Are you considering a refurbishment project for your building but worried about the financing? A well-crafted loan proposal can make all the difference in securing the funds you need to transform your space. In this article, we'll explore the key elements of an effective proposal, including how to outline your project goals and financial needs convincingly. Stick around to discover tips that will help you create a compelling loan application that stands out!

Project Overview

The building refurbishment project aims to revitalize a historic structure located in downtown San Francisco, California, with an area of 15,000 square feet. This initiative includes critical renovations such as updating electrical systems to meet contemporary safety standards and improving HVAC (Heating, Ventilation, and Air Conditioning) efficiency. The facade restoration will preserve its architectural integrity, enhancing urban aesthetics while complying with local preservation guidelines. Upgrading the interior spaces will introduce modern amenities, including energy-efficient lighting and sustainable materials, to align with LEED (Leadership in Energy and Environmental Design) certification standards. This project is expected to increase property value by approximately 25% post-renovation, making it a strategic investment in the urban landscape.

Financial Background

Building refurbishment projects often require substantial financial investment, typically ranging from tens of thousands to millions of dollars, depending on the scale and complexity of the work involved. Adequate financial backing is crucial for successful execution, ensuring that all aspects such as materials, labor, and unforeseen expenses are covered. Historical data indicates that refurbishment projects can experience budget overruns of 10% to 30%, making it essential to secure a financing plan that accommodates such contingencies. In urban areas like New York City or London, where property values are significant, accessing refurbishment loans can enhance property appreciation by up to 20% post-renovation. Establishing a solid financial background through detailed projections and a clear repayment strategy is vital in demonstrating the viability of the project to potential lenders.

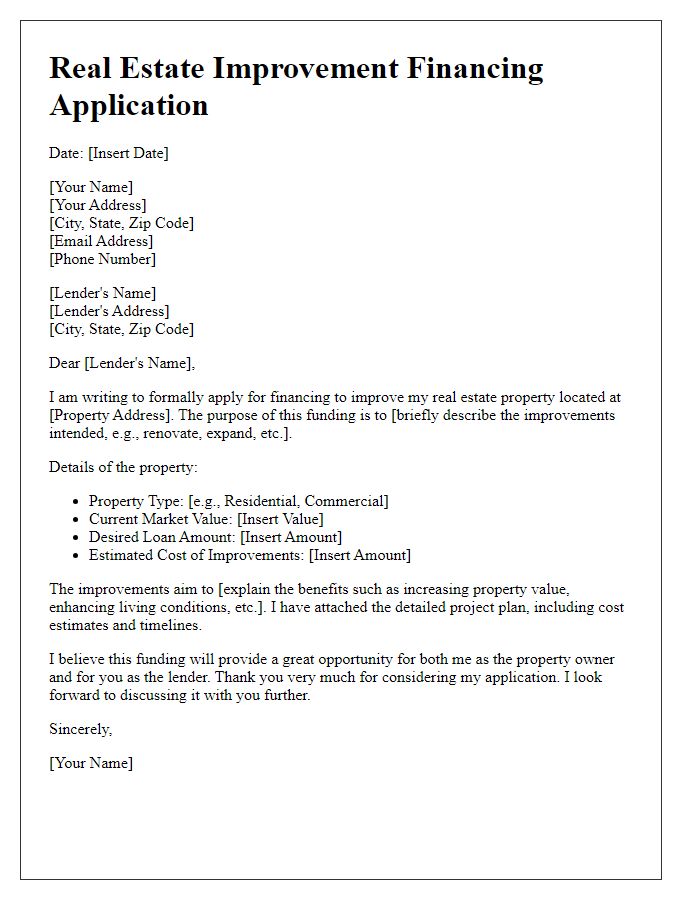

Loan Amount and Terms

Refurbishment loans provide financial assistance for renovating and upgrading buildings. A typical loan amount for refurbishment projects ranges between $50,000 to $500,000, depending on the project scope and property value. Loan terms often vary from 5 to 20 years, with interest rates influenced by factors such as credit score, lender policies, and prevailing market conditions. These loans can be secured against the property, requiring necessary documentation like property appraisal reports and renovation plans. Additionally, details such as repayment schedules, monthly installments, and any applicable fees should be clearly outlined in the proposal to ensure transparency and facilitate the lender's approval process.

