When it comes to securing a loan, understanding the importance of proper documentation is crucial. We've all been there, navigating the maze of paperwork, and it can feel overwhelming at times. But fear not! In this article, we'll break down the essential aspects of loan documentation verification to simplify the process. So, grab a cup of coffee and join us as we explore everything you need to know to get your loan approved smoothly!

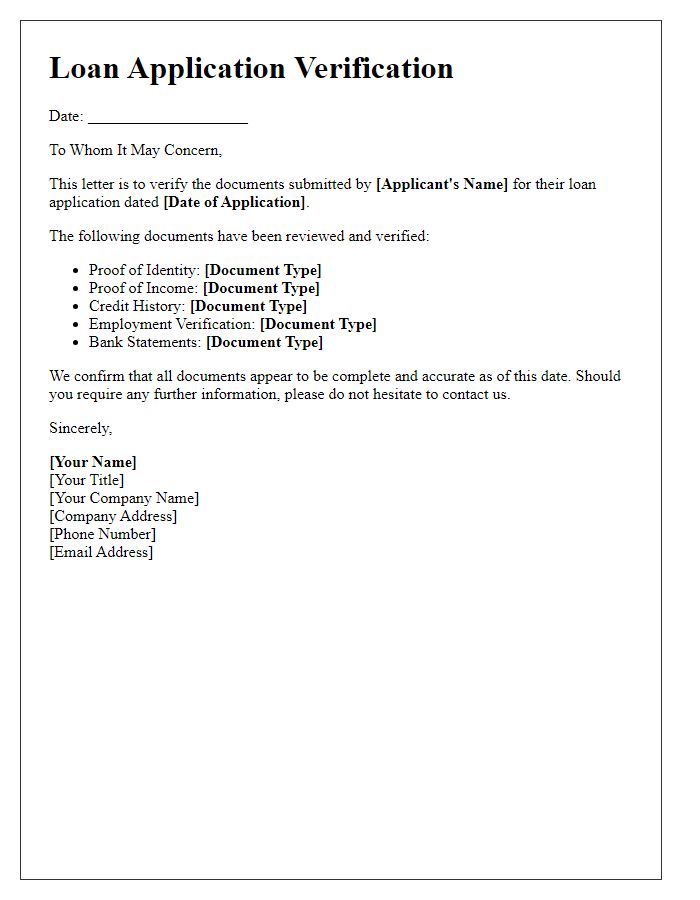

Accurate identification details

Accurate identification details are crucial for loan documentation verification, ensuring security and authenticity during the lending process. Key elements include the applicant's full legal name, as stated on government-issued identification, such as driver's licenses or passports. Social Security Numbers (SSNs) must be provided, adhering to privacy laws and regulations. Additionally, permanent addresses, including city, state, and zip codes, should be verified against utility bills or bank statements dated within the last two months. Employment details, including employer names and addresses, alongside recent pay stubs or tax documents, can substantiate income claims. Verification of these identification details helps prevent fraud and safeguards against potential risks in the lending landscape.

Clear loan terms and conditions

Loan documentation verification is essential for ensuring clear understanding of terms and conditions associated with financial agreements. Key elements include interest rate (typically a percentage like 3.5% per annum), loan amount (such as $50,000), repayment period (usually spanning 5 to 30 years), and any associated fees (for example, origination fees reaching up to 1% of the loan amount). Clarity on prepayment penalties and late payment charges (commonly $25-$50) is crucial to avoid unexpected expenses. Essential dates like loan disbursement and first payment due also hold significance within the documentation. Accurate verification of these components can safeguard against potential disputes and foster a transparent borrowing experience.

