Are you feeling overwhelmed after receiving a loan modification denial? You're not alone; many go through the stress of financial challenges and face similar hurdles. In this article, we'll guide you through the process of drafting an effective appeal letter that can increase your chances of approval. So, let's dive in and explore how to turn your denial into an opportunity for success!

Clear Identification of Borrower and Loan Details

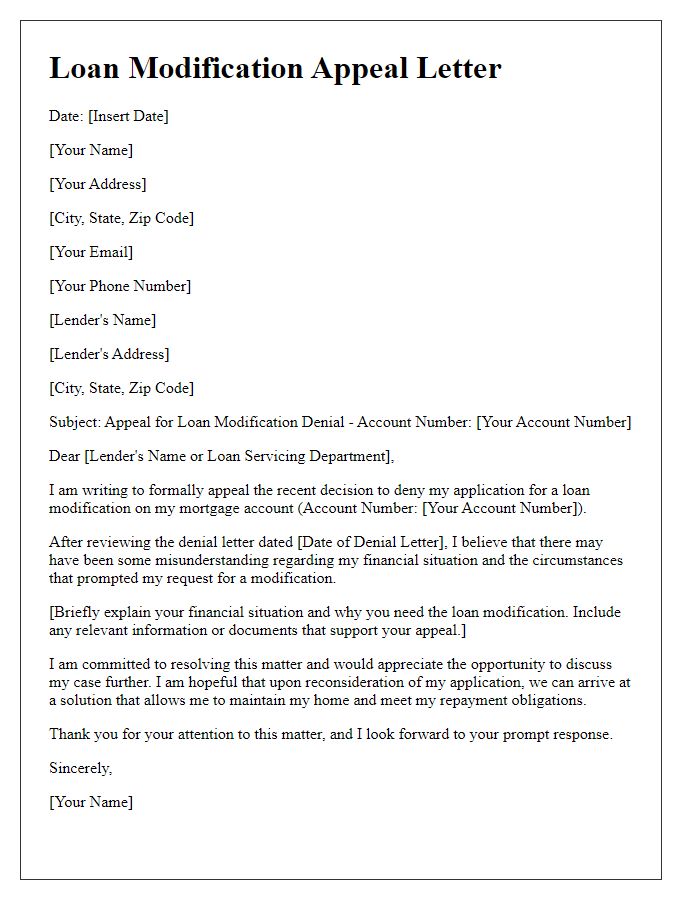

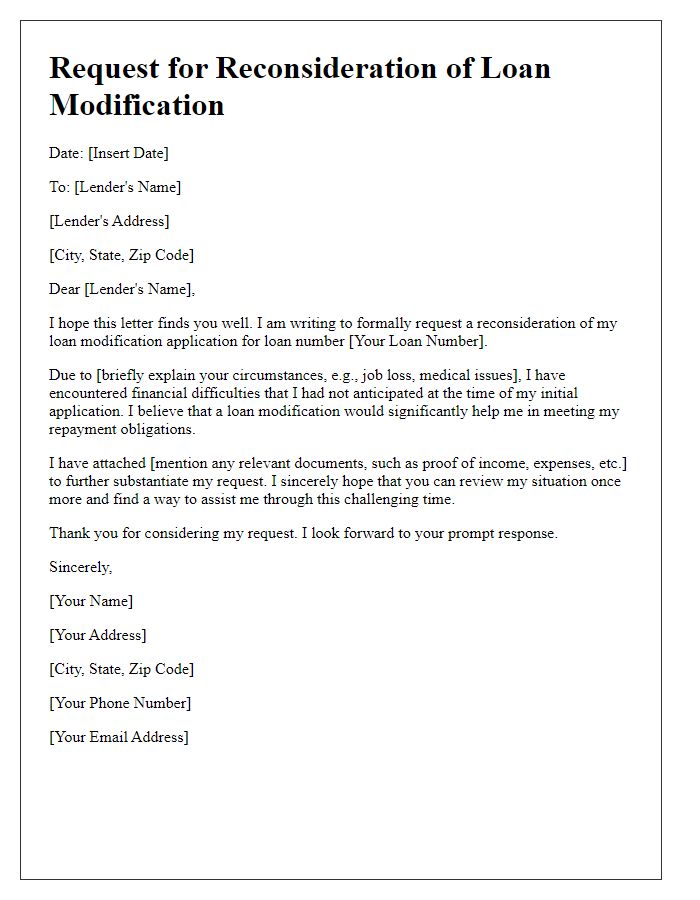

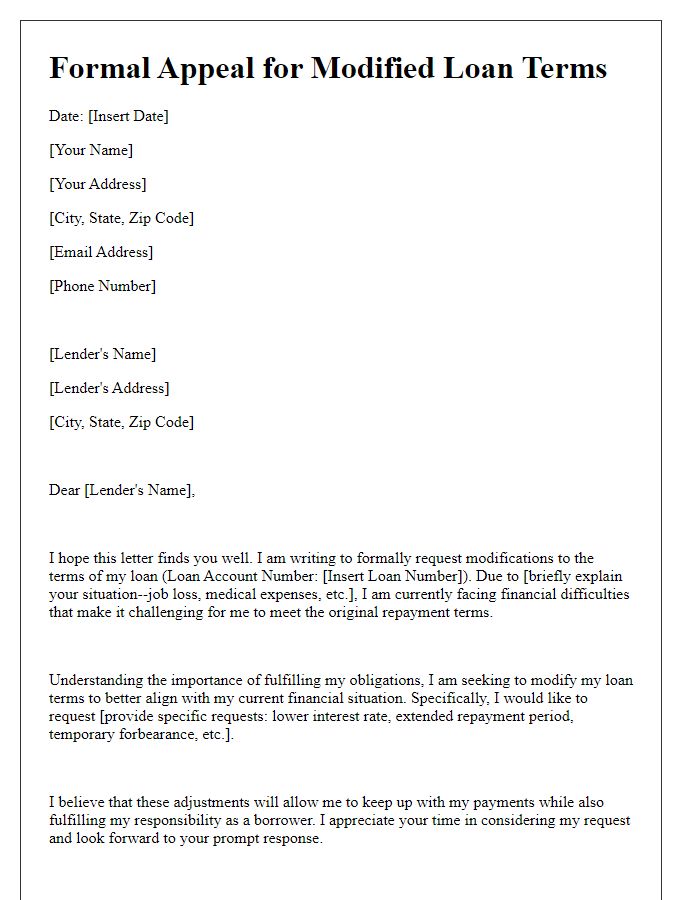

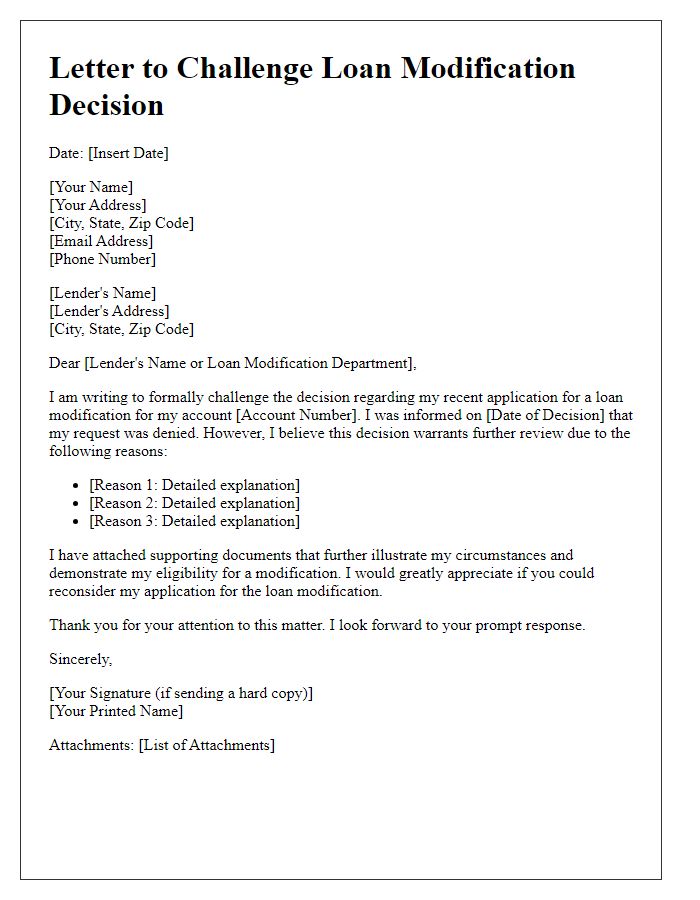

The appeal for loan modification denial requires a clear identification of the borrower alongside specific loan details to facilitate effective processing. Essential borrower information includes the full name, home address, and the contact number, which enable lenders to verify identity. Loan details should encompass the loan number, original loan amount, current outstanding balance, and the type of loan (such as FHA, VA, or conventional). Providing context about the financial hardship leading to the request for modification strengthens the appeal. Similarly, including any past interactions with the lender concerning the loan modification process offers a comprehensive overview of the situation, promoting urgency and clarity in the appeal. Proper documentation such as evidence of income and hardship statements further substantiate the borrower's case.

