When life throws unexpected expenses your way, navigating financial commitments can feel overwhelming. It's important to stay proactive, especially when it comes to managing payday loans and their due dates. This article will guide you through the essential steps and considerations for requesting a payday loan extension, ensuring you remain informed and empowered in your financial journey. So, let's dive in and explore how you can alleviate some of that financial pressure!

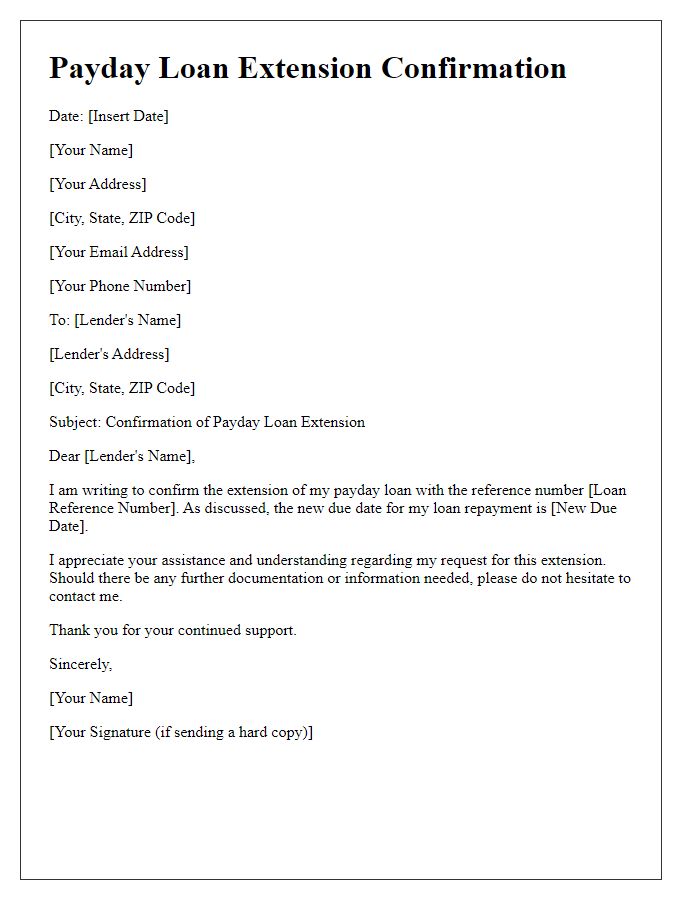

Clear Subject Line

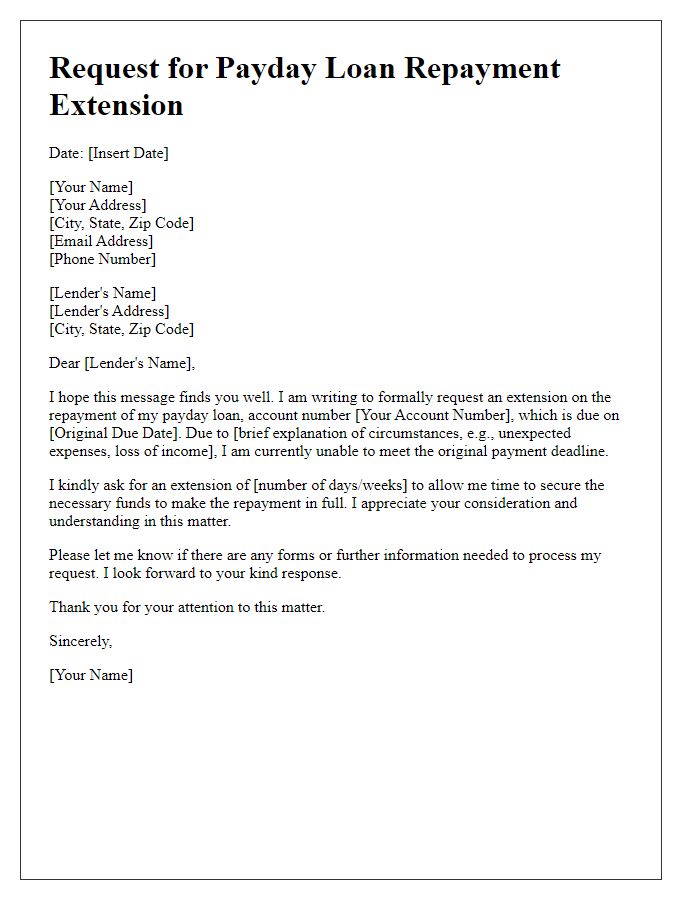

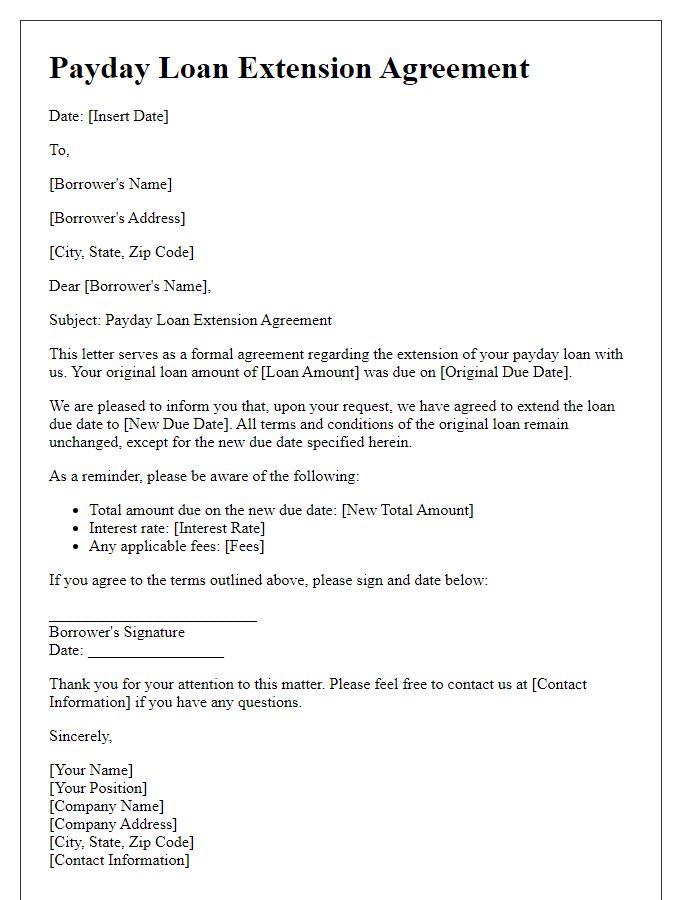

A payday loan extension notification requires precise communication to ensure clarity and understanding. A templated notification should include details such as the loan amount (for example, $500), the original due date (e.g., November 15, 2023), and the extended due date (e.g., December 15, 2023). Include information regarding any applicable fees (such as a $50 extension fee), the terms of the extension, and potential impacts on interest rates. Clear instructions should be provided for the borrower, including contact information for any questions (like a customer service phone number or email). Providing a straightforward subject line, such as "Important: Your Payday Loan Extension Confirmation," will help recipients prioritize and recognize the notification efficiently.

