Hey there! If you've ever found yourself waiting anxiously to hear back about your loan application status, you're not alone. It can feel like an eternity while you wonder if your request will be approved, denied, or if it's still under review. In this article, we'll explore the best ways to follow up on your loan status and what information you should include in your inquiry. So, stick around and learn how to navigate this process with confidence!

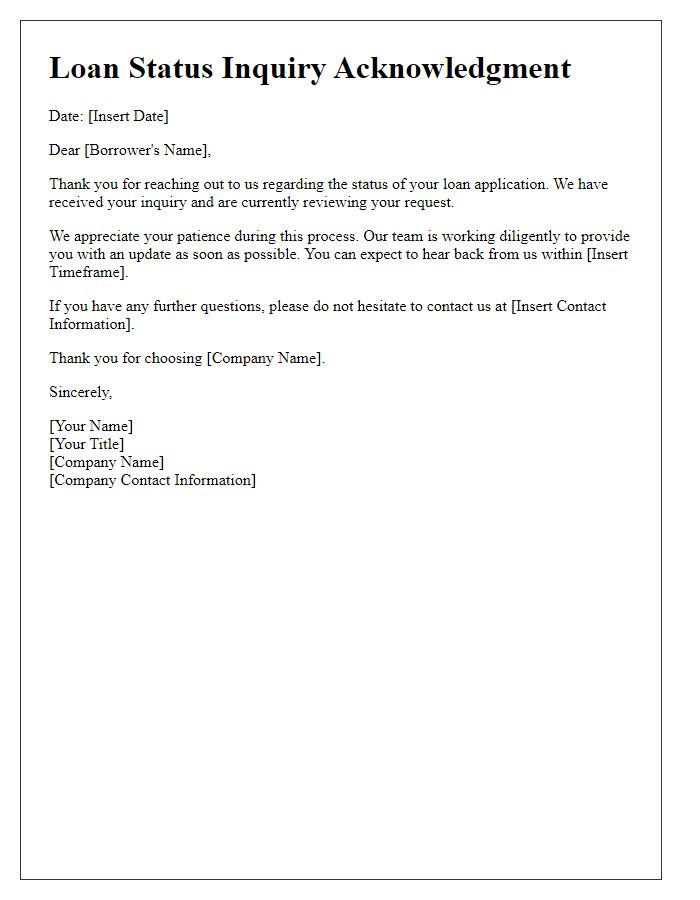

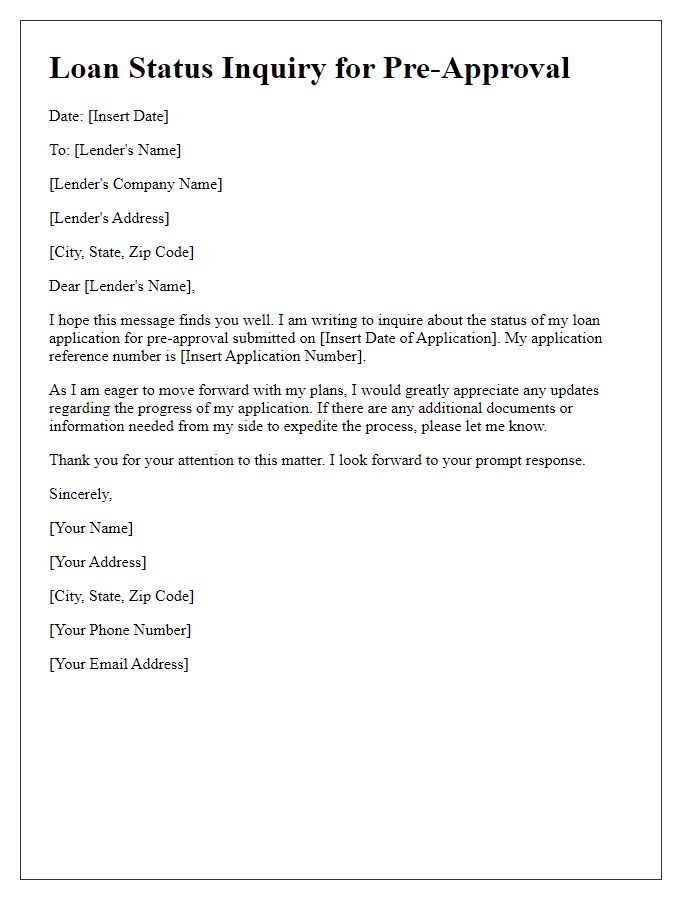

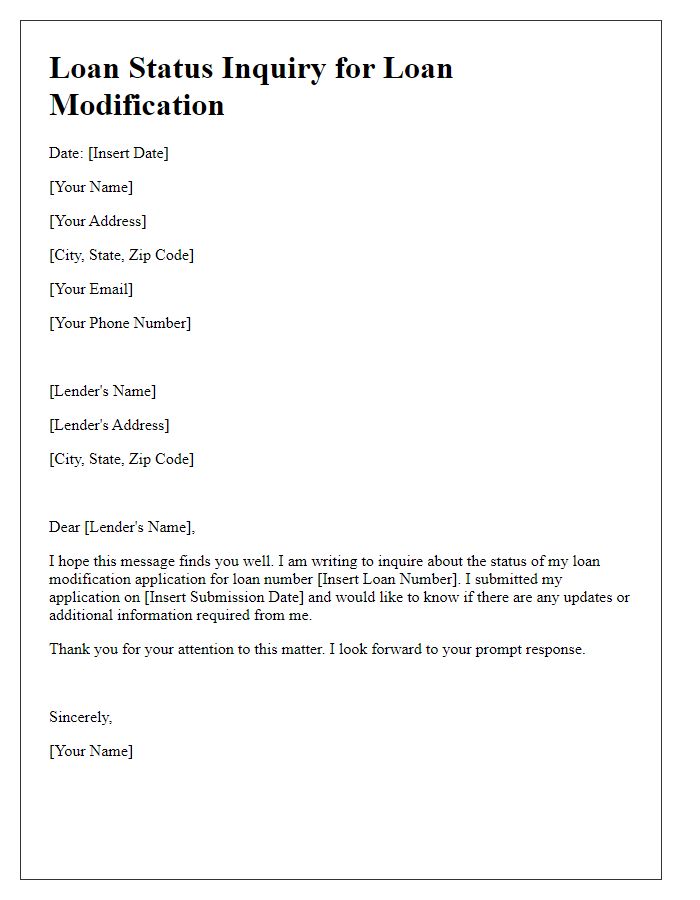

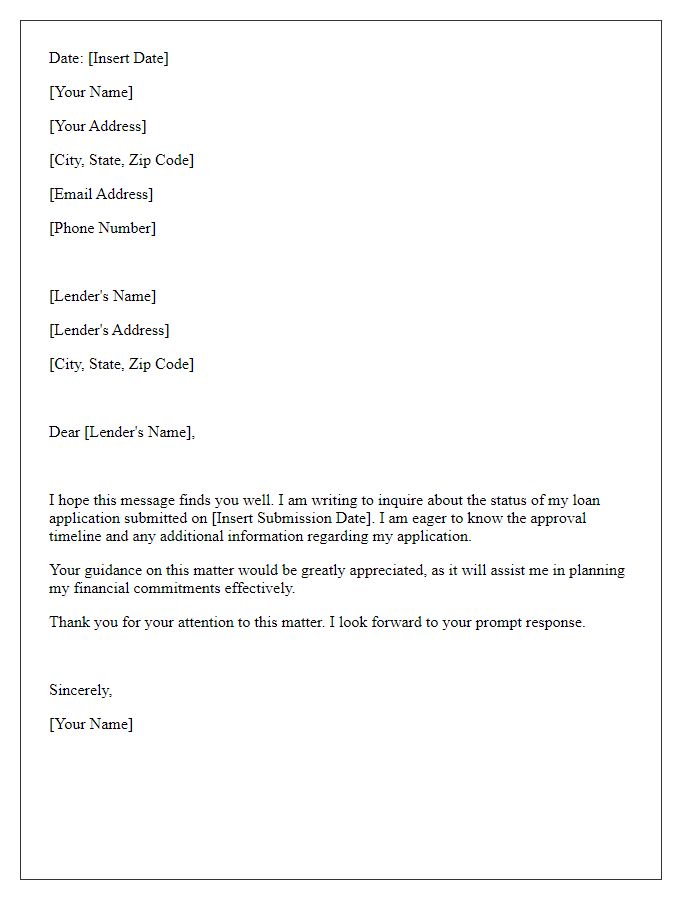

Professional tone

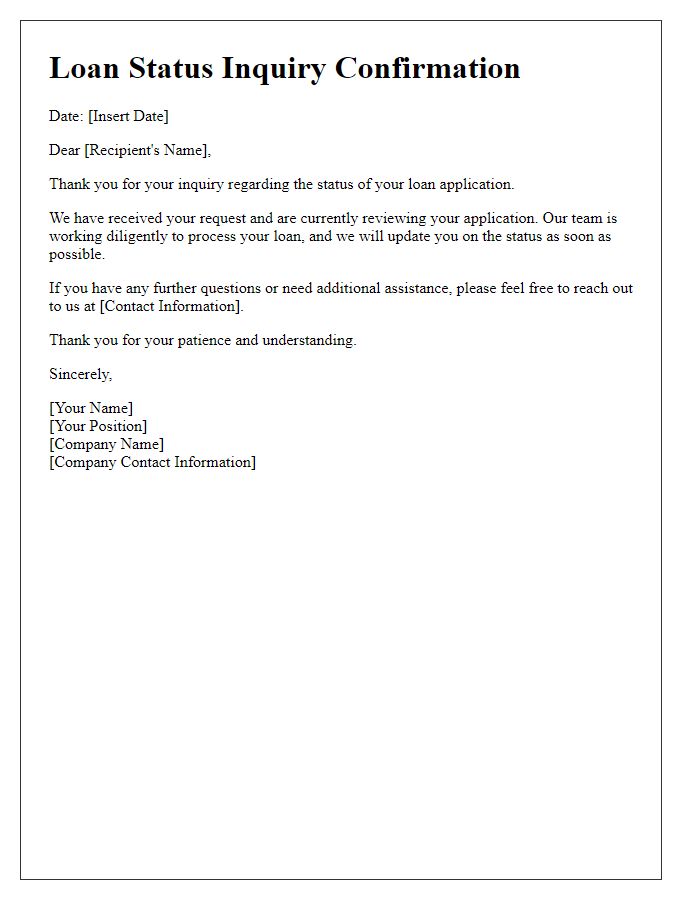

Loan status inquiries provide clients with essential updates regarding their financial applications. Clients typically want information about approval timelines, outstanding documentation, or conditions that may hinder progress. Clear communication ensures transparency, cultivates trust, and reaffirms the lender's commitment to customer service. Maintaining a professional tone while providing accurate details enhances the borrower's understanding of their situation, minimizing uncertainty. Key elements include specific loan types (e.g., personal, mortgage), interest rates (e.g., fixed or variable), and the status of the application, reflecting ongoing engagement in financial matters.

Personalized salutation

