Are you considering securing a fixed deposit loan but unsure how to approach the process? A well-crafted letter can make all the difference in articulating your intent and ensuring a smooth transaction. In this article, we'll explore a straightforward letter template that outlines the essentials for using your fixed deposit as collateral, helping you present your case effectively. So, let's dive in and discover the key elements you need to include!

Lender and Borrower Details

A fixed deposit loan collateral often involves lender details such as the name of the financial institution, contact information, and reputation in the market. The borrower details include personal information like full name, address, identification number, and financial history that assesses their creditworthiness. Fixed deposit accounts, typically offered by banks or credit unions, involve locking in a sum of money for a specific term, generally yielding higher interest rates than regular savings accounts. Borrowers must ensure their fixed deposits remain intact throughout the loan duration, as defaulting could lead to the bank seizing the collateral to cover dues. This agreement serves as a security measure, reducing the lender's risk while facilitating easy access to funds for borrowers.

Loan and Deposit Information

Fixed deposit loans serve as collateral against funds deposited in financial institutions, offering a secure borrowing option. A fixed deposit (FD) typically involves a minimum investment amount, which can vary by bank, often starting at $1,000. Borrowers are allowed to take loans up to 90% of the deposit value, safeguarding the principal amount while gaining access to immediate liquidity. Interest rates on these loans can differ based on the duration of the deposit and the lender's policies, usually ranging from 8% to 12% annually. Repayment terms may extend from three months to several years, emphasizing the important role of adherence to the repayment schedule to maintain the collateral's status and avoid penalties.

Collateral Terms and Conditions

A fixed deposit loan collateral arrangement offers borrowers a secure and cost-effective means to access funds using their bank's fixed deposit account as collateral. Financial institutions typically require deposit amounts ranging from $1,000 to $100,000, depending on the terms of the agreement. The interest rates for loans secured by fixed deposits can vary, often falling between 7% and 12%, significantly lower than unsecured loans. Borrowers retain ownership of their fixed deposits while the bank holds the lien, meaning funds remain inaccessible during the loan term, usually between 6 months to 5 years. In the event of non-repayment, the bank has the right to utilize the maturity value of the fixed deposit to recover outstanding amounts, including any accrued interest, ensuring that both parties are protected during the loan tenure.

Repayment and Interest Rates

Fixed deposit loans offer collateral based on a portion of the sum invested in savings accounts. The typical interest rate ranges from 7% to 10% annually, dependent on the financial institution and prevailing market conditions. Repayment terms vary, often spanning 1 to 5 years, with some lenders allowing partial withdrawals from the fixed deposit without penalty. The security of the fixed deposit acts as a low-risk guarantee for lenders, encouraging competitive rates while ensuring borrowers maintain their investment growth during the loan period. Institutional policies often stipulate that defaulting on payments may lead to the forfeiture of the fixed deposit.

Legal and Compliance Clauses

Fixed deposit loans function as secured borrowings, with fixed deposits (FD) serving as collateral against the loan amount. Collateral, or the FD, must meet the financial institution's minimum value requirement (often around $5,000), secured through legal agreements. Compliance with regulatory guidelines such as the Reserve Bank of India's directives (specifically for Indian banks) is mandatory. The lending institution retains the right to liquidate the FD in case of default, ensuring protection against financial risk. The agreement must include detailed terms surrounding interest rates (typically lower than unsecured loans), loan tenures (ranging from one to five years), and prepayment penalties to guarantee adherence to all legal standards. Regular monitoring of the FD's status during the loan tenure is essential to prevent breaches of contract.