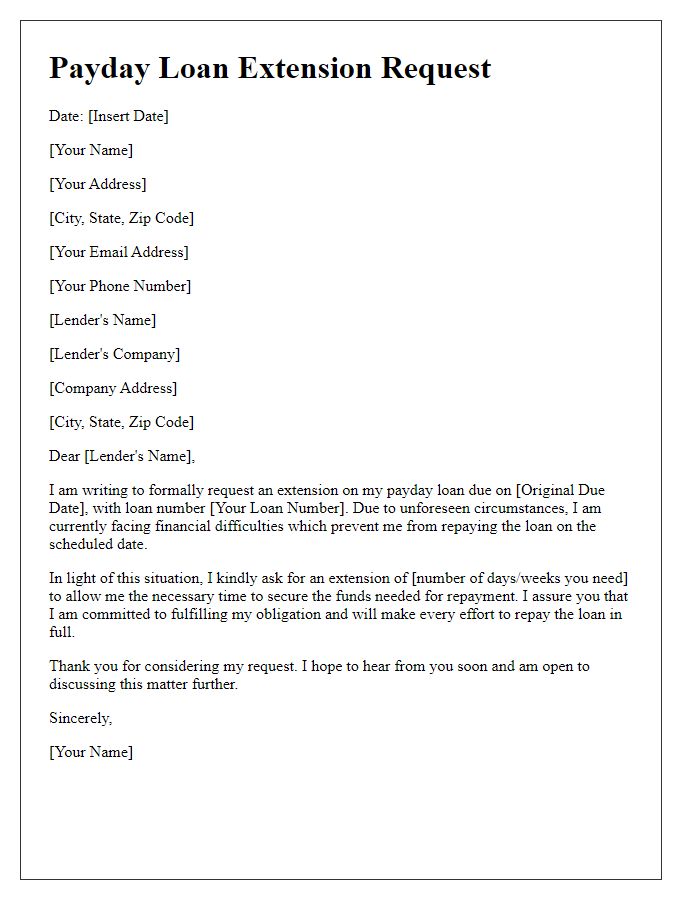

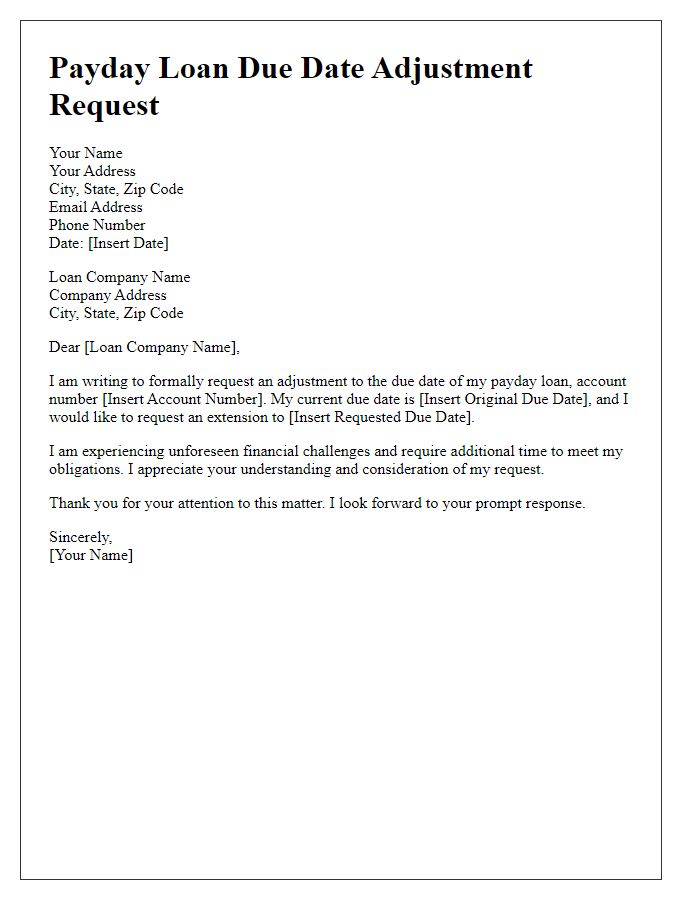

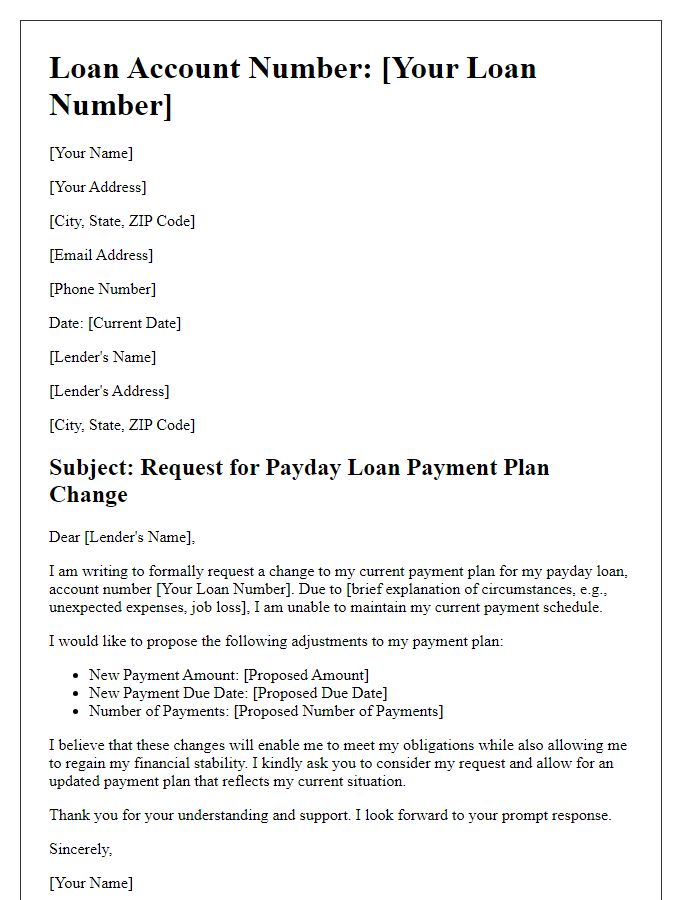

Borrower Information

Payday loan extension notifications notify borrowers of adjustments related to their loan repayment schedule. Essential details include the borrower's name (e.g., John Smith), loan number (123456), original due date (March 15, 2023), and new due date (April 15, 2023). The total outstanding balance ($500) may require updated interest calculations, reflecting any fees incurred during the extension period. Additionally, borrowers should be informed of the new payment amount ($550) to fulfill obligations. Legal regulations governing payday loans, such as those established by the Consumer Financial Protection Bureau (CFPB), dictate clear communication of extension terms to ensure compliance and transparency between lenders and borrowers.

