Are you considering a second mortgage to help finance a major expense or consolidate debt? You're not alone; many homeowners explore this option to leverage their property's equity for additional funds. In this article, we'll guide you through a letter template specifically designed for requesting a second mortgage loan. So, grab a cup of coffee and let's dive into the essentials of crafting your request!

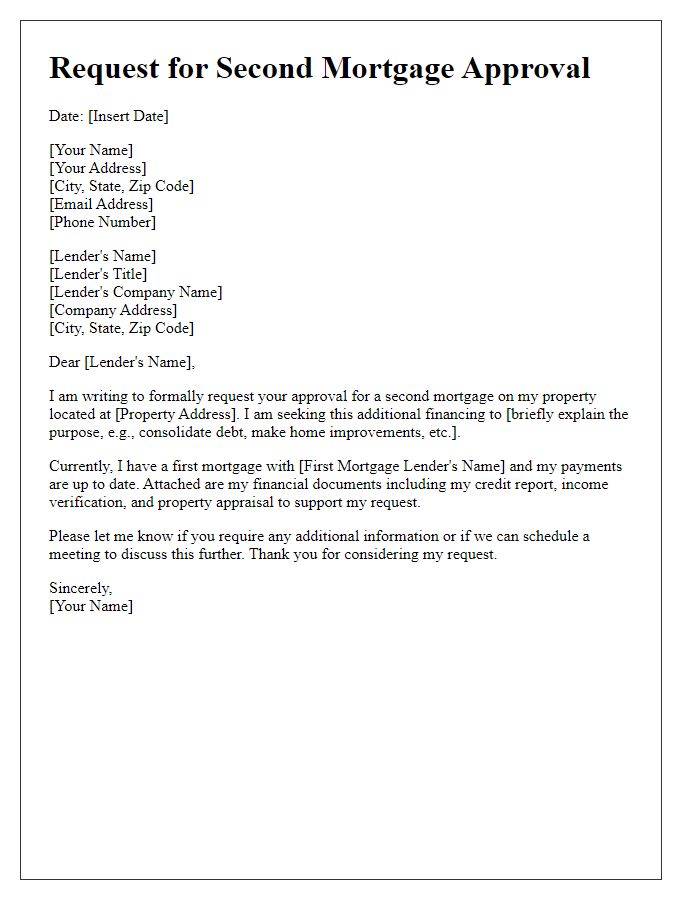

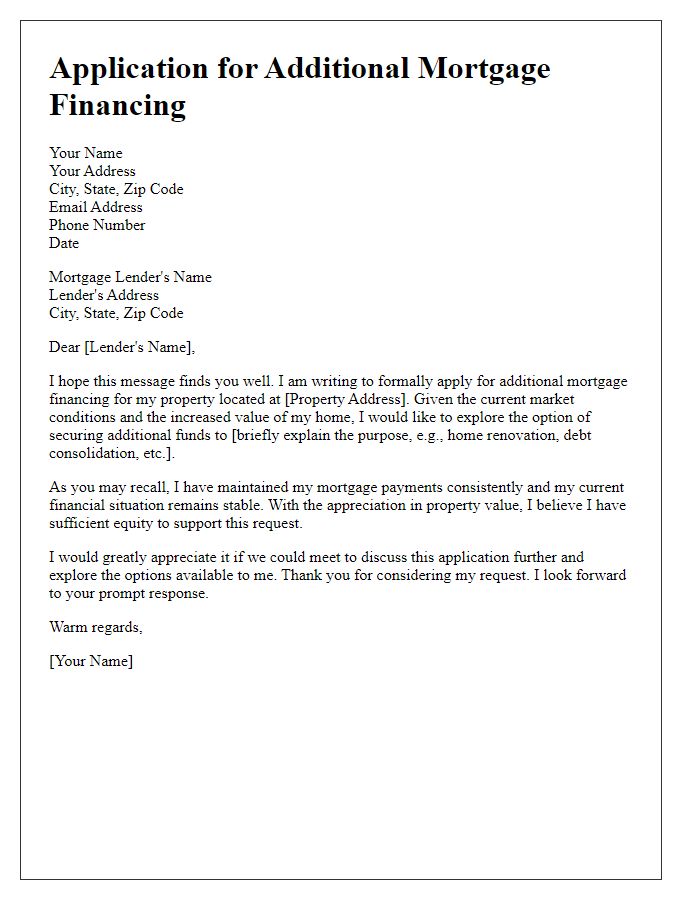

Borrower's Personal and Financial Information

A second mortgage loan request requires detailed personal and financial information to evaluate eligibility and risk. Borrower's full name, current residential address including city and zip code, date of birth (for identity verification), social security number (for credit checks), and contact number must be included. Financial details such as annual income amount from employment, additional sources of income (like rental properties or investments), monthly debts, and credit score (which typically ranges from 300 to 850 and significantly impacts loan approval) are crucial. Documenting existing mortgage information, including lender name, balance owed, and property value (estimated through local real estate market conditions), offers insight into the borrower's equity position. Additional information like employment history (duration with current employer) and savings account balances provides lenders a comprehensive view of financial stability. Assembling this data enhances the chances of a favorable loan assessment.

