Are you considering applying for a principal residence loan and feeling overwhelmed by the process? You're not alone, as many prospective homeowners find themselves navigating the complexities of paperwork and requirements. Understanding what lenders look for can significantly simplify your journey to homeownership. Join us as we explore essential tips and a sample letter template that will help you craft a compelling application!

Applicant's Personal Information

The applicant's personal information includes critical details necessary for processing a principal residence loan application. Relevant data such as full name, residential address, and date of birth serve as primary identifiers. Financial information, including annual income (often required to determine eligibility), employment status (e.g., full-time, part-time, self-employed), and credit score (which impacts loan approval rates), is essential as well. Additionally, Social Security number (for identity verification), contact information (phone number, email address), and marital status (which can influence financial liability) are important aspects of the application. Finally, information about current debts (like credit card balances and existing loans) aids the lending institution in assessing the applicant's financial health and ability to repay the loan.

Loan Amount and Purpose

Applying for a principal residence loan requires detailed information on the loan amount and its intended purpose. Typically, loan amounts can range from $100,000 to several million dollars, depending on the property's location, size, and market value. The purpose of the loan often centers around purchasing a single-family home, townhouse, or condominium in urban areas such as New York City or Los Angeles, where property prices are notably high. Borrowers may also seek funds to improve their residence through renovations or upgrades. Detailed information about the property, including the address, square footage, and year built, is essential for assessing the loan application. Additionally, applicants typically need to outline their financial situation, including income, employment status, and credit score, which significantly influences loan approval.

Employment and Income Details

When applying for a principal residence loan, employment and income details play a crucial role in the assessment process. For instance, steady employment at a reputable organization, such as a government agency or Fortune 500 company, generally signals financial stability. Income verification documents may include recent pay stubs, tax returns from the last two years, and W-2 forms. A consistent annual income of at least $50,000 is often preferred by lenders to ensure loan eligibility. Additionally, employment history spanning over two years in the same field enhances credibility, while self-employment history might require additional documentation like profit and loss statements. Mentioning bonuses, overtime, or secondary income sources can provide a broader view of financial capabilities, which may positively influence loan approval outcomes.

Property Description

The property located at 123 Maple Avenue, Springfield, is a charming two-story single-family home built in 1995, featuring four bedrooms and three bathrooms. The living space encompasses approximately 2,400 square feet, with a spacious open-concept layout that includes a modern kitchen with granite countertops and stainless steel appliances. The property also boasts a well-manicured yard of 0.25 acres, complete with a landscaped garden and a wooden deck ideal for outdoor gatherings. Nearby amenities include Springfield Park, a local elementary school within a mile, and convenient access to major highways like Interstate 55. The neighborhood has a strong sense of community and a low crime rate, making it an attractive location for families. The current market value is estimated at $450,000, supported by recent comparable sales in the area.

Repayment Plan and Collateral Information

A comprehensive repayment plan outlines the structured financial strategy intended to successfully repay a principal residence loan. The primary loan amount, which could range from $150,000 to $500,000, will determine the monthly payment obligations based on a fixed or variable interest rate, typically between 3% and 7%. Collateral for the loan consists of the property itself, which must be assessed for value through a professional appraisal, often conducted by certified appraisers. This property, located in neighborhoods such as Oakwood and Maple Heights, can serve as a secure asset, protecting the lender's investment. The repayment timeline is usually set for 15 to 30 years, ensuring manageable monthly installments that could range from $1,000 to $3,500, depending on the total loan amount and interest rate. Maintaining consistent payments enhances credit profiles and facilitates the eventual payoff of the loan.

