Are you feeling overwhelmed by your current financial obligations and considering a repayment holiday on your loan? You're not alone; many individuals find themselves in similar situations and are looking for ways to ease their financial burdens. A repayment holiday can provide you with some much-needed breathing room to get back on your feet. If you're interested in learning how to effectively request a repayment holiday for your loan, keep reading for a comprehensive letter template!

Clear Subject Line

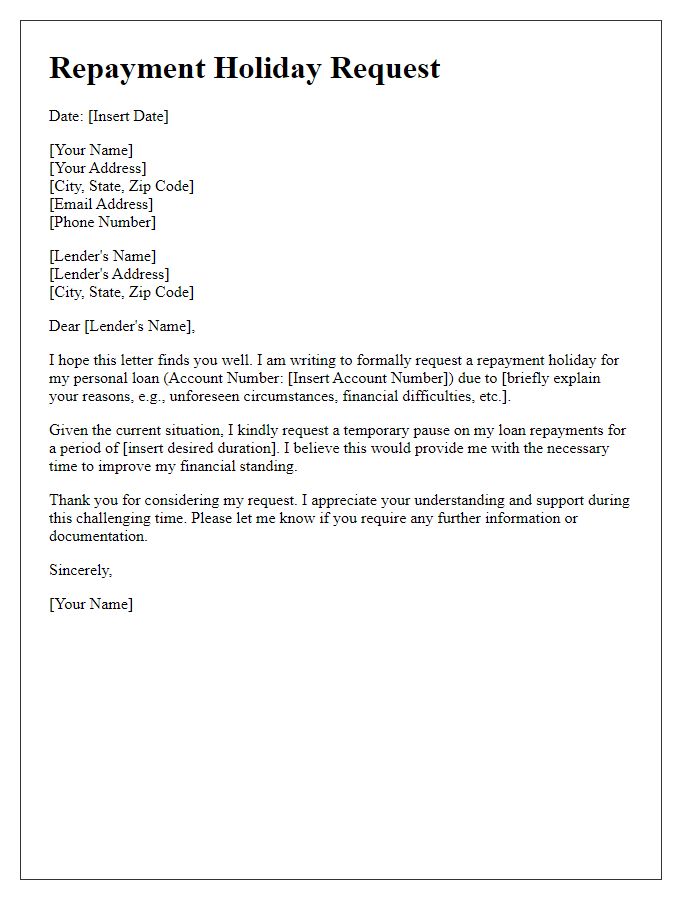

A repayment holiday loan request requires careful consideration of personal financial circumstances and formal communication with the lending institution. Key details such as current loan amount, repayment schedule, duration of the requested holiday, specific reasons for the request--like unexpected financial hardship due to job loss or medical expenses--should be clearly articulated. Including personal information, such as account number and contact details, can facilitate processing. A well-structured request conveys respect for the lender's policies while demonstrating a commitment to fulfilling obligations, ultimately enhancing the chances of approval for a temporary relief solution.

