Are you feeling overwhelmed by your current loan payments and considering a fresh start? Crafting a well-structured loan restructuring plan can be your ticket to financial relief and peace of mind. In this article, we'll explore the essential elements of a compelling loan restructuring proposal that can help you negotiate better terms with your lender. So, let's dive in and discover how to take control of your financial future!

Accurate Financial Overview

Accurate financial overviews are critical in formulating effective loan restructuring plans for individuals or businesses in financial distress. An accurate financial overview typically includes assets, liabilities, income sources, and expenses. For instance, total debt can amount to $150,000 while monthly income showcases $5,000 and fixed monthly expenses total $3,500. Detailed categorization of debts, such as personal loans, credit card debts, and mortgage obligations, provides insight into the debt repayment structure. Additionally, a projection of future cash flows over the next 12 months can aid lenders in assessing the borrower's capacity to meet restructured payment terms, fostering a more favorable negotiation environment. Drafting such overviews often involves financial statements, tax returns, and bank statements from the previous year, ensuring transparency and increasing the likelihood of securing favorable terms.

Justification for Restructuring

A loan restructuring plan proposal is often justified when borrowers face financial difficulties often due to economic downturns or unexpected business expenses. Analysis of cash flow statements may reveal decreased revenue, leading to challenges in meeting scheduled payments on the existing loan agreement. External factors--such as changes in industry regulations, market competition in specific sectors like retail, or natural disasters affecting local businesses--can create cash flow strain. A proposed restructuring typically aims to modify the loan terms, such as extending the payment period or lowering the interest rate, which can enhance financial stability in the long term. Furthermore, presenting a solid repayment strategy and demonstrating commitment can foster lender confidence while ensuring ongoing business operations.

Proposed New Terms

A loan restructuring plan proposal often includes key elements that outline the proposed new terms to accommodate the borrower's current financial situation. New repayment schedules may extend the loan term from 5 years to 10 years, lowering monthly payments significantly--potentially from $1,500 to $800. Interest rates can also be adjusted; for instance, a reduction from 6% to 4% can lead to substantial overall savings. Additionally, payment deferment for a period of 6 months might provide immediate relief, allowing borrowers time to stabilize their finances before resuming payments. It's essential to specify whether fees or penalties will be waived during this restructuring process, creating a more favorable environment for repayment. Clear documentation of these new terms can aid in fostering mutual understanding and agreement between the borrower and the lending institution.

Impact Analysis

A loan restructuring plan proposal aims to assess the financial impact on both the borrower and the lender. For borrowers, a detailed impact analysis indicates changes in monthly payment schedules, interest rates, and overall debt burden. For instance, switching from a variable interest rate--potentially fluctuating between 3% to 7% annually--to a fixed interest rate at 5% ensures predictable expenses, aiding budget planning. It also highlights changes in the loan term, which might extend from 15 years to 20 years, increasing the total interest paid but reducing monthly commitments. Lenders, such as commercial banks like JPMorgan Chase or Wells Fargo, benefit from maintaining relationships with clients while mitigating default risks. The analysis must also consider external economic factors, such as the current inflation rate at 5.4% in the U.S. and potential shifts in employment rates affecting borrower income, ensuring a comprehensive understanding of the restructuring's effects.

Supporting Documentation

The loan restructuring plan proposal includes vital supporting documentation essential for a comprehensive assessment by the financial institution. Key documents consist of the current loan agreement detailing interest rates (typically around 5-7% for personal loans), payment history over the past 24 months showcasing consistency or defaults, financial statements illustrating income sources (e.g., employment wages, rental income), and an updated budget reflecting monthly expenses. Additionally, a cash flow analysis provides insights into revenue versus expenditure, crucial for evaluating repayment capacity. If applicable, tax returns from the last two years offer further verification of financial stability. Furthermore, any documentation of unforeseen circumstances, such as medical emergencies or job loss, should be included to contextualize the need for restructuring, ultimately substantiating the request for a favorable reassessment of loan terms.

