Are you considering applying for a healthcare loan benefit but unsure where to start? Navigating the application process can be daunting, but with the right guidance, it becomes much simpler. In this article, we'll break down crucial steps and tips to help you successfully submit your application. So, get comfortable and let's dive deeper into how you can secure the medical financing you need!

Applicant Information

Healthcare loan benefit applications require detailed applicant information to assess eligibility and needs effectively. Personal identification includes full name, date of birth, and Social Security number. Address details necessitate street address, city, state, and ZIP code for accurate location verification. Contact information should include a primary phone number and email address for communication purposes. Employment status must be specified, including the name of the employer, job title, length of employment, and annual income to evaluate financial stability. Additional sections often request details about health insurance coverage, type of healthcare services required, and the estimated costs associated, allowing for a comprehensive understanding of the applicant's situation and loan requirements.

Loan Purpose and Amount

Healthcare loans serve as a financial resource designed to assist individuals seeking to cover medical expenses, educational costs related to healthcare professions, or the establishment of healthcare facilities. These loans often range from $5,000 to $100,000, depending on the individual's needs and financial situation, with interest rates varying between 5% to 12%. The loan purpose can encompass necessary medical treatments, acquiring advanced medical equipment, or funding tuition fees for nursing or medical school programs. Institutions like private banks, credit unions, and specialized healthcare financing companies are key players in this market, offering tailored loan packages that aim to make healthcare more accessible for patients and professionals alike. Understanding eligibility criteria, repayment terms, and application processes at locations such as the Federal Trade Commission or local financial institutions can significantly facilitate the loan acquisition.

Healthcare Provider Details

Healthcare provider details play a crucial role in the healthcare loan benefit application process. This information typically includes the full name of the healthcare facility, such as St. Mary's Hospital located in Chicago, Illinois, the provider's National Provider Identifier (NPI), which is a unique identification number for healthcare providers, and the Type of facility, ranging from hospitals to outpatient clinics. Additional details might encompass the organization's address, with specific street names and ZIP codes, contact information including telephone numbers and email addresses, and any relevant certifications or special recognitions that highlight the provider's credentials and service quality. Ensuring accuracy in these details helps facilitate the processing and evaluation of the loan application.

Financial Situation Overview

The healthcare loan benefit application process requires a comprehensive financial situation overview to assess eligibility and determine the appropriate financial support. Individuals or families applying for assistance should provide detailed information about their monthly income, including employment wages, additional sources of income such as freelance work or government benefits, and any other financial resources that contribute to their total earnings. It is also essential to outline fixed expenses typically incurred each month, such as rent or mortgage payments, utilities, grocery costs, insurance premiums, and transportation expenses like car payments. Furthermore, applicants should disclose any outstanding debts, including credit card balances, student loans, and other personal loans, as this information will provide a clearer picture of their financial obligations. Documentation, such as pay stubs, bank statements, and bills, must accompany the application to substantiate the financial overview presented, ensuring a thorough review by the lending institution.

Supporting Documentation and Attachments

Supportive documentation is crucial for the healthcare loan benefit application process. Essential items should include a completed application form, recent pay stubs (typically from the last two months) to verify income, a current credit report (from major credit bureaus like Experian, TransUnion, Equifax), proof of employment (such as an employment verification letter or contract), and tax returns (usually for the last two years) to assess financial stability. Additionally, documentation of any existing medical expenses, a detailed breakdown of healthcare costs incurred (hospital bills, invoices from healthcare providers), and evidence of any applicable insurance coverage should be included. Official identification documents, such as a driver's license or passport, must also be submitted for identity verification purposes. Each document should be recent and reflect the applicant's current financial and healthcare status.

