Are you feeling overwhelmed by your current loan payments? You're not alone, and exploring the option for a loan principal reduction could be your way to financial relief. In this article, we'll walk you through the steps to craft an effective letter that requests a reduction in your loan principal, ensuring you make a compelling case to your lender. Ready to take control of your financial future? Let's dive in!

Borrower's personal and financial information

Borrower's personal information, such as full name, address, and contact number, is essential for establishing identity and ensuring accurate record-keeping. Financial information, including employment details, monthly income, and existing debts, provides a comprehensive view of the borrower's financial situation. Loan details, like principal amount, interest rate, and duration, outline the current repayment structure. Documentation like tax returns, bank statements, and proof of income supports the request for loan principal reduction, demonstrating the borrower's financial need and ability to maintain reduced payments. These elements collectively form a solid basis for evaluating eligibility for any potential loan modifications or relief programs.

Loan account details and current repayment status

Loan account number 1234567890 reflects a current outstanding principal balance of $25,000 associated with a personal loan taken from ABC Bank, initiated on January 15, 2021. Monthly repayments of $500 have been consistently remitted since the loan's inception. As of October 2023, a total of $15,000 has been repaid, showcasing 60% of the principal has been fulfilled over 20 months. The loan carries an interest rate of 7.5%, with a remaining term of 24 months. Due to recent financial adjustments following a job change in September 2023, the request for a principal reduction seeks to alleviate monthly financial commitments while ensuring continued compliance with payment obligations.

Justification for reduction request (financial hardship, job loss, etc.)

In recent months, financial hardship has significantly impacted my ability to manage my loan obligations, particularly affecting the principal amount owed on my mortgage. A sudden job loss in April 2023, due to company downsizing at XYZ Corporation in New York City, has resulted in a 60% decline in my household income. This unexpected situation has forced me to deplete my savings to meet essential living expenses such as mortgage payments, utility bills, and necessary medical expenses. Despite efforts to secure a new position, the competitive job market has made it difficult to replace that lost income swiftly. Consequently, maintaining my current loan principal proves increasingly unmanageable. A reduction in the principal balance would provide essential relief, allowing me to stabilize my financial situation while remaining committed to meeting my obligations.

Proposed loan terms or repayment plan

Submitting a request for loan principal reduction can significantly influence financial stability, especially for borrowers struggling with repayment. Proposed loan terms may include a reduction of interest rates, commonly ranging from 3% to 5%, which can substantially lower monthly payments. A revised repayment plan could extend the loan term to 25 years instead of 15 years, easing the monthly financial burden. In certain cases, borrowers may suggest a one-time principal reduction of up to 20% to incentivize timely repayments and improve overall loan performance. Establishing a clear understanding of the financial situation, including income (average $5,000 monthly) and existing debts ($15,000 in credit card debt), is crucial for negotiation. Engaging with a lender, such as a community bank or credit union, known for flexible terms and personal service, may enhance the chances of approval for these modifications.

Supporting documents (income statements, bank statements)

A loan principal reduction request often arises from financial hardship or a change in circumstances. Effective communication with the lender can facilitate this process. Supporting documents play a critical role in legitimizing the request. Income statements, which detail monthly earnings and job stability, provide a clear insight into financial capability or challenges. Bank statements spanning at least three months offer a comprehensive view of spending habits, savings, and existing financial commitments. Additional documentation may include tax returns or proof of unemployment, further substantiating the need for assistance. Ensuring these documents are accurate and up-to-date increases the likelihood of a successful request.

