Life can throw unexpected challenges our way, and sometimes, those challenges can affect our ability to meet financial obligations, such as loan payments. If you find yourself needing to explain a delay in your loan payment, crafting a thoughtful letter can help communicate your situation effectively. In this guide, we'll explore how to write a clear and respectful explanation that maintains your relationship with your lender while addressing your current circumstances. So, if you're ready to navigate this sensitive topic with ease, keep reading for valuable tips and a helpful template!

Personal Information (Name, Address, Contact Details)

Delayed loan payments can arise from unforeseen circumstances, affecting borrowers' financial obligations. Factors such as sudden job loss, medical emergencies, or unexpected home repairs can strain personal finances. In 2022, statistics reported that 4.4 million Americans faced delinquent loans due to economic instability. Lending institutions like Bank of America or Wells Fargo often assess individual situations, taking into account payment history and current financial conditions. Borrowers may reach out to loan servicers through customer service hotlines or online banking portals, explaining their specific situations to seek alternative payment arrangements or deferment options. Such communication can help mitigate negative impacts on credit scores, which typically range from 300 to 850, affecting future borrowing potential.

Loan Account Details (Account Number, Loan Type)

Loan account details encompass crucial information pertinent to financial obligations. The account number, a unique identifier consisting of digits (typically 10-12 numeric characters), provides specific identification for the borrower. The loan type, which may include categories such as personal loans, mortgage loans, or auto loans, outlines the purpose of the borrowed funds and the repayment structure. In situations involving a delay in payment, clear communication regarding these details is essential for both the borrower and the lender to facilitate understanding and resolution.

Explanation of Delay (Reason, Duration)

Unexpected medical expenses influenced my current financial situation, leading to a delay in my loan payment schedule. The duration of this setback has been approximately three weeks, during which I sought additional temporary work to mitigate my obligations. This unforeseen circumstance has affected my budgeting, specifically impacting my ability to allocate necessary funds for my loan payment. I am dedicated to resolving this issue promptly and have already taken steps to ensure timely future payments.

Repayment Plan Proposal (New Payment Schedule, Financial Plan)

A repayment plan proposal is essential for borrowers facing delays in loan payments. This document outlines a new payment schedule aimed at restructuring financial obligations while addressing the lender's requirements. For example, borrowers may suggest an extended payment timeline of 12 to 24 months, along with reduced monthly installments. Financial plans should introduce realistic adjustments based on the borrower's current economic situation, providing clarity on income sources, expenses, and any unexpected events impacting repayment capability, such as job loss or medical emergencies. Timely communication of the proposal, ideally sent via registered mail to ensure delivery proof, can foster better relations with the lender and demonstrate a commitment to fulfilling obligations.

Request for Understanding and Next Steps (Apology, Request for Confirmation)

Delays in loan payments can arise from various unforeseen circumstances, such as job loss or unexpected medical expenses. When an individual faces a hardship, communication with the lender becomes essential for understanding possible solutions. In these cases, borrowers should prepare to apologize sincerely for the inconvenience caused by the delay while outlining the specific reasons behind the missed payment. Additionally, a proactive request for confirmation regarding revised payment plans or options for deferment can demonstrate a commitment to resolving the issue responsibly. Providing pertinent financial documents, along with a proposed timeline for future payments, can further facilitate effective dialogue with the lender, ensuring clarity and maintaining trust.

