Are you feeling a bit overwhelmed by your current loan obligations? If you're considering a loan period extension, you're not alone; many people find themselves in a similar situation at some point. This article will guide you through how to effectively draft a letter requesting an extension, making the process smoother and less stressful. So, grab a cup of coffee, and let's dive into the essentials of writing your request!

Clear purpose statement

Seeking a loan period extension requires a clear understanding of personal financial circumstances. Individuals may experience unforeseen events, such as medical emergencies or job loss, which can impede timely repayment. Crafting a request necessitates specific details about the current loan, including the original amount ($10,000) and initial repayment timeline (12 months), alongside reasons for the extension request. It is essential to propose a new timeline, indicating how a six-month extension can facilitate manageable repayments, ensuring clarity for the lender. Including any previous successful payments demonstrates commitment, increasing the likelihood of a favorable response.

Detailed explanation of the situation

A loan period extension request letter template serves as a structured document for individuals seeking additional time to repay a borrowed amount, often due to unforeseen circumstances. The situation may arise from financial difficulties such as job loss, medical emergencies, or unexpected expenses that hinder timely repayments. Essential components of the template include a clear statement of the current loan terms, an explanation of the specific challenges faced, and a proposed new timeline for repayment. This document aims to convey sincerity and responsibility while providing lenders with the necessary context to understand the request, potentially leading to a favorable outcome. Providing supporting documentation such as budget plans or income statements can enhance the credibility of the appeal.

Justification for extension request

A loan period extension can be pivotal for borrowers facing unforeseen financial hardships or delays. Many individuals may experience unexpected events such as job loss or medical emergencies that impact their ability to make timely payments. Additionally, borrowers may encounter fluctuations in income or difficulties due to the overall economic climate, such as inflation rates exceeding 5% or significant increases in living expenses. In some cases, natural disasters or global events may disrupt regular payment schedules, necessitating a formal request for a loan extension to avoid late fees and maintain good standing with financial institutions. Consideration of these factors, along with clear communication of the reasons for requesting an extension, can foster a positive response from lenders and preserve borrower-lender relationships.

Proposed new terms and repayment plan

Prolonged loan periods can present significant implications for both borrowers and lenders, often requiring clear communication regarding terms and repayment plans. When borrowers seek extensions, they must provide detailed proposals outlining new repayment structures tailored to their financial situations. Specific entities, such as financial institutions like Bank of America or Chase, may need to assess factors including interest rates, outstanding balances, and monthly payment capabilities. Borrowers should specify desired extension durations, whether six additional months or a year, to ensure mutual understanding. Additionally, they can suggest alternative arrangements, such as reduced monthly payments or interest-only periods during the extension, aiming to facilitate repayment without imposing undue financial strain amid changing economic circumstances.

Contact information for follow-up communication

A loan period extension request typically involves communicating with financial institutions regarding an adjustment to existing loan terms. In this context, essential contact information such as a phone number, which is usually formatted with a country code (for example, +1 for the United States), and an email address are necessary for efficient follow-up communication. Including specific details about the loan, such as the loan account number associated with the borrowing, ensures clarity during the communication process. Providing a mailing address may also be beneficial for sending official correspondence or documentation, enhancing the transparency and responsiveness of the loan modification application.