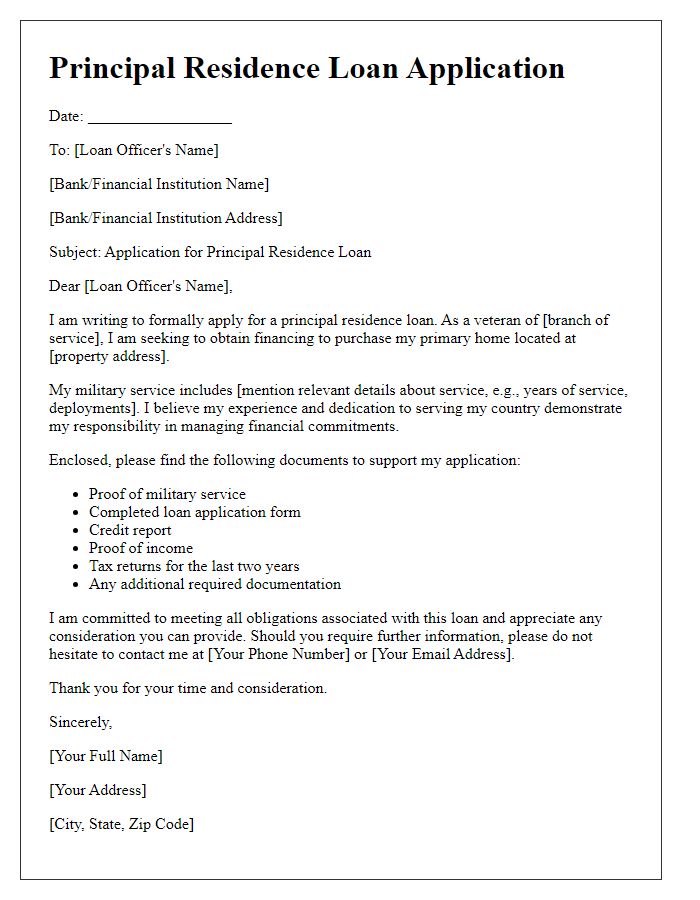

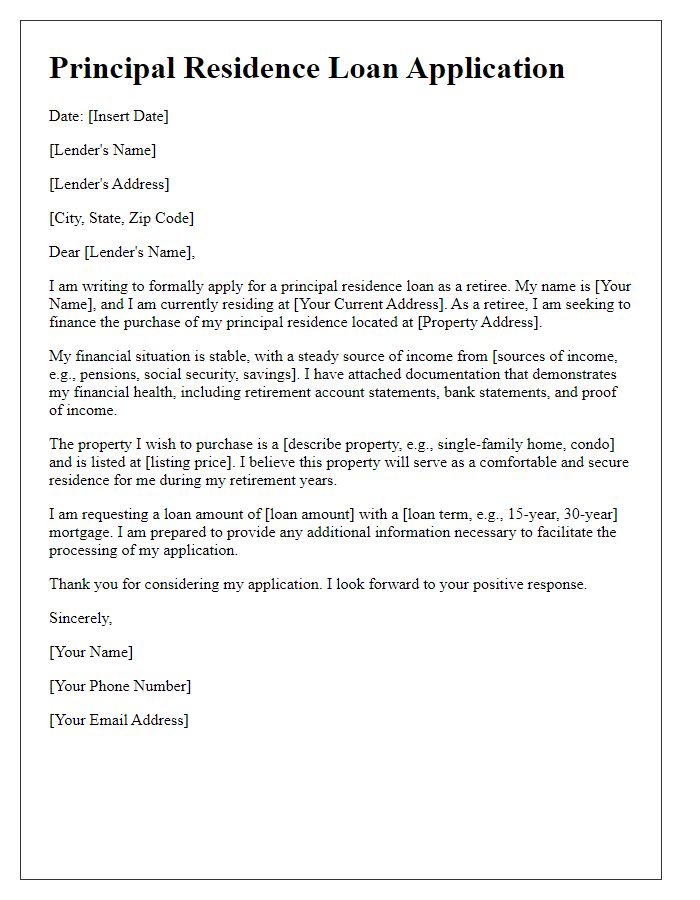

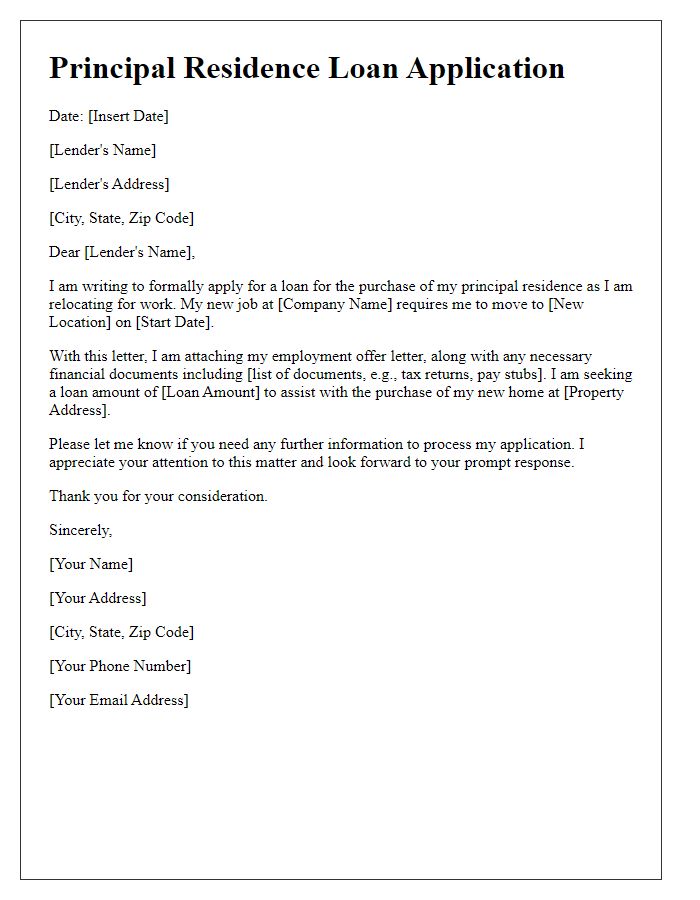

Letter Template For Principal