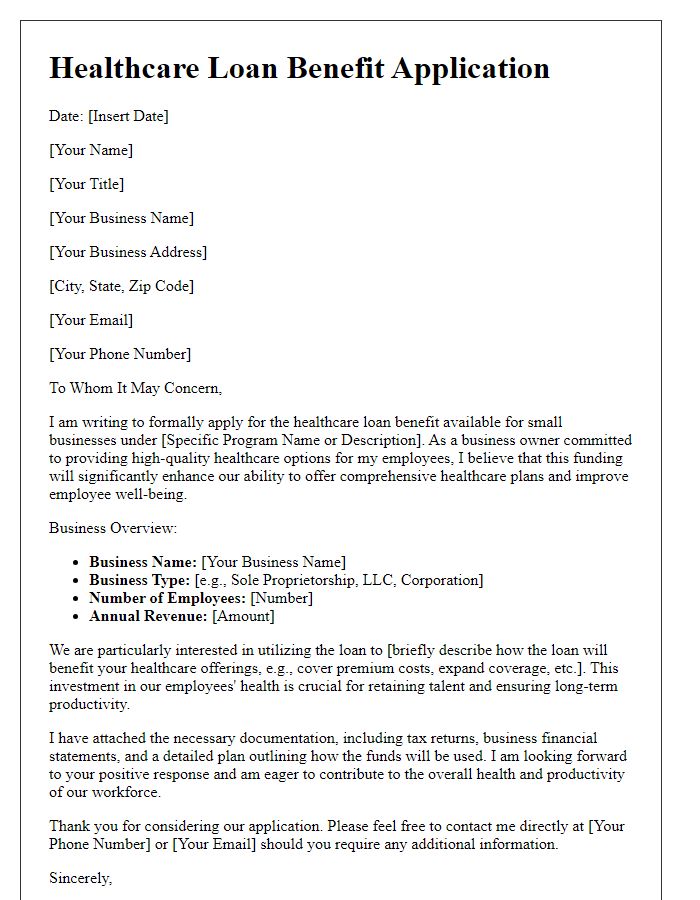

Letter Template For Healthcare Loan Benefit Application Samples

Letter template of healthcare loan benefit application for small businesses.

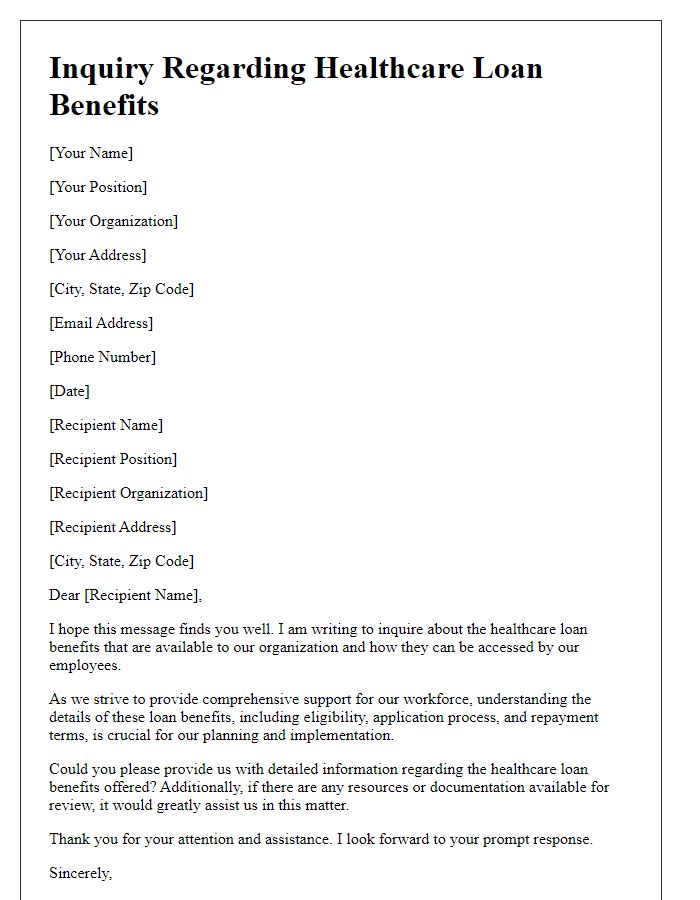

Letter template of healthcare loan benefit inquiry for large organizations.

