Are you in the process of applying for a utility loan and feeling overwhelmed by the feedback you've received? Navigating the world of financial applications can be tricky, but understanding the feedback is crucial for success. It's important to view this input as a valuable guide that can help refine your application and increase your chances of approval. Ready to empower yourself with more insights and tips? Read on!

Clarity in Communication

Clarity in communication is essential for successful utility loan applications, especially in complex financial environments. Misunderstandings regarding loan terms such as interest rates (often ranging from 3% to 10% based on creditworthiness) may lead to confusion. Areas like repayment schedules should specify important dates (typically monthly or quarterly) for clear expectations. Applicants must understand financial jargon commonly used in agreements, ensuring they are well-informed about any fees involving late payments or prepayment penalties. Furthermore, effective communication with utility companies, such as local electric or water providers, enhances the overall borrowing experience and promotes trust, ultimately aiding in the application approval process.

Detailed Financial Analysis

A thorough analysis of financial metrics reveals the viability of a utility loan application. Key indicators include debt-to-income (DTI) ratios, which should ideally remain below 36%, ensuring borrowers maintain manageable monthly payments. Credit scores, ranging between 300 to 850, impact interest rates substantially; higher scores usually qualify borrowers for more favorable terms. In addition, the loan-to-value (LTV) ratio plays a crucial role, as lenders often prefer LTV ratios below 80% to mitigate risk. Comparing operational expenses, including fuel costs and maintenance fees, against revenue generated is essential to ascertain the applicant's financial stability. Stress-testing scenarios that account for fluctuations in utility demand further enhance risk assessment, providing critical insights that guide lending decisions. Overall, the integration of these financial analytics fosters a comprehensive understanding of the applicant's capability to sustain the loan.

Compliance with Regulations

Compliance with regulations in a utility loan application involves ensuring adherence to local, state, and federal guidelines stipulated by the Federal Energy Regulatory Commission (FERC) or the Environmental Protection Agency (EPA). Utilities seeking funding must demonstrate their alignment with specific criteria, including emissions standards, energy efficiency benchmarks, and safety measures. In 2023, for instance, many states implemented stricter regulations on renewable energy projects, requiring comprehensive impact assessments. Loan applicants must provide documentation such as environmental reviews, feasibility studies, and stakeholder consultations to prove compliance. Regulatory compliance not only facilitates smoother approval processes but also enhances trust among investors and project stakeholders. Failure to meet these requirements can result in delays or rejections, highlighting the importance of thorough preparation.