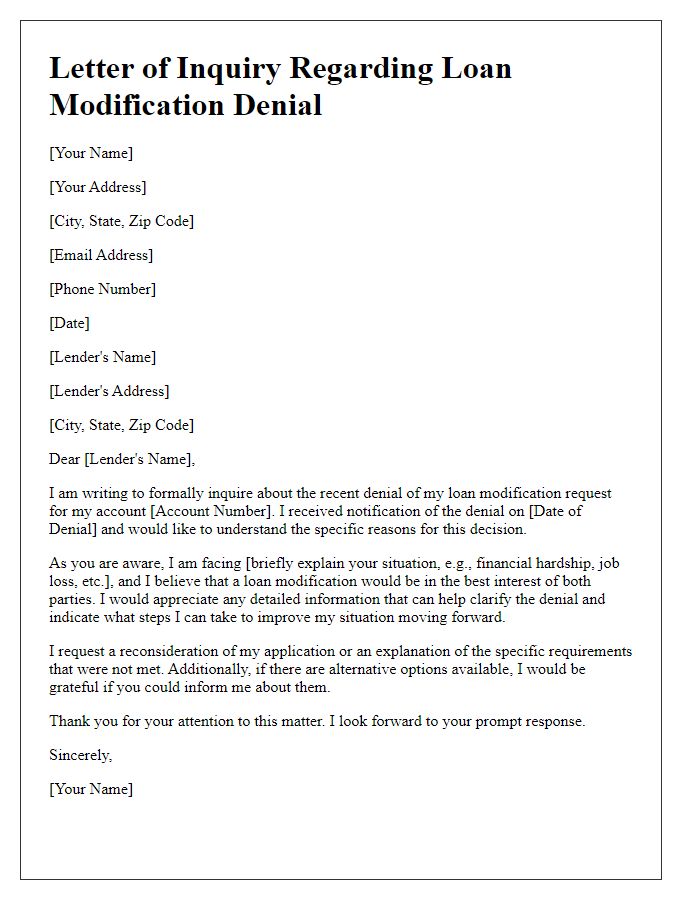

Reason for Denial and Disputable Points

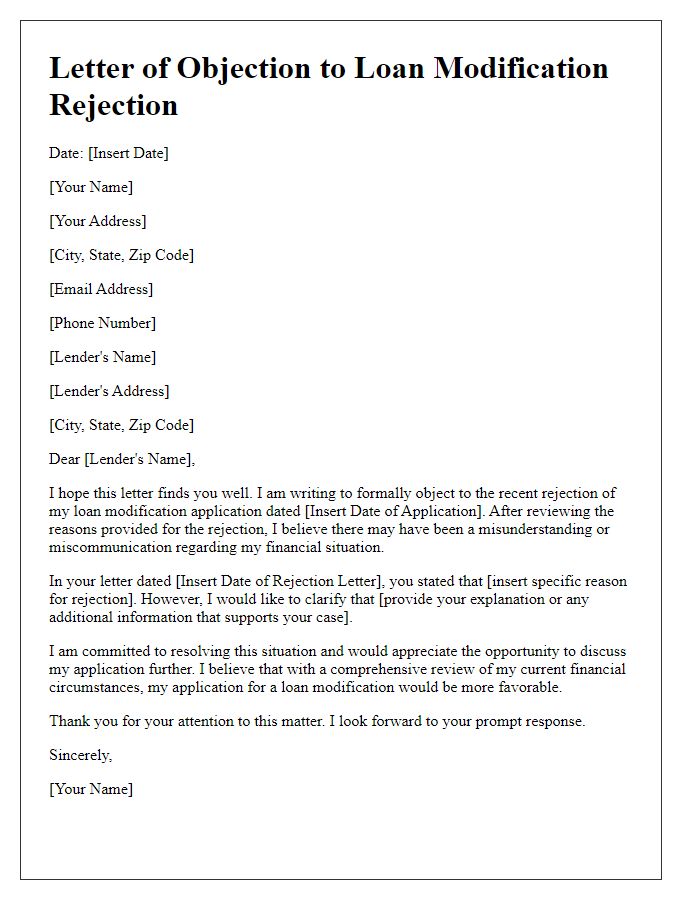

The initial denial of loan modification can stem from various factors, including missed payments and insufficient income documentation. Specifically, instances of late payments exceeding 30 days may flag the application as risky for lenders, impacting the assessment of repayment ability. Disputable points often include discrepancies in reported income, where a borrower may demonstrate higher earnings than indicated in bank statements. Additionally, inconsistent documentation, such as a mismatch between tax returns and other income verification documents, can lead to misunderstandings affecting the outcome. It is crucial to address these inaccuracies through meticulous record review to strengthen the appeal process, potentially influencing decisions by providing clarity on financial stability. Further engagement with the lender may reveal alternative options or programs tailored for distressed borrowers in any current federal relief initiatives enacted through government policies.