Letter Template For Loan Restructuring Plan Proposal Samples

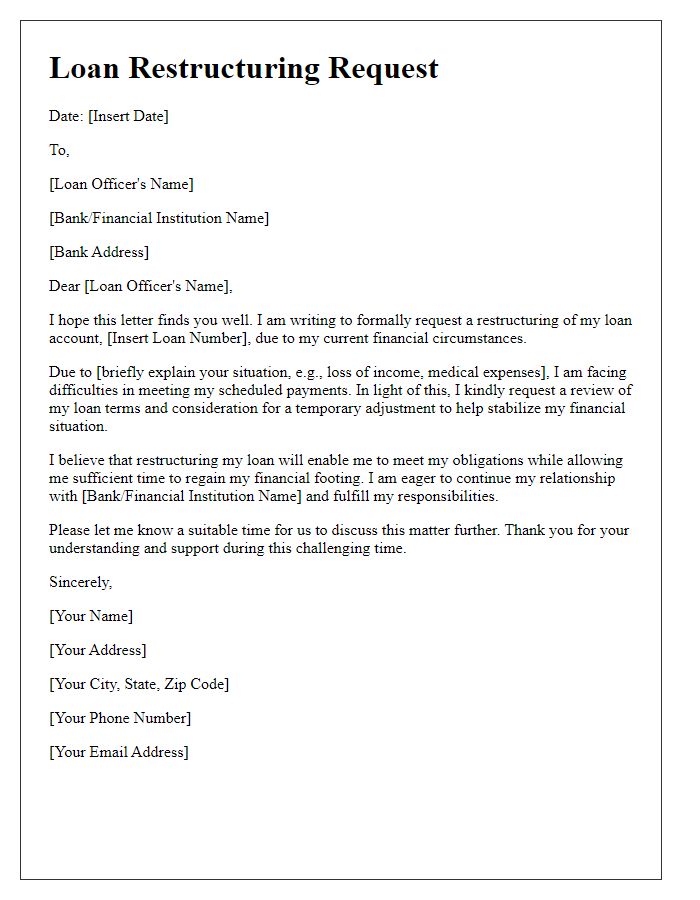

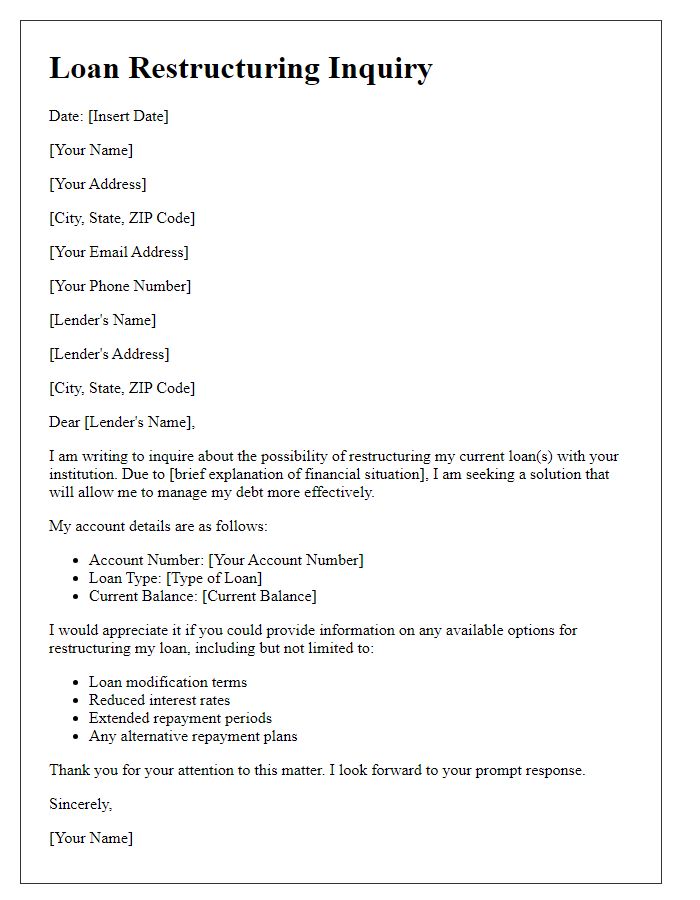

Letter template of loan restructuring request for personal financial relief