Letter Template For Loan Period Extension Request Samples

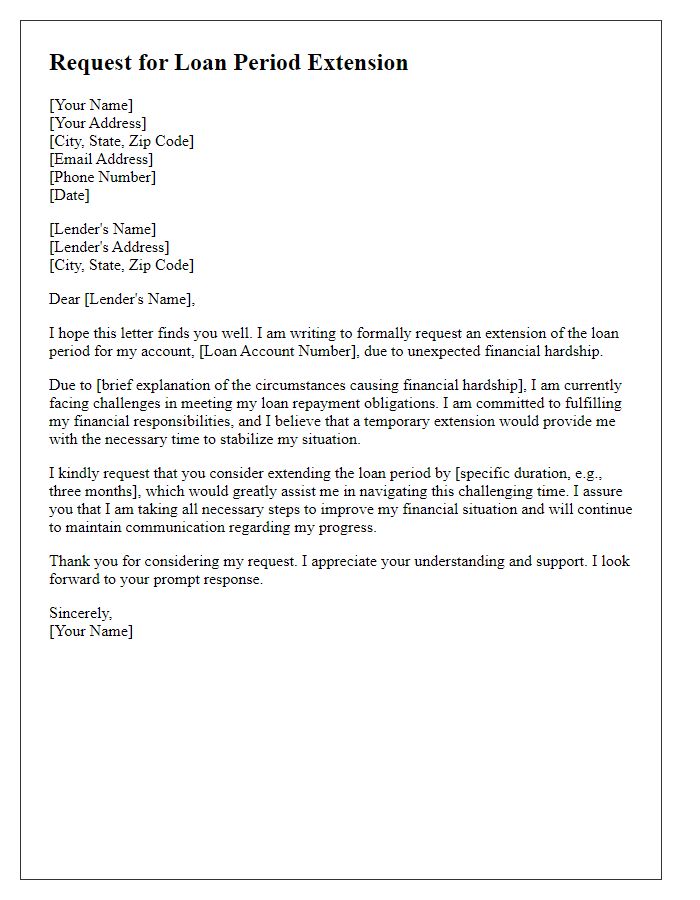

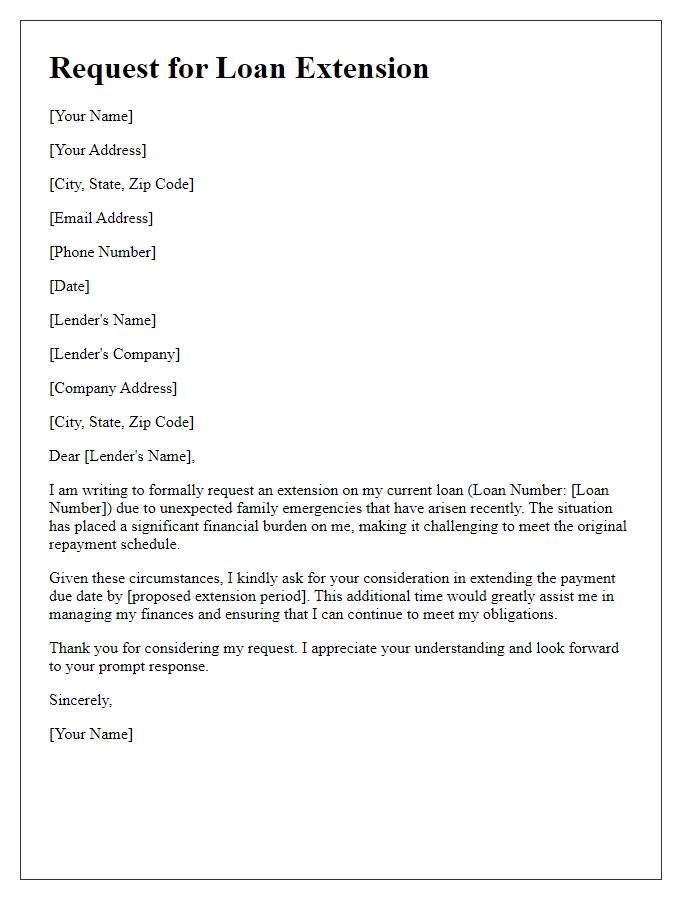

