Are you considering a secured home loan but don't know where to start? It's a smart move to explore your options, as these loans can unlock incredible opportunities for homeownership while providing favorable interest rates. In this article, we'll break down everything you need to know about secured home loans, from the application process to the key benefits they offer. So, grab a cup of coffee and join us as we delve deeper into securing your dream home!

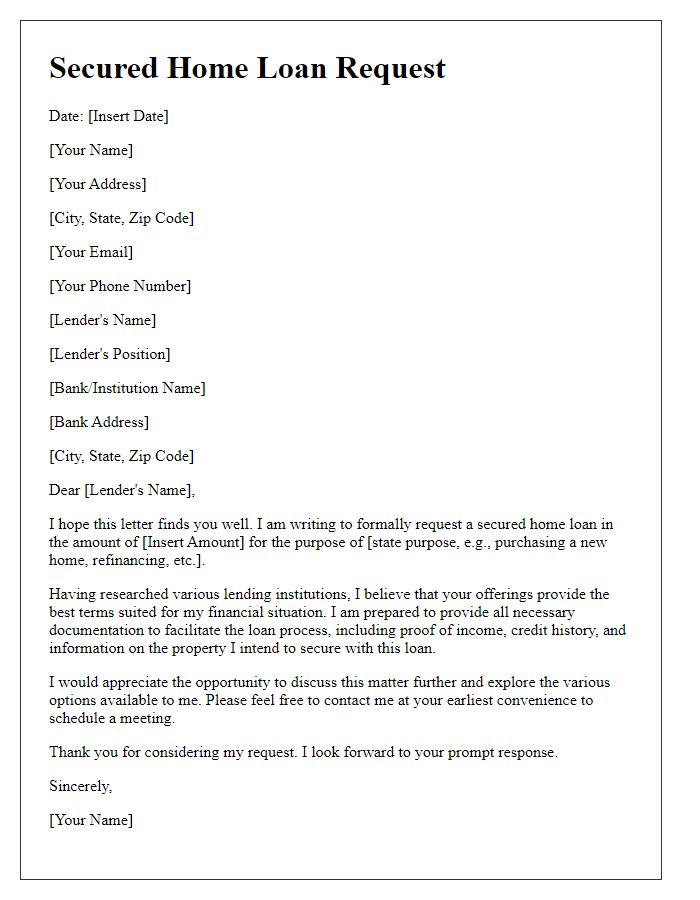

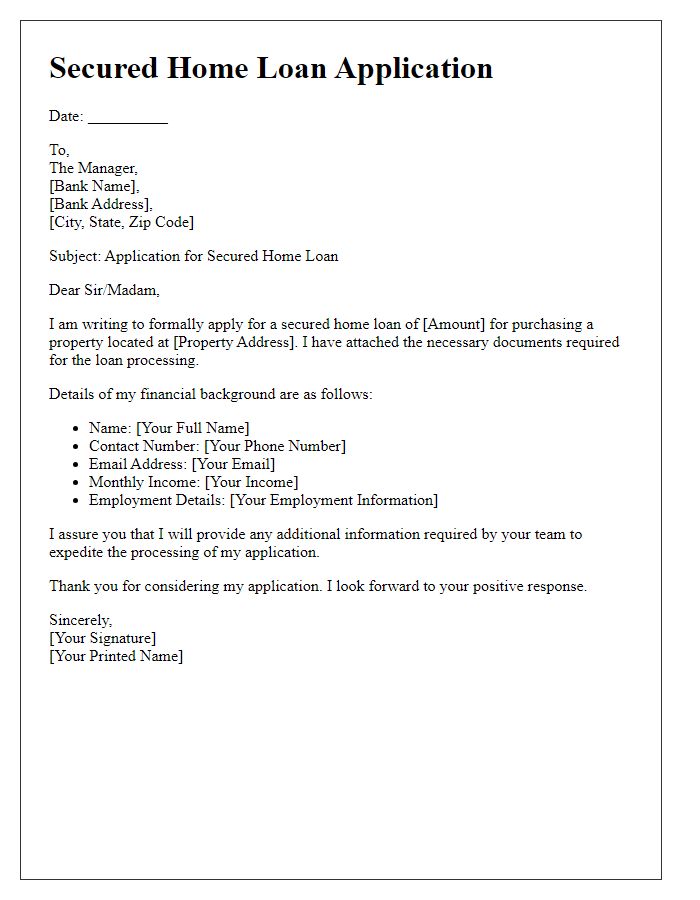

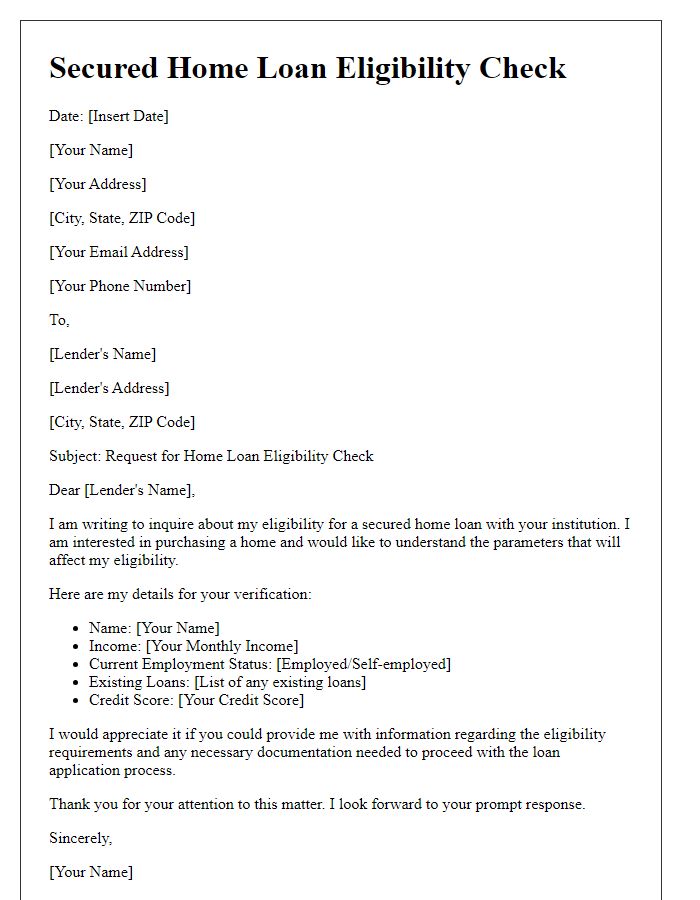

Personal Information

Secured home loans, commonly referred to as mortgage loans, require applicants to provide comprehensive personal information to assess eligibility and risk. Personal details include full name, date of birth, and social security number, crucial for identity verification and credit assessment. Address history, usually covering the past five years, helps establish stability and residency. Employment information, such as employer name, position, and annual income, is essential to evaluate repayment capacity. Additionally, financial statements detailing assets, liabilities, and existing debts provide insights into financial health. Documentation may also include proof of income, such as pay stubs or tax returns, and property details for the intended purchase. Understanding local regulations and requirements, such as those set by Fannie Mae, can influence the inquiry process, ensuring all information meets underwriting standards.