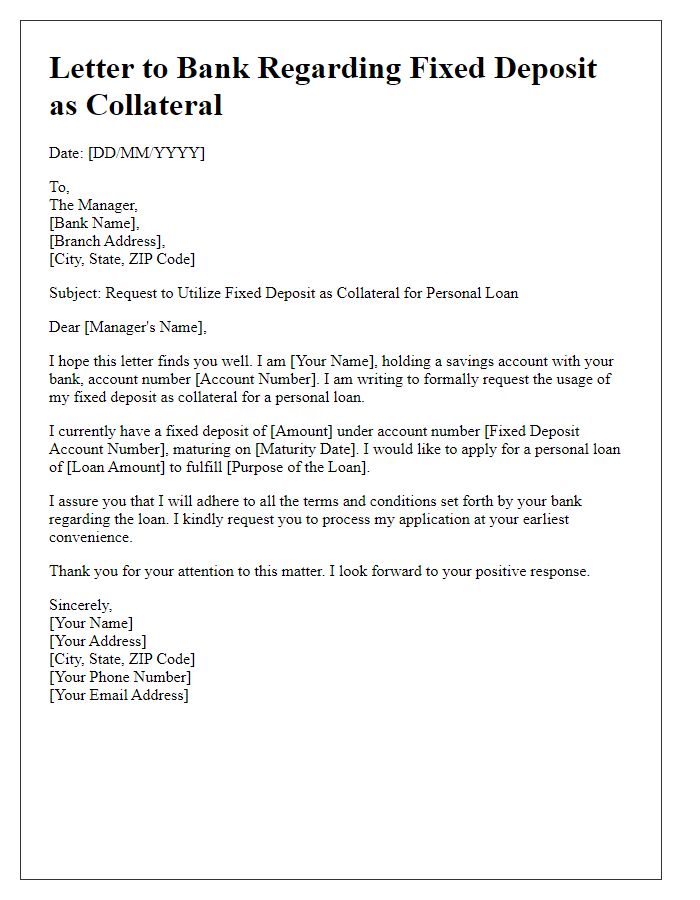

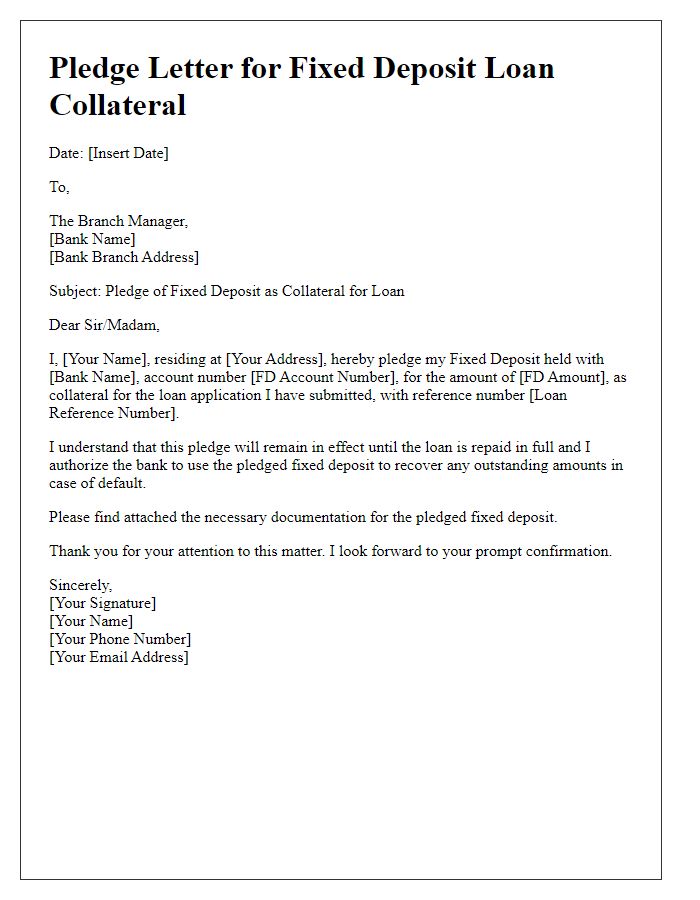

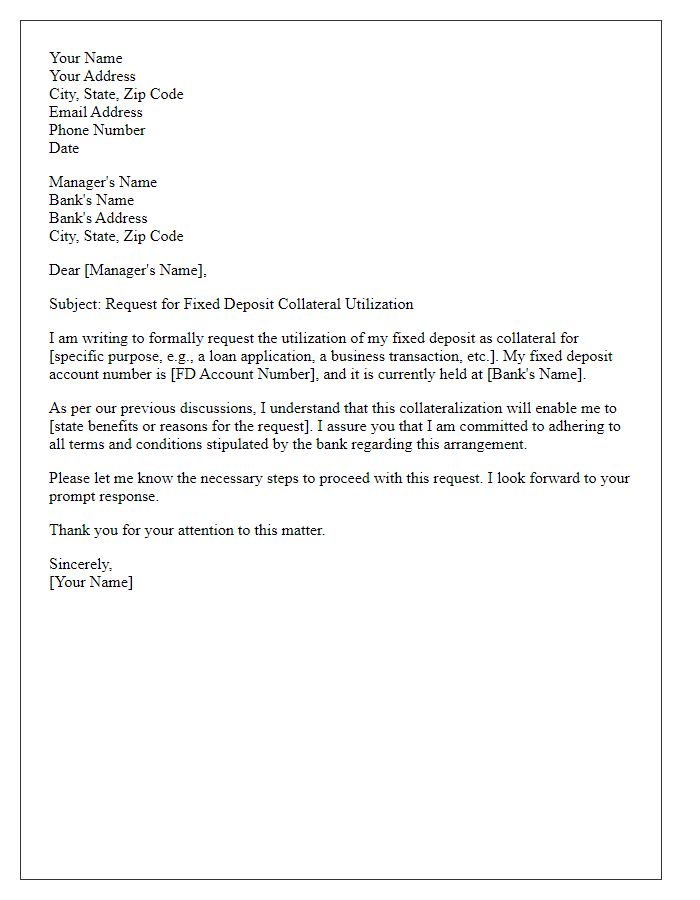