The loan status inquiry typically involves a borrower seeking updated information regarding their application with a financial institution. The borrower may reference their application number, date of submission, and specific loan type, such as a mortgage, personal loan, or auto loan. Timely responses from the lender can enhance customer satisfaction, especially when they provide detailed information about approved amounts, interest rates, and expected disbursement dates. Clear communication regarding required documentation or additional verification processes can also play a significant role in the overall loan approval experience.

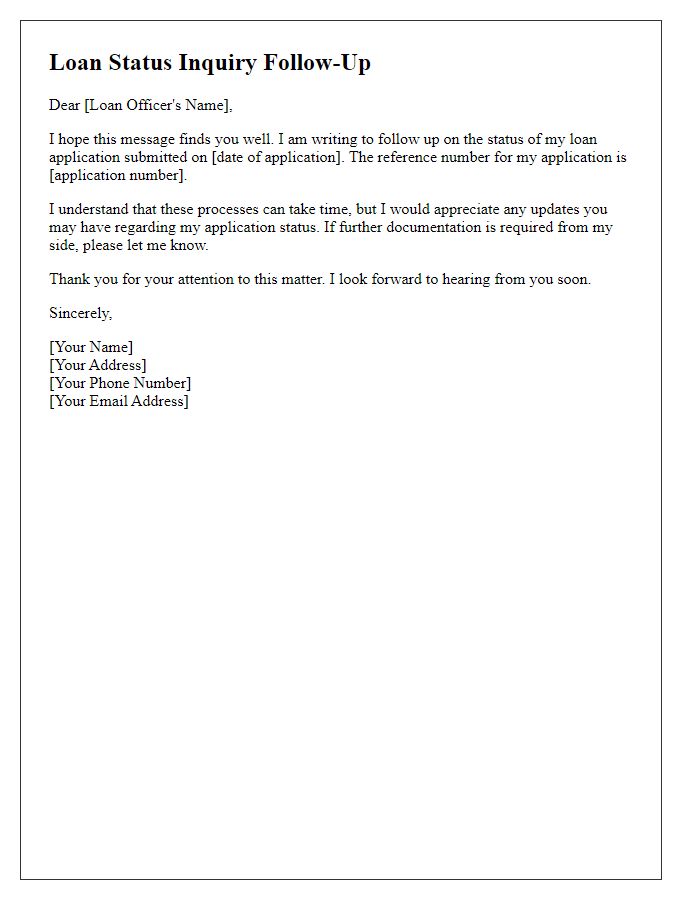

Clear subject line

Loan status inquiries provide essential updates for borrowers. Timely responses can improve customer satisfaction and trust in financial institutions. When addressing a loan status inquiry, include specific details such as loan number (e.g., 123456789), request date (e.g., October 15, 2023), and current loan processing status (e.g., under review, approved). Include estimated timelines for decision-making (e.g., processing usually takes 5-7 business days) and contact information for further assistance. A clear subject line ensures that the recipient immediately understands the email's purpose, such as "Update on Your Loan Status Inquiry.

Concise status update

Currently under review, loan applications submitted to financial institutions such as banks and credit unions typically undergo a thorough evaluation process, expected to take approximately three to five business days. If approval occurs, notifications regarding loan amounts and terms, including interest rates, will be communicated via email or phone. Delays may happen due to incomplete documentation or additional verifications required. For inquiries, contact customer service representatives available weekdays from 9 AM to 5 PM.

Contact information for further inquiries

In the context of loan status inquiries, customers can usually reach out through designated channels provided by lending institutions to ensure streamlined communication. Email addresses such as support@lendingcompany.com or customer.service@financinggroup.org facilitate inquiries in writing, ensuring that customers receive detailed responses. For more immediate assistance, a dedicated phone line (1-800-555-0199) is often available during business hours, typically from 9 AM to 5 PM on weekdays, allowing borrowers to speak directly to representatives regarding their loan applications. Additionally, many institutions maintain online chat services on their websites, offering real-time support for loan-related questions. Users may also find useful information in the FAQs section, addressing common concerns and providing insights into the loan processing timeline, typical requirements, and additional resources for assistance.

Comments