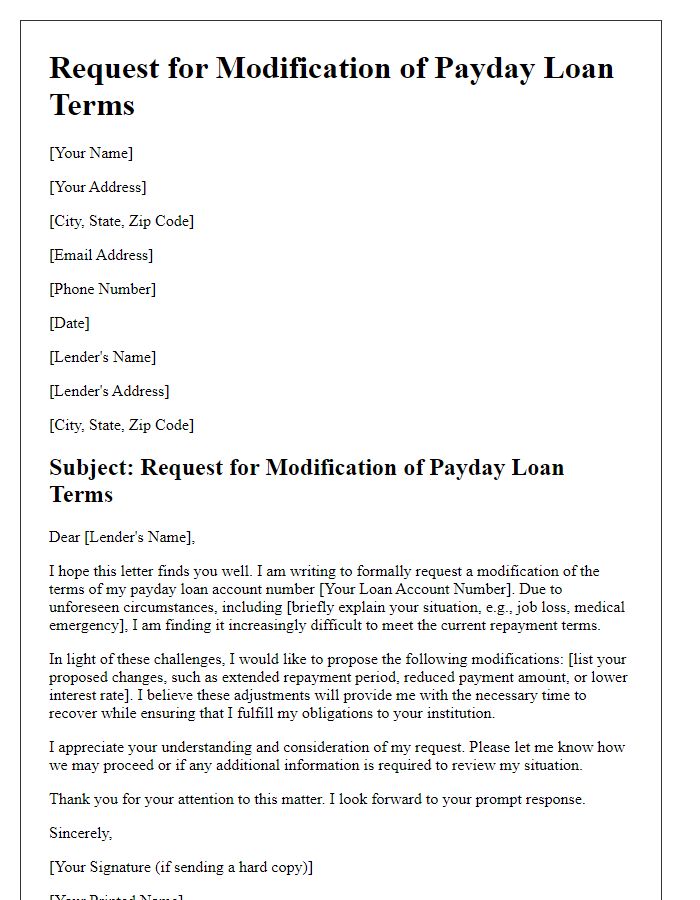

Loan Details

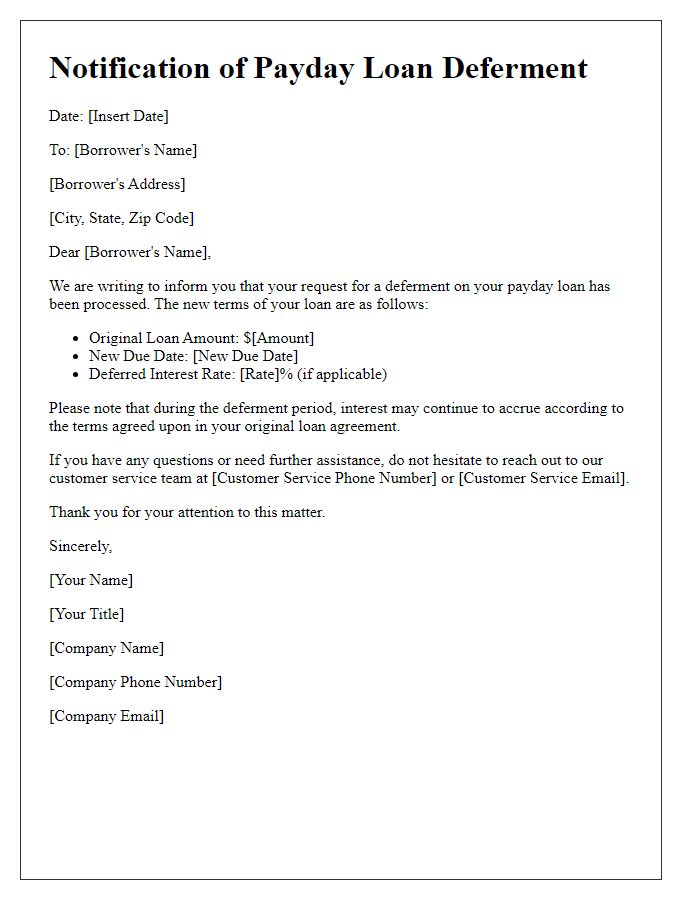

Payday loan extensions often entail specific considerations regarding interest rates, repayment dates, and borrower eligibility. Loan details typically involve the loan amount (for example, $500), the original due date (such as March 15, 2023), and the current interest rate (perhaps 15% per pay period). In many cases, borrowers may be required to provide updated income information or proof of employment to qualify for the extension. Additionally, lenders may specify fees or penalties, depending on state regulations, which can vary significantly across different locations, such as California or Texas. Understanding these details can significantly impact a borrower's financial planning and overall repayment strategy.

