Are you considering applying for an educational loan but feeling overwhelmed by the fine print? You're not alone! Understanding the various terms and conditions can be daunting, and it's essential to know what you're signing up for. Join us as we explore the key factors to look out for, and discover how to make informed decisions for your academic future!

Loan Type and Repayment Options

Exploring educational loan options is crucial for students seeking financial support for their studies. Federal loans, such as Direct Subsidized and Unsubsidized Loans, often provide lower interest rates compared to private loans. Understanding repayment options, including Income-Driven Repayment Plans, allows borrowers to tailor their monthly payments based on income and family size, potentially decreasing stress. For larger loans, like PLUS Loans, interest rates can be higher, and fixed repayment terms typically span 10 to 30 years. Additionally, knowing the difference between deferment and forbearance is essential, as these options can provide temporary relief during financial hardship while also affecting total loan costs. Exploring grants or scholarships can supplement loans and substantially reduce the financial burden during college years.

Interest Rates and Fees

When considering educational loans, potential borrowers should closely examine interest rates and associated fees to understand the overall cost of borrowing. Interest rates can vary significantly; federal loans often feature lower fixed rates (e.g., 4.99% for subsidized direct loans in the 2023-2024 academic year), while private loans may offer variable rates that can soar up to 12% or more based on credit scores and financial profiles. Fees such as origination fees (typically ranging from 0% to 5% of the loan amount) could add to the initial borrowing cost. Repayment terms are crucial; understanding whether the loan offers grace periods, the possibility of deferment, or income-driven repayment plans can greatly influence financial planning. Exploring these factors enables borrowers to make informed decisions tailored to their educational financing needs.

Loan Amount Limits

Educational loans, such as Federal Stafford Loans and Private Student Loans, have specific loan amount limits vital for students pursuing higher education. For example, the federal aggregate limit for undergraduate students may reach up to $57,500, while for graduate students, the maximum could soar to $138,500 depending on the program and degree level. Additionally, Private Student Loans often vary by lender, with some providing amounts up to the full cost of attendance, which can exceed $100,000 for graduate degrees in fields like medicine or law. Understanding these limits is crucial for budget planning and managing educational expenses efficiently.

Eligibility Criteria and Documentation

Educational loans are crucial for students in financing their higher education, particularly in institutions like universities and colleges. Eligibility criteria vary by lender, often including factors such as credit score (typically above 650), income verification (recent pay stubs or tax returns), and enrollment status (full-time or part-time) in accredited programs. Documentation requirements usually include personal identification (government-issued ID or passport), academic records (transcripts or acceptance letters), and financial information (bank statements or proof of income). Additionally, some lenders may require co-signers, particularly for students lacking credit history, to ensure loan security. Understanding these terms thoroughly assists applicants in navigating the complex landscape of educational financing.

Application Process and Timeline

Applying for an educational loan involves several key steps and timelines that students must navigate. Typically, the application process begins with selecting a lender, which can include banks, credit unions, or government programs like the Federal Direct Student Loan Program. Upon choosing a lender, prospective borrowers must complete the Free Application for Federal Student Aid (FAFSA), which allows them to determine eligibility for federal aid and loans. This process may take several weeks, especially during peak filing periods, often starting in October for the following academic year. Once submitted, schools receive FAFSA information and provide a financial aid package, usually by the spring semester. After individuals review their options, they proceed to formally apply for the loan, which may require documentation like proof of enrollment, income verification, and credit history. Approval times can vary, with some lenders providing decisions within a few days while others may take several weeks. During this timeline, students should remain aware of loan disbursement dates to align funding with tuition payment deadlines.