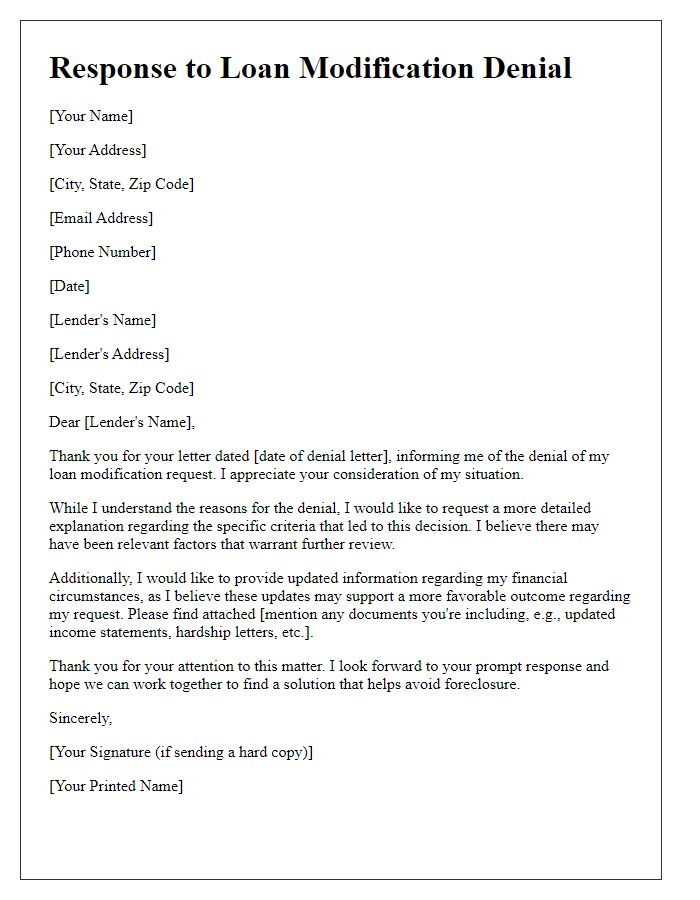

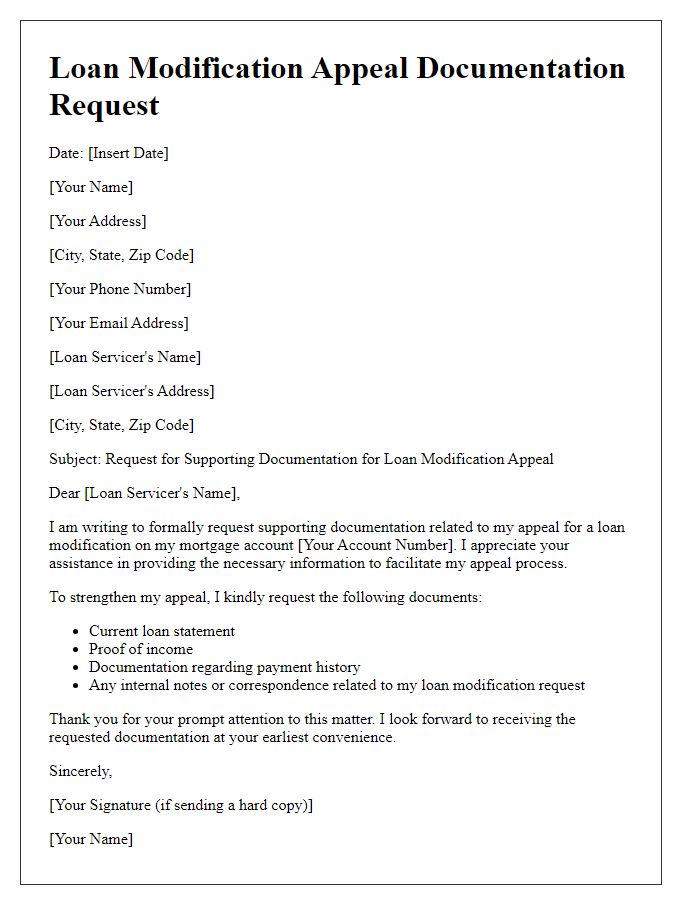

Supporting Financial Documentation

Supporting financial documentation plays a crucial role in the appeal process for loan modification denials. Essential documents include recent pay stubs, bank statements from the last three months, and tax returns for the previous two years to demonstrate income stability and overall financial health. Additionally, a detailed monthly budget outlining necessary expenses, such as housing costs, utilities, and transportation, can provide insight into the borrower's financial situation. Any documentation of hardship, such as medical bills or unemployment notices, can strengthen the appeal by illustrating the impact on the borrower's ability to make timely payments. Providing accurate and relevant information helps lenders reassess the situation and consider modification options.