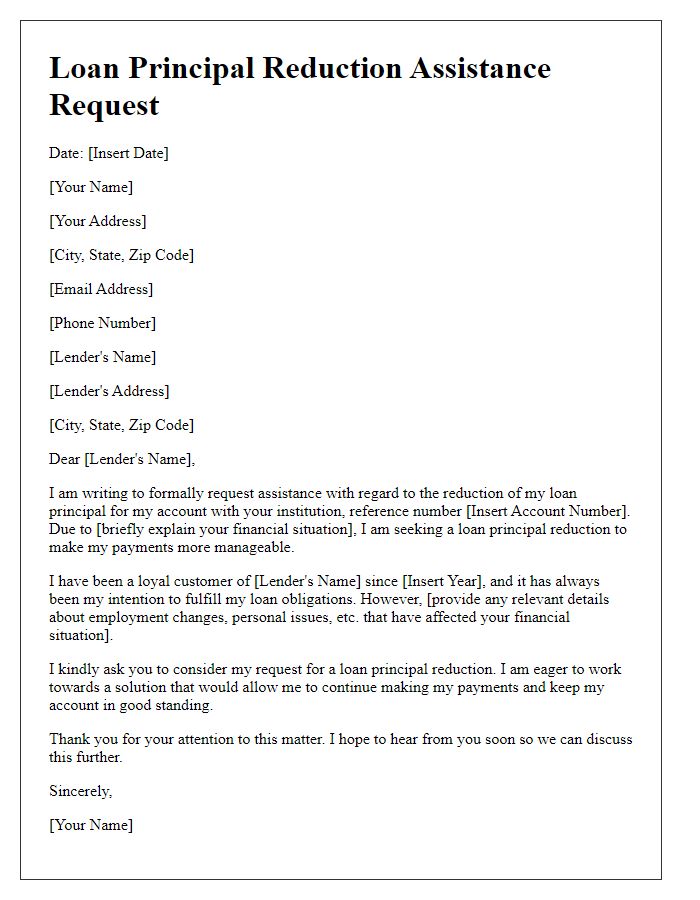

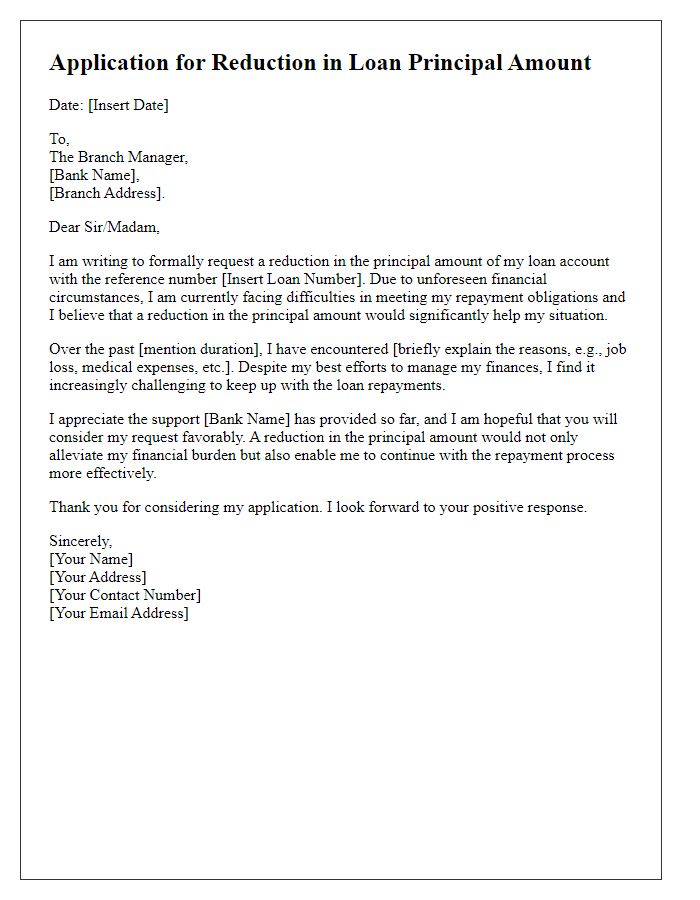

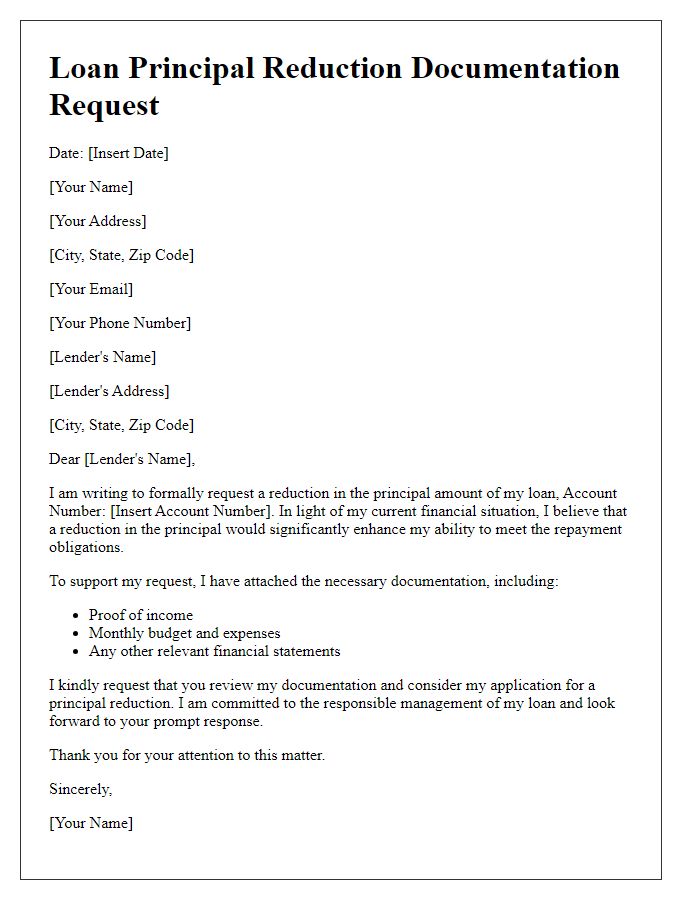