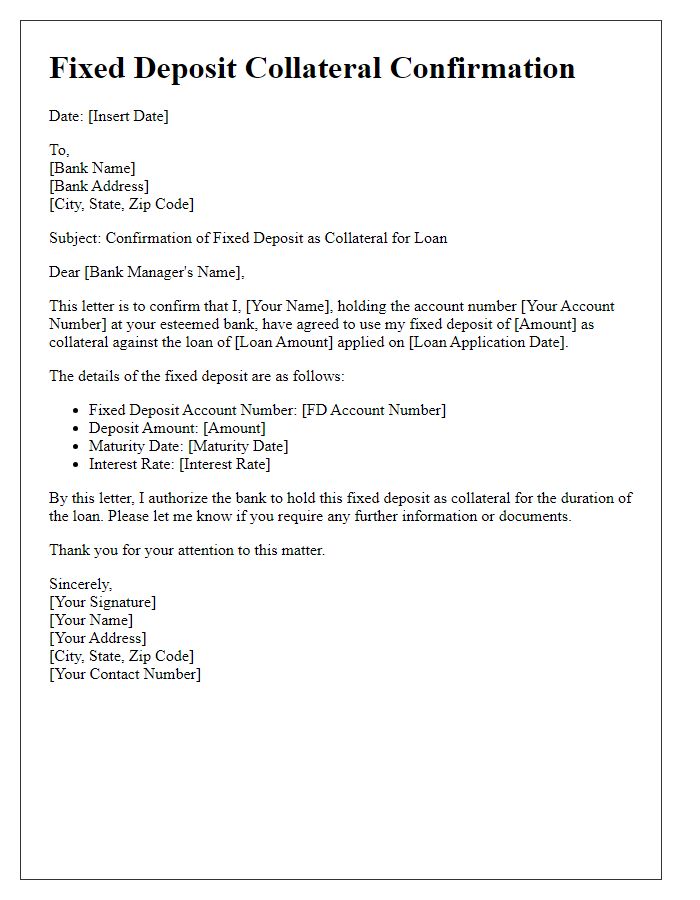

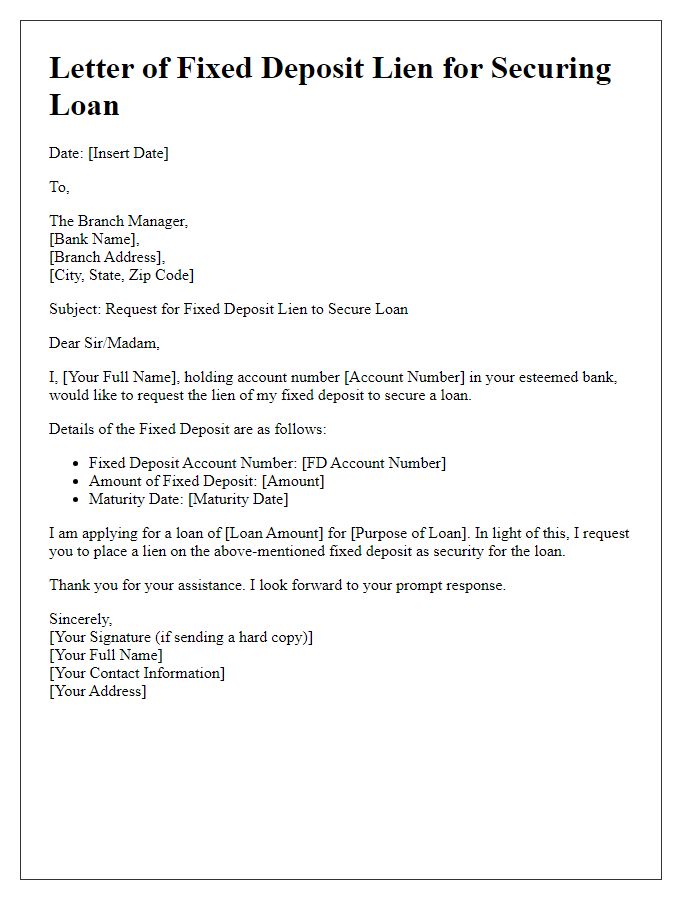

Letter Template For Fixed Deposit Loan Collateral Samples

