Are you considering a medical loan but feeling overwhelmed by the application process? You're not alone! Many individuals find themselves navigating the complexities of financing medical expenses, and a clear understanding of the requirements can make all the difference. Join us as we explore the essential steps and tips for a successful medical loan applicationâread on to discover how to make your financial journey smoother!

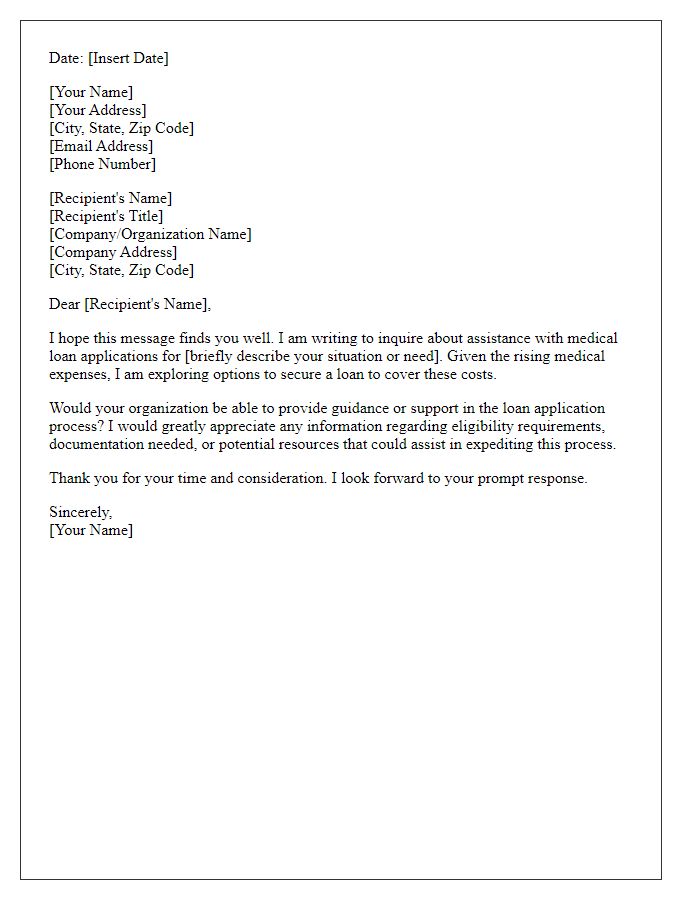

Contact Information

Seeking financial assistance for medical procedures often involves navigating loan applications specifically designed for healthcare expenses. Key players in this process include financial institutions, healthcare providers, and patient advocates. For instance, organizations like CareCredit offer special financing options that cater to medical bills and can cover treatments ranging from dental work to cosmetic surgeries. Applicants should prepare to provide detailed information such as credit scores, income levels (often needing to verify stable income above $50,000 annually), and existing debts, which may influence loan eligibility. Understanding the terms of different lenders, including interest rates ranging from 6% to 36%, is crucial to making informed decisions. Additionally, local health departments often offer advice and resources for securing financing tailored to individual medical needs.