Residence Loan Application Samples

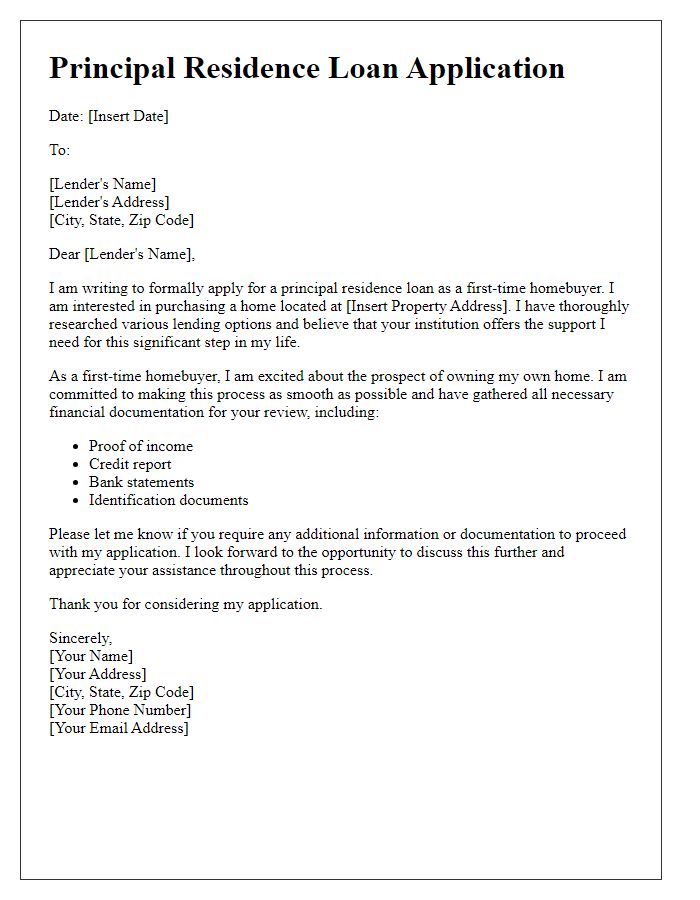

Letter template of principal residence loan application for first-time homebuyers

