If you're considering a long-term loan but feeling a bit overwhelmed by the options available, you're not alone. Many individuals find themselves in a similar situation, seeking clarity on terms, interest rates, and repayment strategies. Understanding the nuances of long-term loans can make a significant difference in your financial planning. Join us as we dive deeper into this topic, and explore our comprehensive guide for helpful tips and resources!

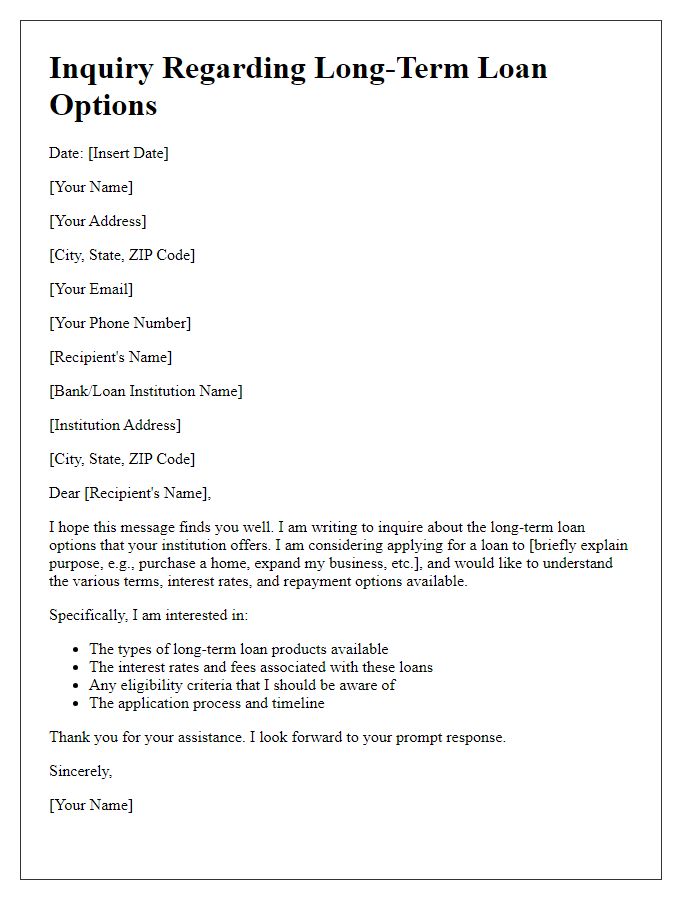

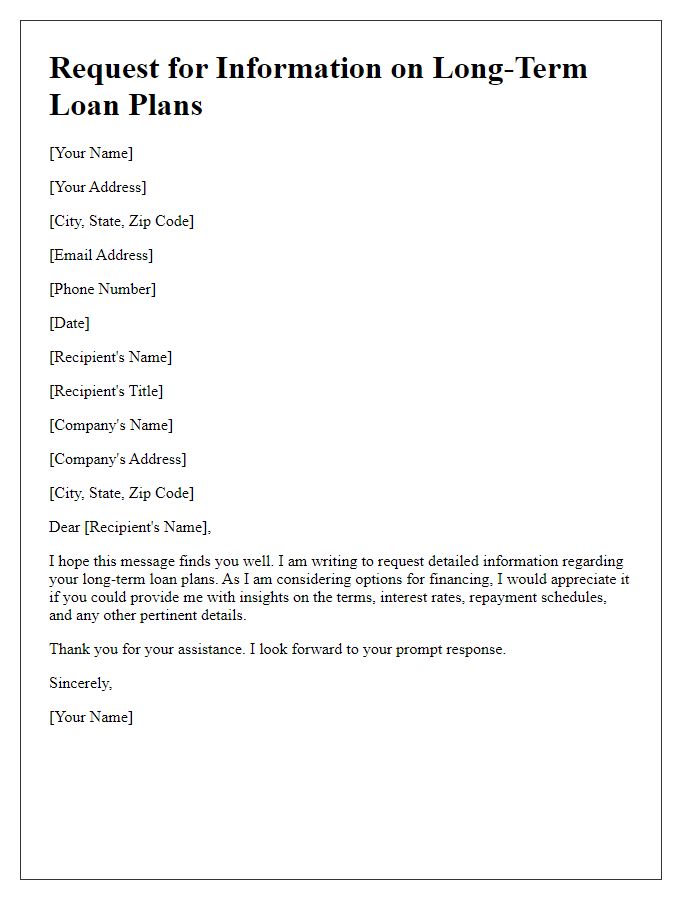

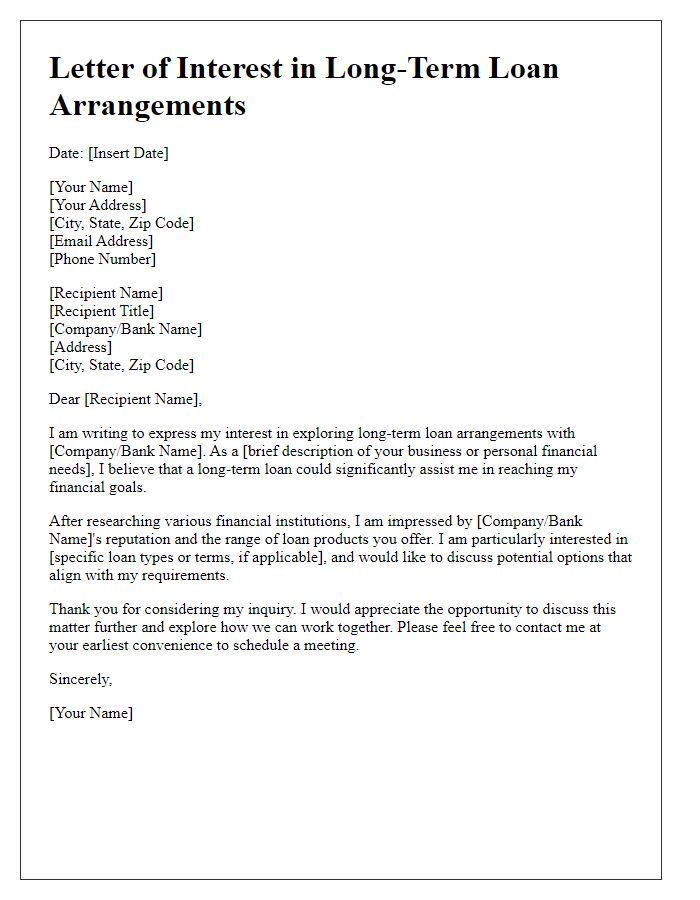

Introduction and purpose of the inquiry

Inquiring about a long-term loan plan provides an opportunity to understand various financing options available for personal or business needs. The purpose of this inquiry centers around exploring specific loan terms, interest rates, repayment schedules, and eligibility criteria to make an informed decision. Insights into lender reliability and customer service reputation can also be important factors. Ultimately, this inquiry aims to find the most suitable financing solution that aligns with individual financial objectives and long-term goals.

Personal and financial background

A long-term loan plan inquiry requires a detailed personal and financial background highlighting key aspects. The applicant's credit score, a crucial numeric identifier of financial health, typically ranges from 300 to 850, influencing loan eligibility. Employment history, specifying duration and income levels, such as annual earnings exceeding $50,000, showcases stability. Additionally, the debt-to-income ratio, ideally below 36%, indicates financial responsibility. Assets like savings accounts or properties, including potential home equity valued at $200,000, can serve as collateral. Understanding of any significant financial events, such as bankruptcy or foreclosure, within the past seven years provides context. Overall, presenting clear and organized information enhances the likelihood of a favorable review and approval of the loan plan.

Detailed loan requirements and amount