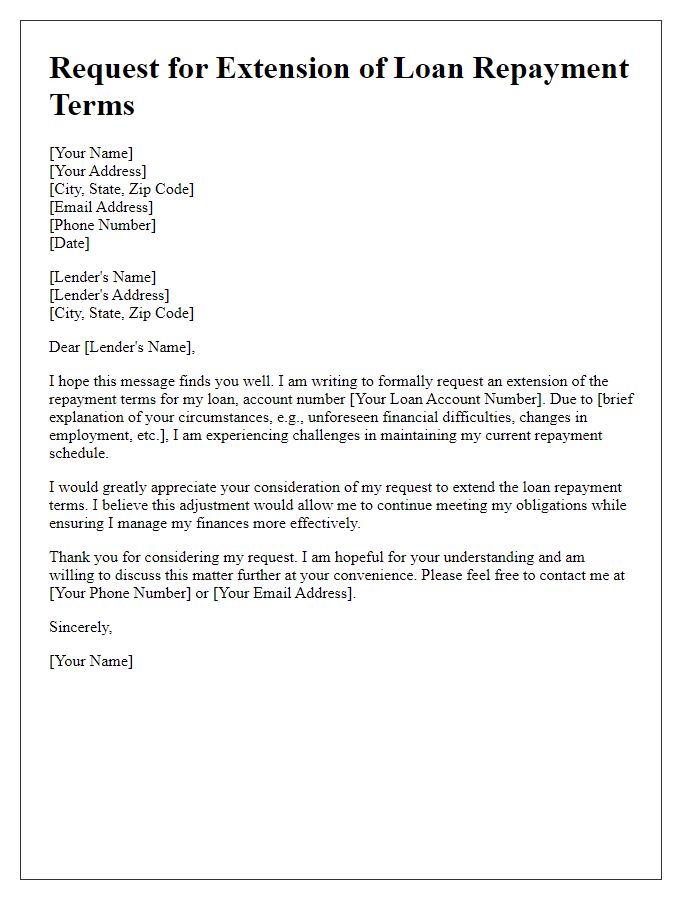

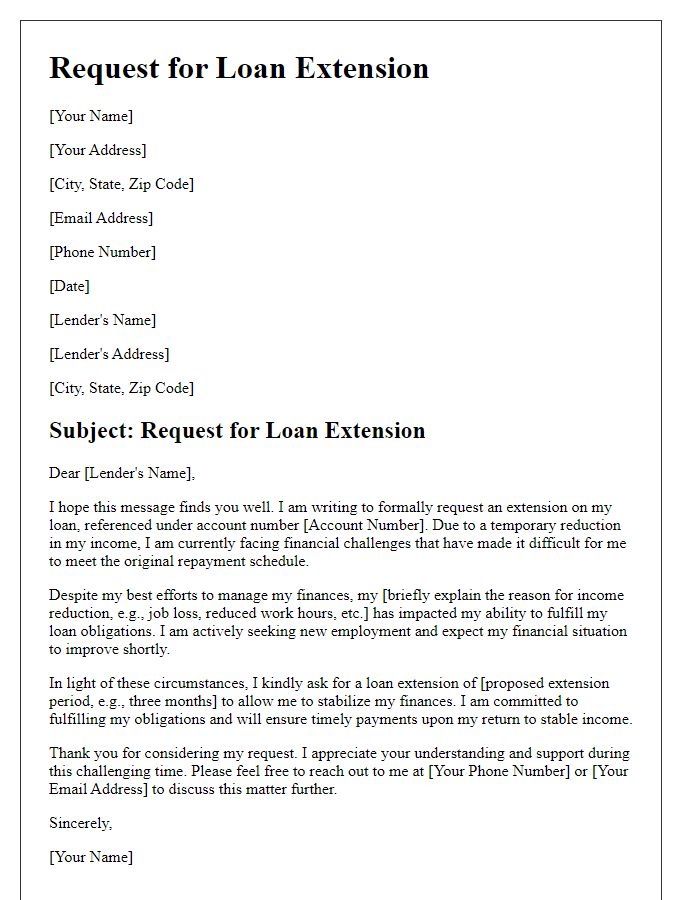

Letter template of request for loan period extension due to financial hardship.