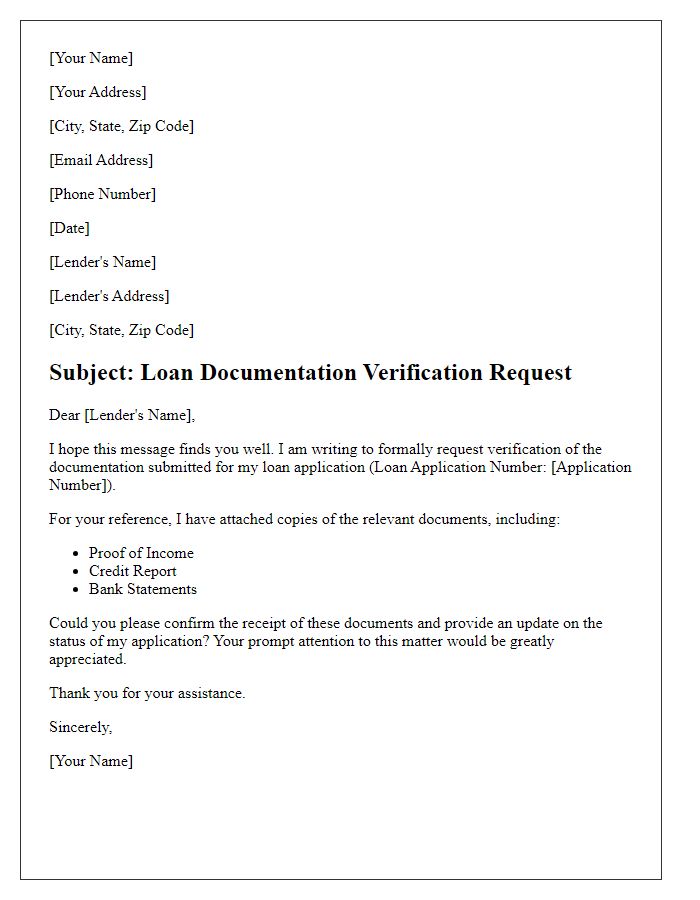

Contact information for verification

Loan documentation verification requires precise contact information for efficient communication. Applicants must provide their primary phone number, ideally a mobile line, ensuring direct reachability during verification. Secondary contact options, such as an email address, streamline correspondence, allowing for the sending of necessary documents. Additionally, a physical address, reflecting current residence, is vital for identity confirmation and compliance with lending regulations. Verification might involve contacting references or previous lenders, thus including details of additional contacts may enhance the verification process. Accurate and complete information accelerates approval timelines, contributing to a seamless experience for applicants seeking financial support.

Reference to relevant documents

Loan documentation verification involves meticulous examination of specific files and records necessary for loan approval. Key documents include the loan application form (which outlines borrower details), credit report (providing credit scores and history), income verification (such as pay stubs or tax returns), and asset documentation (bank statements or investment portfolios). Each document serves a critical role in evaluating the borrower's financial stability and repayment capacity. The verification process ensures that all provided information matches with official records, establishing credibility and reducing the risk of default. Financial institutions adhere to strict regulations, confirming compliance with laws such as the Truth in Lending Act (TILA) and the Secure and Fair Enforcement for Mortgage Licensing Act (SAFE).

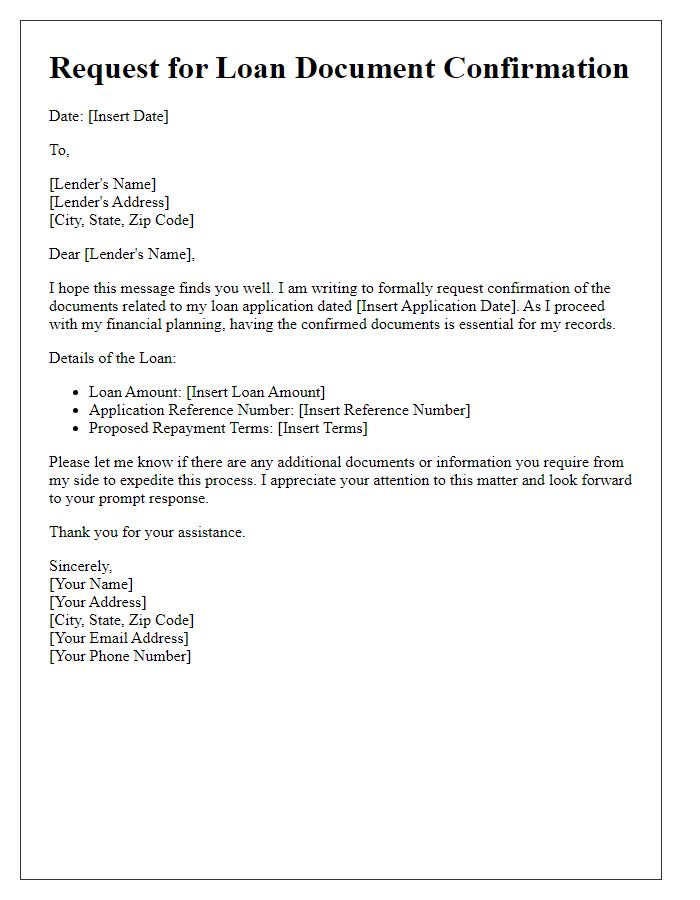

Signature and authorization

Loan documentation verification requires a signature and authorization to ensure the processing of requests. Each borrower must provide a physical signature to approve the verification process, confirming the accuracy of their financial information, such as income statements and credit history. This authorization is typically located on the last page of the loan application form, outlining the rights for data collection and sharing with financial institutions, including FICO scores. Accurate signature alignment on this document, especially under applicable state laws, is critical for legal validation of the loan agreement and ensures compliance with regulations such as the Truth in Lending Act (TILA).

Comments