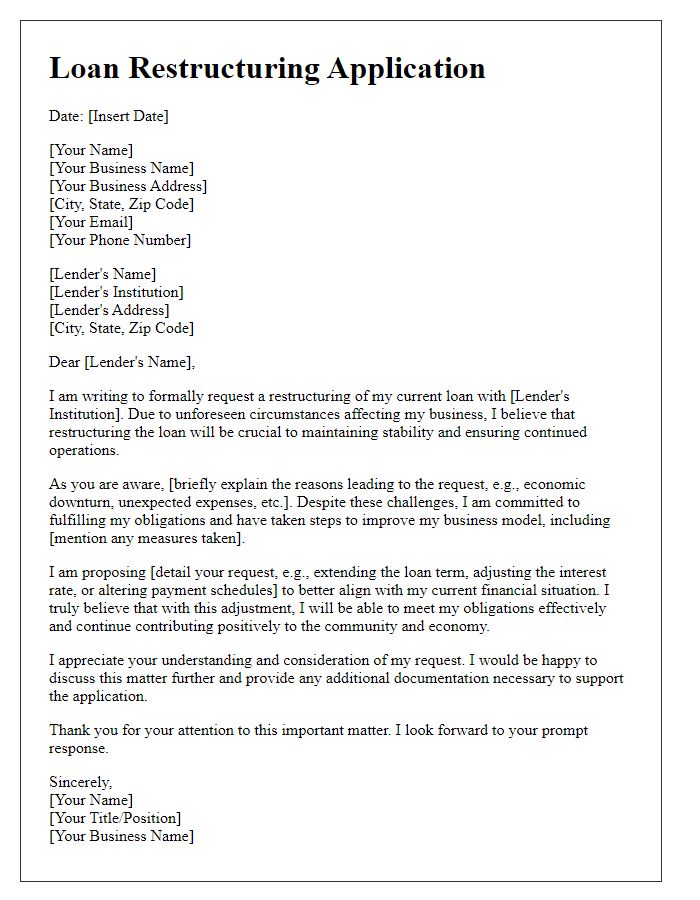

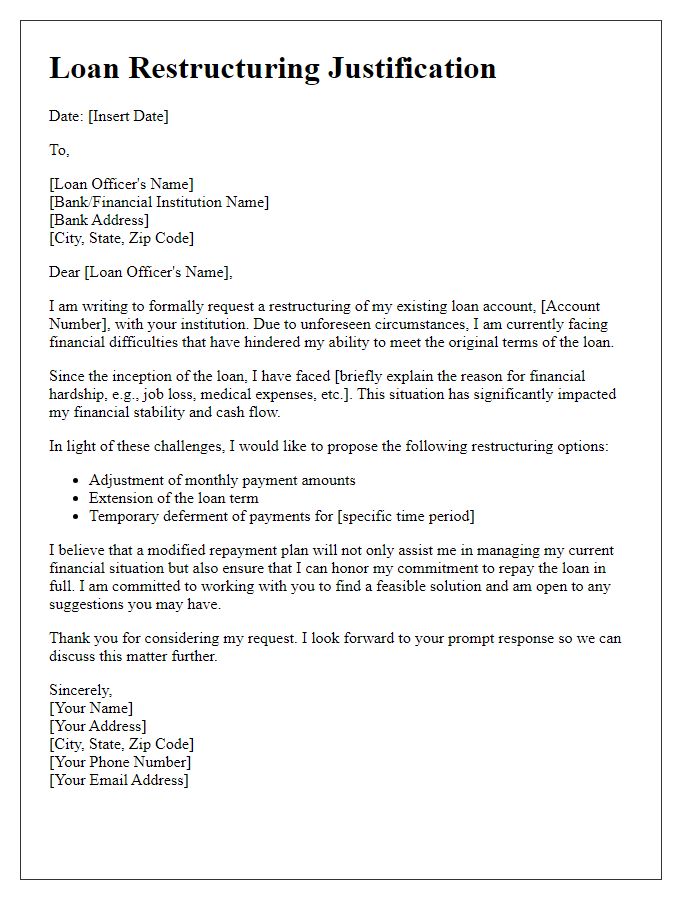

Letter template of loan restructuring application for business stability

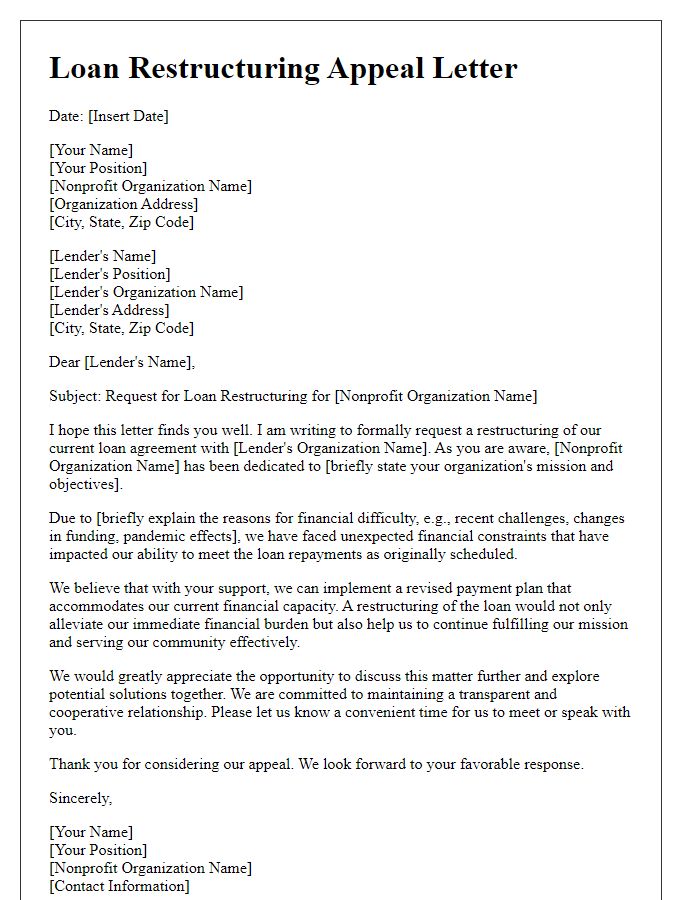

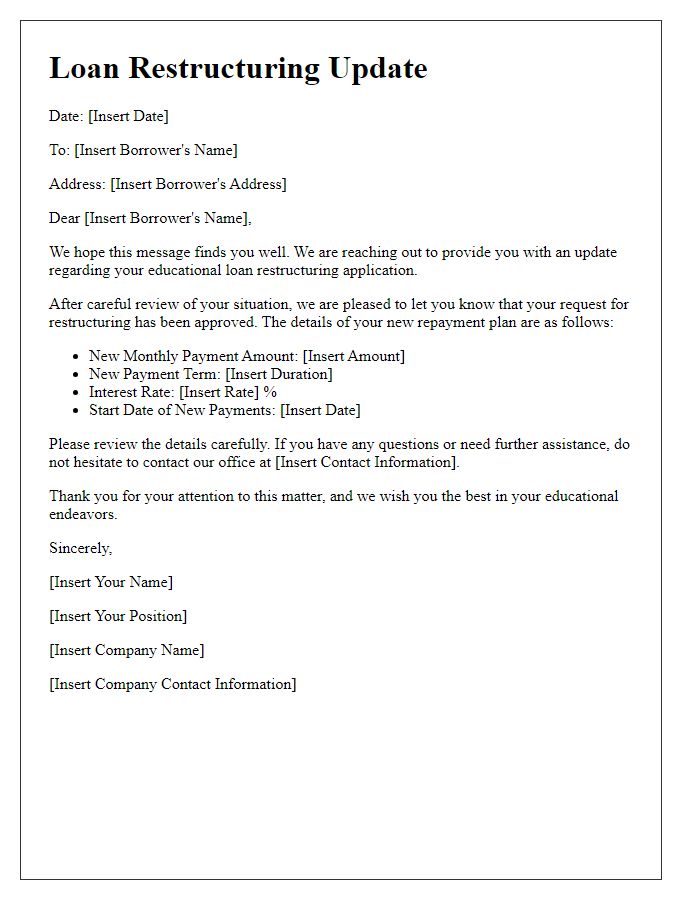

Letter template of loan restructuring appeal for nonprofit organizations

Letter template of loan restructuring recommendation for corporate clients

Letter template of loan restructuring negotiation for agricultural loans

Comments