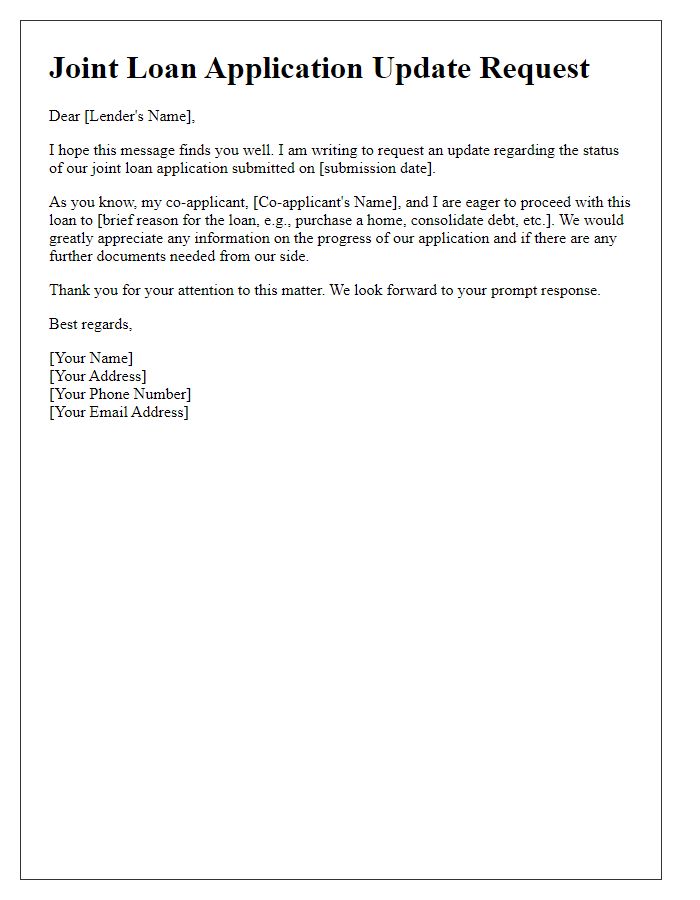

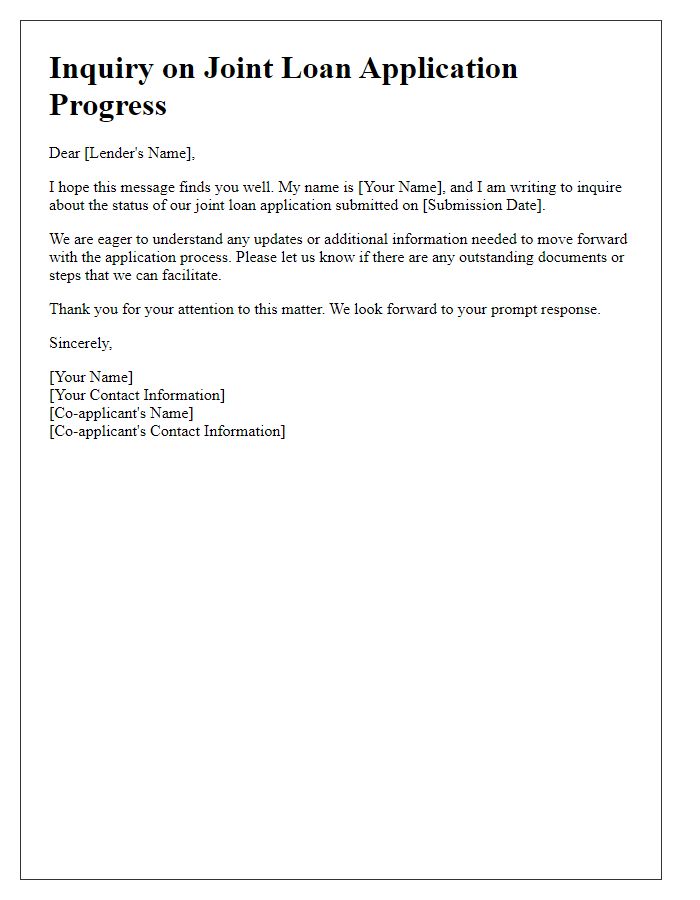

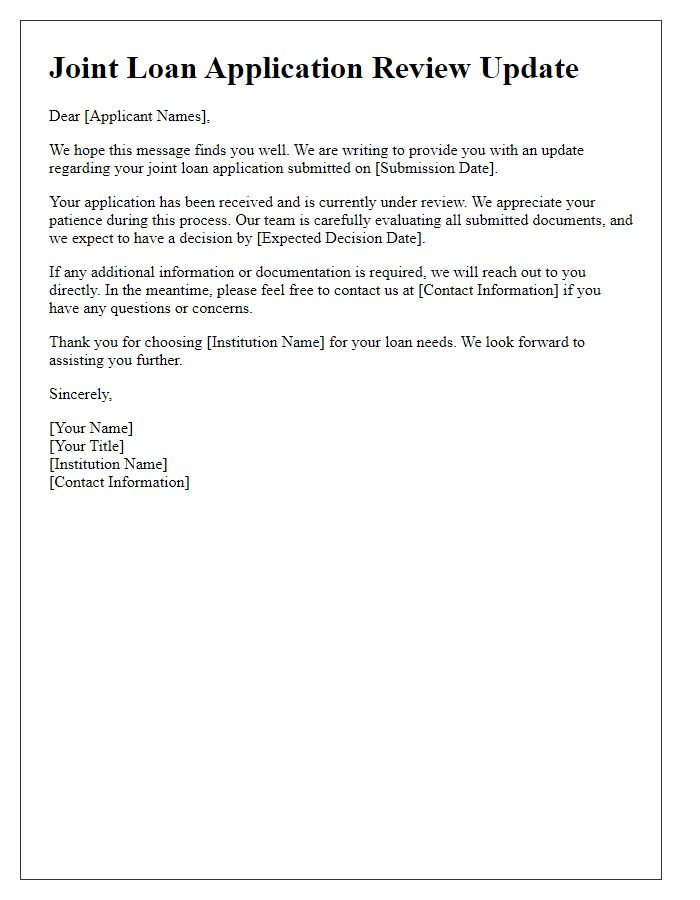

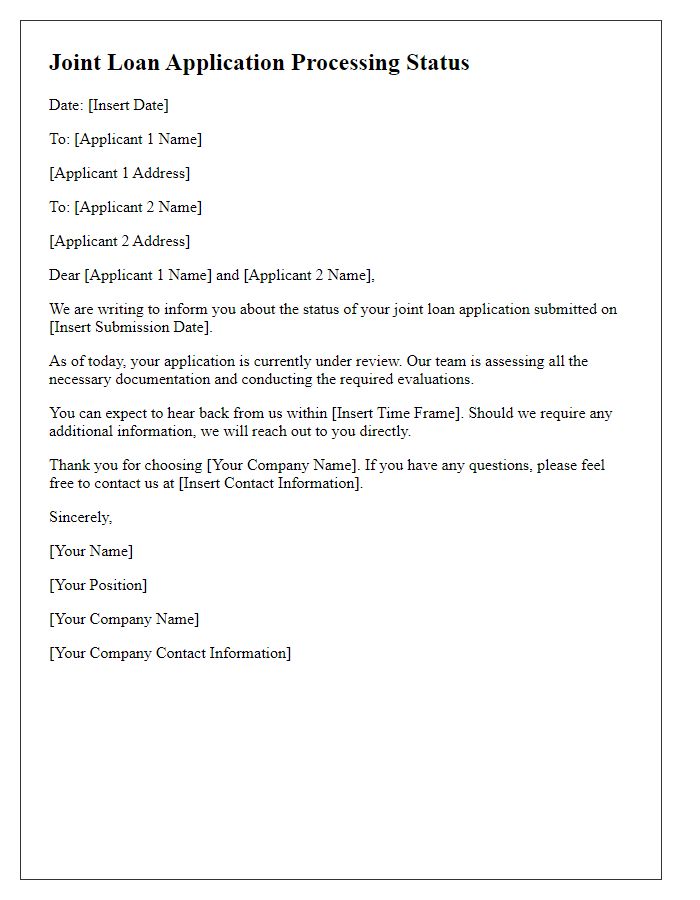

Are you in the process of applying for a joint loan and wondering about the status of your application? Understanding where you stand can be crucial for your financial planning and peace of mind. Whether you're eager to finalize your dream home or fund a significant purchase, knowing the ins and outs of your loan application can help you