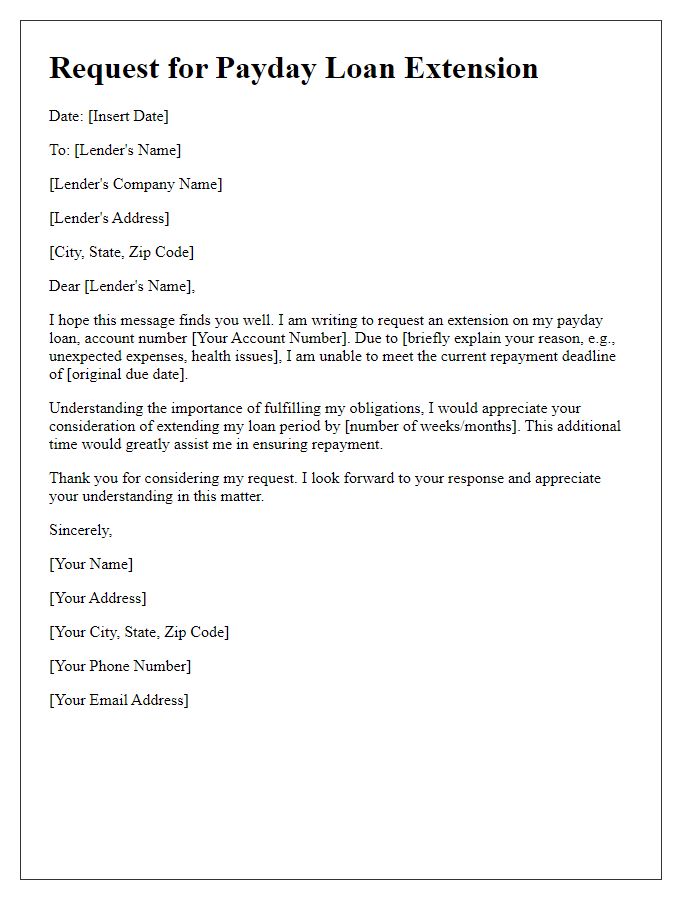

Extension Terms

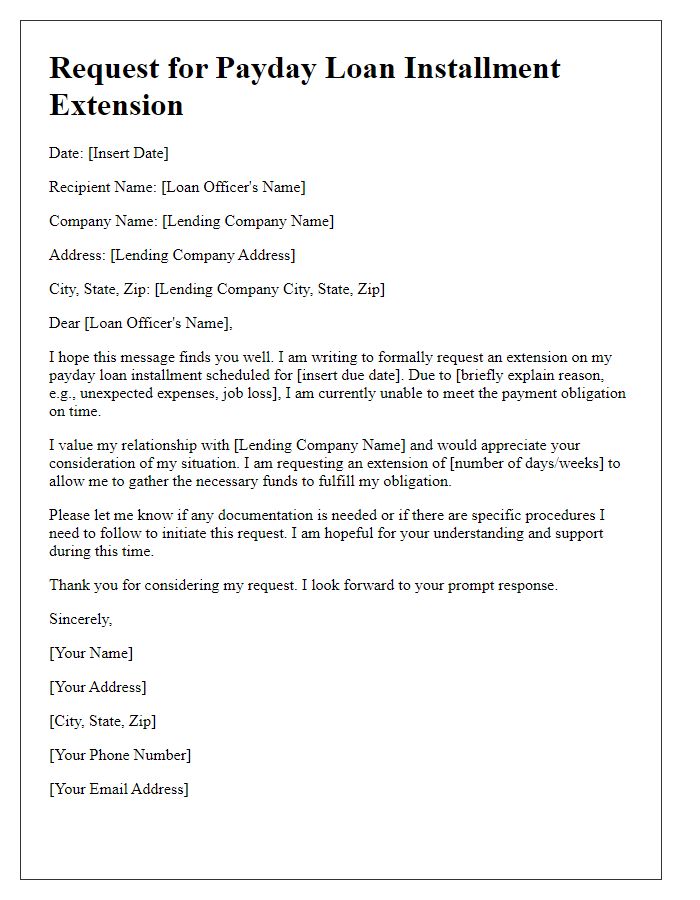

Payday loans often require borrowers to navigate strict repayment terms, which can sometimes lead to financial strain. An extension of payday loan terms allows borrowers to extend their repayment deadline, typically for an additional fee or interest. For instance, a common scenario involves a borrower owing $500, originally due in two weeks, seeking a 30-day extension. This extension could lead to an additional fee of around $75, resulting in a total repayment amount of $575, now due in one month. The lender may provide explicit terms for the new deadline, interest rates, and any other conditions attached to the loan extension, ensuring the borrower understands their obligations clearly. Communication regarding these extensions is vital, occurring through notifications, letters, or online portals, preserving transparency between the borrower and lender.

Payment Instructions

Payday loan extensions often involve specific payment instructions and terms that should be clearly communicated to borrowers. Loan providers typically require prompt notifications outlining the extension process. Important details include the new due date for the extended payment, potential interest rates adjustments, and any applicable fees. Clear guidelines on how borrowers can make their payments--whether online, via phone, or by mail--should also be specified. Providers might include additional resources like a customer service phone number or email for questions, ensuring borrowers understand their obligations and can easily navigate the extension process.

Comments