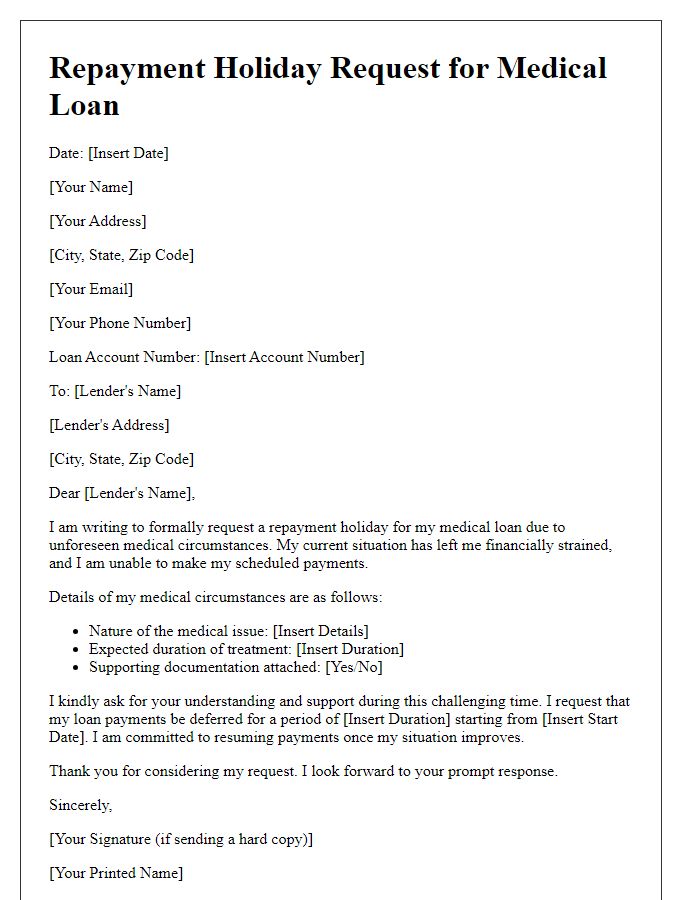

Borrower's Personal Information

A repayment holiday request involves important personal information. This includes the borrower's full name, typically such as John Doe, which identifies the individual in loan agreements. The address must be provided, including street name and number, city, and postal code, for correspondence purposes and to confirm identity. Phone number, like (123) 456-7890, facilitates immediate contact if clarifications or discussions are needed. Email address, for instance, johndoe@email.com, serves as a digital communication channel for official updates. Finally, loan account number is crucial, allowing lenders to quickly access the specific loan details pertaining to the borrower, essential for processing the repayment holiday request efficiently.

Loan Details

A repayment holiday loan request often involves specific loan details critical for processing the request effectively. Loan amounts should be specified, such as $10,000, with an original loan term of 36 months beginning on January 1, 2023. The interest rate, which could be 5.5% annually, must be clearly documented. Additionally, mention the required payment amount per month, like $300, which could be based on the borrower's current financial situation. Specific institutions, such as ABC Bank located in New York, may have particular policies for repayment holidays, allowing borrowers to temporarily pause payments under certain conditions. Providing a reference number, such as LOAN123456, ensures proper tracking of the request within the bank's system.