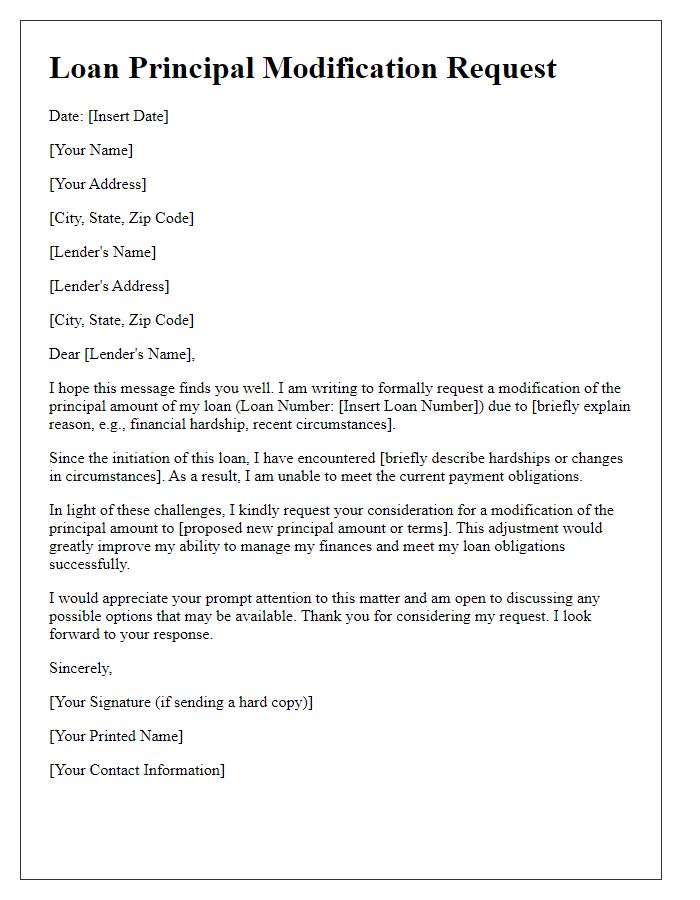

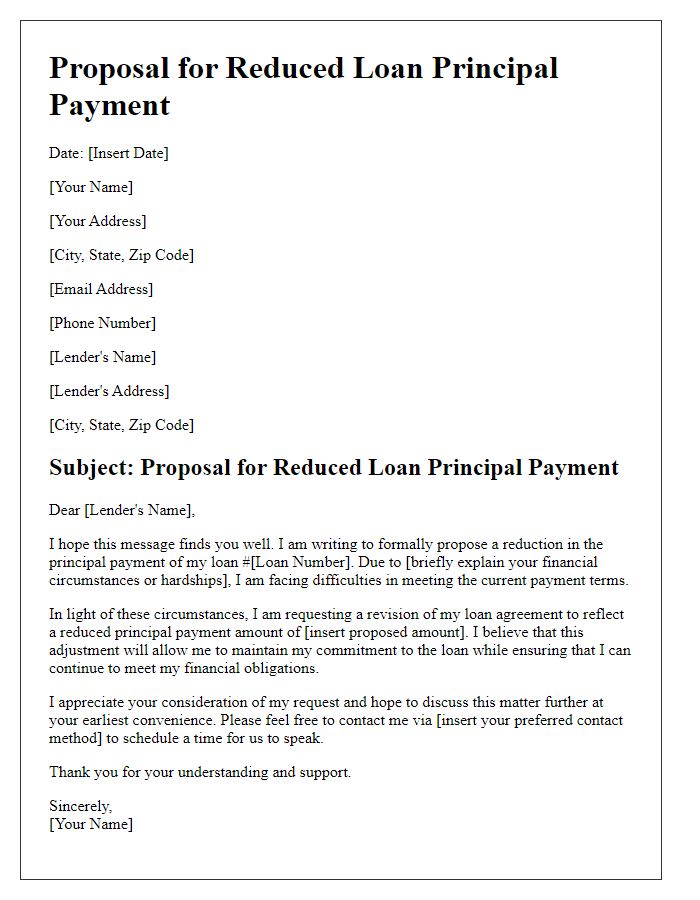

Letter Template For Loan Principal Reduction Request Samples

