Are you dreaming of a stress-free holiday this season but worried about the financial side of things? You're not alone! With our holiday loan schemes, you can easily fund your getaway without breaking the bank. Curious to learn how you can make your holiday dreams a reality? Read more to discover the benefits and options available!

Personalized Greeting

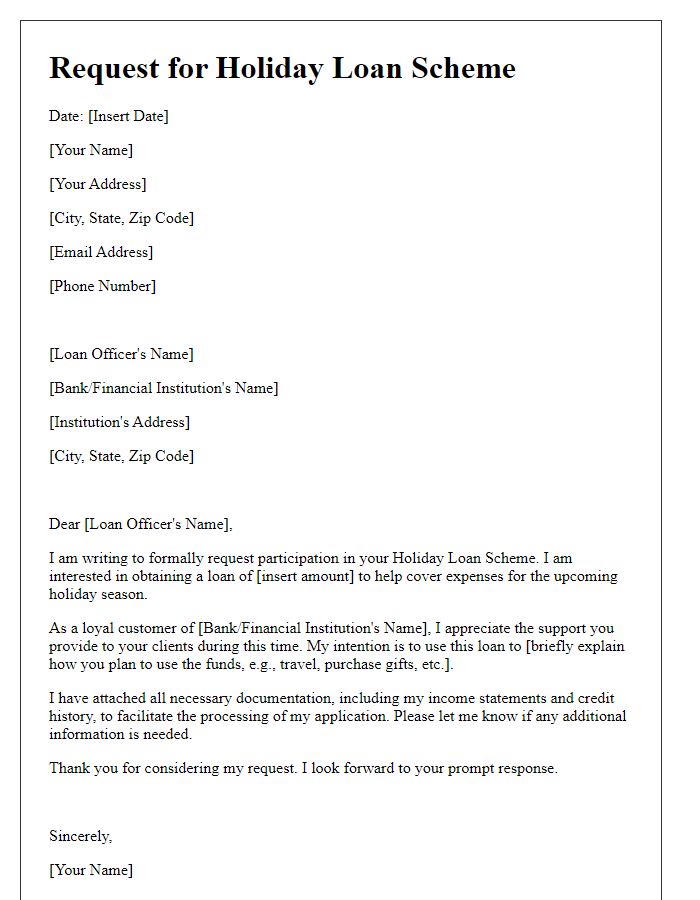

Inquiring about a holiday loan scheme reveals essential financial options for individuals seeking festive experiences. Various institutions offer tailored loans with interest rates averaging between 6% to 12%, depending on creditworthiness and repayment terms. Holiday loan schemes often cater to specific needs such as travel, gift purchases, and home decorations, promoting financial flexibility during festive seasons. Noteworthy events like Christmas and Thanksgiving significantly drive demand for such loans, as families aim to create memorable celebrations. Applicants typically need to provide proof of income, credit history, and identification to qualify, ensuring a streamlined process for those eager to celebrate without financial burdens.