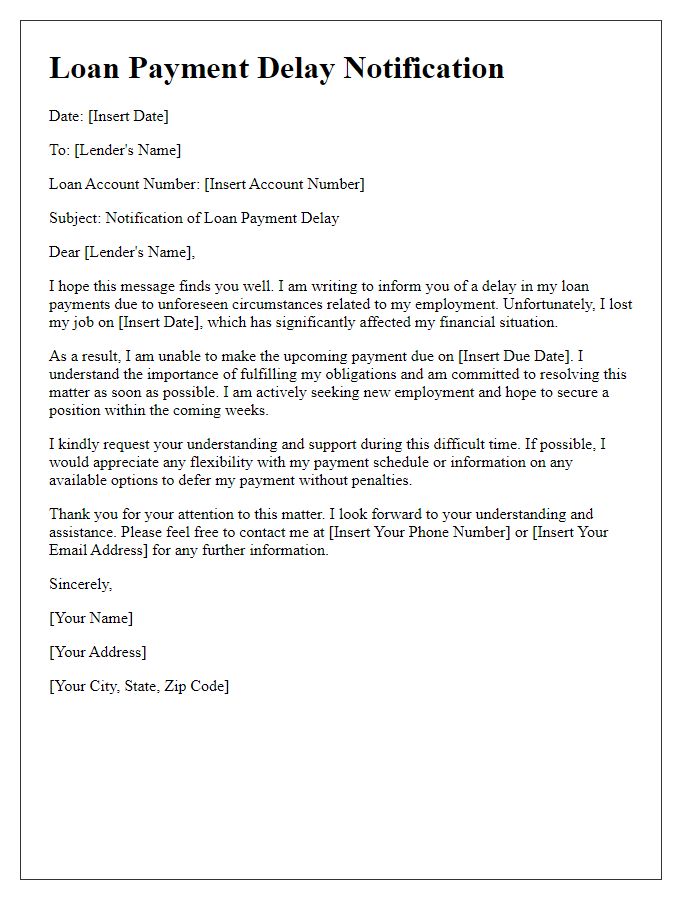

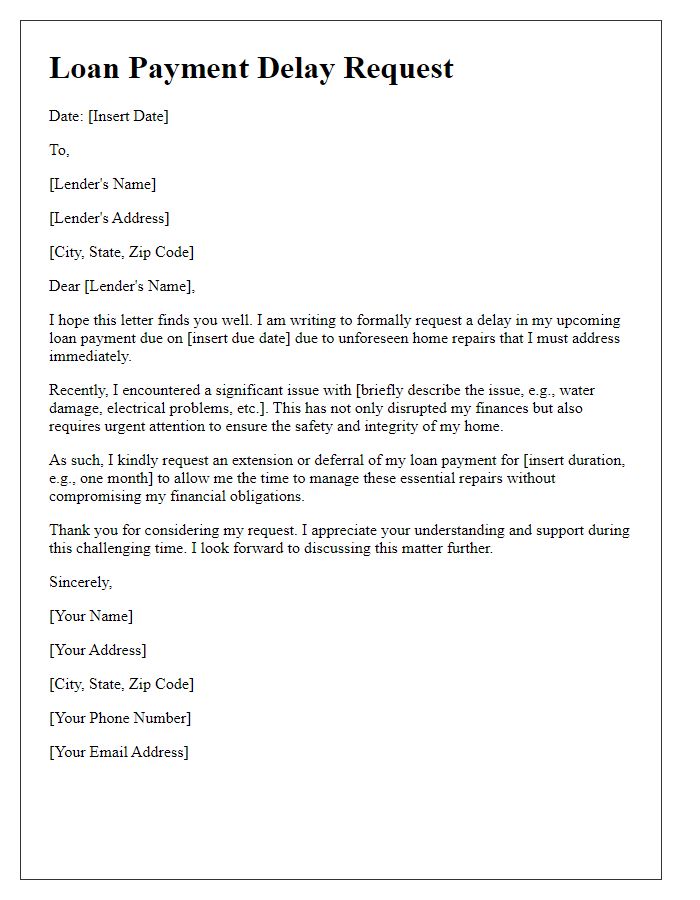

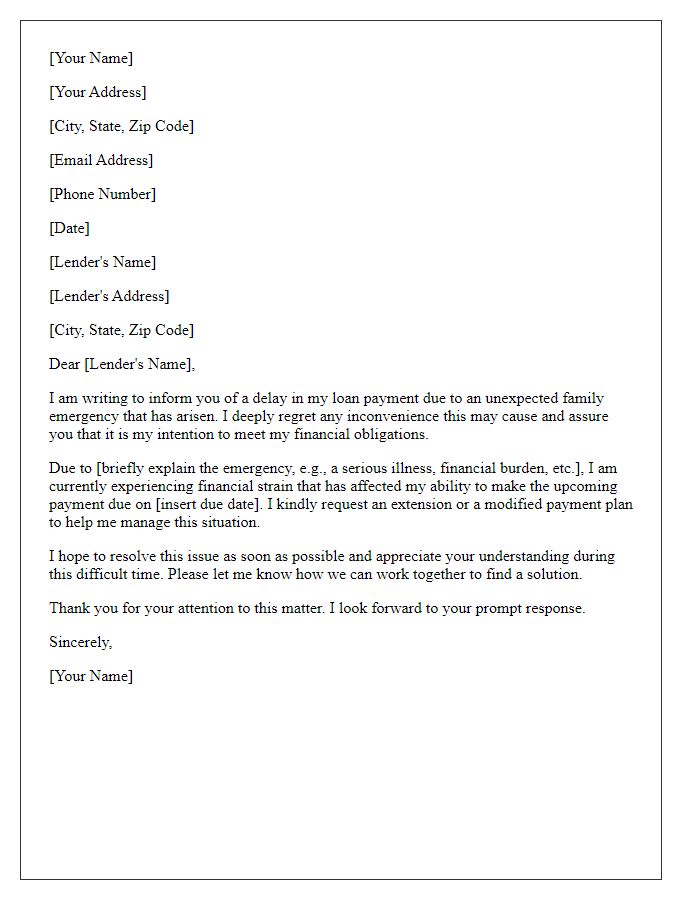

