Hey there! If you're gearing up to navigate the loan closing process, you're in the right spot. This can seem daunting, but understanding the essential steps can truly simplify the experience. We're excited to break it down for you, so grab a cup of coffee and let's dive into the details togetherâread more to uncover what you need to know!

Borrower's Contact Information

Initiating the loan closing process involves collecting essential details from the borrower. Borrower's contact information includes crucial data such as full name, current address (house or apartment number, street name, city, state, and zip code), email address (primary contact for correspondence), and phone number (cell or home for direct communication). This information is paramount to ensure seamless communication throughout the closing process and to facilitate sending legal documents and notifications regarding the loan. Timely and accurate contact information helps streamline the process, reducing potential delays and ensuring a smooth transition towards loan disbursement.

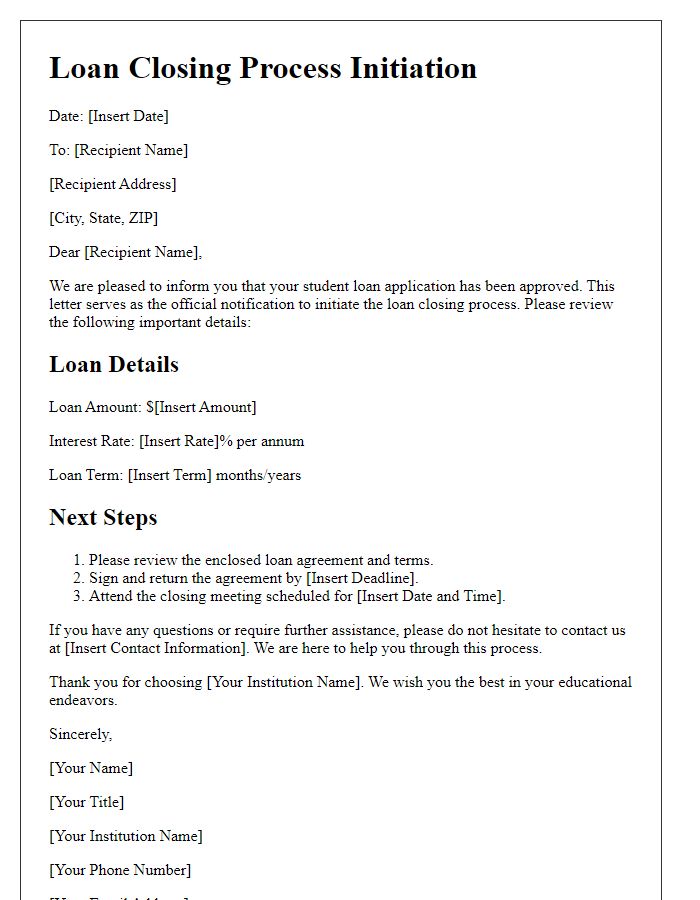

Loan Details and Terms

The loan closing process initiation includes crucial details such as loan amount, interest rate, and repayment duration. For example, a mortgage loan might be set at $250,000 with a fixed interest rate of 3.5% over 30 years. Closing costs often include fees (approximately 2% to 5% of the loan amount), such as title insurance, appraisal fees, and attorney fees, which must be addressed. Essential documents include the Closing Disclosure, providing a summary of loan terms and costs, and the Promissory Note, outlining the borrower's promise to repay the loan. The loan's funding source, whether a bank (like Wells Fargo) or credit union (such as Navy Federal), also plays a significant role in the closing process.

