Are you curious about how non-profit loan programs can help your organization thrive? These programs offer invaluable financial support tailored specifically for non-profits, making it easier to fund impactful projects and initiatives. By exploring these options, you can unlock new opportunities for growth and sustainability in your mission. Read on to discover more about the benefits and processes behind non-profit loan programs!

Clarity of Purpose

Inquiries about non-profit loan programs often stem from organizations aiming to enhance community services. Clarity of purpose is crucial in articulating how funds will support specific projects or initiatives. Non-profit entities, such as community development organizations, seek financial assistance to foster economic growth within designated areas like urban neighborhoods. The loan criteria typically require detailed proposals outlining the intended use of funds, such as purchasing equipment, expanding facilities, or launching educational programs. Transparency about the projected impact, such as the number of beneficiaries or anticipated economic outcomes, enhances the application's credibility and aligns it with the financial institution's goals for community investment.

Specific Financial Request

Inquiring about non-profit loan programs for financial support can greatly impact community initiatives. Specifically, organizations like Community Development Financial Institutions (CDFIs) offer loans worldwide, addressing pressing needs such as affordable housing or job creation. Non-profit entities often seek funding ranges from $50,000 to $500,000, intended for specific projects. Successful applicants typically must demonstrate a sustainable business model and community benefit, underlining investment potential. Additionally, understanding interest rates, which can range from 3% to 7%, is essential for evaluating project viability. Engaging with local economic development offices can provide insights on regional grants and incentives available for eligible non-profits.

Explanation of Need/Impact

In urban communities facing economic challenges, access to financial resources is crucial for local businesses to thrive. Non-profit organizations dedicated to fostering entrepreneurship play a vital role in this environment, with loan programs designed to support start-ups and small businesses. Many entrepreneurs lack sufficient collateral or traditional credit histories, making it difficult to secure funding from conventional banks. As a result, this loan program aims to bridge the financial gap by providing low-interest loans to applicants who demonstrate potential for growth and community impact. The infusion of capital can enable businesses to hire local employees, invest in marketing efforts, and expand product offerings, ultimately contributing to the local economy. For instance, a small cafe in a historically underserved neighborhood might use a loan to purchase equipment, leading to increased job opportunities and enhanced community engagement, which are essential for economic revitalization in locations like Detroit or Philadelphia.

Supporting Documentation

The non-profit loan program offers financial assistance to organizations seeking funding for community impact initiatives. Essential supporting documentation includes the organization's IRS tax-exempt status (501(c)(3) designation), detailed project budgets, and a comprehensive business plan outlining goals and objectives. Financial statements from the past three years hold significant importance, showcasing income sources and expenditure patterns. Additionally, letters of support from community stakeholders emphasize the program's expected impact and alignment with local needs. Specific project timelines with clear milestones (ideally set within 12 months) will enhance the application, indicating progress and measurable outcomes anticipated throughout the project lifecycle.

Contact Information and Follow-up Details

Non-profit organizations seeking financial assistance through loan programs must provide essential contact information. Key details include organization name, registered address, email address, and a primary contact person's phone number. In addition, follow-up actions should outline preferred communication methods, whether via email or phone, and any specific timeframes for responses. Tracking previous correspondence and setting reminders can enhance communication effectiveness, ensuring timely follow-ups, especially with loan program representatives. Documenting these interactions helps maintain clear records, crucial for future applications and enhancing relationship-building with lending institutions.