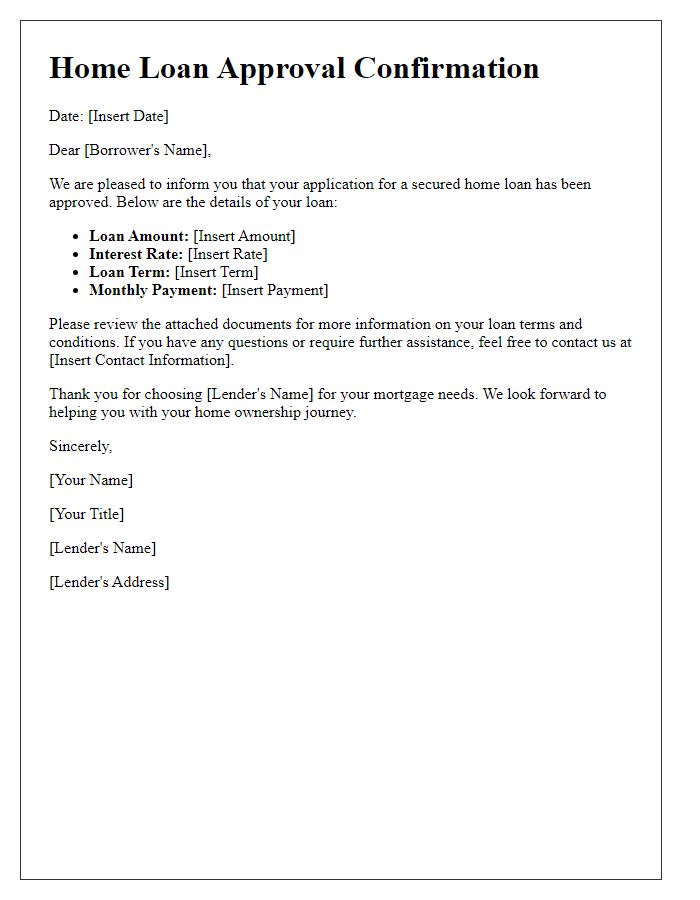

Loan Amount and Purpose

A secured home loan inquiry includes key factors such as the desired loan amount and its intended purpose. The typical loan amount for a secured home loan may range from $50,000 to over $1,000,000, depending on factors including property value and borrower qualifications. The purpose often encompasses buying a new home, refinancing an existing mortgage, or funding major renovations that can increase property value. Specific details about the property location, such as neighborhood demographics or local market trends, can significantly influence loan options and approval rates. Additionally, essential documentation may include proof of income, credit history, and current property assessments to facilitate the loan process effectively.