Reason for Request

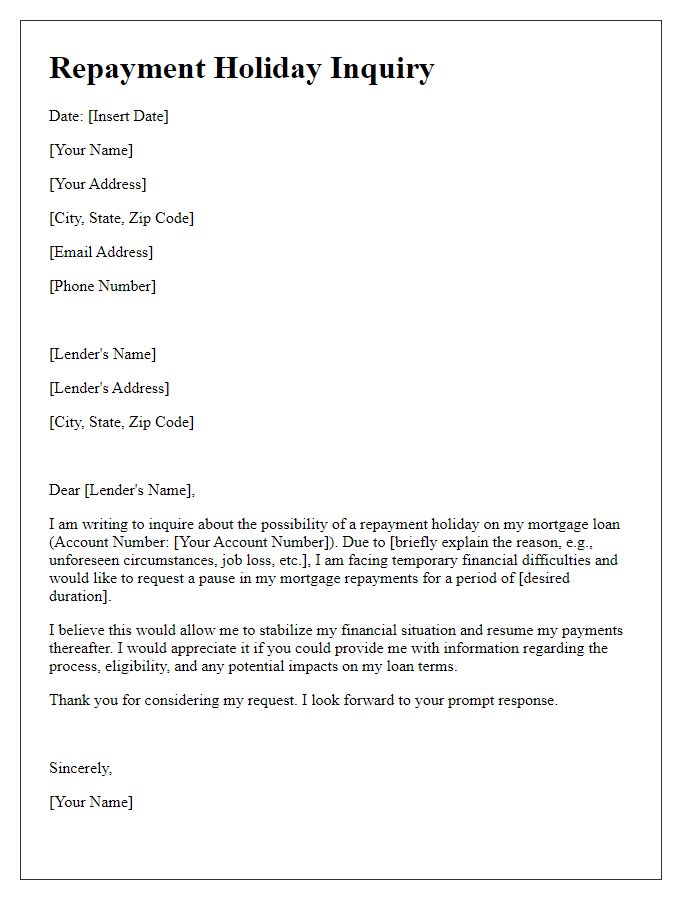

Requesting a repayment holiday for a loan may stem from various circumstances. Financial hardships, such as unexpected medical expenses or loss of employment, create significant challenges for borrowers. A recent event, such as a natural disaster affecting property in Florida, can impact the ability to meet monthly obligations. Additionally, the economic fluctuations during the COVID-19 pandemic increased reliance on such assistance. Borrowers often seek temporary relief to stabilize their finances before resuming normal payment schedules. It's crucial to articulate the situation clearly, providing supporting documentation where possible, to enhance the chances of approval for a repayment holiday.

Proposed Repayment Plan

Proposing a repayment plan for a holiday loan requires detailed consideration of current financial circumstances. The holiday loan, often used to cover travel or festive expenses, may have a principal amount ranging from $1,000 to $10,000. Suggested terms could involve a temporary deferment period of up to six months, allowing borrowers to stabilize their finances before the full repayment begins. Monthly payments thereafter might be structured over a five-year term, with interest rates typically between 5% and 15% annually, depending on creditworthiness. Incorporating milestones for financial reassessment during this period serves to ensure both lender and borrower maintain clear communication regarding the repayment status and any potential adjustments needed.