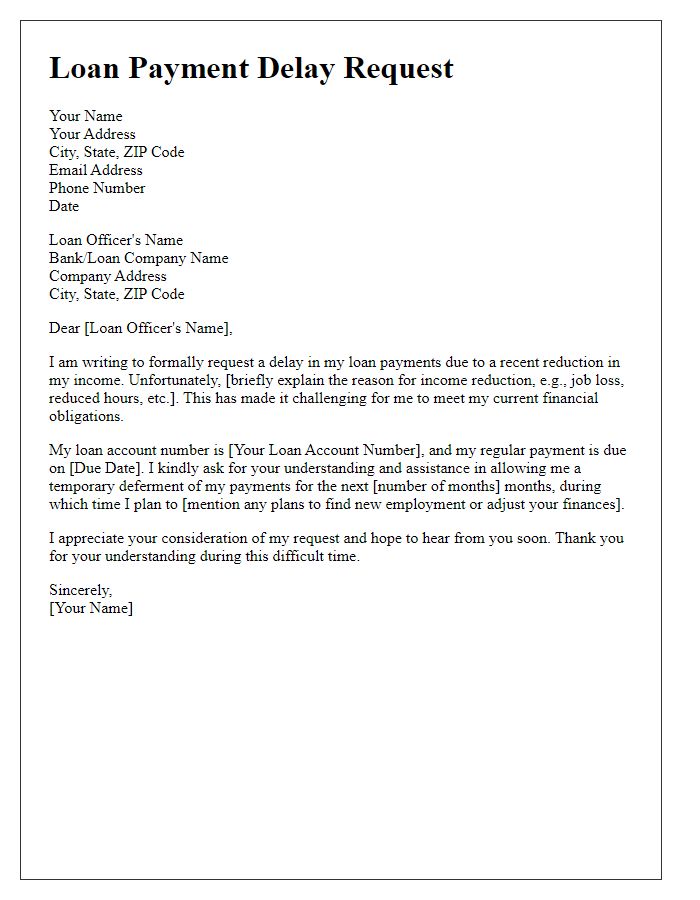

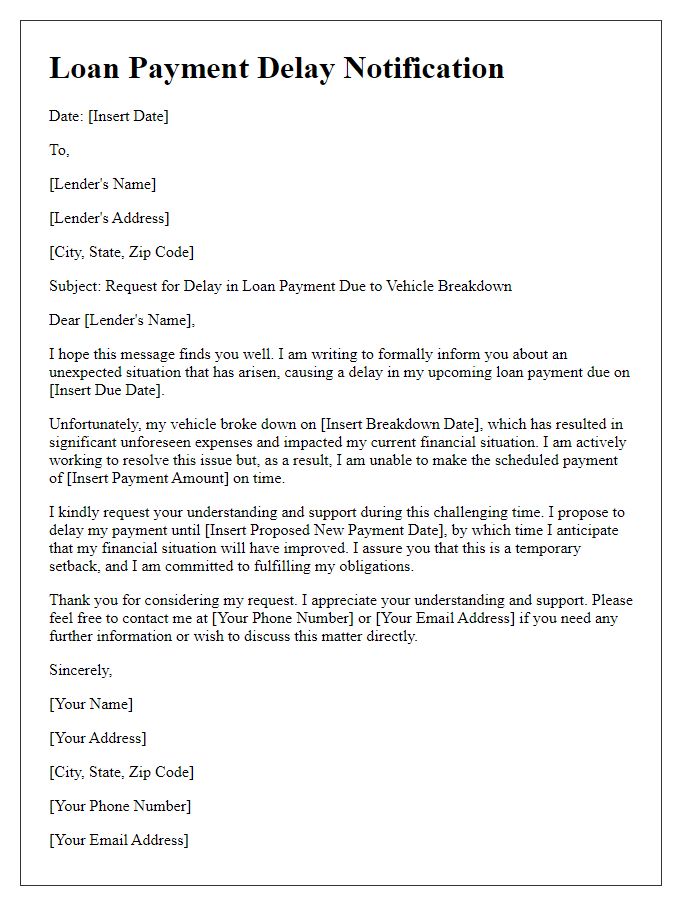

