Are you curious about how long it typically takes to process a loan application? You're not aloneâmany applicants wonder what to expect during this crucial stage. Whether you're seeking a mortgage, a personal loan, or any other financing option, understanding the timelines involved can make all the difference in planning your finances. So, let's dive deeper into the factors that influence loan processing times and what you can do to expedite your applicationâkeep reading to find out more!

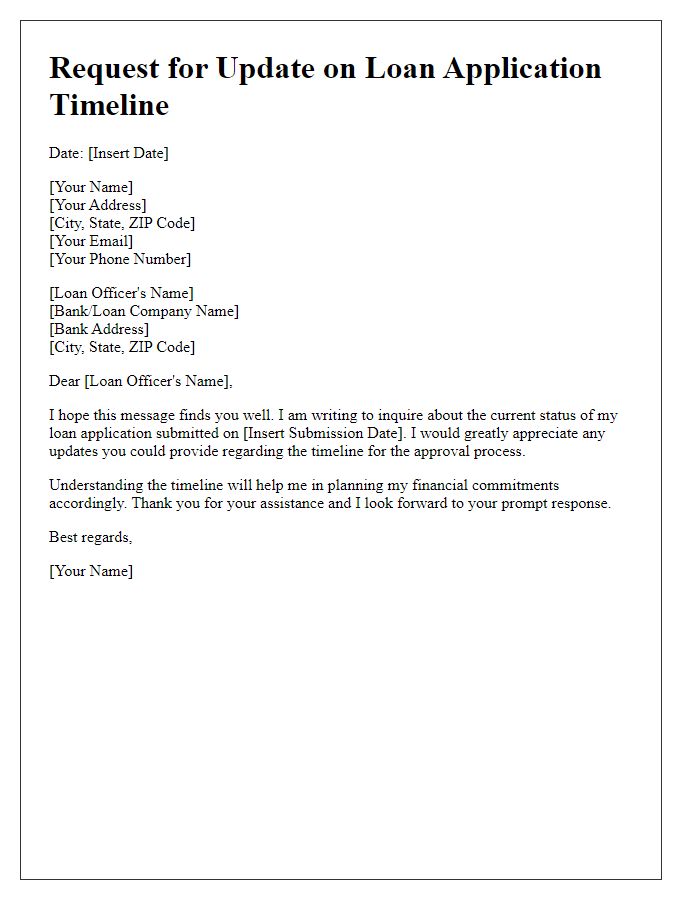

Clear Subject Line

Loan processing time can vary significantly based on several factors including lender policies, application completeness, and documentation requirements. For instance, typical processing times range from a few days to several weeks, depending on the loan type, such as personal loans, mortgages, or auto loans. Institutions such as banks or credit unions may prioritize faster processing times for pre-approved loans, completing steps like credit checks and income verification promptly. Market conditions, such as peak lending periods or economic downturns, can also influence processing times, impacting how quickly funds are disbursed. Borrowers are encouraged to maintain open communication with their lenders to receive updates during the process.