Detailed Property Description

The spacious property located at 123 Maple Avenue features a charming two-story design with four bedrooms and three bathrooms, encompassing approximately 2,800 square feet of living space. Situated in the suburban community of Oakwood, this home is nestled on a beautifully landscaped lot of 0.25 acres. The fully equipped kitchen includes modern appliances such as a stainless-steel refrigerator, gas range, and granite countertops, enhancing both functionality and aesthetics. Additionally, the open-concept living area boasts hardwood flooring, large windows for natural light, and a cozy fireplace, creating a welcoming atmosphere. The master suite features an en-suite bathroom with a soaking tub, providing a tranquil retreat. The property also includes an outdoor deck, perfect for entertainment, and a fenced backyard, ensuring privacy. Conveniently located near local schools and parks, this residence offers a desirable blend of comfort and community.

Purpose and Justification for Loan Request

Second mortgage loans serve various purposes, such as home improvement, debt consolidation, or significant expenses like education. Homeowners seeking a second mortgage may highlight their current property's equity, which can enhance financial stability when leveraged correctly. A typical homeowner may possess a primary mortgage totaling $200,000 and an existing equity of $100,000, allowing potential borrowing against this capital. In instances of home renovations, individuals might use funds to upgrade kitchens or bathrooms, potentially increasing property value by approximately 20%. Debt consolidation allows homeowners to pay off high-interest credit cards, with average rates around 18%, converting multiple debts into more manageable monthly payments. Education expenses may represent significant financial burdens, with average student debt reaching $30,000. A well-structured loan request should detail these purposes alongside current financial stability assessments, such as income statements and credit scores, to demonstrate repayment capability.

Creditworthiness Evidence and Income Verification

Second mortgage loan requests often require comprehensive evidence of creditworthiness and income verification. Documents such as credit reports, which detail financial behavior over the past several years, play a crucial role in assessing an applicant's reliability. Pay stubs representing earnings can demonstrate consistent income, while tax returns offer a broader view of financial stability. Property appraisal reports provide current market values of the home, which is critical in determining how much equity exists. Employment verification letters from designated HR representatives confirm job security. Additionally, documentation of existing debts reveals debt-to-income ratios, an essential factor in lenders' decision-making processes. These aggregated documents create a framework for understanding an applicant's financial health in the context of securing a second mortgage.

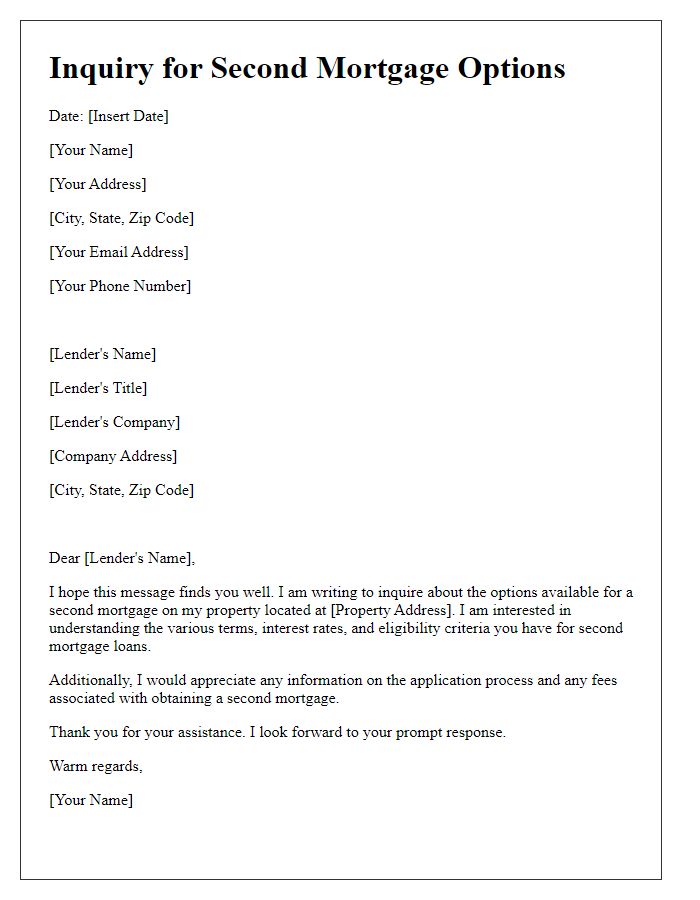

Terms and Conditions Proposed for the Second Mortgage

A second mortgage loan request involves specific terms and conditions crucial for understanding the agreement. The proposed interest rate for the second mortgage, typically higher than the first mortgage, may fall between 3% to 8%. Loan duration often spans 10 to 30 years. Borrower eligibility usually requires a minimum credit score of 620, alongside a stable income verification process, like pay stubs or tax returns. The loan-to-value ratio, which measures the loan amount against the home's appraised value, typically should not exceed 85%. Additionally, the lender may stipulate a property appraisal to confirm market value, while also requiring proof of homeowner's insurance. Closing costs associated with the second mortgage, often around 2% to 5% of the loan amount, should also be accounted for. Finally, pre-payment penalties may be included in the terms, impacting financial flexibility.

Comments