Customer Experience Enhancement

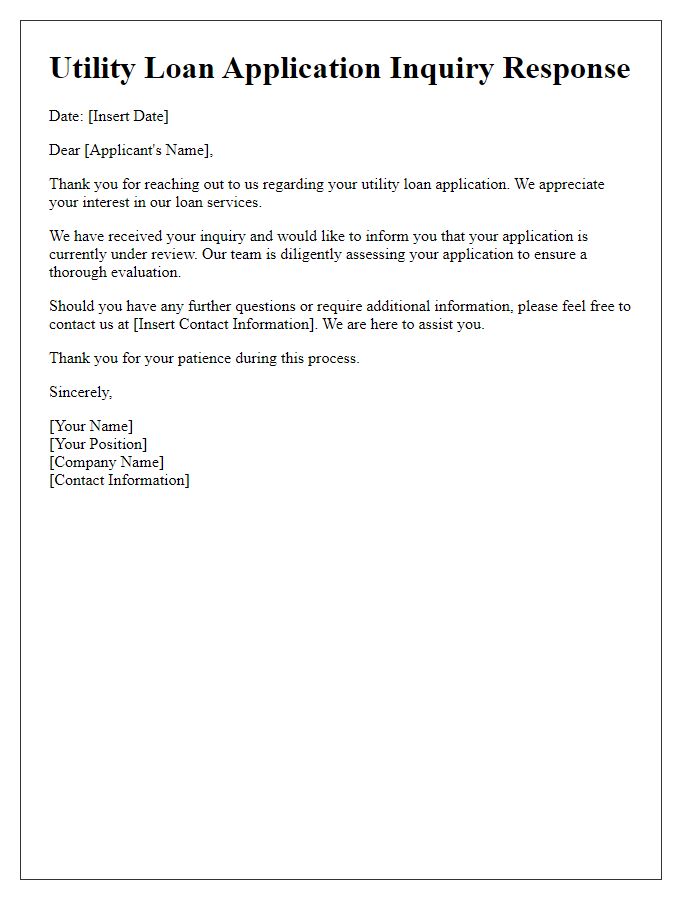

Utility loan applications often involve a complex process, requiring clear understanding of terms and conditions associated with financing. Feedback mechanisms implemented by companies facilitate improvements in customer experience related to these loan applications. Survey responses reveal common concerns regarding lengthy processing times, with some applicants reporting delays exceeding three weeks. Additionally, clarity on interest rates and repayment schedules remains a frequent request among customers, impacting overall satisfaction levels. Companies can enhance user experience by providing more detailed FAQs and streamlined online application systems, which together could reduce confusion and expedite approvals. Furthermore, utilizing chatbots for immediate assistance can greatly enhance real-time support for applicants navigating the loan application journey.

Personalized Feedback

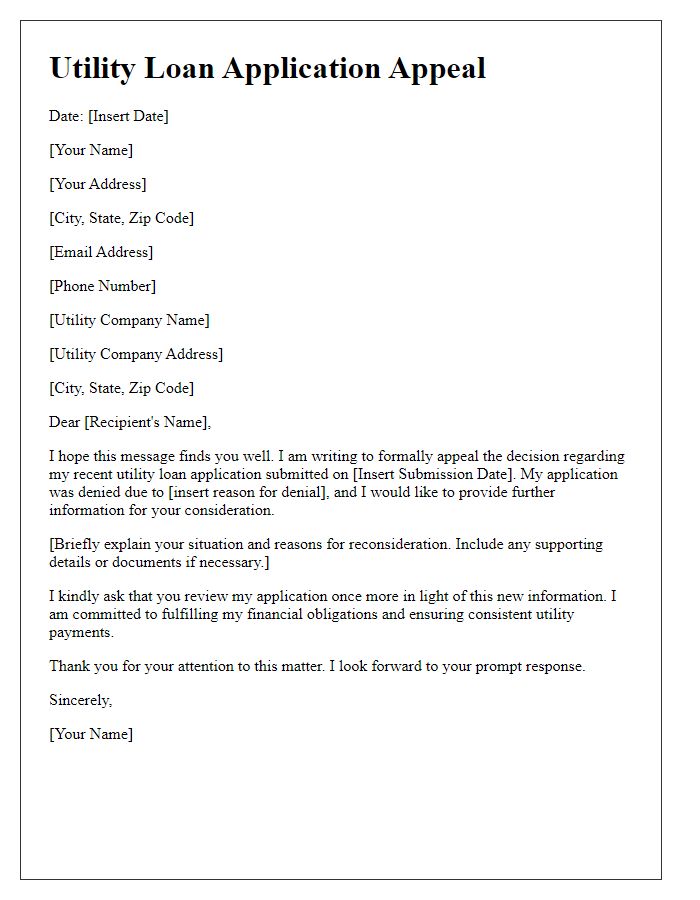

Utility loan applications can serve as crucial financial assistance for individuals or businesses seeking to manage costs related to heating, electricity, water, or other essential services. Feedback on these applications typically includes detailed analysis of income qualifications, such as annual earnings below the federal poverty line of $13,590 for an individual in 2023, and credit history considerations. In addition, applicants may be evaluated based on their payment history with local utility services, ensuring reliability and commitment to financial obligations. Additionally, service area residency can be a determining factor, with many programs requiring proof of residence within specific zip codes or regions eligible for assistance. Understanding these elements can provide necessary insights for improving future applications and ensuring successful loan attainment.

