Are you feeling overwhelmed by multiple loans and high interest rates? If so, you're not alone, and the good news is that there's a way to simplify your financial situation. Loan consolidation may be the solution you need to ease your monthly payments and reduce your overall debt burden. So, if you're curious about how to take the first step towards financial freedom, keep reading to discover more!

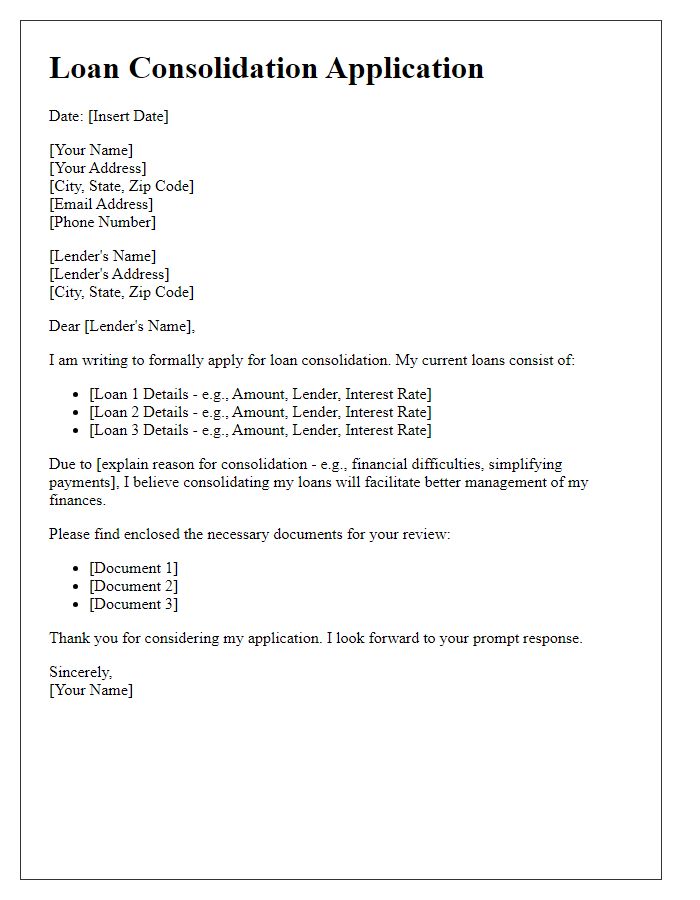

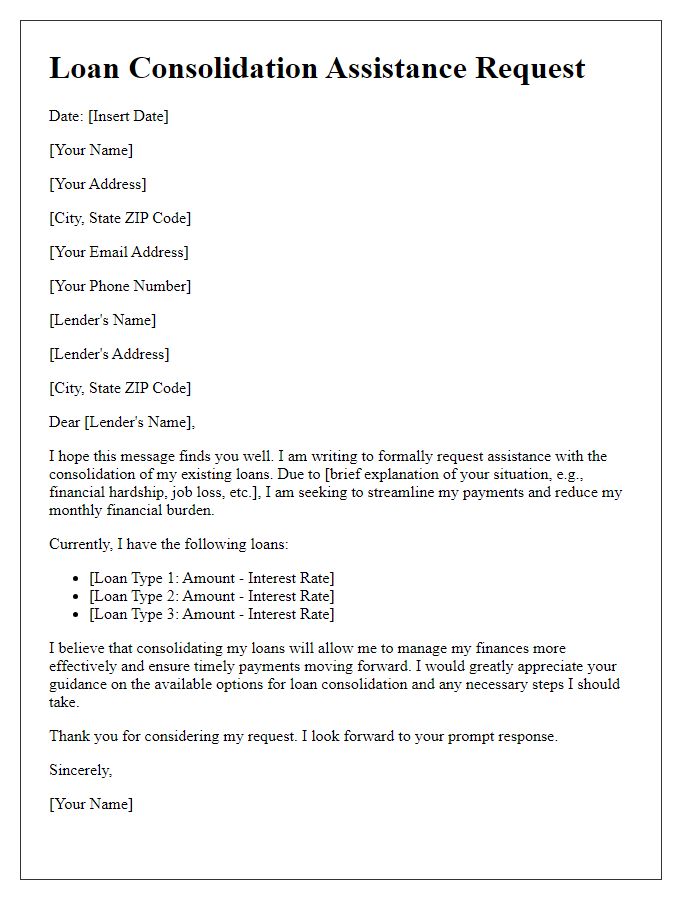

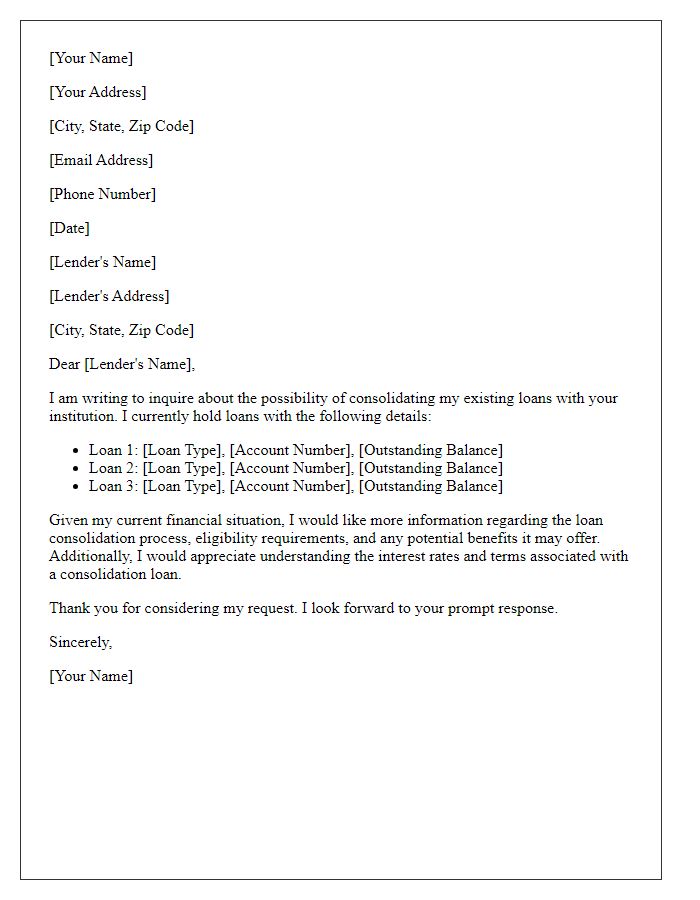

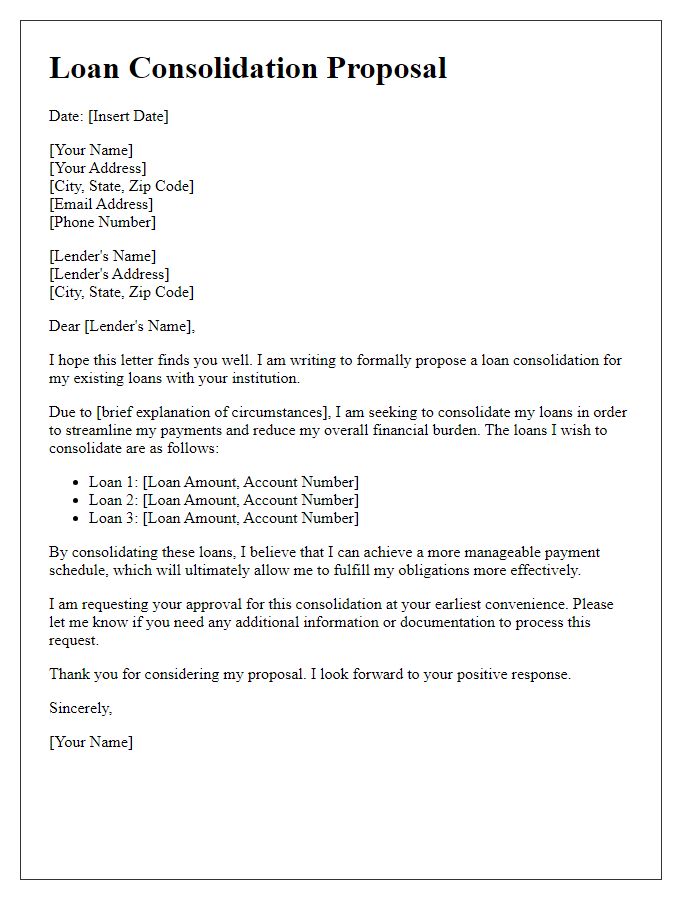

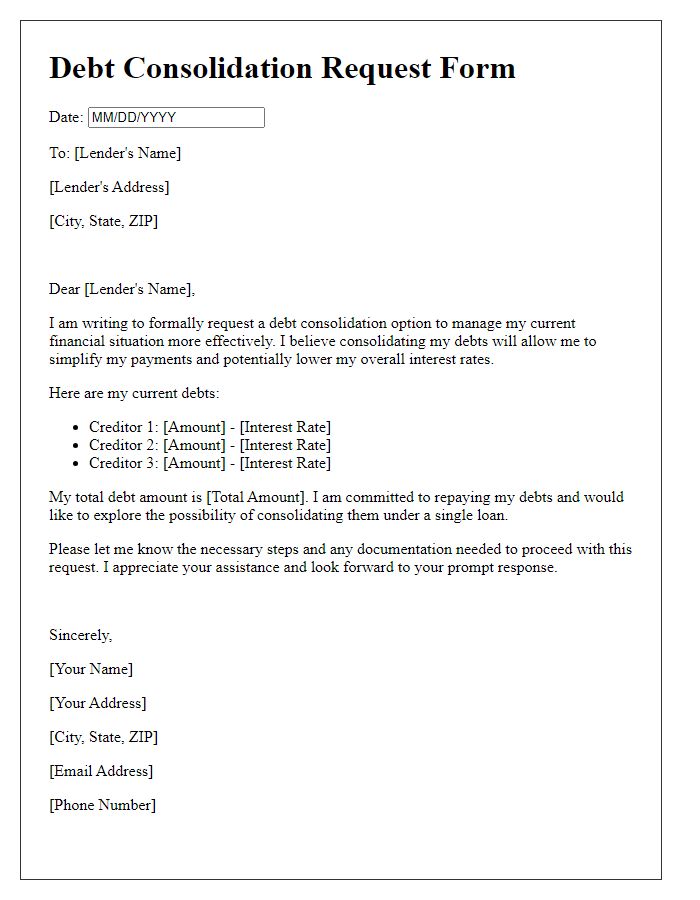

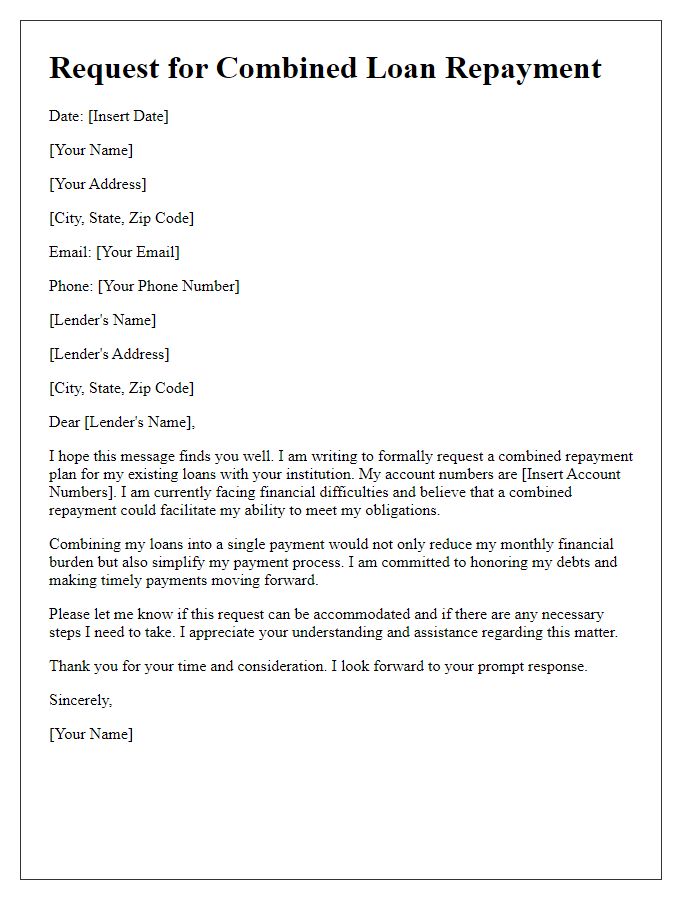

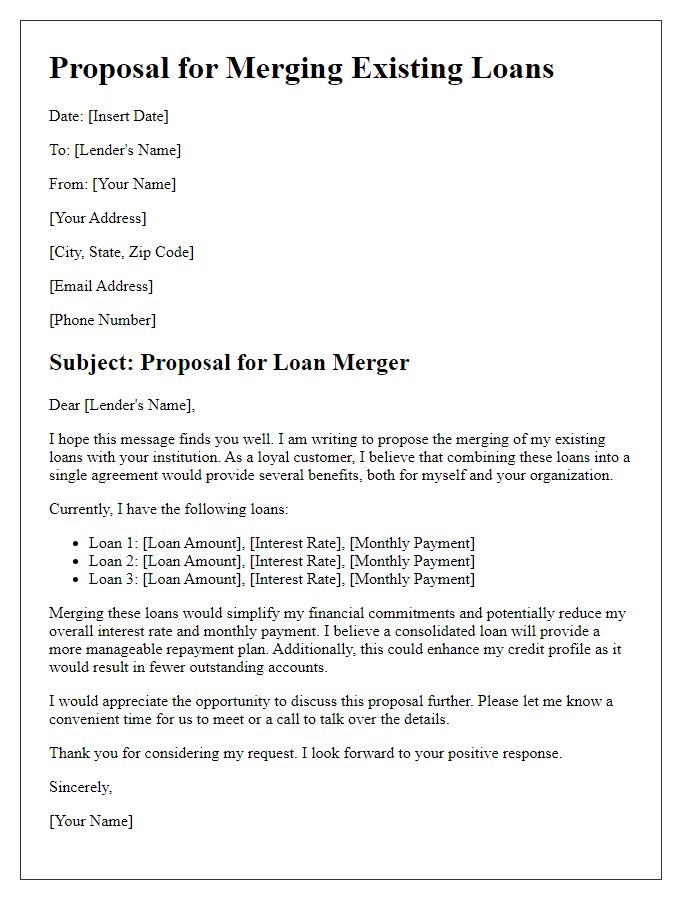

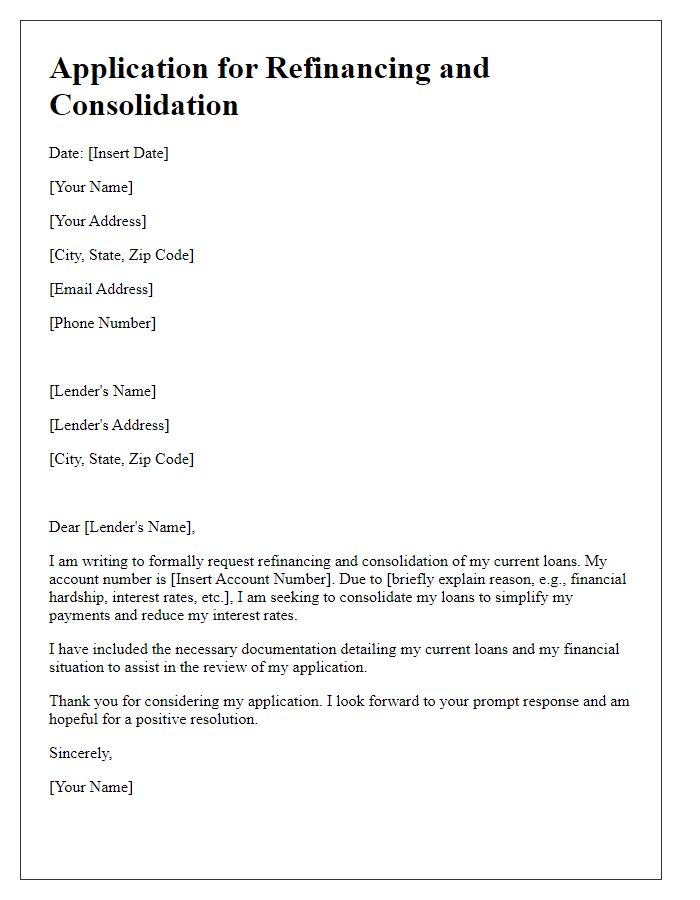

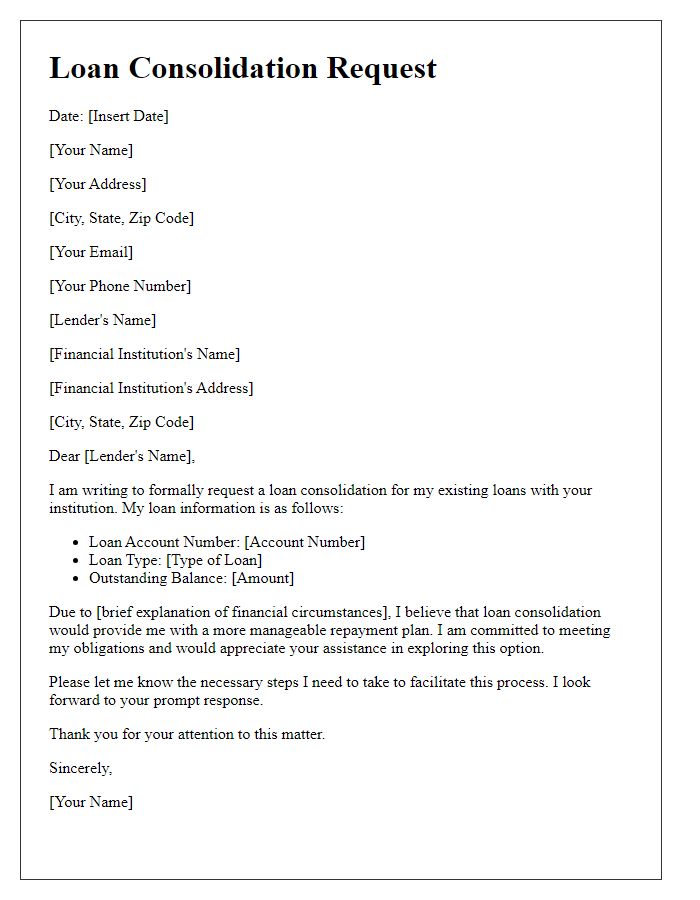

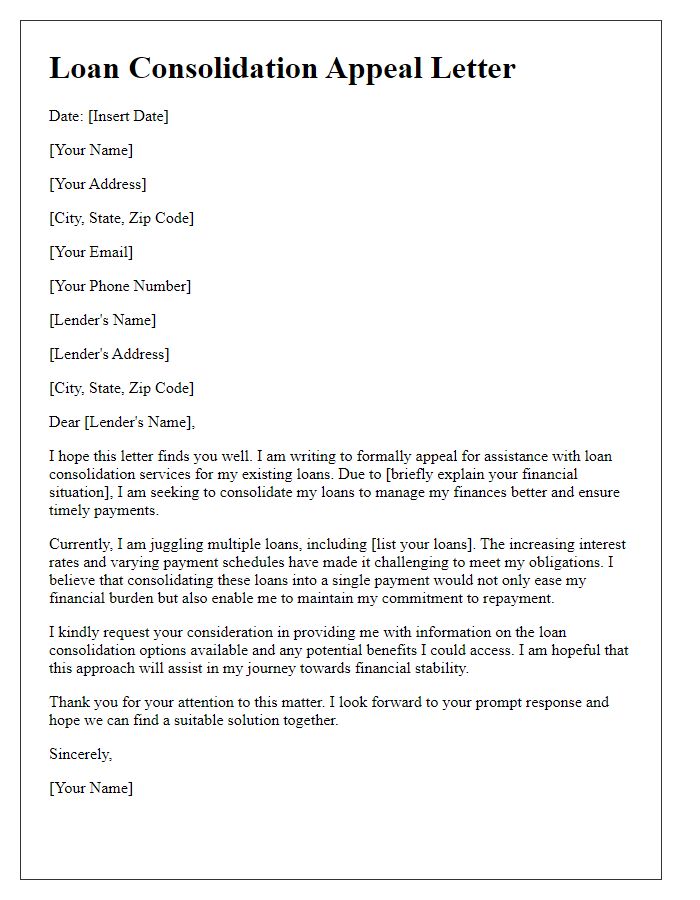

Borrower's Full Name and Contact Information