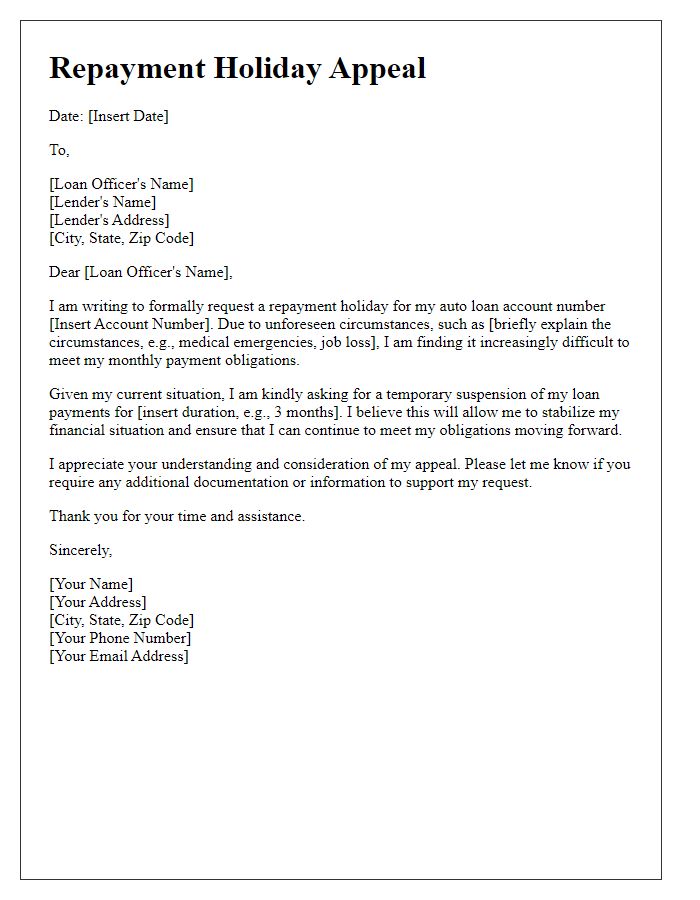

Letter Template For Repayment Holiday Loan Request Samples

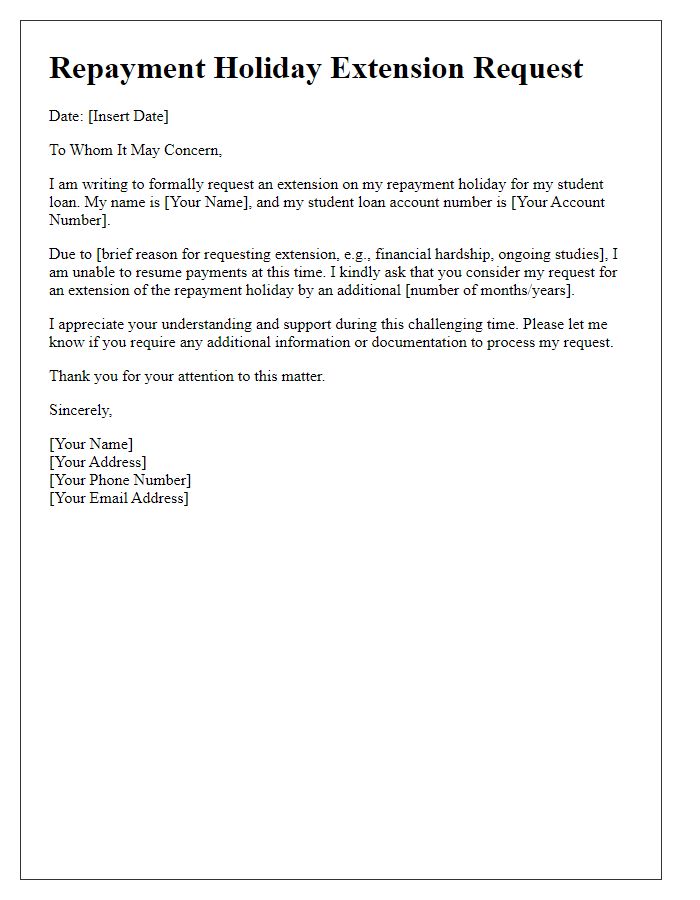

Letter template of repayment holiday extension request for student loan.

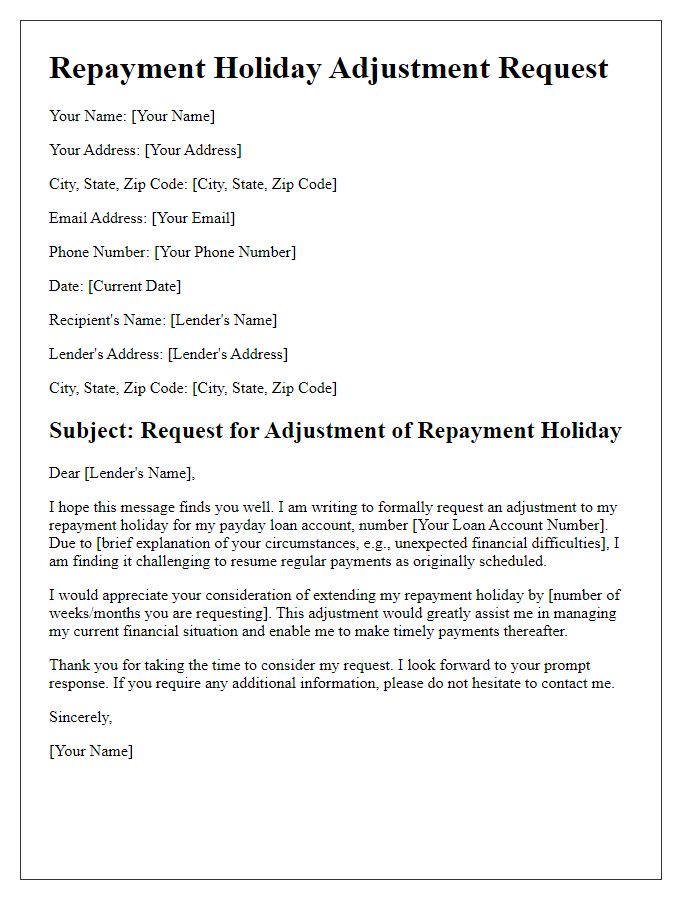

Letter template of repayment holiday adjustment request for payday loan.