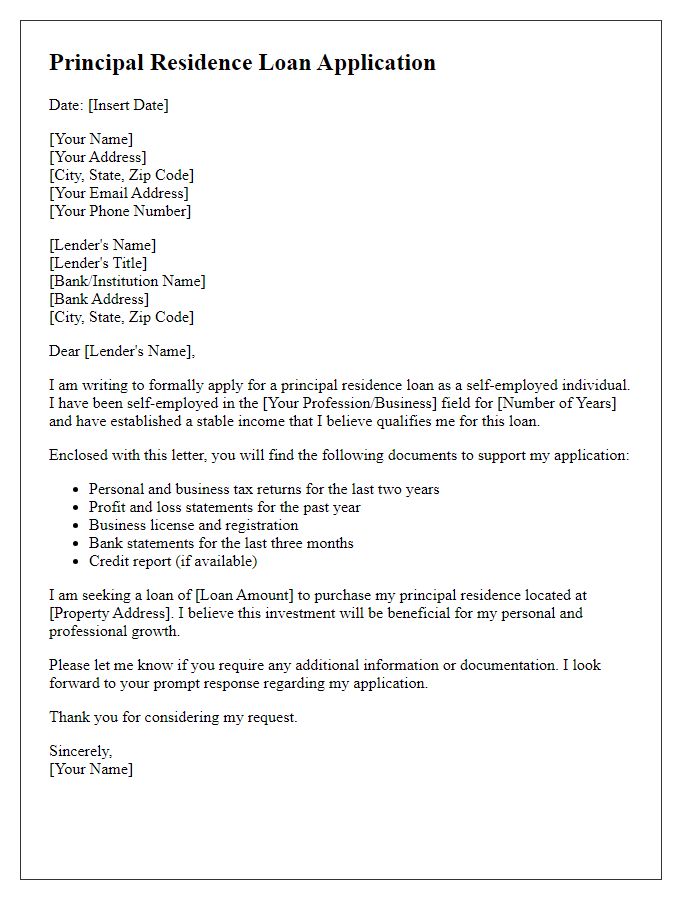

Letter template of principal residence loan application for self-employed individuals

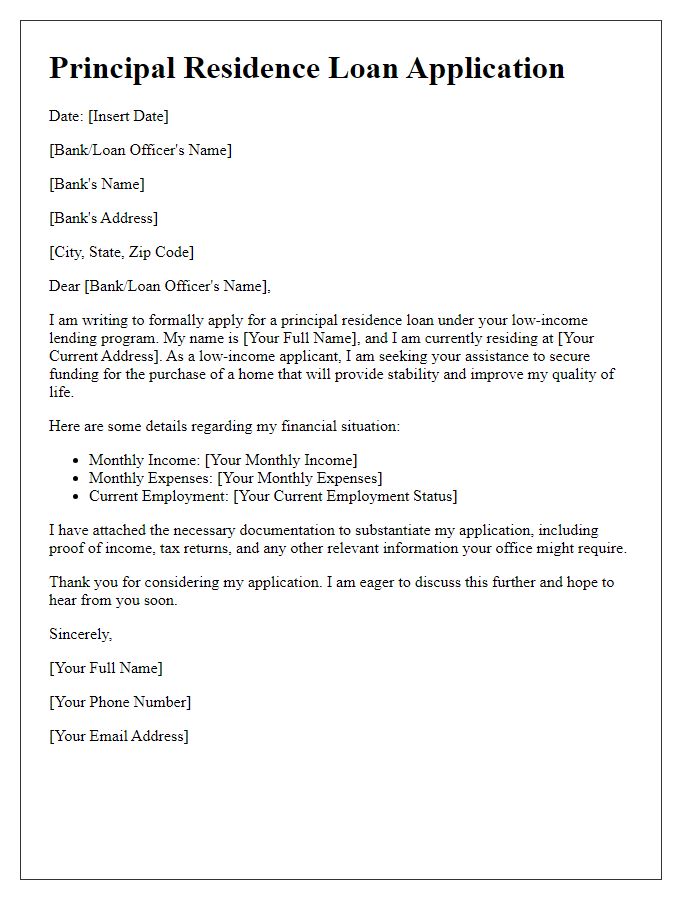

Letter template of principal residence loan application for low-income applicants