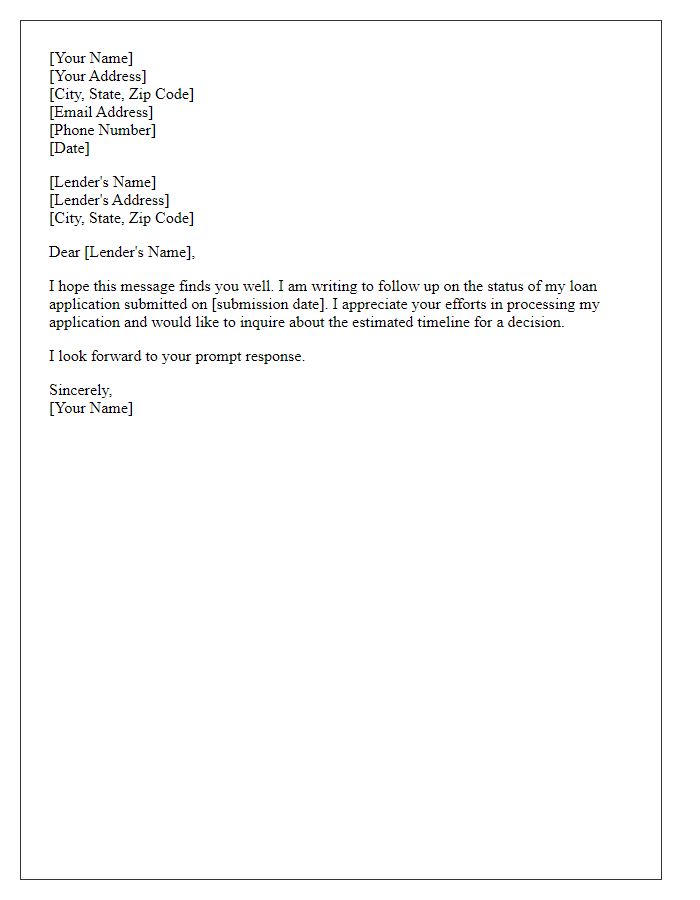

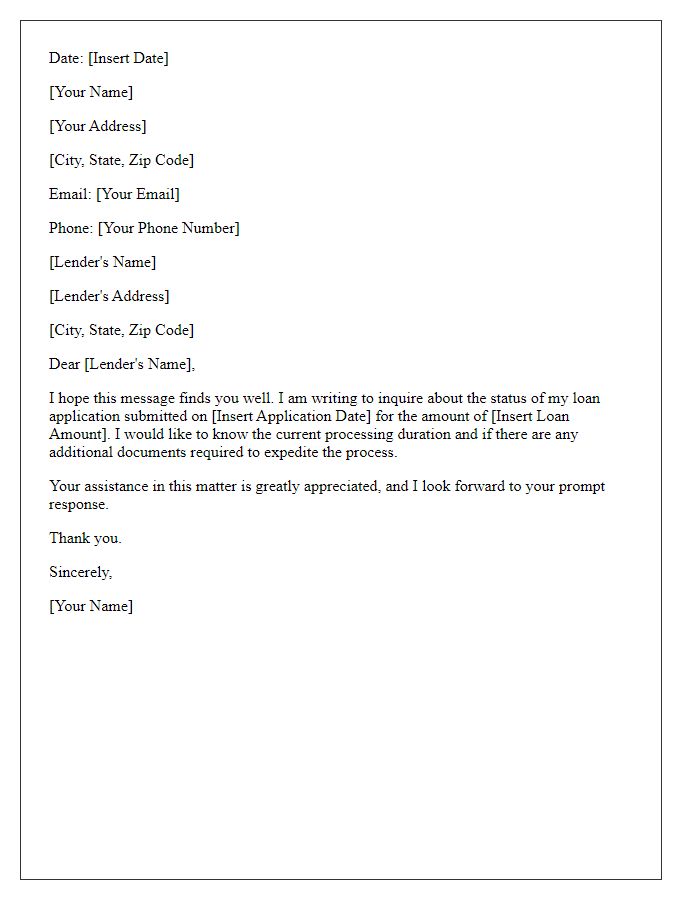

Applicant Information

Loan processing times can significantly vary across financial institutions, often influenced by factors such as application volume and documentation completeness. For instance, major banks like JPMorgan Chase or Bank of America typically process personal loans within 1 to 14 business days, depending on their workload. In contrast, online lenders like SoFi or LendingClub may expedite the process, sometimes offering approvals within minutes but still requiring additional time for fund disbursement. Essential applicant information should include personal identification such as a Social Security number, income verification through pay stubs or tax returns, and credit history documentation, which collectively impact overall processing speed and approval likelihood. Regular communication with the lender can provide updates and potentially mitigate delays during the processing phase.

Specific Loan Details

Loan processing time for personal loans can vary significantly. Standard processing typically ranges from 3 to 10 business days, depending on the lender's policies and the specific type of loan, such as secured or unsecured personal loans. Lenders like Wells Fargo and Bank of America may expedite approvals for existing customers with streamlined processes. Important factors influencing processing time include required documentation, credit checks, and any need for additional information from borrowers. Furthermore, external events, such as economic downturns or regulatory changes, can impact processing times as lenders reassess risk and funding capacities. Always verify with the lender for the most accurate and current timelines.

Inquiry about Processing Time

Loan processing times vary significantly based on the type of loan applied for, the lender's internal procedures, and specific borrower circumstances. Traditional mortgage loans often take anywhere from 30 to 60 days to process, as they require extensive documentation and appraisal of the property being financed, often located in vibrant real estate markets like Los Angeles. Personal loans can be processed more quickly, sometimes within 24 to 48 hours, especially with online lenders. Factors influencing processing times include the completeness of submitted documentation, the complexity of the borrower's financial situation, and the effectiveness of communication between the borrower and the lender. Additionally, external influences, such as fluctuating interest rates or sudden changes in the economic climate, can impact the processing timeline.

Contact Information

Loan processing times can significantly vary based on financial institutions and specific loan types. For example, conventional mortgage loans often take 30 to 45 days for processing, while personal loans can be approved in as little as one day to one week. Factors influencing these timelines include document verification processes, credit score assessments, and the volume of applications being handled by the lender. Additionally, institutions such as Bank of America, Wells Fargo, or Chase might have different operational efficiencies and resources, thereby affecting the duration of loan processing. Understanding these variables aids borrowers in making informed decisions about their financial needs.

Comments