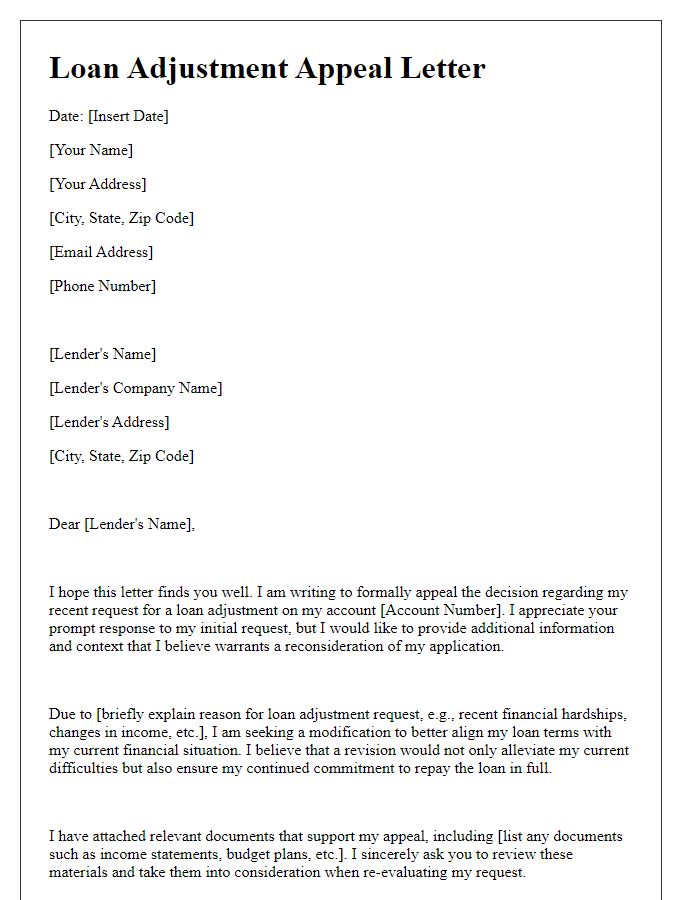

Explanation of Circumstantial Changes

Financial strain due to job loss has significantly impacted household income. Reduction from an annual salary of $75,000 (pre-layoff) to current unemployment status has resulted in difficulty meeting mortgage obligations on a residence located in Atlanta, Georgia. Medical expenses have increased, amounting to $15,000, due to unforeseen health issues affecting a family member. Additionally, rising living costs, including rent hikes of approximately 10% and increased utility bills, have intensified financial pressure. The combination of these factors has created a precarious economic situation, prompting the need for a reconsideration of the loan modification application.

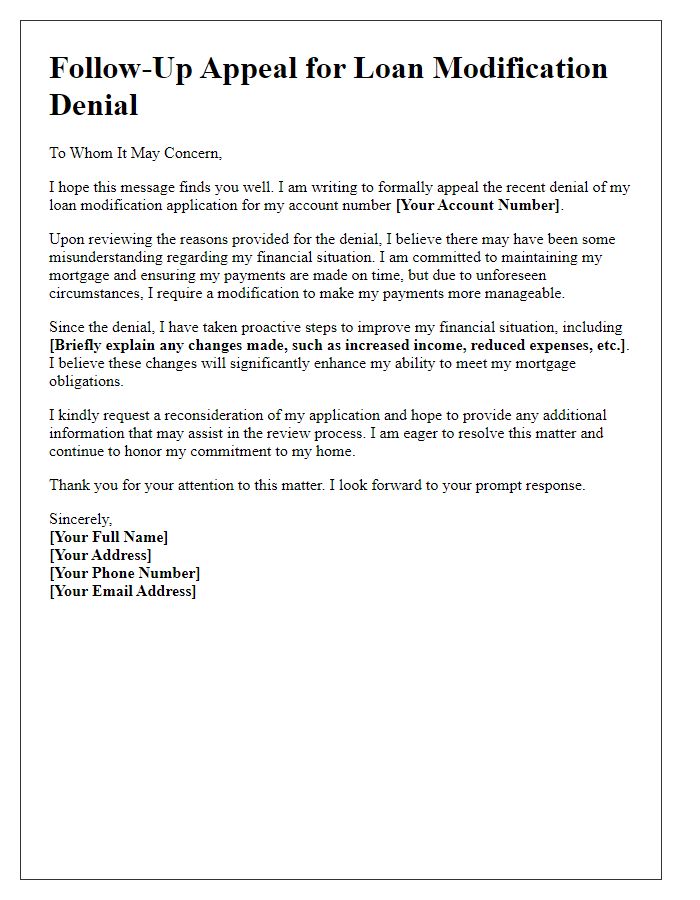

Request for Reconsideration and Next Steps

Submitting an appeal for a loan modification denial can be a critical step for homeowners facing financial difficulties. An effective appeal should clearly outline the reasons for the reconsideration request while incorporating supporting documentation such as income statements, bank statements, and statements of hardship. Detailed explanations of significant changes in financial circumstances, such as job loss, medical expenses, or other emergencies, strengthen the case. Additionally, referencing specific loan details like account numbers, the mortgage servicer's name, and dates of previous correspondence provides clarity. Homeowners may also benefit from mentioning relevant housing programs or local assistance resources that indicate their willingness to resolve the situation. Finally, including a request for a timely response and outlining potential next steps demonstrates proactivity and engagement in finding a resolution.

Comments