Are you excitedly waiting for a loan approval? Understanding the key components of a loan approval notification can make the process seem less daunting. From outlining the terms to reassuring you of the approval, this notification serves as both a confirmation and a guide for your next steps. So, grab a cup of coffee and join me as we dive deeper into the essentials of a loan approval letter!

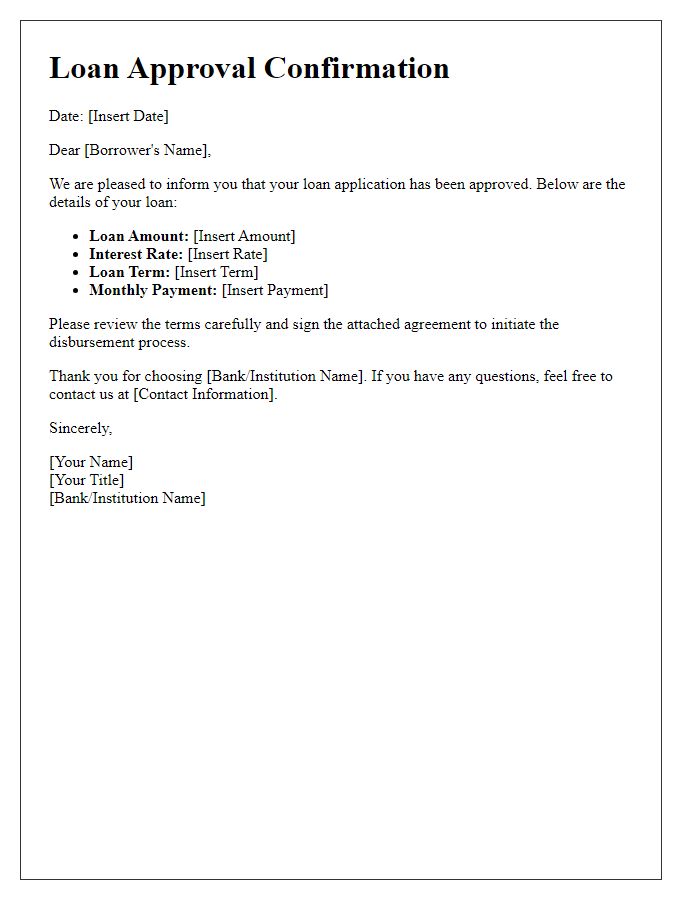

Personalized recipient information

Loan approval notifications provide essential updates to individuals regarding their financial applications. A well-structured notification typically includes personalized recipient information such as the individual's full name, address, and application number. This information serves to establish identity and clarify the specific loan type, whether it is a mortgage, personal loan, or auto loan. The notification often details the approved loan amount, interest rate, and repayment terms, providing clarity on the financial commitment undertaken. Additionally, contact details for loan officers or customer service representatives may be included, ensuring the recipient has access to support for any inquiries or further actions required. Timeliness and clarity in delivering this information are crucial to facilitate the next steps in the loan process.