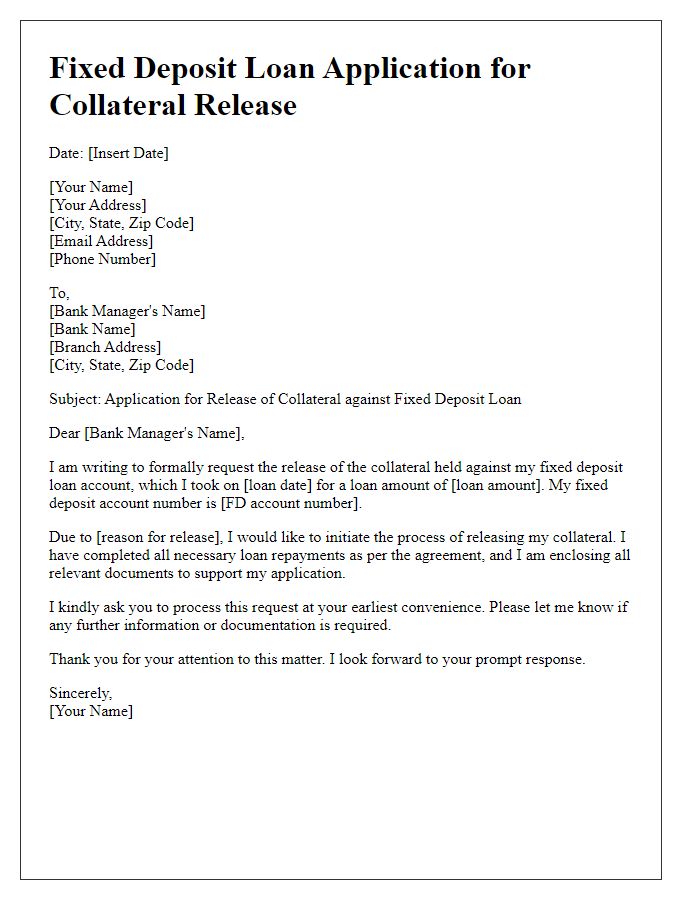

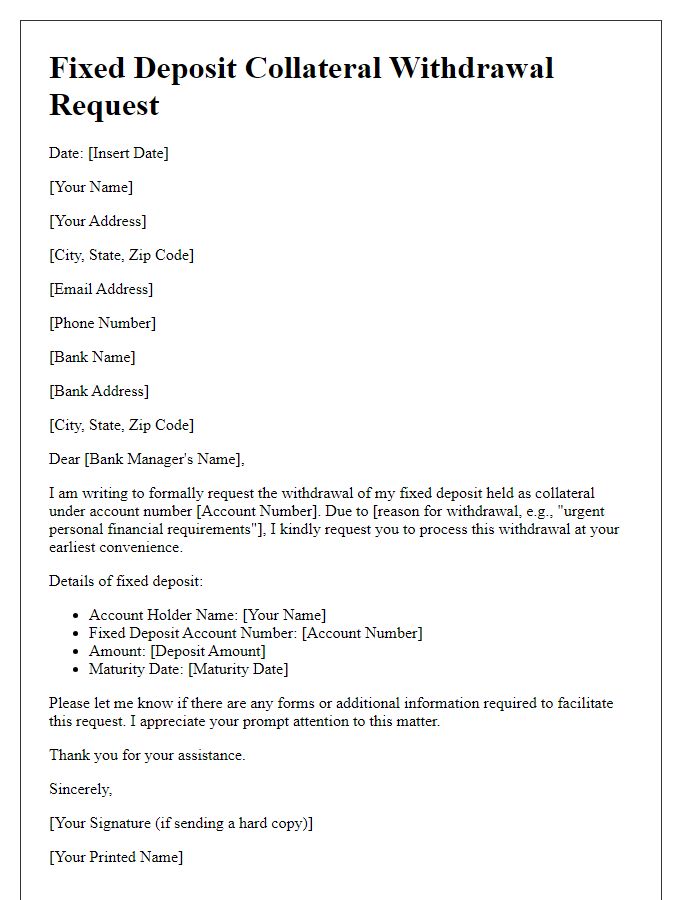

Letter template of fixed deposit loan application for collateral release

