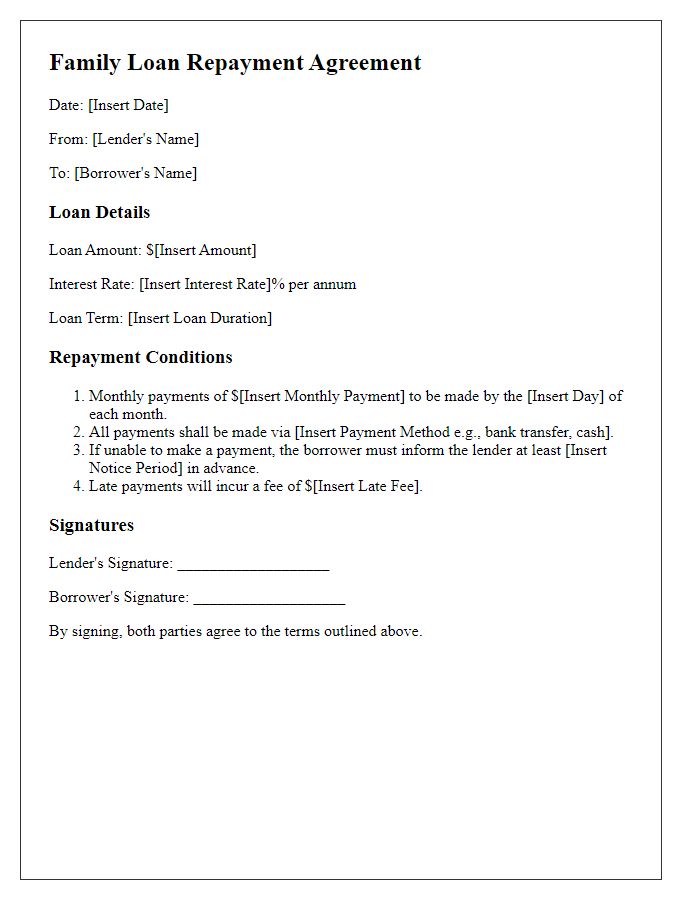

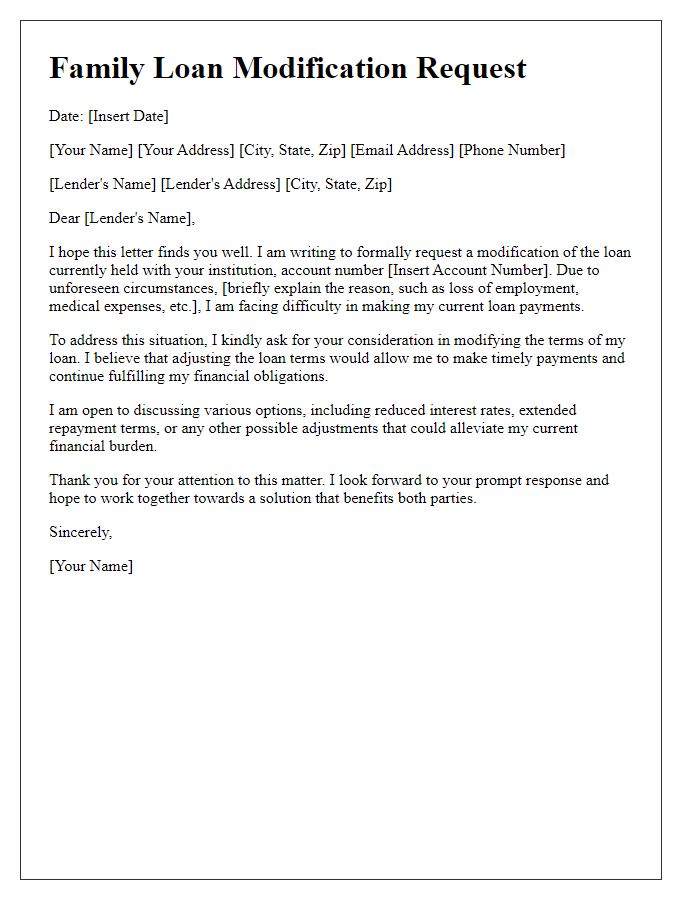

Loan Duration and Early Repayment Options

Family loan arrangements often include specific terms to ensure clarity and understanding between parties. Loan duration typically outlines the period the borrower has to repay the borrowed amount, which can range from a few months to several years, depending on the agreement. Predetermined repayment schedules (monthly or quarterly) can facilitate planning for both parties. Early repayment options allow borrowers to pay off the loan ahead of schedule, potentially reducing interest costs. Many family loans may include clauses that specify whether early repayment incurs fees, how the interest is recalculated, and whether the lender will accept this arrangement. Clear communication regarding these terms promotes lasting relationships while ensuring financial agreement stability.