Letter Template For Non-Profit Loan Program Inquiry Samples

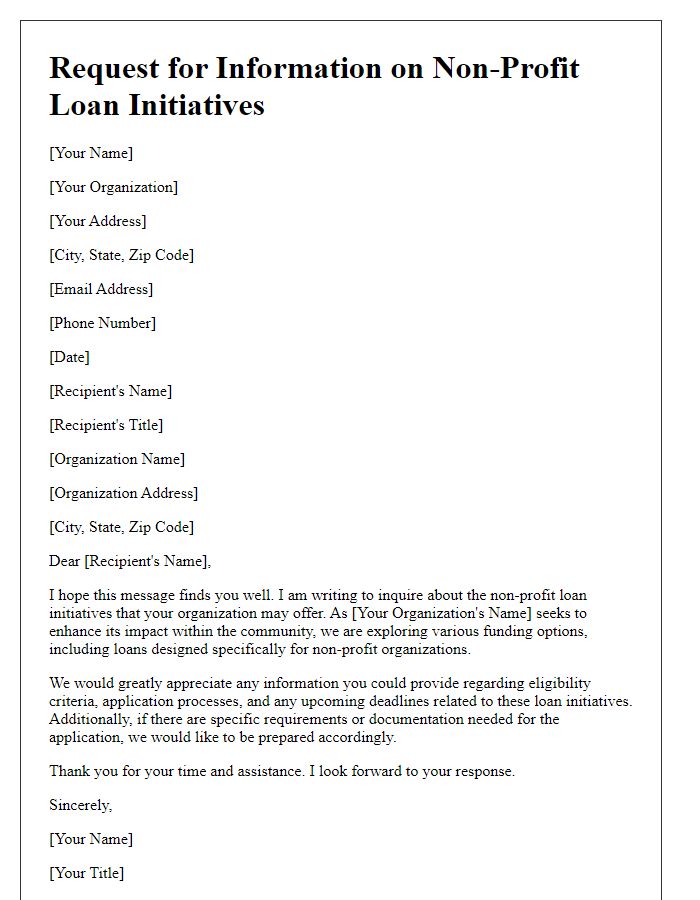

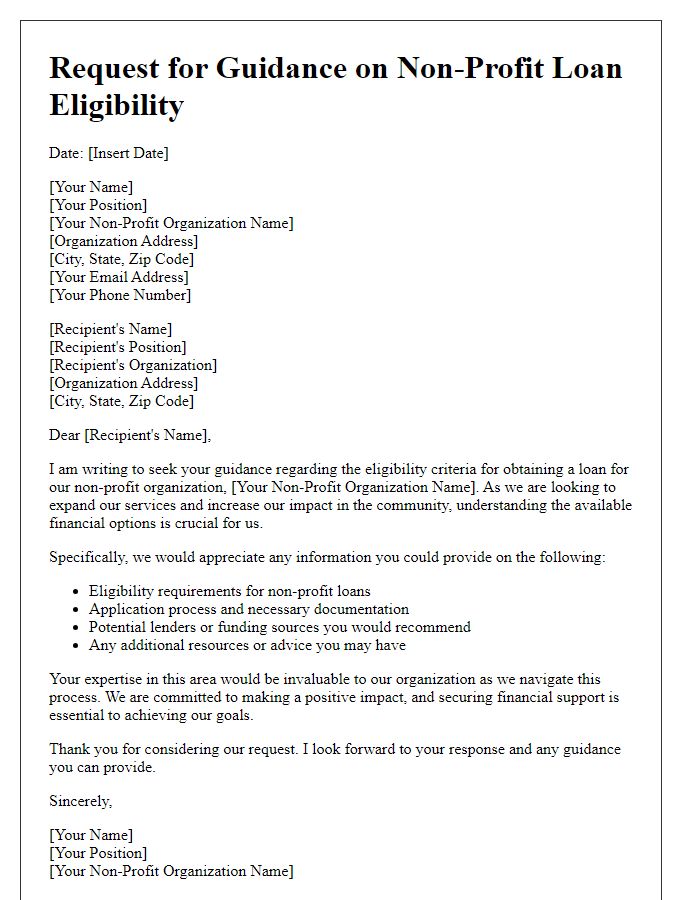

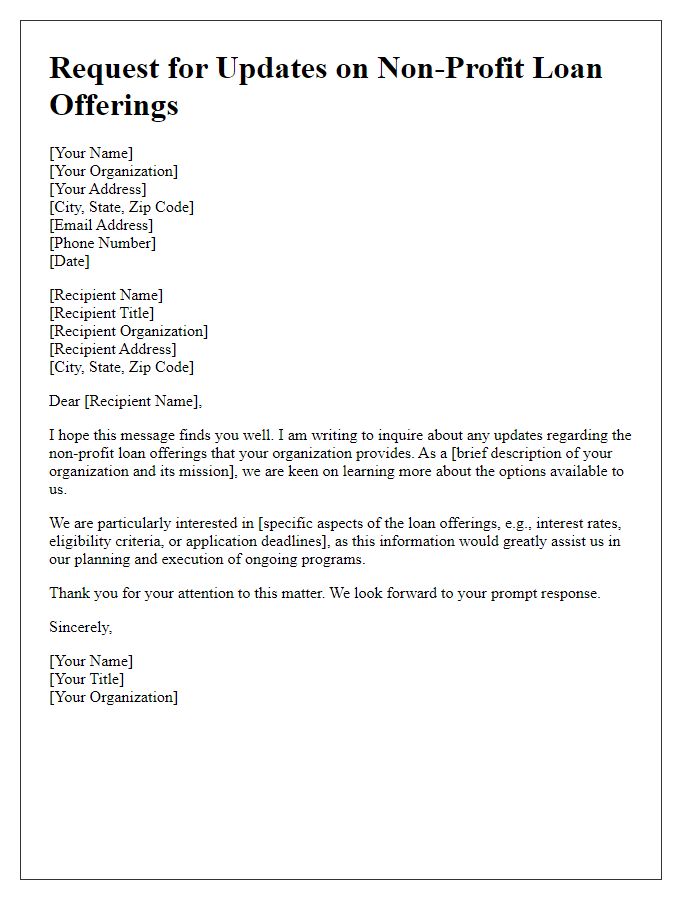