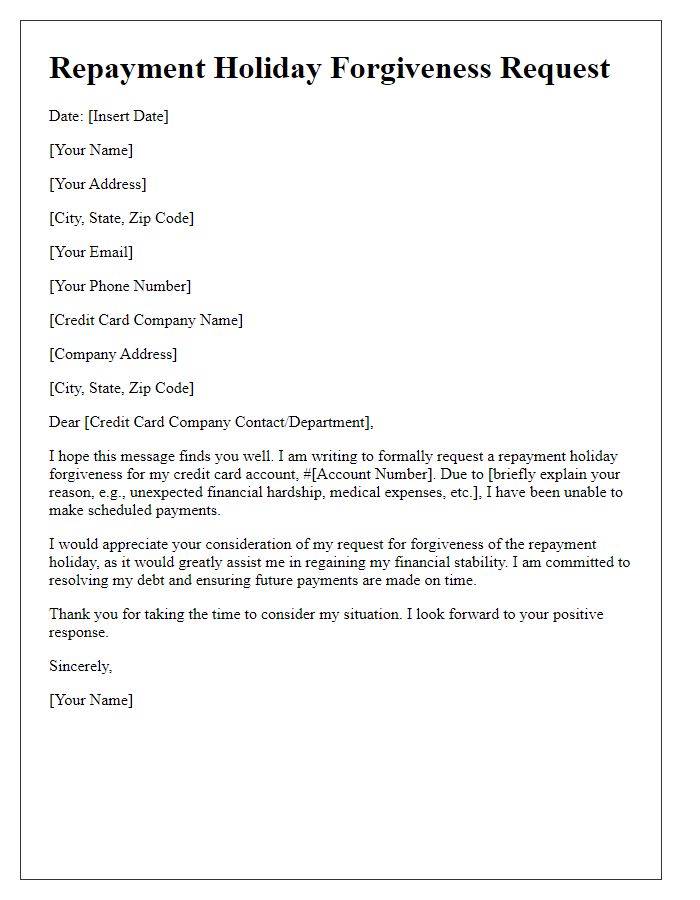

Letter template of repayment holiday forgiveness request for credit card debt.

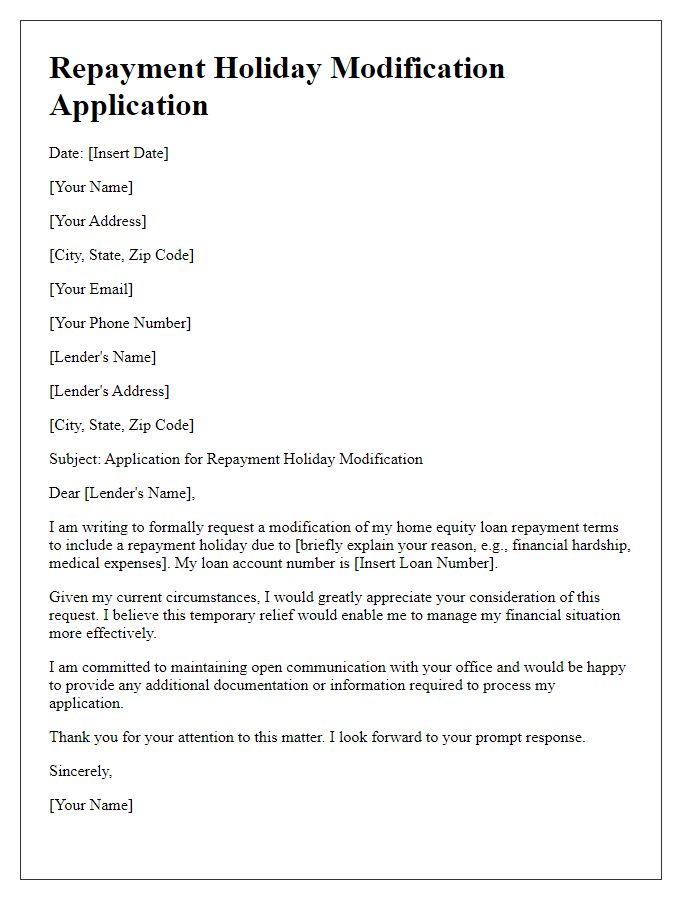

Letter template of repayment holiday modification application for home equity loan.