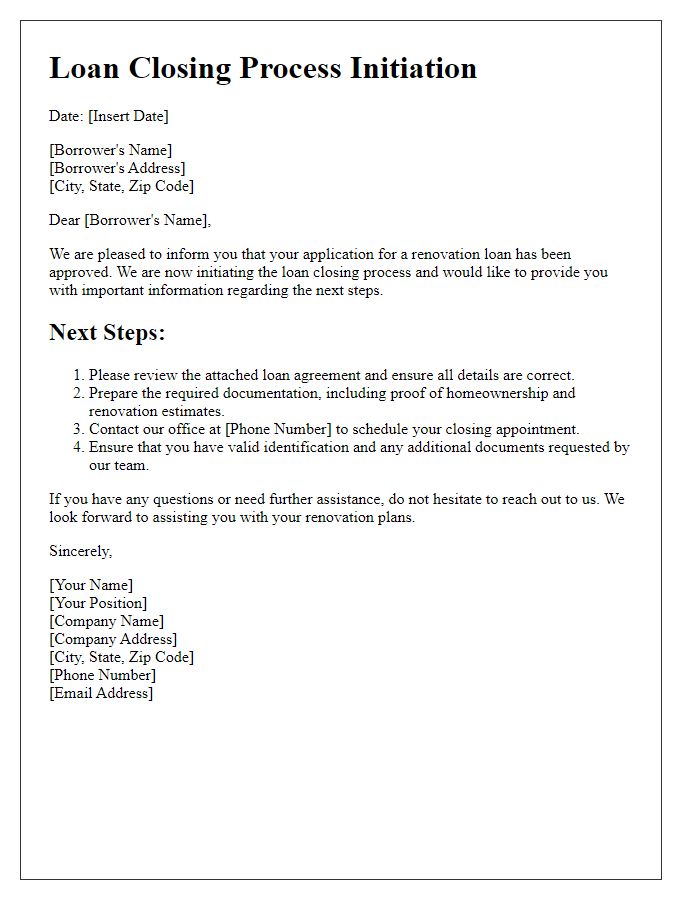

Official Lender's Letterhead

The loan closing process initiates once all necessary documentation is gathered, marking a significant milestone in securing financing for a residential property, like the charming Victorian home located at 123 Maple Street, Springfield. The final steps require coordination among various parties, including the lender, title company, and buyer, to ensure the accurate transfer of title and funds. Buyers should prepare to review critical documents, such as the Closing Disclosure, which details loan terms, monthly payments, and closing costs, typically issued three days prior to closing. The closing meeting often takes place in a designated office, where signatures are affixed to relevant agreements, ensuring compliance with both state and federal laws. Timely completion of this process is essential, as delays can incur additional fees or impact the buyer's move-in schedule.