Letter template of request for information about non-profit loan initiatives

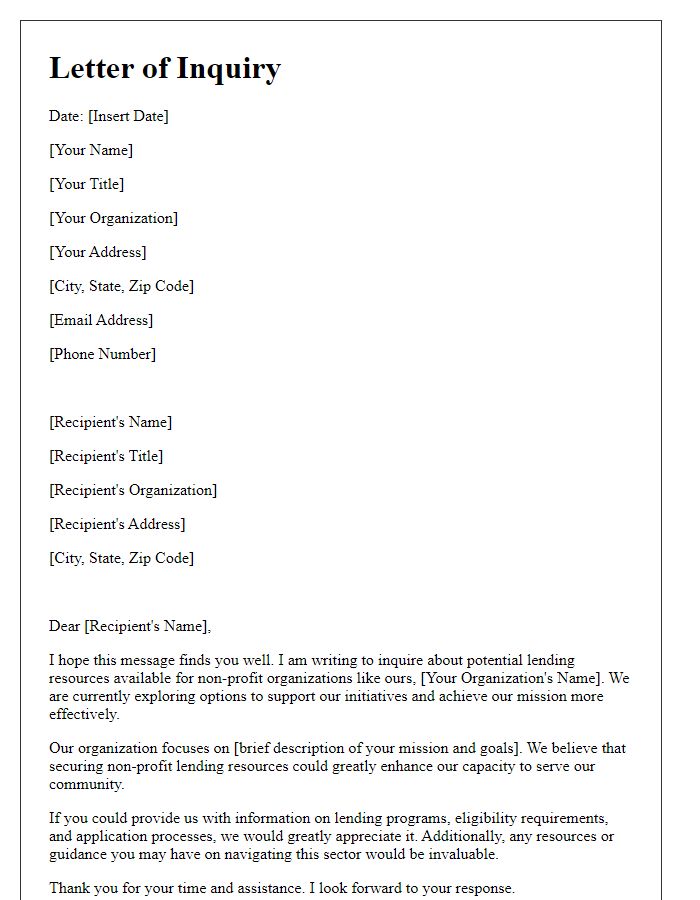

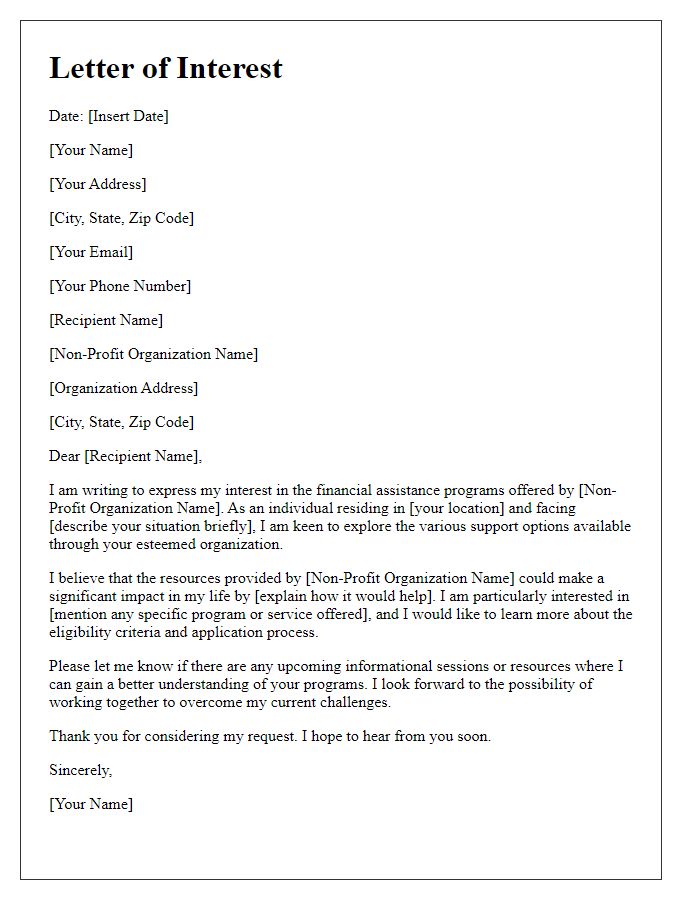

Letter template of inquiry for assistance with non-profit lending resources