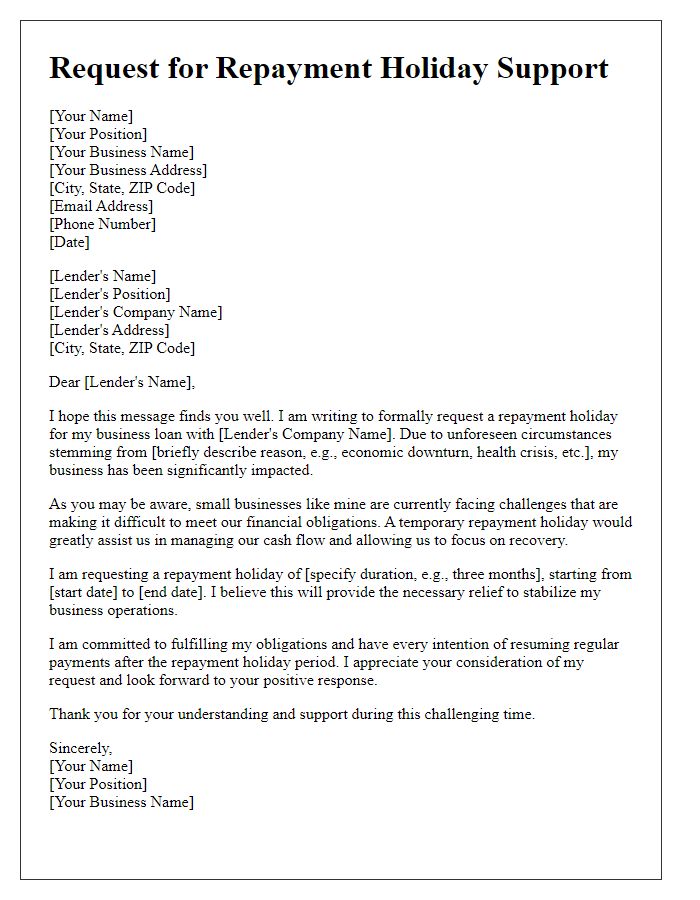

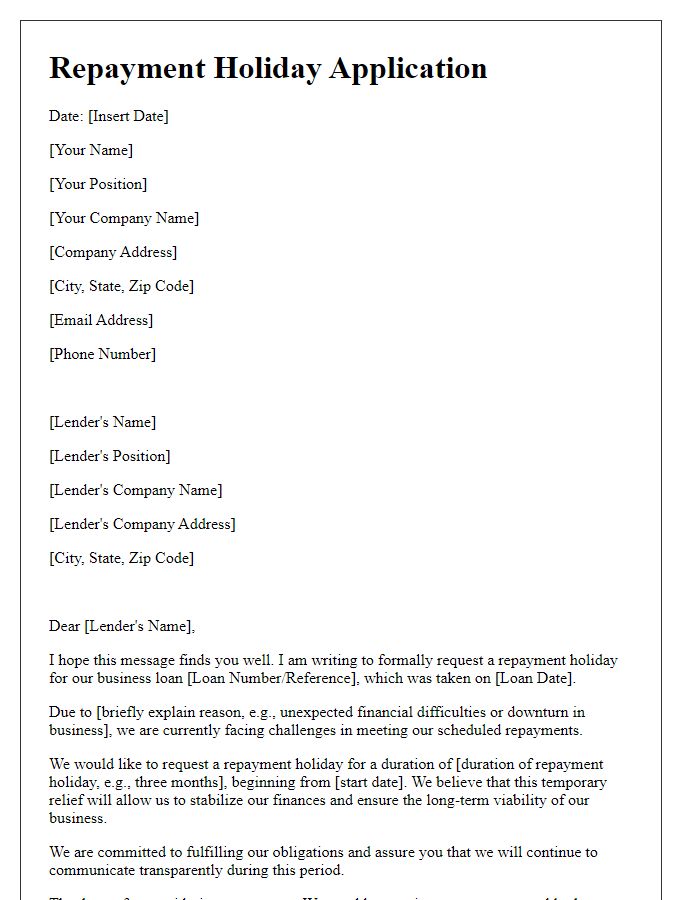

Letter template of repayment holiday support request for small business financing.

Comments