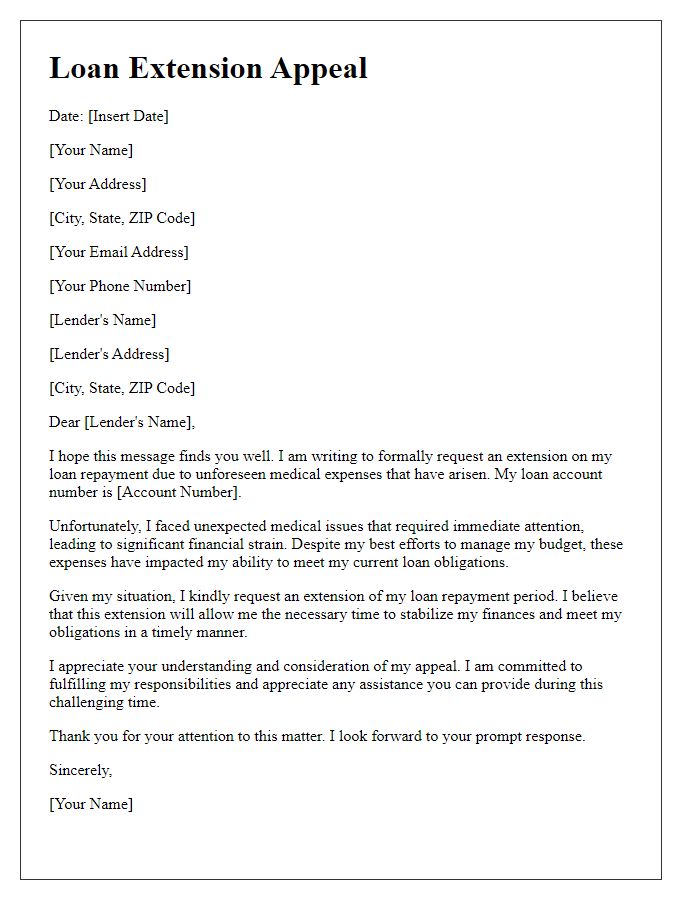

Letter template of loan extension appeal for unexpected medical expenses.

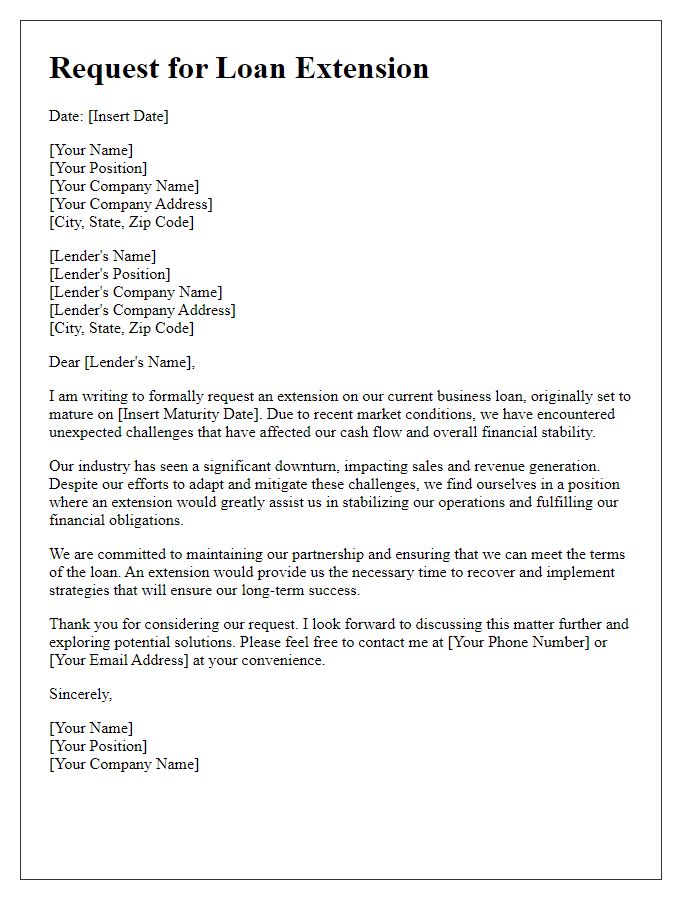

Letter template of request to extend business loan due to market conditions.