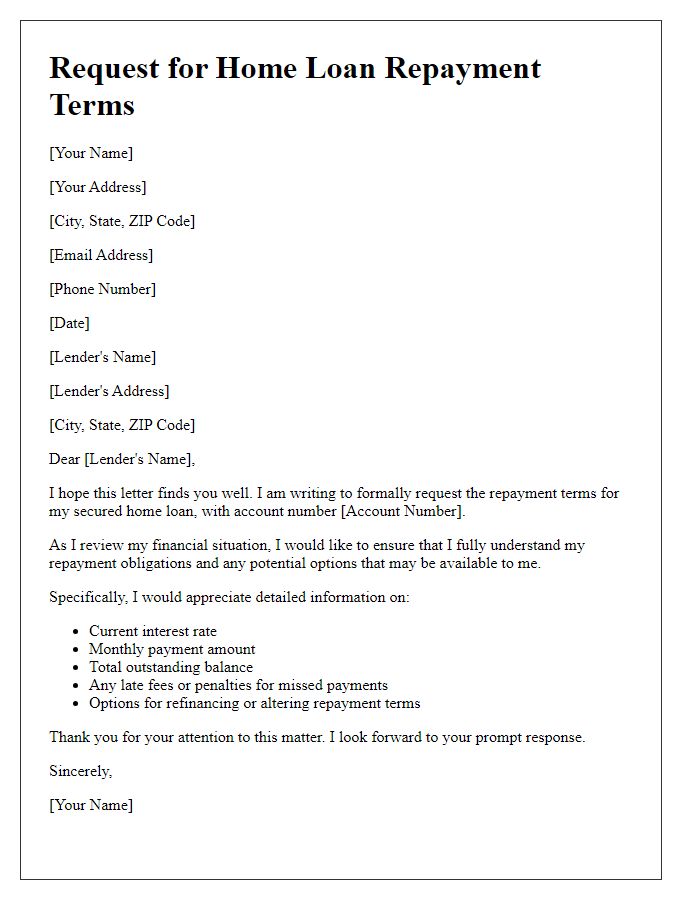

Income and Financial Details

A secured home loan inquiry requires comprehensive income and financial details to assess eligibility and repayment capability. Applicants should include annual income figures, which may encompass salaries, bonuses, or additional revenue sources such as rental income from real estate properties in established markets like New York City or Los Angeles. Debt-to-income ratio, calculated by comparing monthly debt payments to gross monthly income, is crucial in determining financial health. Essential documentation includes recent pay stubs, tax returns from the past two years, and bank statements highlighting savings and checking account balances. A stable employment history should be underscored, ideally with at least two years in the same occupation or sector. Credit scores, obtained from agencies like Experian or TransUnion, should be included to provide lenders with insight into creditworthiness. All these components significantly influence the loan decision process and potential interest rates offered by financial institutions.

Property Information

Secured home loans generally require detailed property information to assess the loan's viability. Essential details include the property's location, often specified by the street address, city, and ZIP code which contributes to determining property value. Property type, such as single-family home, condominium, or multi-family dwelling, informs lenders about the specific characteristics associated with different housing styles. Property size measured in square footage indicates the total living space which can influence home value. Recent sale price, typically derived from local real estate market conditions, aids in evaluating current worth. Age of the property, noting renovations or updates, also plays a vital role in determining the overall condition and potential appraisal value. Additionally, any outstanding liens or existing mortgages on the property are crucial in evaluating financial risk before approving a secured home loan.

Contact Information

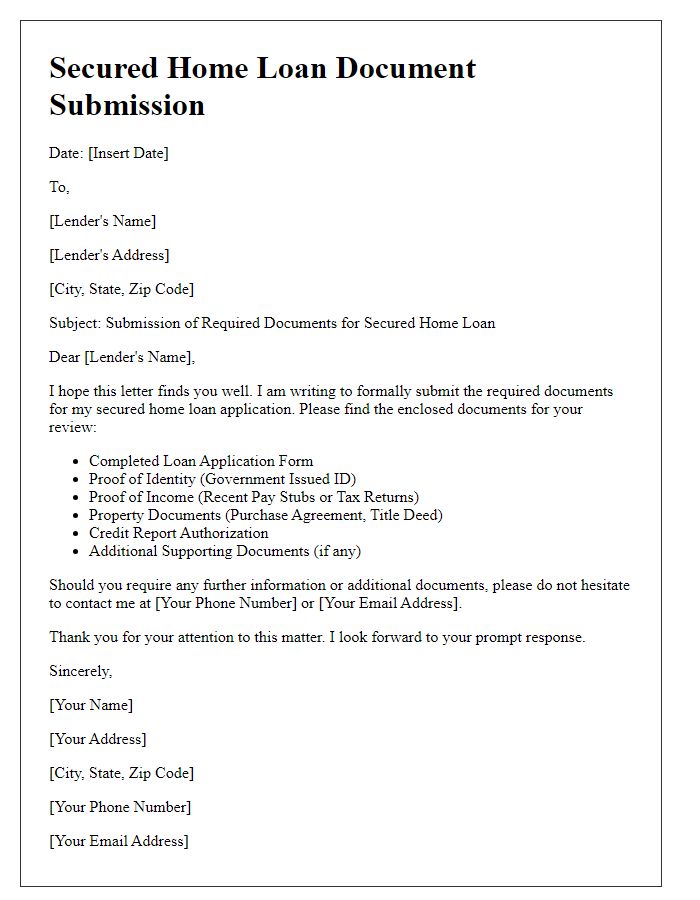

Secured home loans, designed for home purchase or refinancing, often require detailed contact information from prospective borrowers. Essential details include full name, current address, and phone number to facilitate communication. Email addresses enable efficient correspondence for document requests and loan updates. Additional information such as employment status, annual income, and credit score helps lenders assess eligibility and risk. Providing complete contact information streamlines the process, allowing lenders to promptly address inquiries and expedite the loan approval process. Accurate data ensures effective follow-up and enhances the overall borrowing experience.

Comments