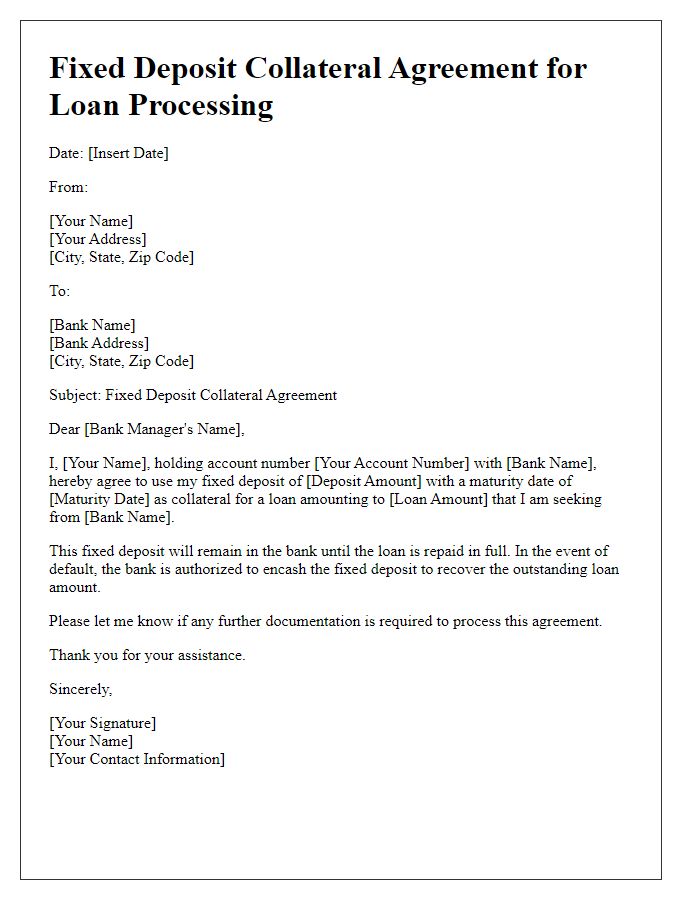

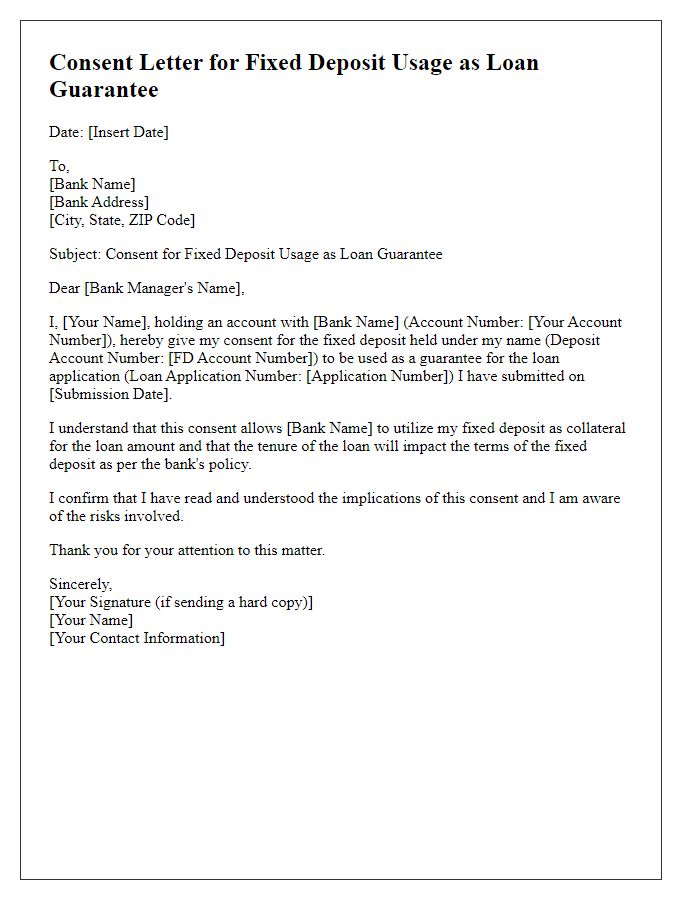

Letter template of fixed deposit collateral agreement for loan processing