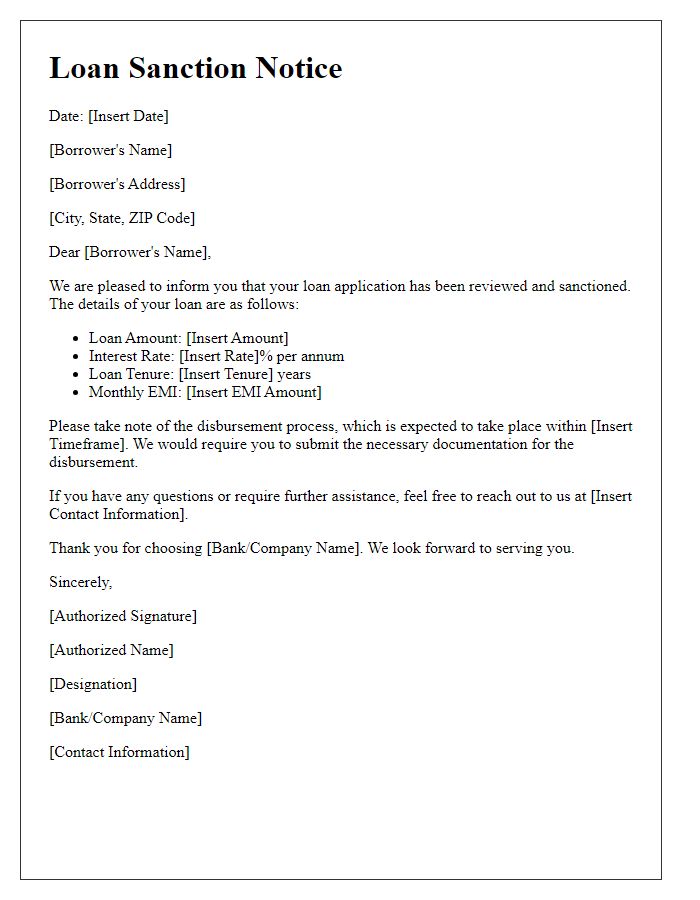

Loan approval details

The loan approval process often culminates in a formal notification detailing essential information. This notification may highlight the loan amount approved, which can range from a few thousand to several million dollars. Interest rates typically vary and may start at about 3% for personal loans or go up to 7% for secured loans, influenced by factors like creditworthiness and market conditions. The duration of repayment plans often spans from 12 months to 30 years, allowing borrowers to budget their finances according to their unique situations. Furthermore, it is important to note any specific terms and conditions tied to the approval, including fees related to origination and early repayment. Additional considerations, such as collateral requirements for secured loans, play a crucial role in the overall agreement.

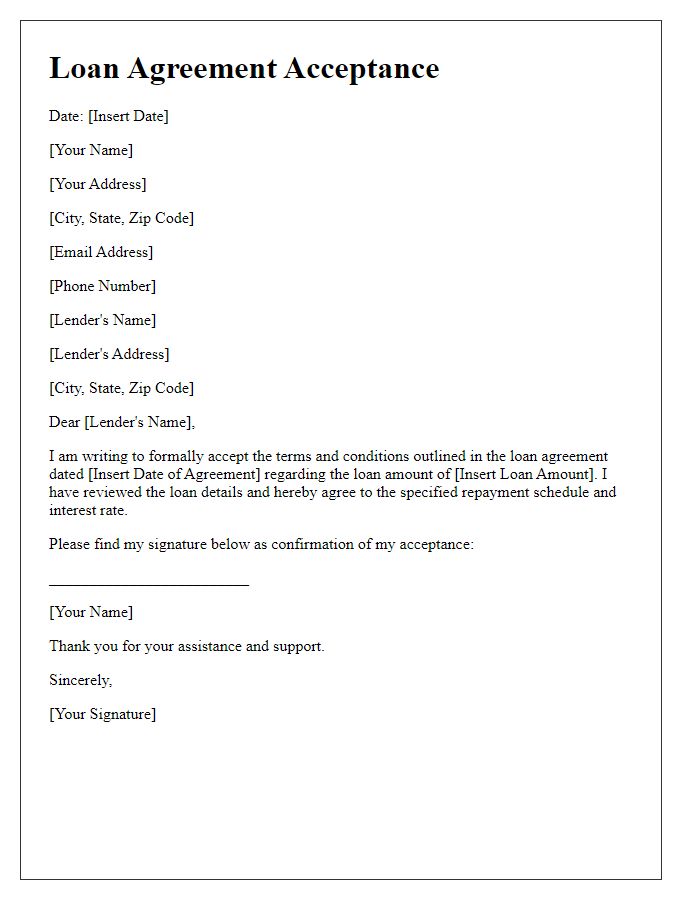

Repayment terms and conditions

Loan approval notifications outline essential details regarding repayment terms and conditions. Borrowers receive clear information about the loan amount, interest rates, and repayment schedules. For instance, a $10,000 loan at a 5% annual interest rate may require monthly payments of approximately $188 over a five-year period. Specific repayment terms include the due date of each installment, acceptable payment methods (such as online transfers or checks), and penalties for late payments, which can range from 5% to 10% of the installment amount. Additionally, the notification may emphasize prepayment options, allowing borrowers to pay off the loan early without incurring additional fees, enhancing financial flexibility and reducing overall interest paid.

Contact information for questions

Loan approval notifications serve as formal communications to inform applicants about the status of their loan applications. A well-crafted approval notification includes essential details, ensuring that recipients understand their loan terms and have access to support if needed. Key contact information, such as a dedicated loan officer's name, phone number (typically a direct line for immediate assistance), and email address (for quick written queries) should be clearly listed. Including business hours (for example, Monday through Friday, 9 AM to 5 PM) can also enhance accessibility. Additionally, providing a customer service hotline can offer broader support for general inquiries or concerns.

Closing with a positive tone

Loan approval notifications are crucial communications in the financial services industry. These notifications inform applicants of their loan status, detailing the terms of approval and any necessary next steps. The notification should include the loan amount, interest rate, repayment period, and any conditions attached to the approval. For example, a home mortgage approval might highlight a loan amount of $250,000 with a fixed interest rate of 3.5% over 30 years, subject to verification of employment and credit history. Ending the notification on a positive note is essential, fostering good customer relations and encouraging timely responses, for instance, thanking the applicant for their trust in the financial institution and expressing eagerness to assist further in the process.

Comments