Consolidating multiple loans into a single, manageable payment can greatly alleviate financial stress. Loan consolidation allows borrowers to combine various debts, such as student loans, credit card balances, and personal loans, into one loan with a potentially lower interest rate. For instance, federal student loan consolidation can streamline monthly payments, often lowering rates to around 4.5% from rates exceeding 7%. Loan servicers like Nelnet or Great Lakes offer guidance throughout the process, emphasizing eligibility criteria such as credit scores, which significantly influence approval rates. Additionally, borrowers should consider the implications on credit scores and loan repayment terms when making consolidation decisions.

Lender's Name and Address

Loan consolidation can simplify multiple debt repayments into a single monthly payment. This financial strategy can significantly reduce interest rates, especially for loans such as personal loans or credit card debts, potentially lowering rates by over 5% in some cases. Implementing loan consolidation can enhance credit scores over time if managed responsibly, while also providing an opportunity for borrowers to extend payment terms up to 10 to 30 years, depending on the lender's policy. Financial institutions may offer specific programs tailored for student loans, mortgages, or auto loans, which can streamline the borrowing process and alleviate financial stress for individuals.

Loan Details and Account Numbers

Loan consolidation, particularly for multiple personal loans, can significantly ease financial management. Consolidating loans, such as student loans or credit card debt, allows borrowers to combine