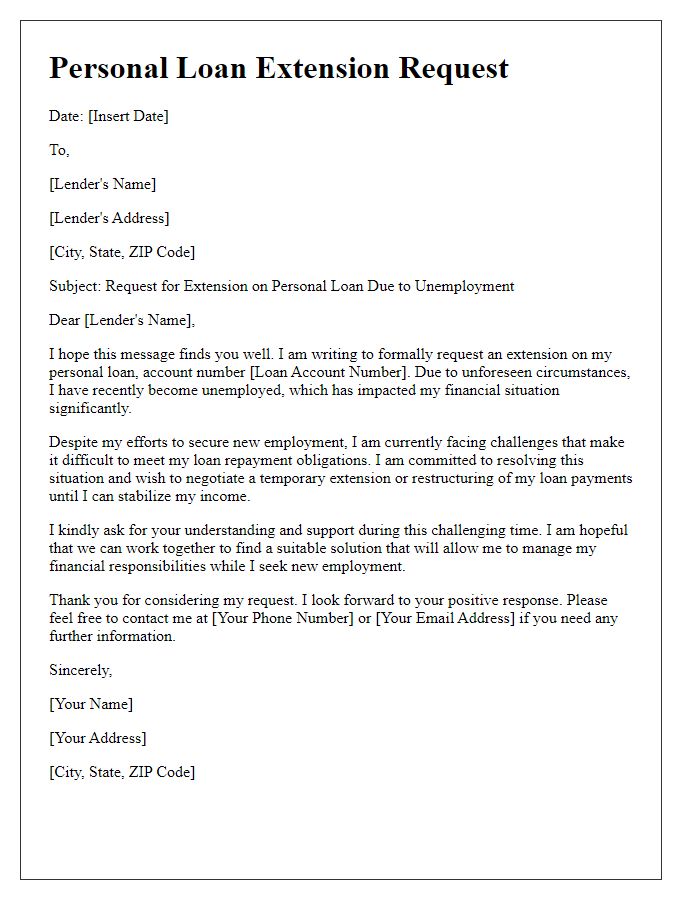

Letter template of personal loan extension request for unemployment situations.

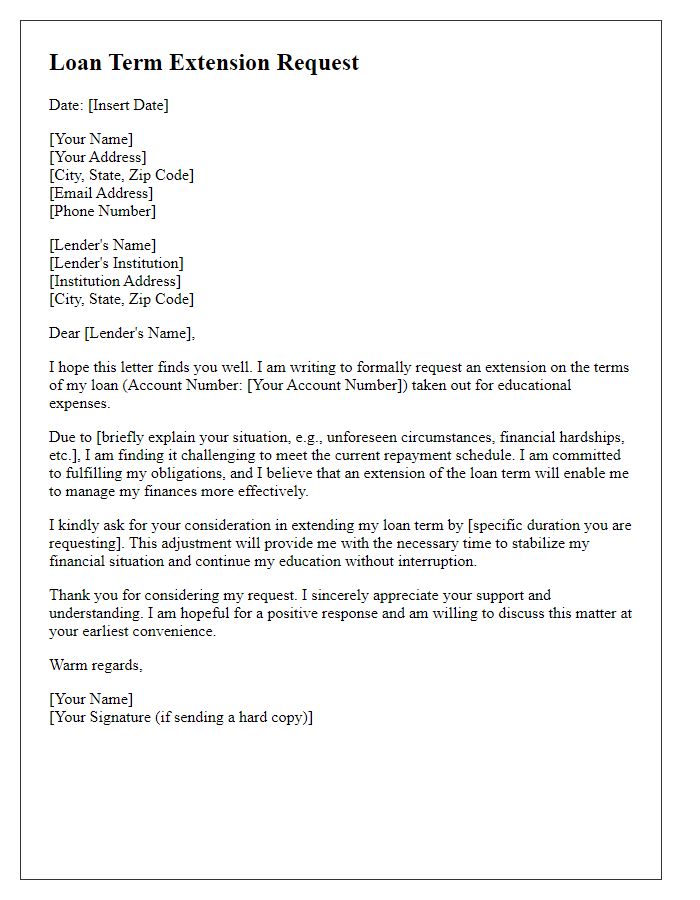

Letter template of letter seeking loan term extension for educational expenses.