navigate the next steps. Join us as we delve into common scenarios and tips related to joint loan applicationsâread on for more insights!

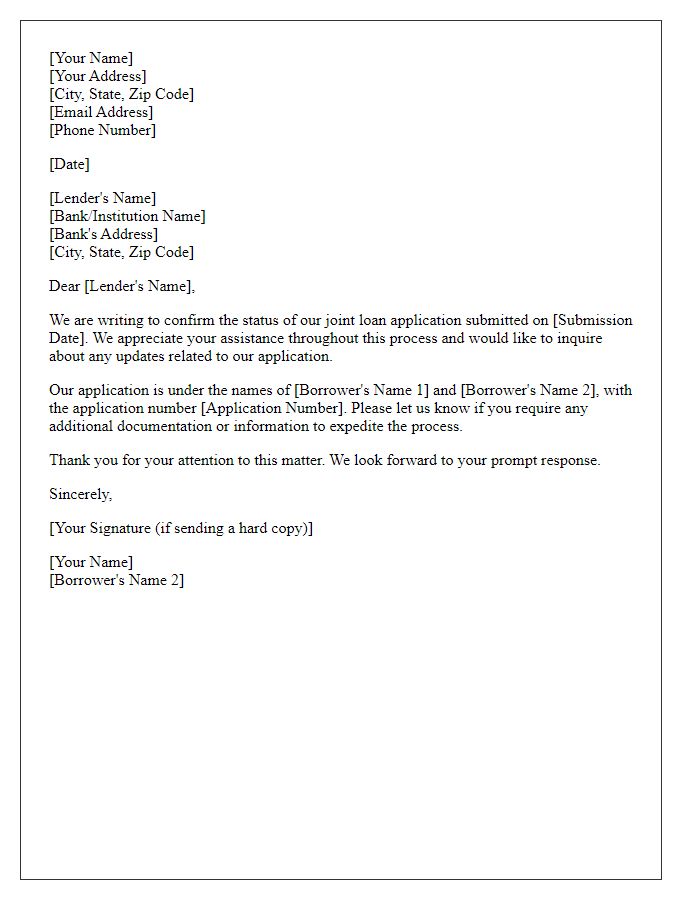

Applicant Information (Full names, contact details, and identification)

The joint loan application status reveals essential details regarding the individuals involved in the financing decision. Full names of both applicants, including first names and surnames, serve as primary identifiers. Contact details, encompassing mobile phone numbers, email addresses, and residential addresses, facilitate direct communication concerning the loan process. Identification elements, such as Social Security numbers in the United States or national identification numbers in other countries, are crucial for verifying the applicants' identities and determining eligibility for the loan. Understanding these elements aids in assessing the financial reliability and creditworthiness of the applicants, paving the way for loan approval or rejection.

