Are you considering a cross-border loan arrangement and feeling a bit overwhelmed by the process? You're not alone! Many individuals and businesses face unique challenges when navigating the complexities of international lending. In this article, we'll break down the key elements of creating an effective loan arrangement and provide you with a handy template. So, let's dive in and explore how to make your cross-border financing journey seamless!

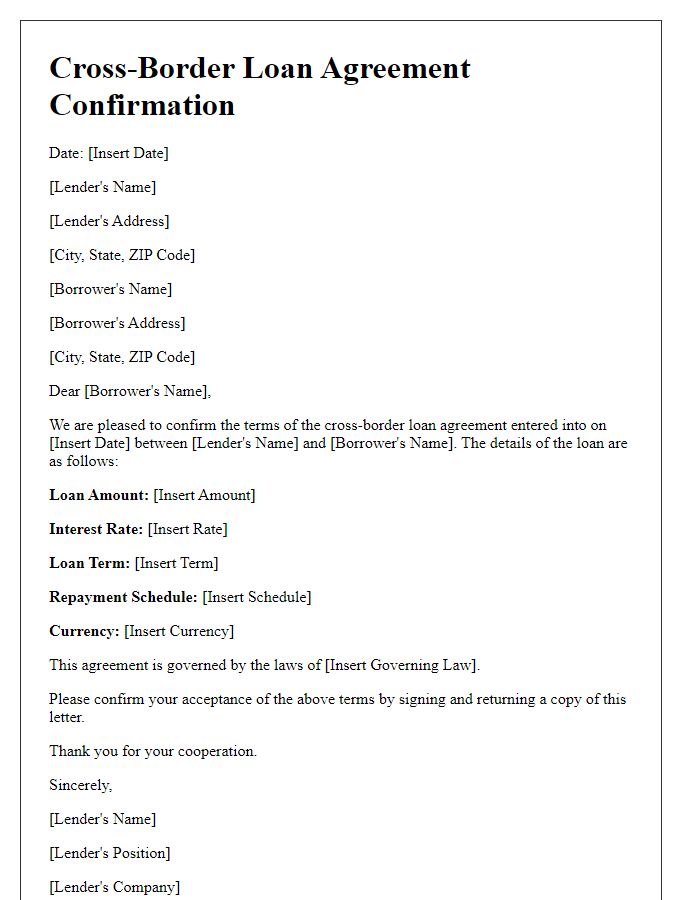

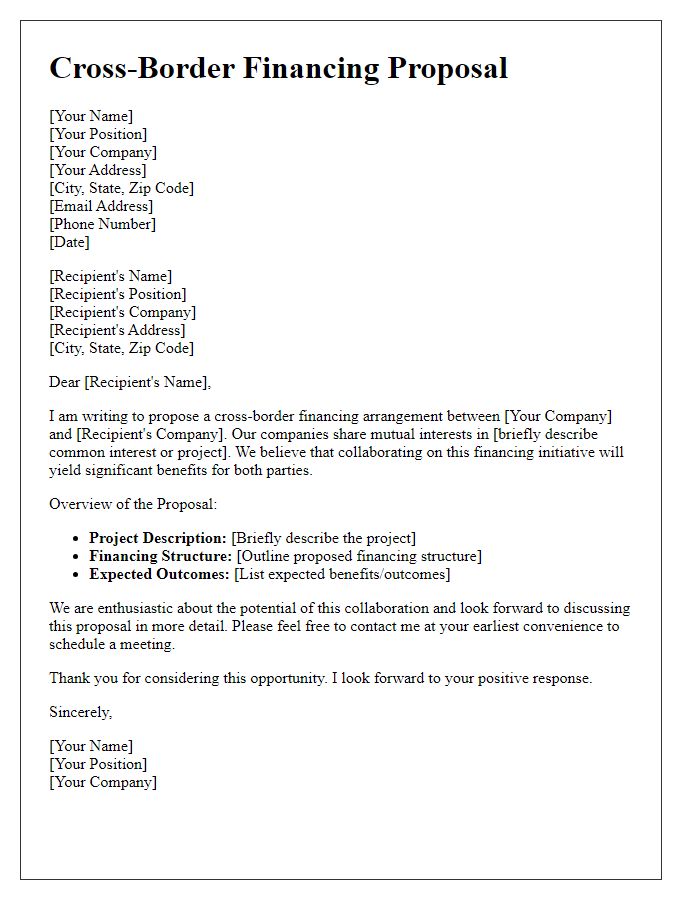

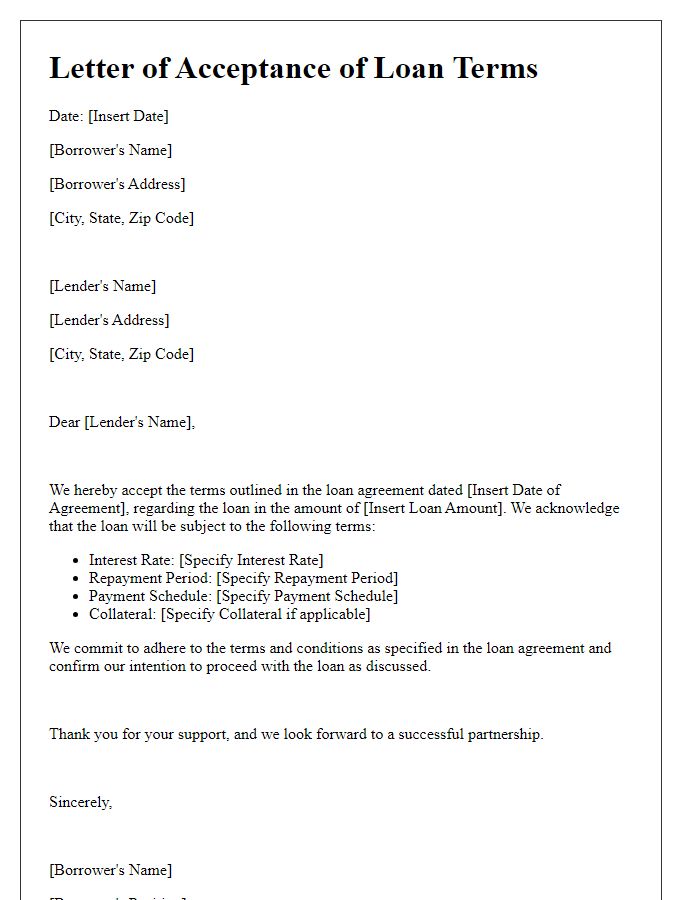

Borrower and Lender Identification

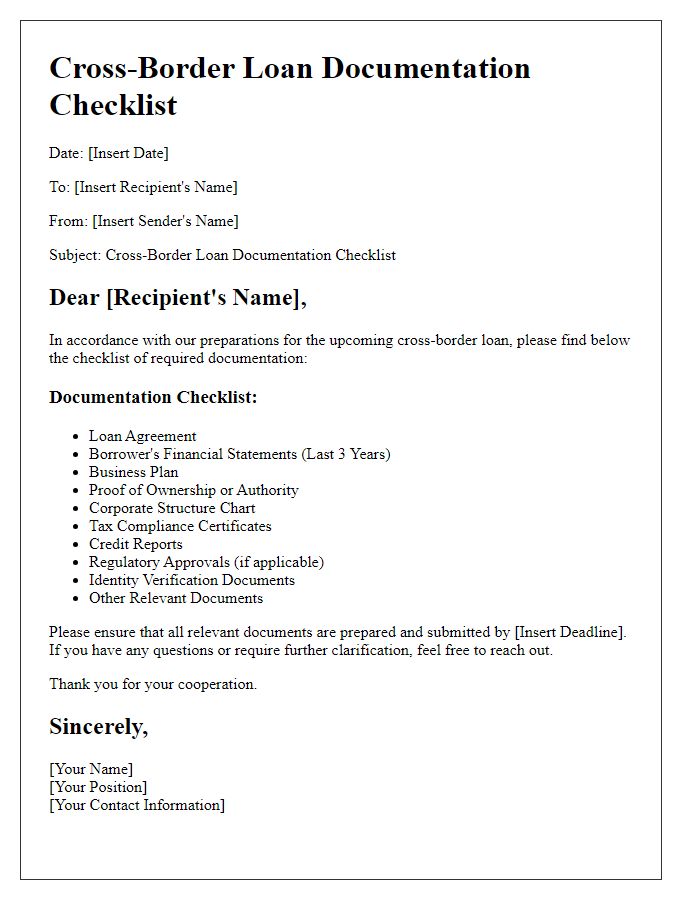

In cross-border loan arrangements, clear identification of Borrower and Lender is crucial for legal compliance and transaction transparency. The Borrower, typically a corporation or individual seeking capital, must provide specific details such as legal name, registration number in their home country (such as a unique company identifier), and address of the principal place of business, ensuring it is compliant with local regulatory frameworks. The Lender, often a financial institution or private entity, must also disclose pertinent information, including legal name, country of incorporation, registration number, and principal address, thus confirming its legitimacy and ability to engage in international financing. This mutual identification mitigates risks associated with cross-border lending, establishing a foundation for contract enforcement and jurisdiction in case of disputes.