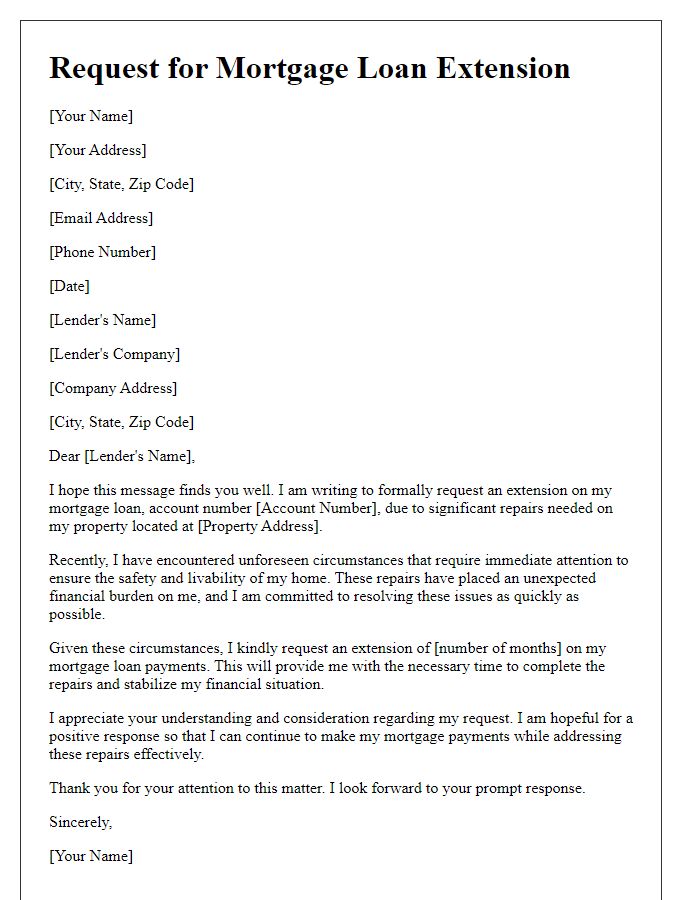

Letter template of appeal for mortgage loan extension amidst property repairs.

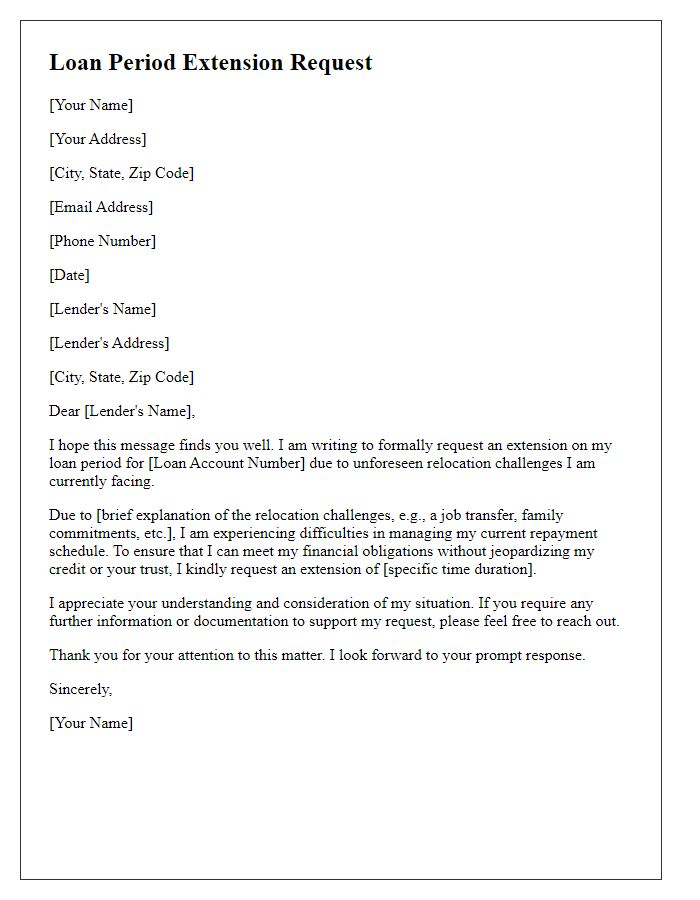

Letter template of loan period extension request for relocation challenges.

Letter template of letter requesting loan extension due to family emergencies.

Comments