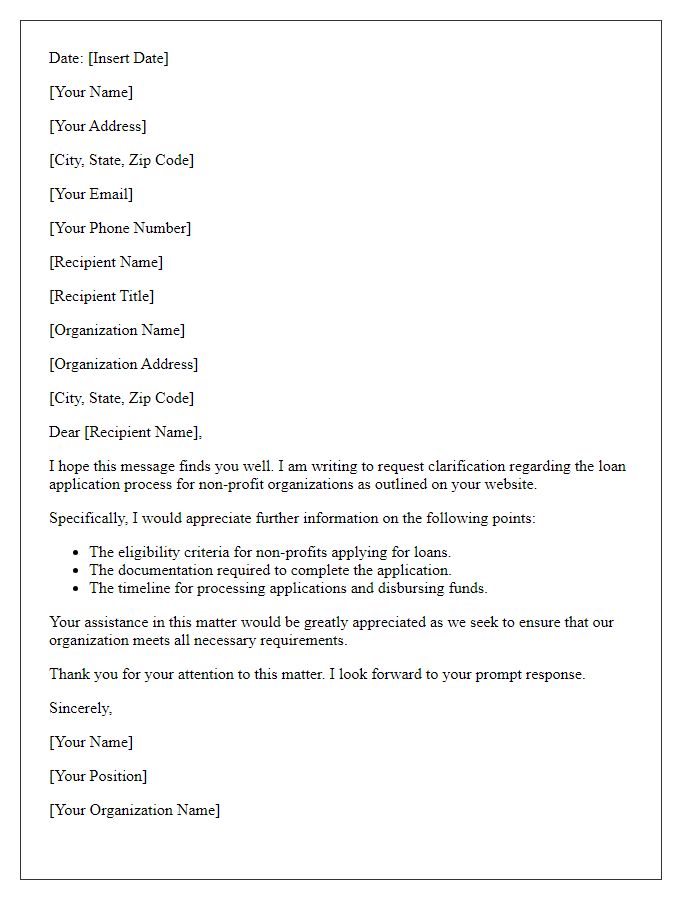

Letter template of seeking clarification on non-profit loan application process

Letter template of proposal for collaboration on non-profit lending projects

Comments