Repayment Plan

When seeking a building refurbishment loan, a comprehensive repayment plan outlines the strategy for repaying the borrowed funds. The loan, typically ranging from $50,000 to $500,000, will be repaid over a period of 5 to 15 years, depending on the lender's terms and the project scope. Monthly payments, which might be around $1,000 to $5,000, are structured to accommodate cash flow while ensuring timely repayments. Interest rates can vary, averaging between 4% to 8%, influencing the total repayment amount significantly. The plan includes a detailed breakdown of income generated from the refurbished property, estimated to increase by 20% to 30% once improvements are completed, ensuring the viability of the repayment strategy. Additionally, contingency plans for potential cost overruns or delays, such as setting aside 10% of the total loan amount, are incorporated for financial security during the refurbishment process.

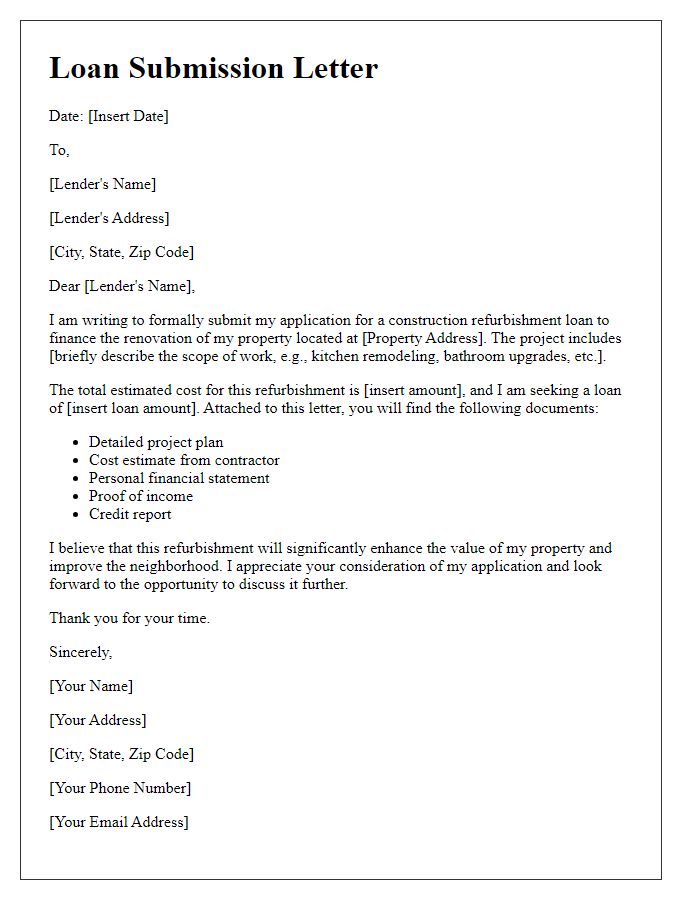

Supporting Documentation

A comprehensive proposal for a building refurbishment loan necessitates thorough supporting documentation to reinforce the assessment of financial viability and project feasibility. Key documents include an itemized project budget detailing estimated costs for construction, materials, and labor, illustrating a total project cost possibly exceeding $500,000. A timeline projection with critical milestones such as permit acquisition and completion phases ensures transparency in planning. Architectural plans, ideally drafted by a licensed architect or designer, must be included to provide visual context for renovations. Additionally, historical property documentation, such as title deeds and prior inspections, can support claims on property value. Financial statements from the past three years exhibit the borrower's ability to repay the loan. An environmental impact assessment, if applicable, indicates adherence to local regulations and sustainability measures. All these components collectively create a robust foundation for the loan proposal, underscoring the project's potential for increased property value and community enhancement.

Comments