Loan Details (Type, amount requested, purpose)

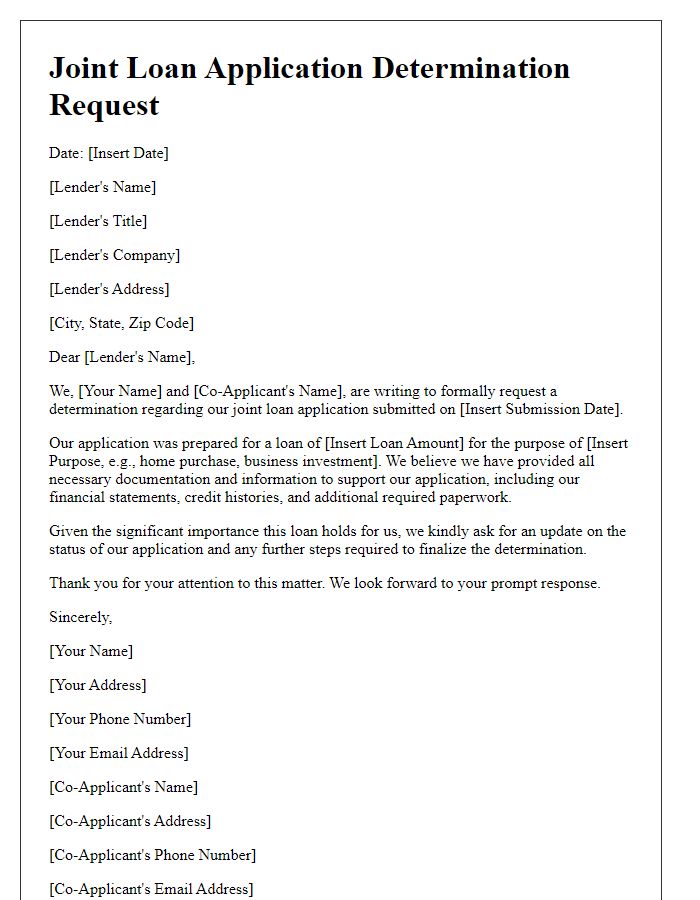

The joint loan application status reveals critical details regarding the request submitted by two individuals to a financial institution. The loan type, which can include options such as a personal loan, mortgage, or auto loan, is essential for determining eligibility criteria. The total amount requested, for example, $250,000 for a home purchase, signifies the applicants' intention to invest in real estate. The purpose, in this case, the acquisition of property located in Austin, Texas, highlights the significance of the loan in achieving a major life goal. Monitoring the progress of this application is crucial to understand approval timelines and satisfy any additional documentation requirements.

Current Application Status (Approved, pending, or declined)

The current application status of the joint loan, initiated by the parties involved, is pending review by the financial institution. This phase typically lasts between 7 to 14 business days, during which the underwriting team evaluates submitted documentation, including credit scores, income verification, and debt-to-income ratios. The analysis considers the applicants' financial histories, which can range significantly in terms of creditworthiness. A decision will be communicated once the assessment is completed, allowing the applicants to prepare for potential next steps, such as closing procedures or appeals in case of a decline.

Required Actions (Additional documents, signature needed)

A joint loan application often requires specific actions to proceed, such as the submission of additional documents. Commonly requested items include proof of income (pay stubs or tax returns from the last two years), identification (government-issued IDs such as driver's licenses or passports), and information regarding assets (bank statements or property deeds). Signatures from all applicants may also be necessary on various forms, such as the loan application itself and disclosures. Timely submission of these requirements is crucial, as incomplete applications can lead to delays in the approval process or even denial. Regular follow-ups with the lending institution can provide clarity on the status of the application and any further actions needed.

Contact Information (Loan officer, customer service)

Inquire about the status of a joint loan application through official contact points. For instance, the loan officer responsible for overseeing the application process often operates within a specific financial institution, such as Wells Fargo or Bank of America. Customer service departments typically offer assistance via designated phone numbers or emails provided on the institution's website. Ensure to reference the application number for clarity and expedite the inquiry process. Timeliness is crucial in these communications, particularly concerning loan processing timelines that can range from a few days to several weeks, depending on the institution's protocols.

Comments