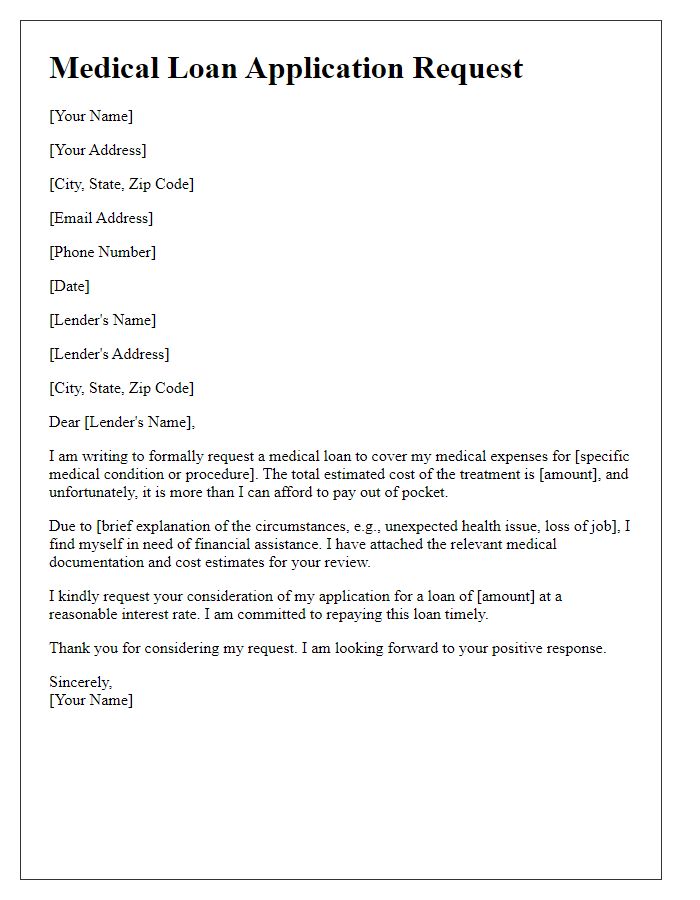

Purpose and Reason for Loan

Medical loans provide individuals with financial assistance for various healthcare expenses, including surgeries, treatments, and medications. Many patients face unexpected medical bills, often exceeding thousands of dollars. For instance, a major surgical procedure can cost between $15,000 to $50,000 depending on factors like location (U.S. hospitals such as Johns Hopkins or Mayo Clinic), procedure complexity, and insurance coverage limitations. Patients may seek loans to cover costs associated with elective surgeries, dental work, or fertility treatments, where insurance may not cover all expenses. Additionally, immediate access to funds can alleviate stress and allow prompt treatment, ultimately improving health outcomes. Financial institutions specializing in medical loans often offer flexible repayment plans tailored to individual circumstances, enabling borrowers to manage repayments effectively while prioritizing their health.

Amount Requested

In a medical loan application inquiry, the amount requested should correspond to the specific medical treatment or procedure necessary, such as a surgery costing $15,000 or a long-term care facility fee of $5,000 per month. Factors affecting the amount include additional expenses like medical equipment or evaluation fees, which might range from $500 to $2,000. Documentation may include detailed invoices from healthcare providers, estimated costs from hospital administrators, or estimates for medical devices. A precise computation of expenses can strengthen the inquiry and aid in securing the necessary funds.

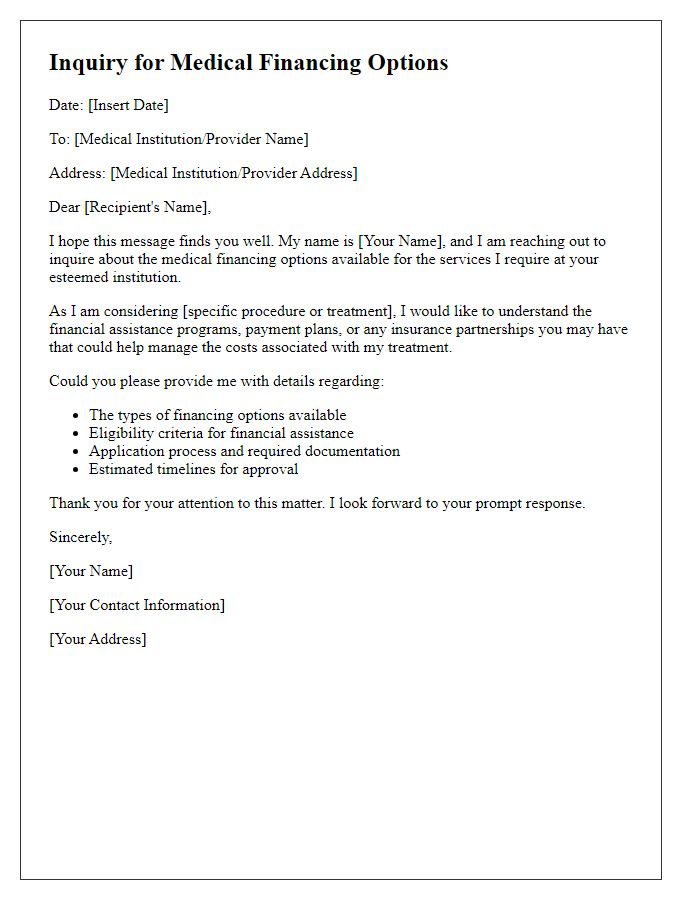

Financial and Employment Details

Inquiring about financial assistance for medical needs, individuals often seek information regarding loan applications and the required financial and employment details. Key components such as gross monthly income must be clearly stated to determine loan eligibility; typically, this includes all sources of income such as salary, bonuses, or side jobs. Employment status, whether full-time or part-time, plays a critical role in assessing repayment stability. Details of the current employer, including the company's name and tenure, reinforce financial reliability. Additionally, understanding credit scores, which fall into ranges such as poor (300-579), fair (580-669), good (670-739), and excellent (740-850), assists lenders in evaluating risk. Documentation typically required includes recent pay stubs, tax returns, and bank statements, which provide insight into overall financial health and borrowing capacity.

Medical and Treatment Information

When considering a medical loan application, it is essential to provide detailed medical and treatment information, including diagnosis, treatment plans, and estimated costs. Medical diagnostic terms, such as "diabetes mellitus" or "hypertension," help lenders understand the severity of the condition. Information from healthcare providers, such as treatment schedules or recommended procedures (e.g., MRI scans, surgical interventions), must be detailed. Cost estimates from healthcare facilities, like St. Jude's Hospital or Mayo Clinic, give a clearer picture of financial needs, including consultation fees, pharmacy costs, and potential insurance coverage gaps. Using statistics, such as the average cost for outpatient surgery, can underscore the importance of timely funding in managing health issues effectively.

Letter Template For Medical Loan Application Inquiry Samples

Letter template of inquiry for assistance with medical loan applications

Comments