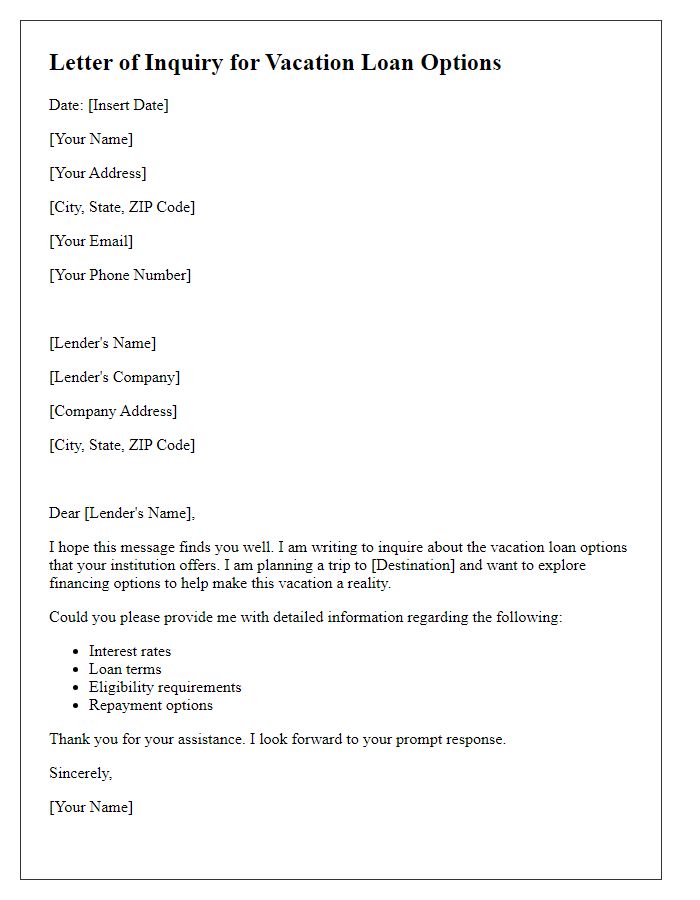

Purpose of Inquiry

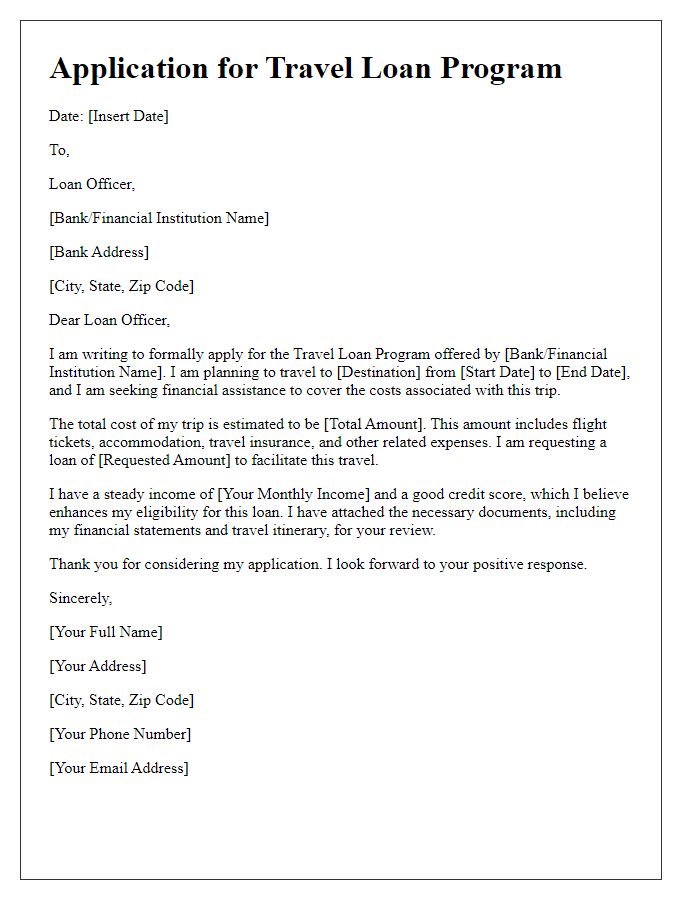

A holiday loan scheme offers individuals the opportunity to finance travel plans and experiences, often through financial institutions like banks or credit unions. Purpose of inquiry typically focuses on understanding the loan terms, including interest rates, repayment schedules, eligibility requirements, and any associated fees. Many consumers seek clarity on specific financial limits, such as maximum loan amounts, and the impact of credit scores on application approval. Additionally, potential borrowers may inquire about special promotions, seasonal offers, or the process for accessing funds in specific regions, such as Europe or Asia, to ensure a seamless travel experience.

Specific Loan Amount and Terms

Holiday loan schemes provide financial assistance for travel and festive expenses. Specific loan amounts often range from $1,000 to $10,000, tailored to individual needs. Terms may vary, typically spanning six months to five years, depending on the lender's policies (interest rates potentially between 5% and 20% annually). Key factors influencing loan approval include credit scores (usually above 650), income levels, and debt-to-income ratios, which should not exceed 40%. Some institutions, like credit unions, offer lower fees and more flexible repayment options. It's essential to review the total repayment amount including interest and any additional costs associated with the loan arrangement.

Financial Details and Eligibility

The holiday loan scheme offers financial assistance tailored for vacations, allowing borrowers to manage expenses effectively. Income eligibility typically requires a stable monthly income (often above $2,500) to ensure repayment capability. Lenders assess credit scores, which ideally should be above 650, to determine borrower reliability. Additional factors include employment status, with full-time positions favored over part-time or freelance work. The maximum loan amount may reach $15,000, with repayment terms ranging from 12 to 60 months, depending on the lender and individual financial profiles. Documentation requirements often include recent pay stubs, tax returns, and identification verification to facilitate the application process.

Contact Information and Follow-up Request

Holiday loan schemes, often offered by financial institutions, provide individuals with an opportunity to finance their festive expenses such as travel, gifts, or events. These schemes typically feature varying interest rates (often between 5% and 15% per annum) and repayment periods spanning from six months to five years. For example, a holiday loan of $5,000 could entail monthly repayments ranging from $150 to $200 depending on the interest rate applied. Contacting customer service of organizations like banks or credit unions is essential for inquiries, as representatives can clarify loan eligibility criteria and required documentation such as proof of income and credit history. Following up with a request for detailed term sheets and comparisons could streamline the decision-making process and ensure that individuals select the most suitable financial product for their holiday needs.

Comments