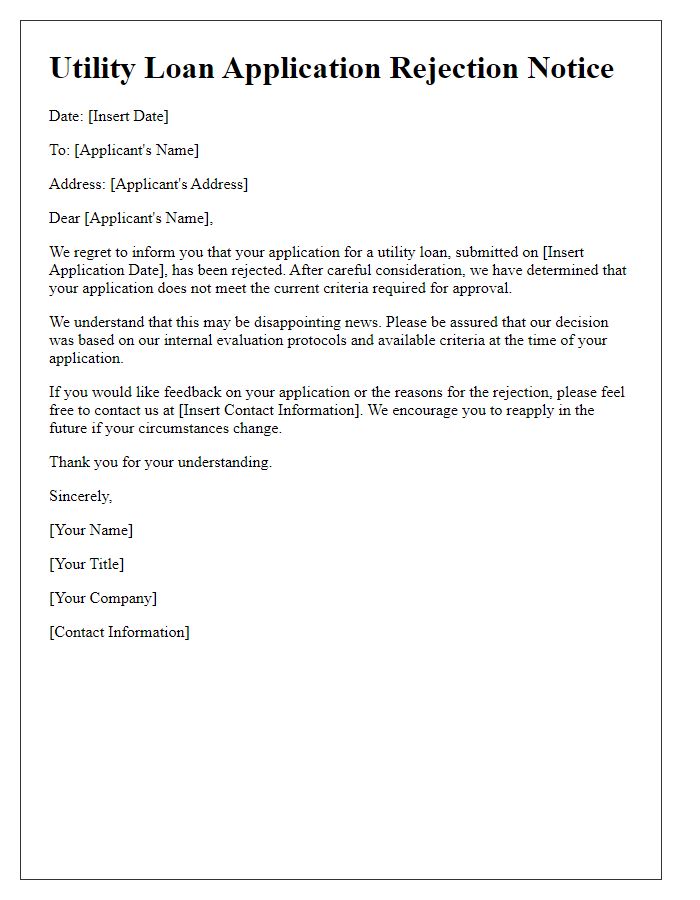

Letter Template For Utility Loan Application Feedback Samples

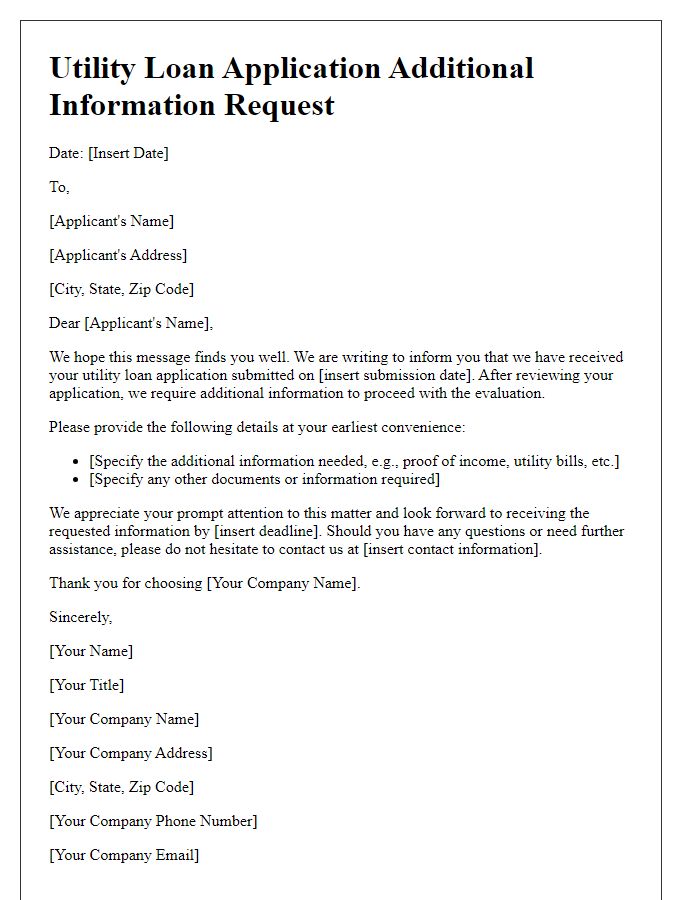

Letter template of utility loan application additional information request

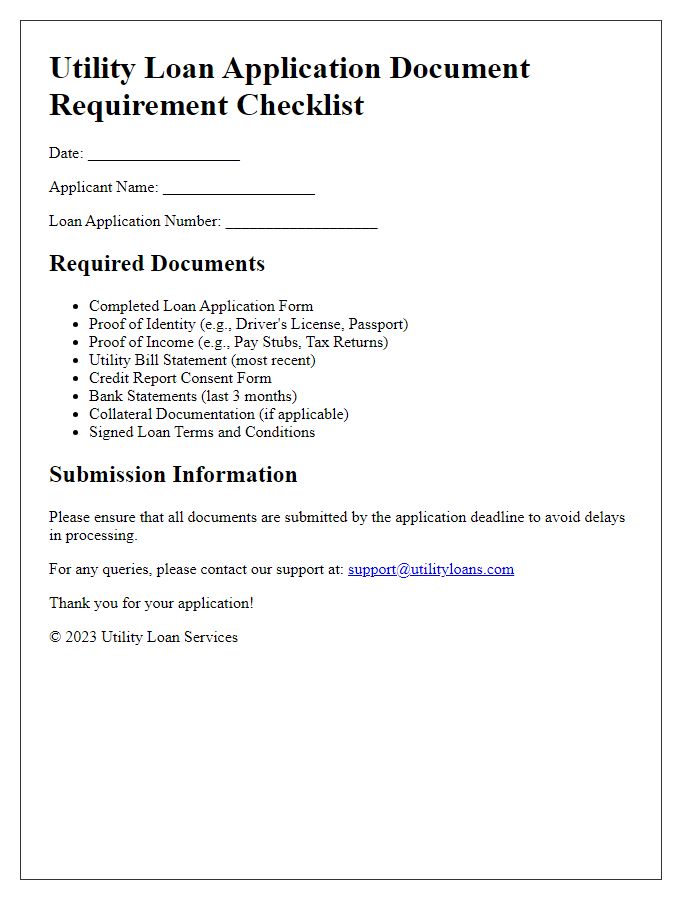