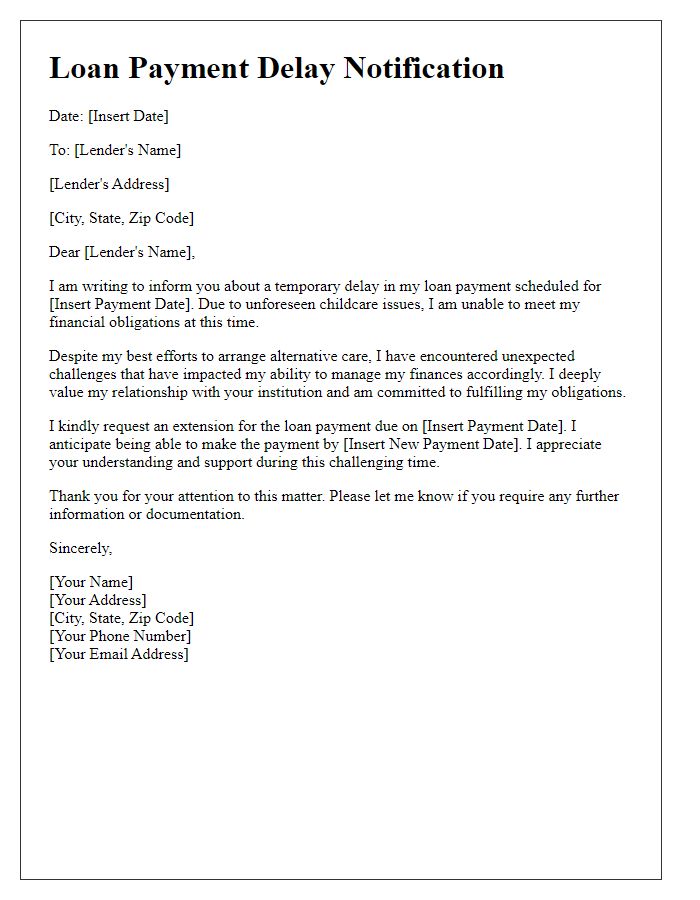

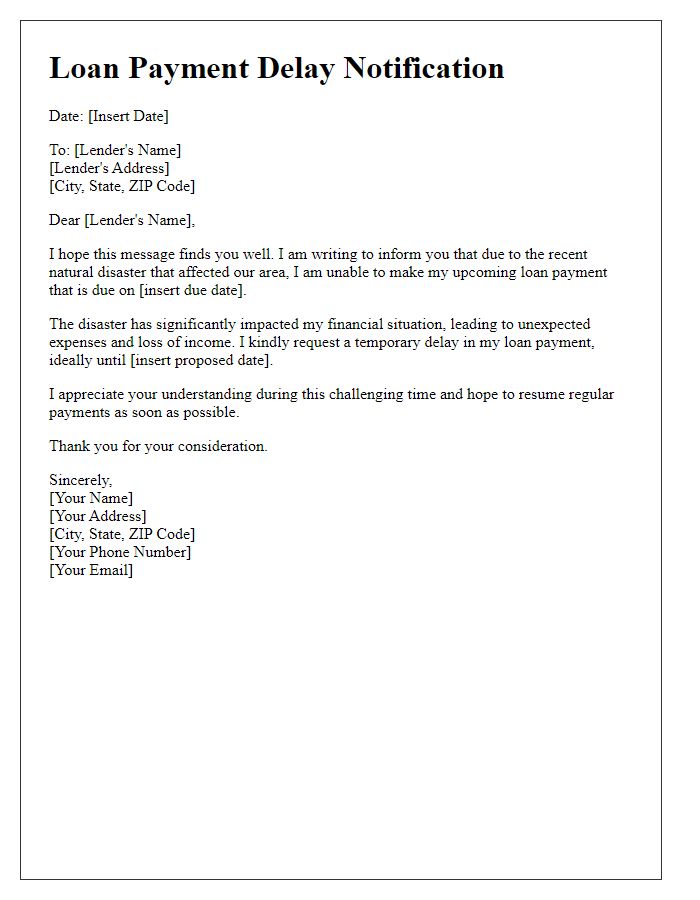

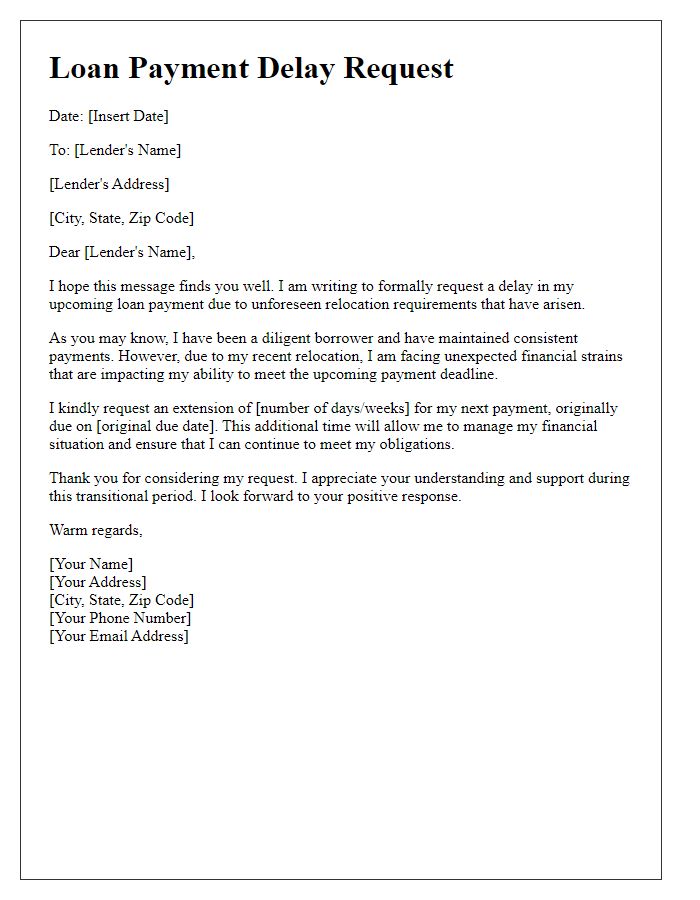