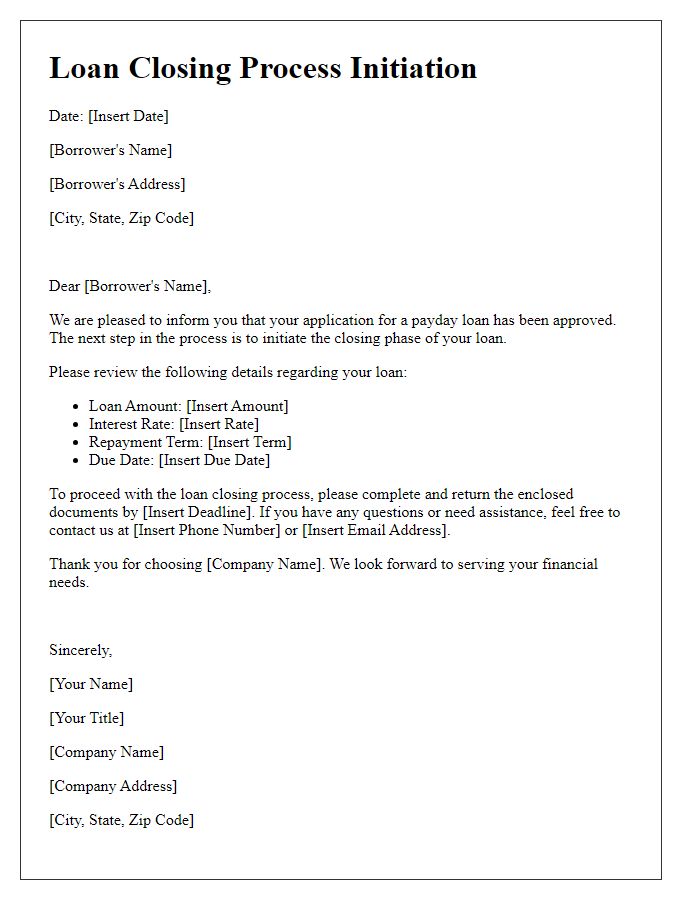

Closing Date and Process Overview

A loan closing process involves several critical stages that ensure the finalization of borrowing agreements. The closing date, typically set 30 to 45 days after the loan application is submitted, signifies the culmination of all preceding steps, including underwriting (the detailed evaluation of the borrower's creditworthiness), appraisal (the assessment of the property's market value), and title search (verification of the rightful property ownership). During this process, documents such as the Closing Disclosure (providing itemized loan costs and terms) and the promissory note (the borrower's signed agreement to repay the loan) are prepared meticulously. Relevant fees may include origination fees (processing charges), recording fees (costs for registering the mortgage with local authorities), and escrow fees (charges for services provided by a third-party that holds the funds for transaction completion). Successful loan closing requires coordination among numerous parties--lenders, borrowers, real estate agents, and title companies--to ensure compliance with legal requirements and satisfied financing conditions.

Required Documentation Checklist

The loan closing process requires meticulous preparation across various documentation, which is crucial for smooth transactions. Borrowers must gather recent income verification documents like pay stubs (typically last two months) and W-2 forms (for the last two years). Additionally, lenders need details regarding assets such as bank statements (from the past two months) and investment account summaries (if applicable). Property-related documents like the purchase agreement and title commitment are necessary for real estate transactions, especially in locations like California where property laws might vary. Credit reports, obtained from major bureaus (TransUnion, Equifax, Experian), play a pivotal role in assessing the borrower's creditworthiness. Identification documents such as government-issued ID (driver's license or passport) are mandatory to establish identity. Meeting these documentation requirements expedites the closing timeline, enhancing efficiency and promoting transparency throughout the loan process.