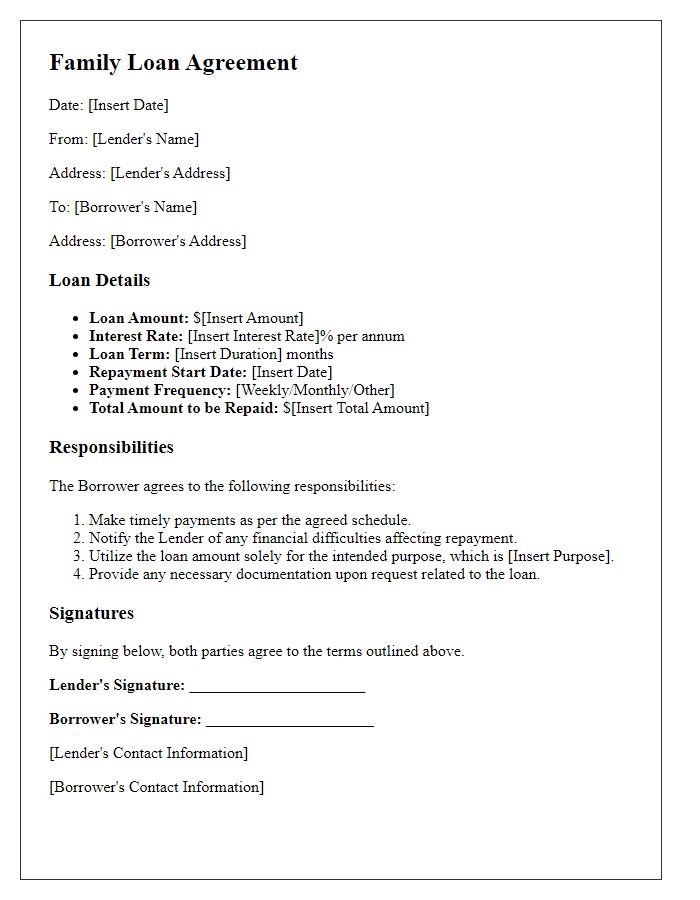

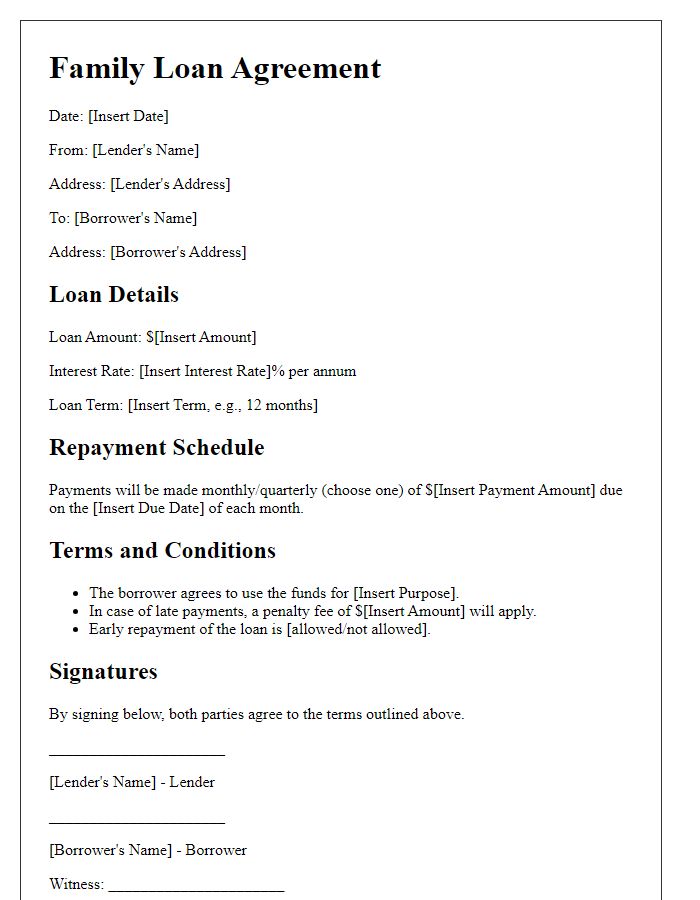

Legal Agreement and Signatures

A family loan arrangement typically includes a legal agreement outlining the terms of the loan, repayment schedule, interest rate, and signatures of both the lender and borrower to formalize the understanding. The document should contain essential details, such as the loan amount (e.g., $5,000), repayment duration (e.g., 12 months), interest rate (e.g., 5% per annum), and specific payment dates (e.g., first of each month). It's crucial to mention any late fees or penalties for missed payments, ensuring clarity and accountability. Signatures should include the full names of both parties, along with the date of agreement, to validate the arrangement as a legally binding contract. Ideally, the agreement should be witnessed by a neutral third party or notary public to enhance its legal credibility.

Comments