Loan Amount and Currency Specification

In cross-border loan arrangements, specifying the loan amount and currency is crucial for clarity and compliance. The principal amount, often quantified in US dollars (USD) or Euros (EUR), determines the financial obligation agreed upon by both parties. Exchange rates at the time of the agreement can influence the total cost of repayment, as fluctuating rates can affect the amount owed in local currency. Clear stipulations on currency conversion procedures and potential fees associated with currency exchange can prevent misunderstandings. Additionally, parties should consider regulatory compliance, including taxation implications in jurisdictions involved, to ensure a smooth transaction and adherence to financial regulations.

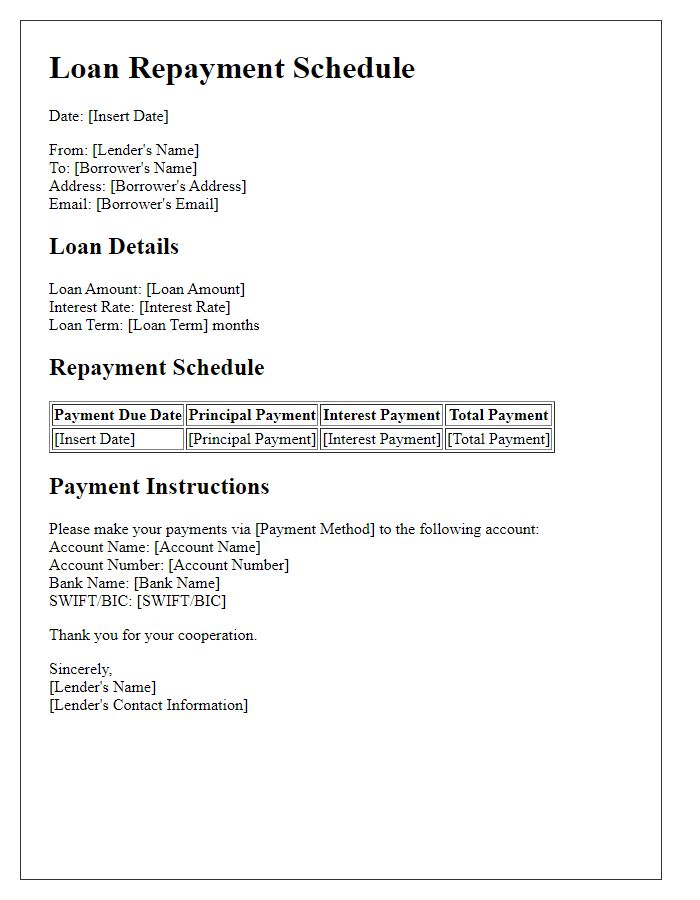

Interest Rate and Repayment Terms

Interest rates for cross-border loan arrangements can vary significantly based on multiple factors, such as country-specific regulations, creditworthiness of borrowers, and currency exchange fluctuations. Typical interest rates may range from 3% to 10% annually. Repayment terms usually span from 1 to 10 years, with options for periodic payments (monthly, quarterly) or balloon payments at the end of the term. Borrowers should be aware of potential fees related to currency conversion and international transfer charges, which can affect the overall cost of the loan. Legal frameworks in different countries, including compliance with international banking regulations, also play a crucial role in structuring these agreements.

Jurisdiction and Governing Law

Cross-border loan arrangements often involve complex legal frameworks, influenced by the jurisdictions of the parties involved. It is essential to establish clear governing laws that will apply in the event of any disputes throughout the loan period. Typically, lenders and borrowers may select a jurisdiction that offers favorable legal protections and stability, such as New York or London common laws. In these cities, legal precedents provide a comprehensive framework for financial transactions, ensuring clarity for both parties. Understanding local regulations, interest rate limits, and tax implications are critical in shaping the arrangement. Furthermore, arbitration clauses may be included to streamline dispute resolution across borders, reinforcing the necessity of an agreed-upon jurisdiction in the contract.

Collateral and Security Details

Cross-border loan arrangements often involve complex collateral and security details critical to all parties involved. Collateral types may include real estate assets, with evaluation metrics aligned to market values potentially fluctuating based on location, such as properties in Manhattan, New York, or London, England. Security interests could encompass guarantees from parent companies or subsidiaries and may include asset-backed securities, like receivables from international accounts. Jurisdictional factors play a significant role, as laws governing collateral enforcement differ between countries like Germany, France, and the United States. Additionally, currency risk must be evaluated, especially when loans are denominated in foreign currencies, affecting the overall repayment strategy. Proper documentation, including legal opinions on enforceability, is essential to mitigate risks inherent in cross-border transactions.

Comments