Letter Template For Loan Closing Process Initiation Samples

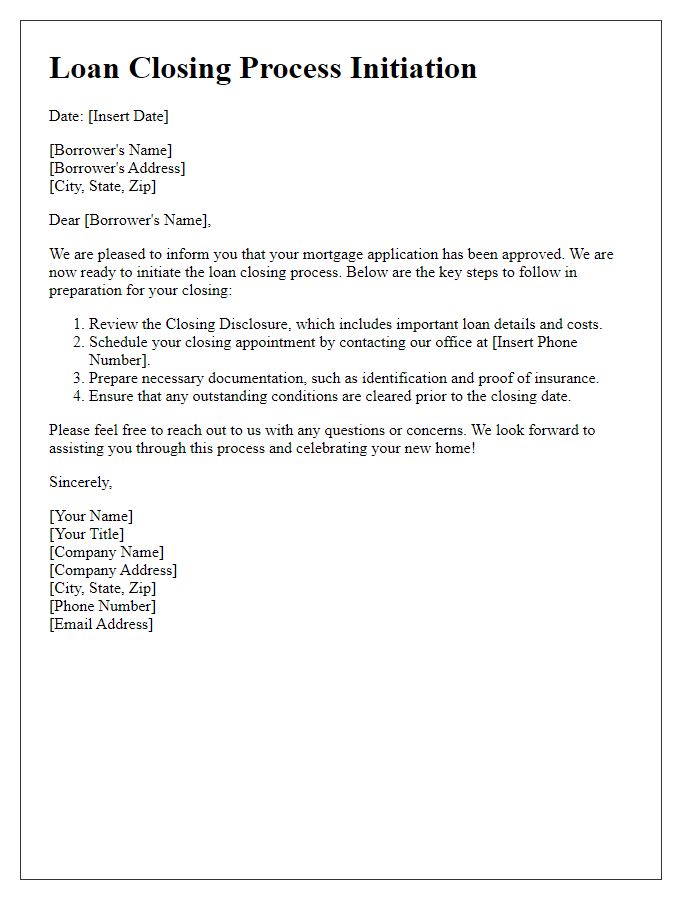

Letter template of loan closing process initiation for mortgage applications

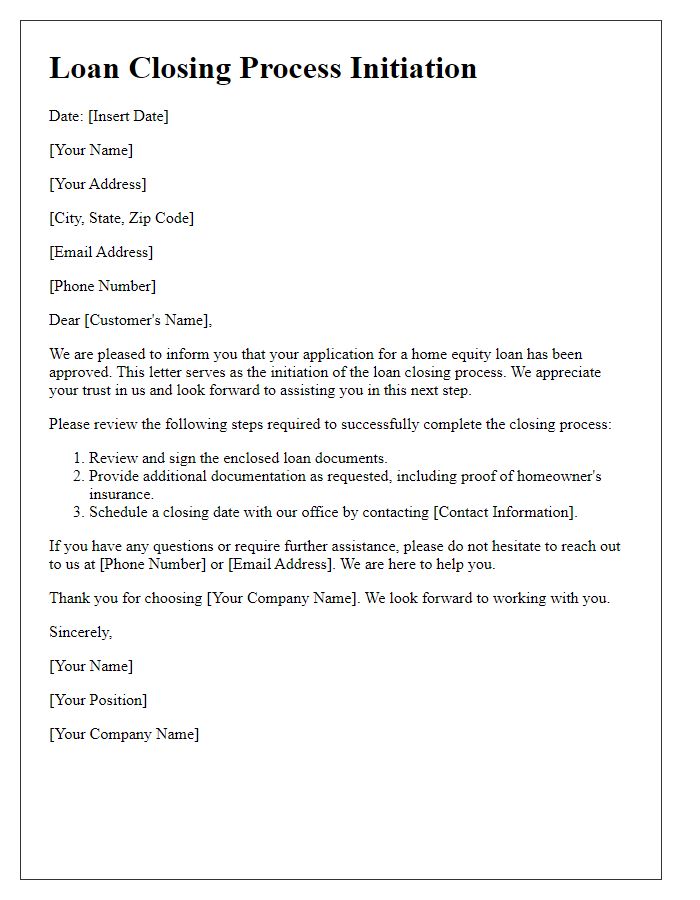

Letter template of loan closing process initiation for home equity loans

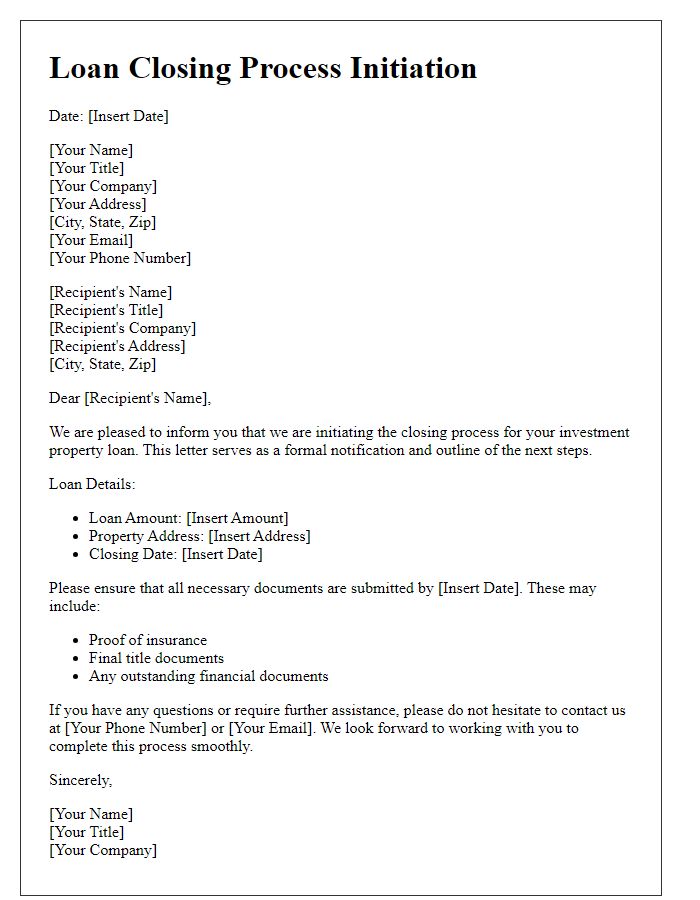

Letter template of loan closing process initiation for investment property loans

Letter template of loan closing process initiation for debt consolidation loans

Comments