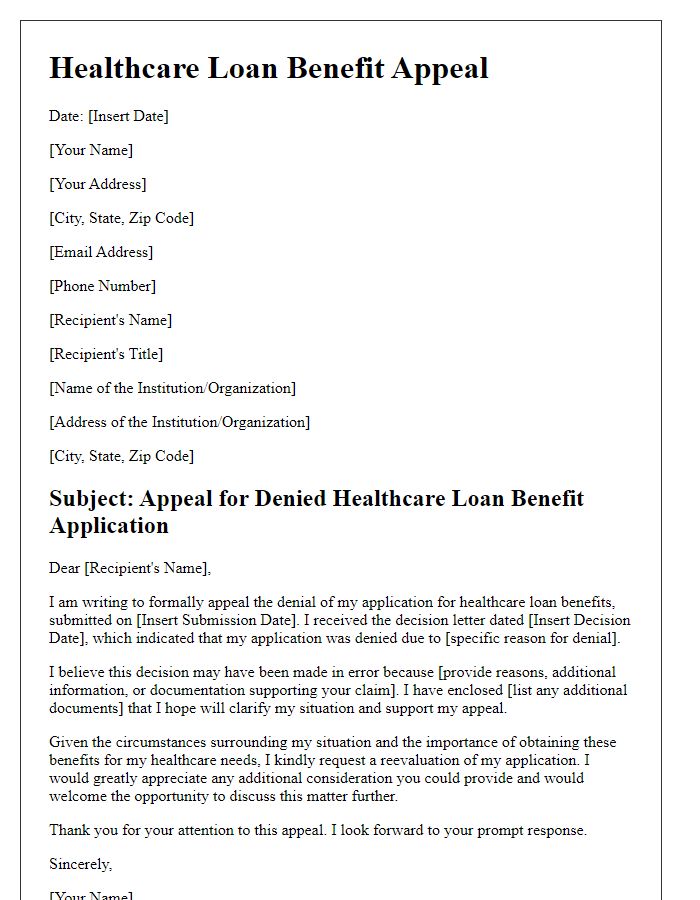

Letter template of healthcare loan benefit appeal for denied applications.

Letter template of healthcare loan benefit application for medical practitioners.

Letter template of healthcare loan benefit request for emergency situations.

Letter template of healthcare loan benefit application for non-profit organizations.

Letter template of healthcare loan benefit funding request for community health initiatives.

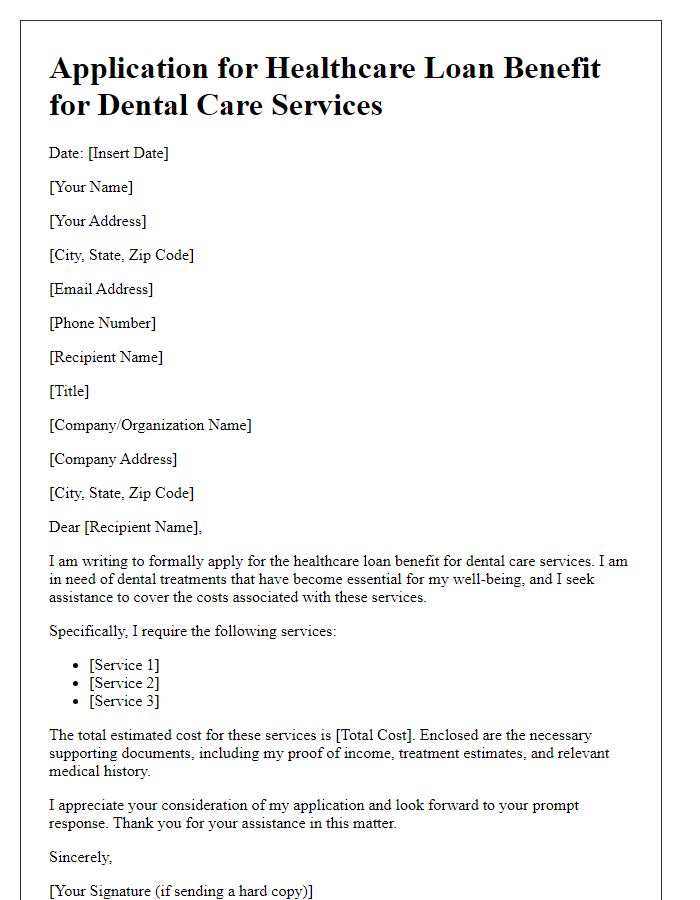

Letter template of healthcare loan benefit application for dental care services.

Comments