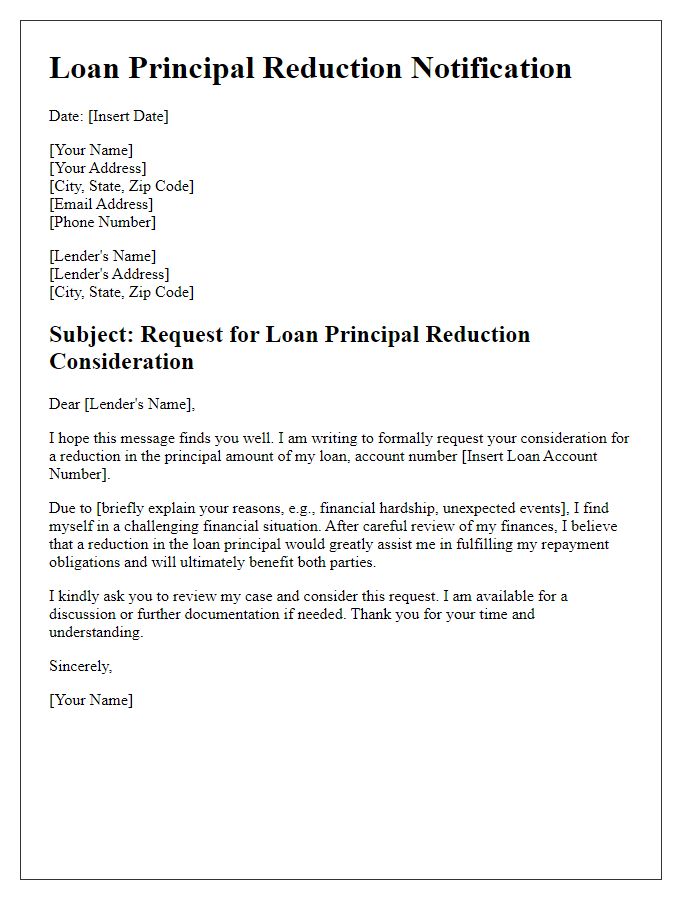

Letter template of notification for loan principal reduction consideration

Comments