existing debts into a single payment, typically with lower interest rates, reducing the overall financial burden. Essential loan details include account numbers, which uniquely identify each loan, remaining balances, and current interest rates. Institutions like credit unions or private lenders often provide consolidation options, assessing applicants based on creditworthiness, income, and debt-to-income ratio, ensuring loans are manageable while potentially improving credit scores through streamlined payments.

Justification for Consolidation Request

Loan consolidation can streamline numerous outstanding debts, simplifying monthly payments into a singular transaction. For instance, managing multiple student loans from various institutions, such as federal Perkins loans or private Sallie Mae loans, wields the potential for confusion and increased financial strain. Combining these loans into a single consolidation loan can secure a lower interest rate, reducing overall financial burden. Furthermore, the availability of Income-Driven Repayment plans allows borrowers to adjust monthly payments based on earnings, enhancing affordability. Achieving consolidation through credible lenders, such as the Department of Education or private banks, may also improve credit scores by reducing overall credit utilization, promoting financial stability. This strategic move not only enhances efficiency but also empowers individuals to regain control over their financial future.

Borrower's Financial Status and Repayment Plan

A comprehensive loan consolidation request requires an intricate understanding of the borrower's financial situation and a well-structured repayment plan. The borrower's financial status often includes monthly income details, such as an average salary of $3,500, alongside fixed expenses like rent ($1,200), utilities ($300), and other monthly obligations, totaling around $2,500. Including the total debt amount is crucial, such as $25,000 from various loans like student loans and personal credit lines, all with varying interest rates. This sets the stage for a discussion on the proposed consolidation through a trusted financial institution, such as a credit union or bank, which can offer a loan with a lower interest rate of approximately 5%. The repayment plan should detail the duration, typically 5 to 10 years, outlining monthly payments that fit comfortably within the borrower's budget to alleviate any financial stress, ensuring that the total debt is manageable without compromising essential living expenses.

Comments