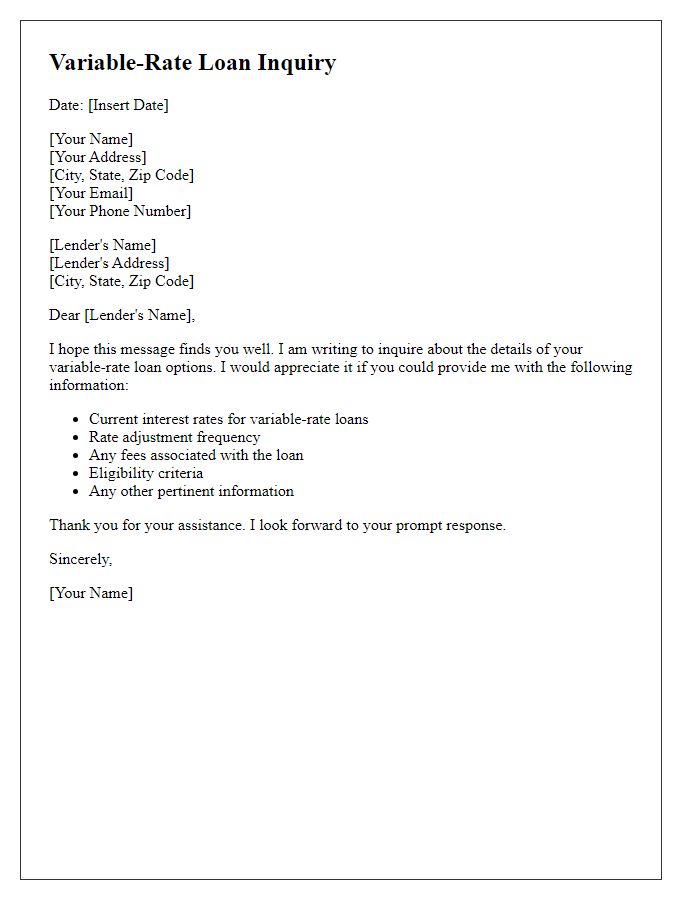

When it comes to navigating the world of variable-rate loans, it's essential to understand how they can impact your financial journey. Whether you're a first-time borrower or looking to refinance, knowing the ins and outs can make a significant difference in your decision-making process. This article will break down the key factors to consider, offering practical tips and insights along the way. So, let's dive in and explore the details that can help you make informed choices about your variable-rate loan!

Loan amount and terms

Variable-rate loans, such as those offered by financial institutions like banks, often involve fluctuating interest rates based on market conditions. For example, a typical loan amount might range from $10,000 to $500,000, depending on the borrower's qualifications and the lender's policies. Terms generally vary from 5 to 30 years, significantly impacting monthly payments and total interest paid over the life of the loan. Evaluating the specific loan amount, interest rate--often tied to benchmarks like the Federal Reserve Rate--and repayment timeline is crucial in determining overall loan affordability. Factors such as credit score, income level, and existing debts play a pivotal role in the assessment process.

Interest rate and fluctuations

Variable-rate loans, commonly linked to indexes such as the London Interbank Offered Rate (LIBOR), can present significant challenges due to changing interest rates. Interest rates fluctuate based on economic indicators, with factors such as inflation rates and central bank policies heavily influencing them. For instance, an increase in rates may lead to monthly payments rising by several percentage points, significantly impacting borrowers' financial stability. Understanding the relationship between the Federal Reserve's actions and the variable rate's adjustments is crucial for borrowers, as changes often occur quarterly or biannually. Additionally, market conditions, such as increased demand for credit, can further amplify interest rate volatility, raising concerns among borrowers regarding their long-term repayment strategies. Keeping informed about these dynamics is vital for effective loan management.