When seeking a long-term loan, clarity on detailed requirements and specific amounts is essential. Loan amounts can vary significantly, often ranging from $10,000 to $500,000, influenced by factors such as credit score, income stability, and collateral. Loan requirements typically include proof of income, tax returns for the past two years, a comprehensive budget outlining monthly expenses, and a thorough credit report detailing credit history. Additionally, lenders may request information regarding the purpose of the loan, such as business expansion, home purchase, or debt consolidation. Understanding the loan's terms, including interest rates (which can range from 3% to 10% depending on the lender and borrower's creditworthiness), repayment schedules, and potential fees, can greatly aid in making an informed decision.

Repayment plan suggestion and duration

A long-term loan plan inquiry often necessitates a clear understanding of the repayment structure and timeline associated with the financing. Individuals seeking loans from financial institutions such as banks or credit unions should consider key elements like the principal amount borrowed, interest rates (which can range from 3% to 10% annually), and the duration of repayments (usually spanning from 5 to 30 years). Potential borrowers should also evaluate monthly payment estimates based on amortization schedules, which illustrate how much of each payment goes toward the principal versus interest over time. Moreover, it is essential to inquire about any prepayment penalties that may apply if the borrower decides to pay off the loan early. Understanding these factors can help in crafting a suitable repayment plan tailored to personal financial circumstances.

Contact information and request for further discussion

A long-term loan plan inquiry typically arises when individuals or businesses explore financing options for substantial investments such as homes, vehicles, or equipment. Financial institutions like banks or credit unions provide various loan terms, including interest rates and repayment schedules tailored to individual needs. Potential borrowers, while interested in initiating discussions, should provide their contact information, including full name, phone number, and email address, facilitating direct communication with loan officers. Detailed requests for further discussions should specify particular loan amounts, desired terms, and any additional requirements, ensuring a focused conversation that addresses the borrower's financial goals and circumstances.

Comments