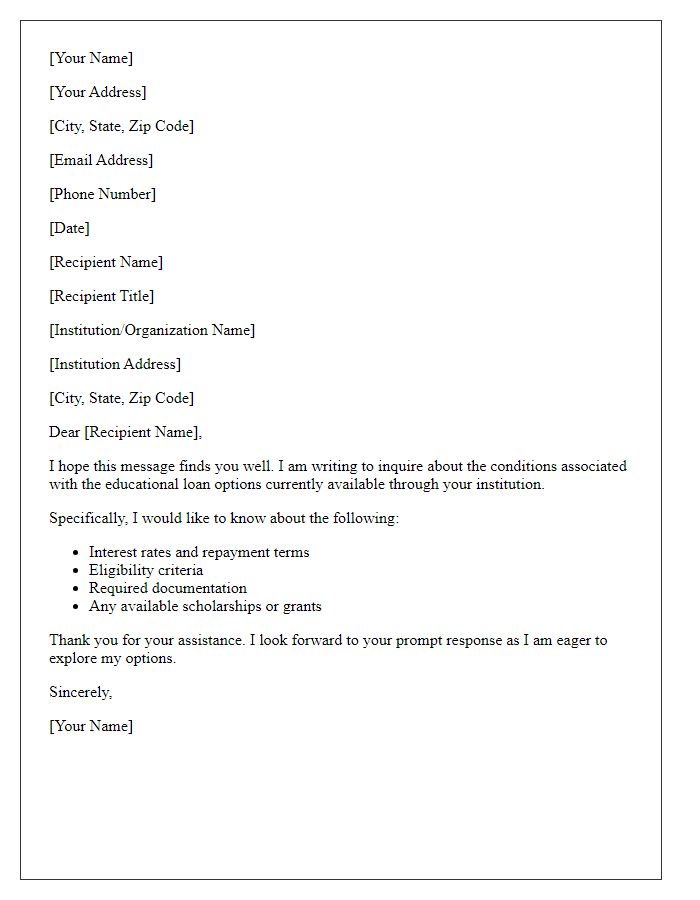

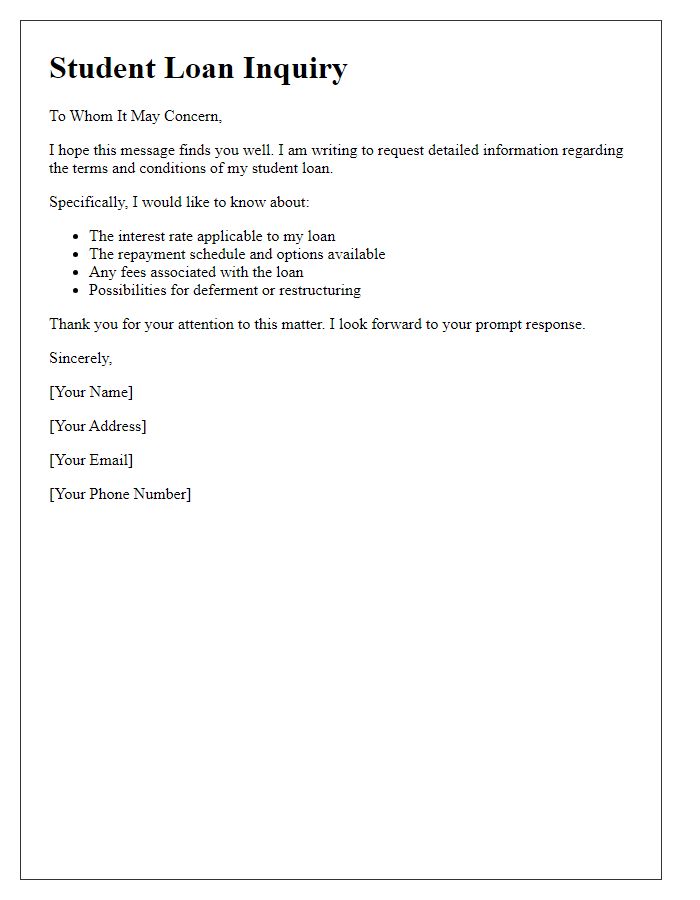

Letter Template For Educational Loan Terms Inquiry Samples

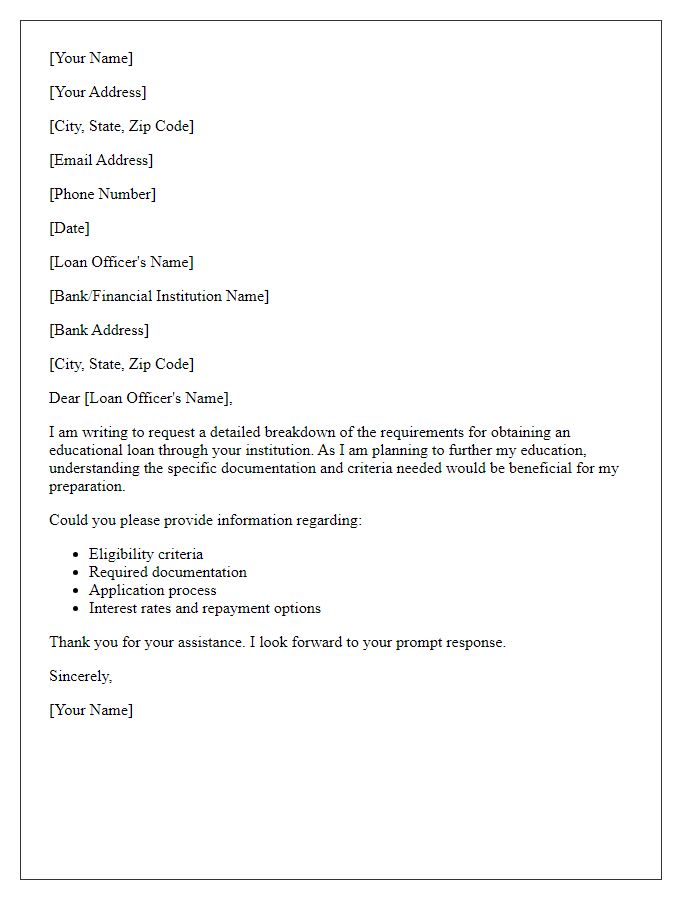

Letter template of request for breakdown of educational loan requirements

Comments