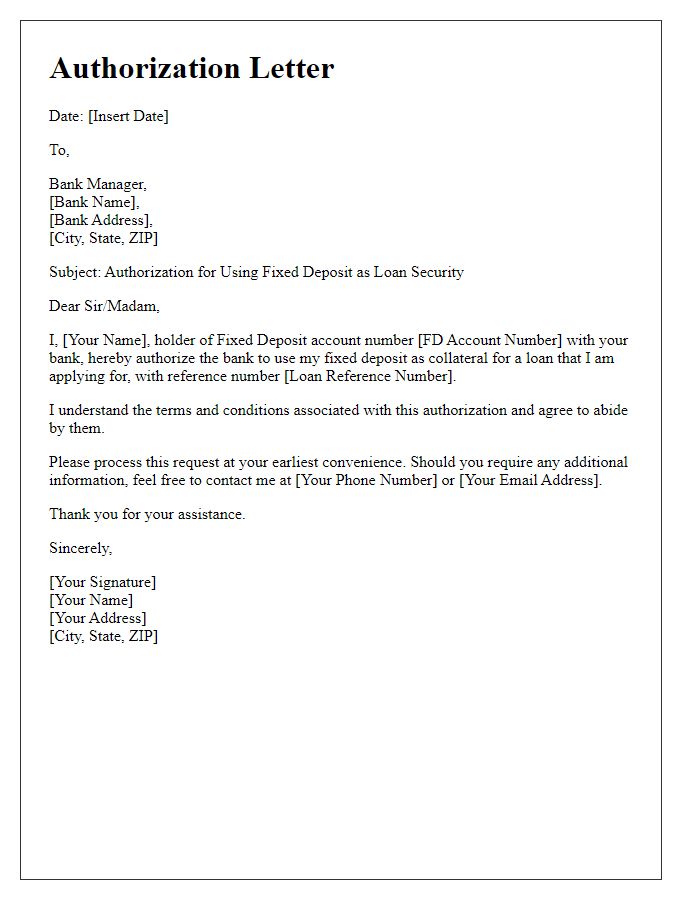

Letter template of authorization for using fixed deposit as loan security

Comments