Letter template of utility loan application document requirement checklist

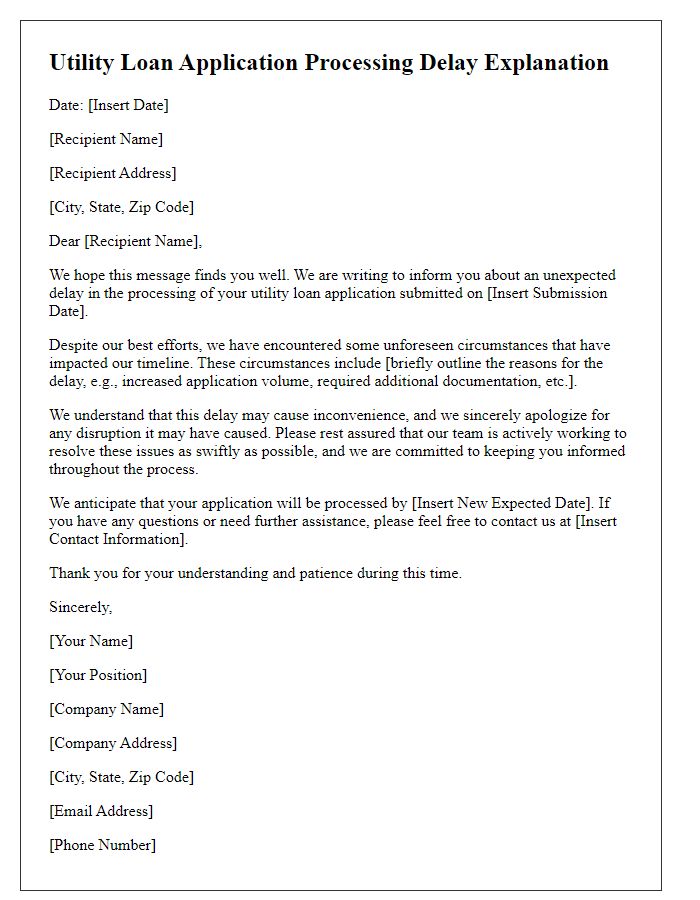

Letter template of utility loan application processing delay explanation

Letter template of utility loan application final decision communication

Comments