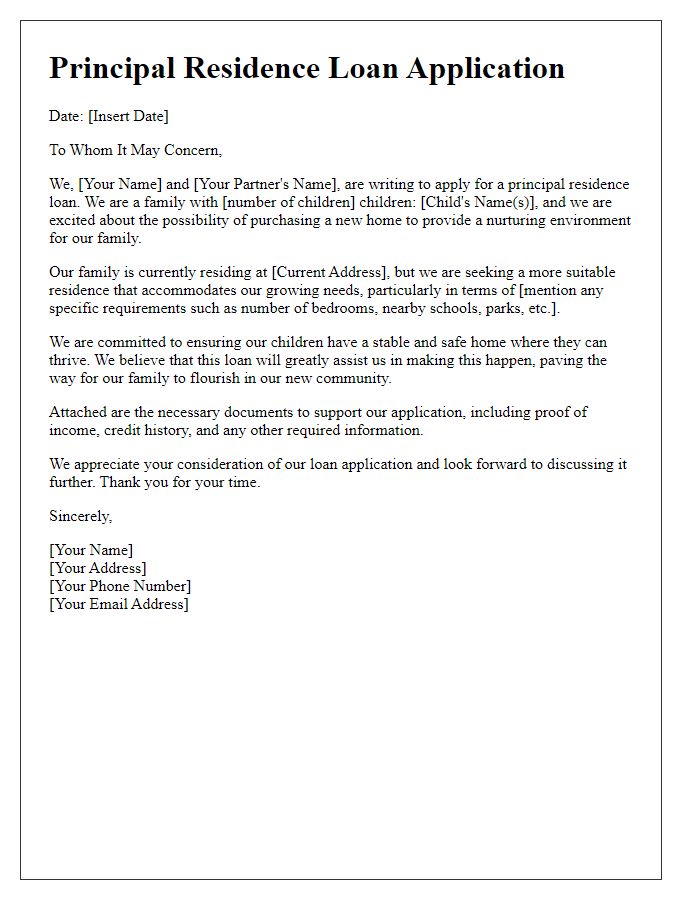

Letter template of principal residence loan application for families with children

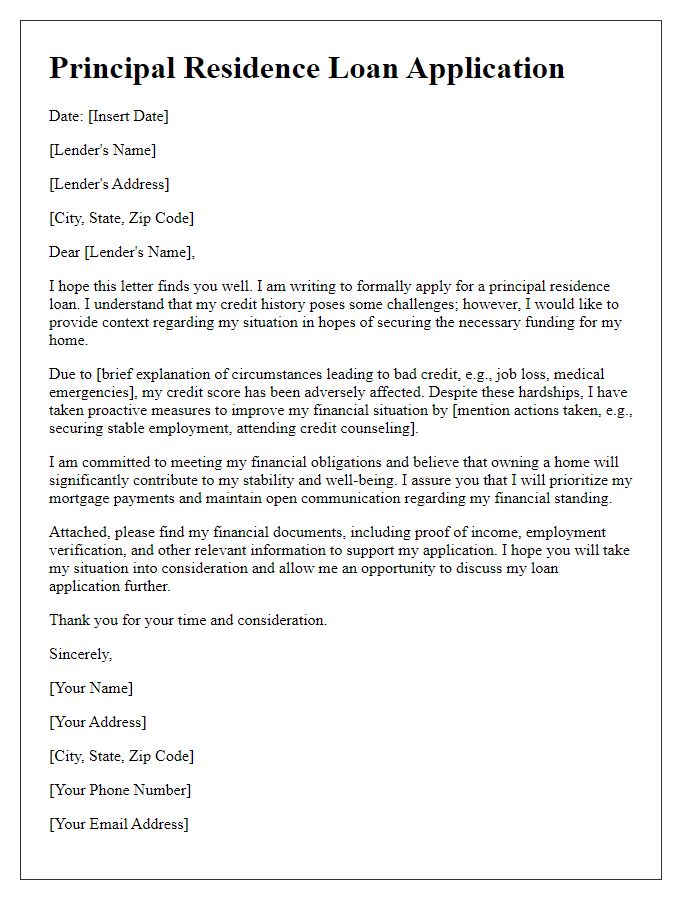

Letter template of principal residence loan application for individuals with bad credit