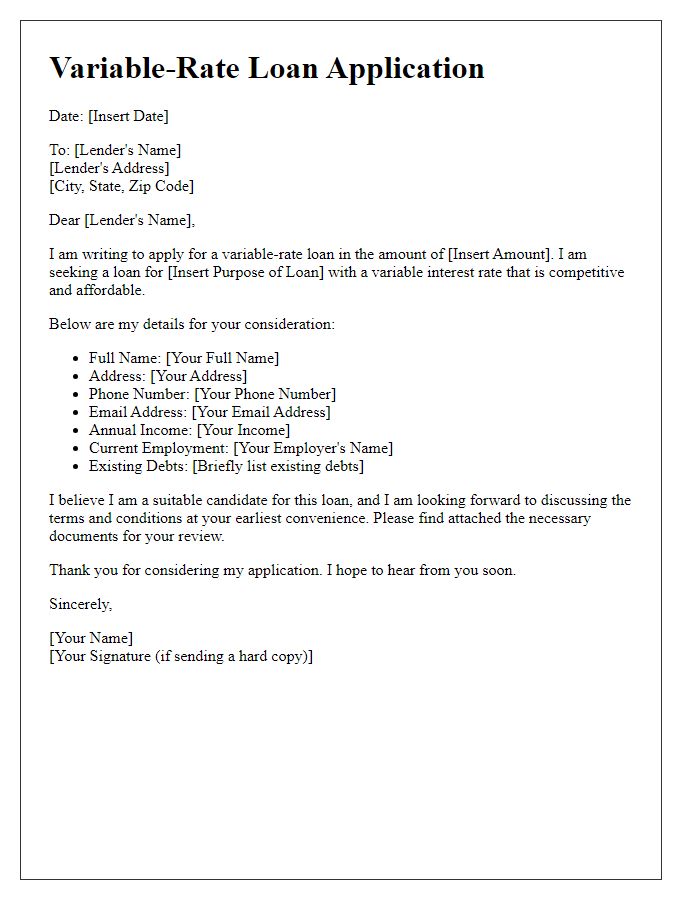

Borrower financial profile

A variable-rate loan assessment examines the borrower's financial profile, including credit score assessments ranging from 300 to 850, annual income ranging from $50,000 to over $200,000, and existing debt levels which should ideally be below 36% of total income to meet lender requirements. Additionally, employment stability reflecting a minimum of two years in the same job or industry strengthens the profile, while assets such as savings accounts, retirement funds, and property ownership add value to the assessment. Lenders also review the borrower's repayment history on previous loans to gauge reliability and willingness to meet financial obligations.

Collateral and security details

The collateral for the variable-rate loan assessment typically includes real estate properties, often involving residential or commercial buildings. These properties must be appraised, with a fair market value determined, often exceeding a minimum requirement of 80% loan-to-value (LTV) ratio. Security details may involve various asset types such as vehicles, equipment, or financial instruments, each evaluated based on current market rates. Documentation like title deeds, ownership proof, and asset valuation reports are essential in establishing legitimacy. Furthermore, borrowers may be required to obtain insurance coverage on collateral assets, safeguarding lender interests against potential loss.

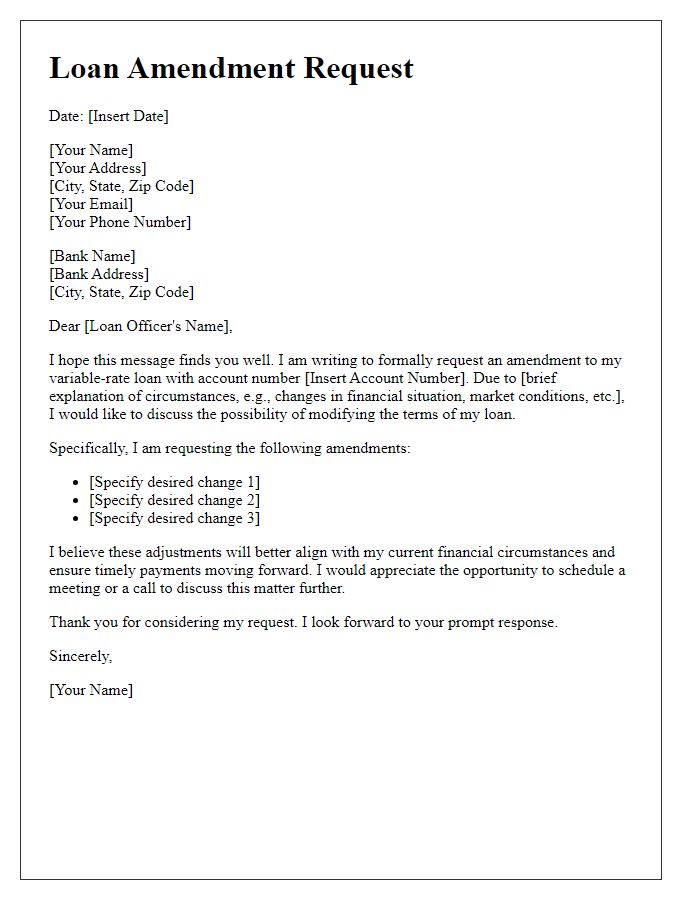

Repayment schedule and options

Variable-rate loans typically have fluctuating interest rates, influenced by benchmark rates like LIBOR (London Interbank Offered Rate). Borrowers often experience changes in monthly payment amounts as interest rates change, impacting overall repayment strategies. Common loan terms range from 5 to 30 years, with amortization schedules determining the repayment timeline and interest allocation. Lenders provide options for borrowers to switch to fixed-rate loans at specific milestones or after a certain period, thereby stabilizing payments against future rate increases. Financial tools and calculators aid borrowers in assessing total interest costs, payment schedules, and potential savings, ensuring informed decisions are made regarding their loan repayment options.

Comments