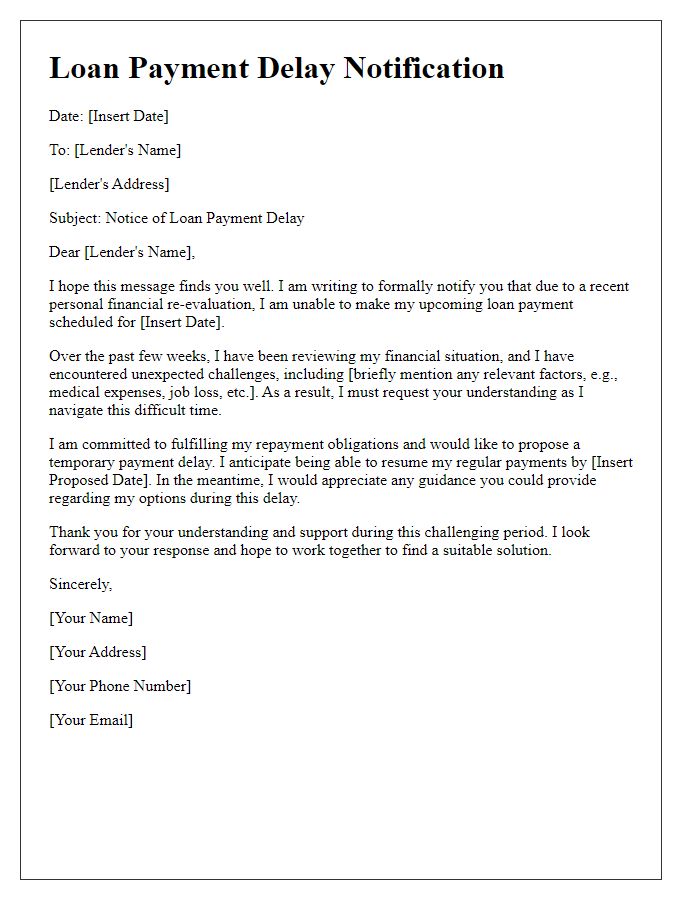

Letter Template For Loan Payment Delay Explanation Samples