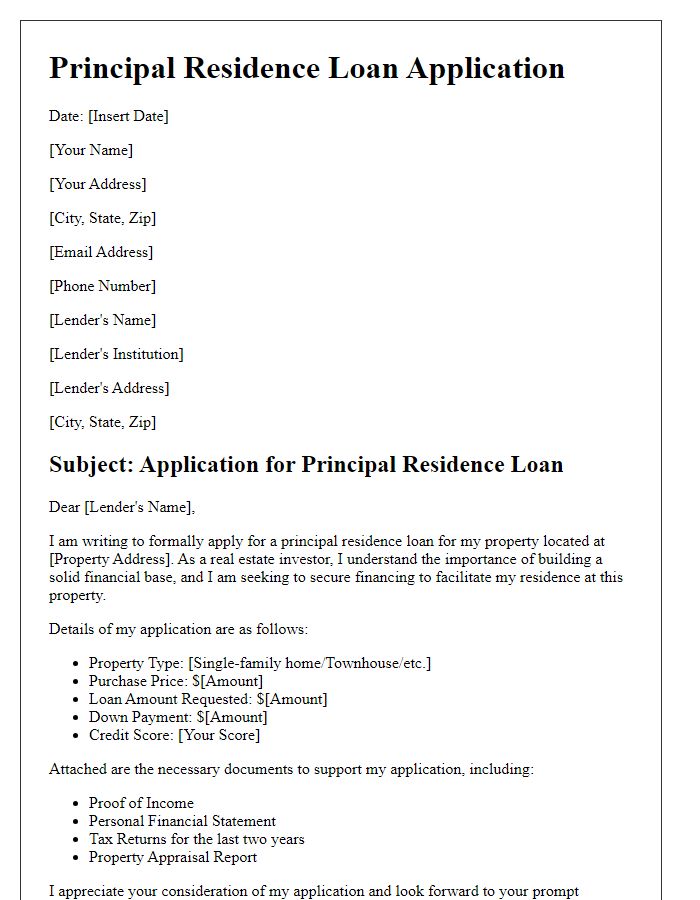

Letter template of principal residence loan application for real estate investors

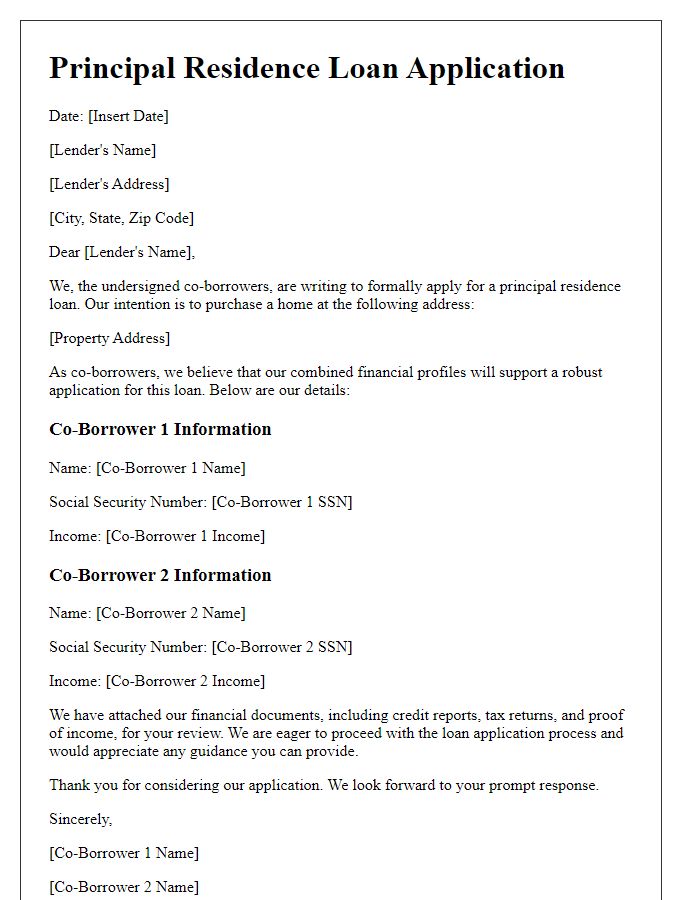

Letter template of principal residence loan application for co-borrowers

Comments