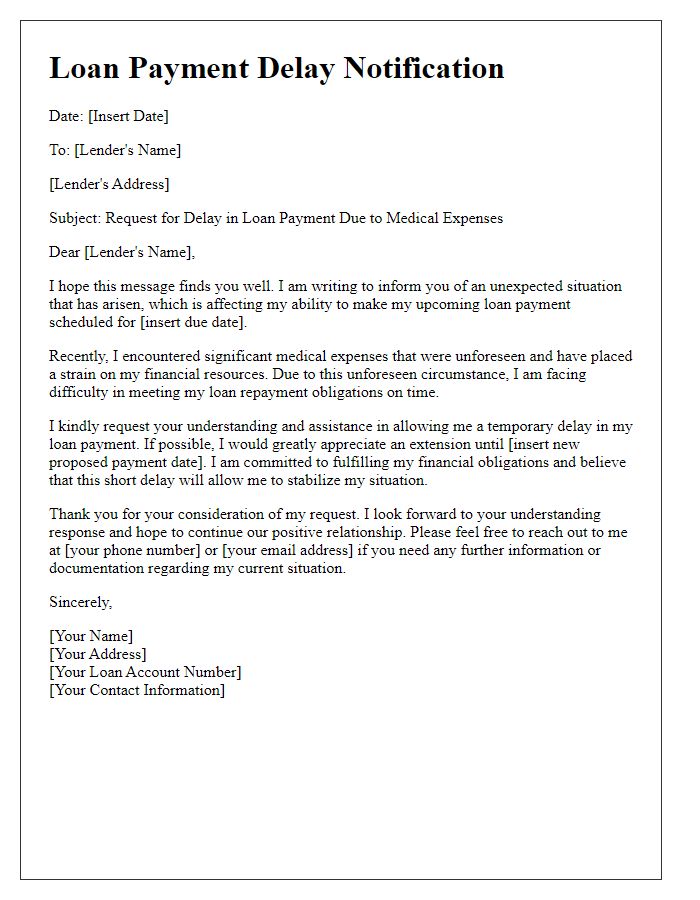

Letter template of loan payment delay due to unexpected medical expenses

Comments