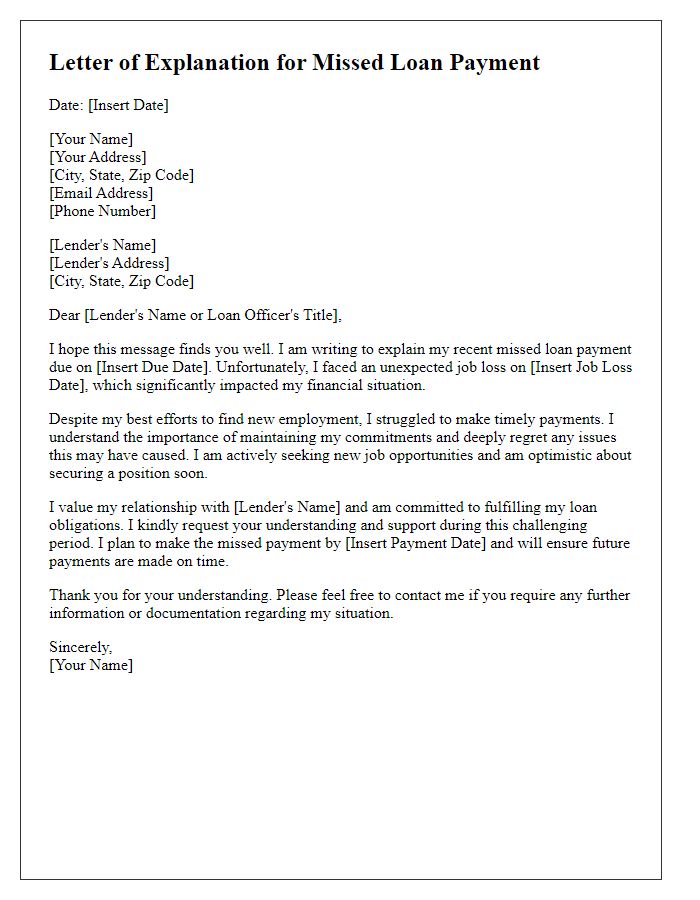

If you've ever found yourself stressed about a missed loan payment, you're definitely not alone. Life can sometimes throw unexpected challenges our way, making it difficult to stay on top of financial commitments. But don't worry, explaining your situation in a thoughtful letter can go a long way in addressing any concerns with your lender. Ready to learn how to craft the perfect letter? Let's dive in!

Loan Account Information

A missed loan payment can significantly impact a borrower's financial stability and credit score, often resulting in late fees and increased interest rates. For instance, individuals with personal loans from banks like JPMorgan Chase may face penalties if payments exceed 30 days past due, leading to a potential rate increase from around 9% to 14%. Credit reporting agencies, including Experian, note that late payments can remain on a credit report for up to seven years, affecting future borrowing opportunities. Additionally, understanding the terms outlined in the loan agreement, such as grace periods typically lasting 15 days, is crucial for effective financial management. Prompt communication with the lender, including providing detailed explanations for missed payments, can help mitigate negative consequences and negotiate potential repayment options.

Reason for Missed Payment

A missed loan payment can stem from various financial difficulties, such as unexpected medical bills (average costs exceeding $1,500 for uninsured patients) or loss of employment (unemployment rate fluctuating around 4.2% in 2023). These events can create significant cash flow issues. For instance, a sudden medical emergency, like an unplanned surgery, can lead to substantial short-term expenses, disrupting the ability to make scheduled loan payments. Additionally, timing issues, such as delayed salary deposits or unforeseen expenses like vehicle repairs (costing upwards of $500), can further exacerbate financial strain. Understanding these circumstances can provide context for the missed payment and highlight the need for communication with the lender regarding potential solutions or adjustments.

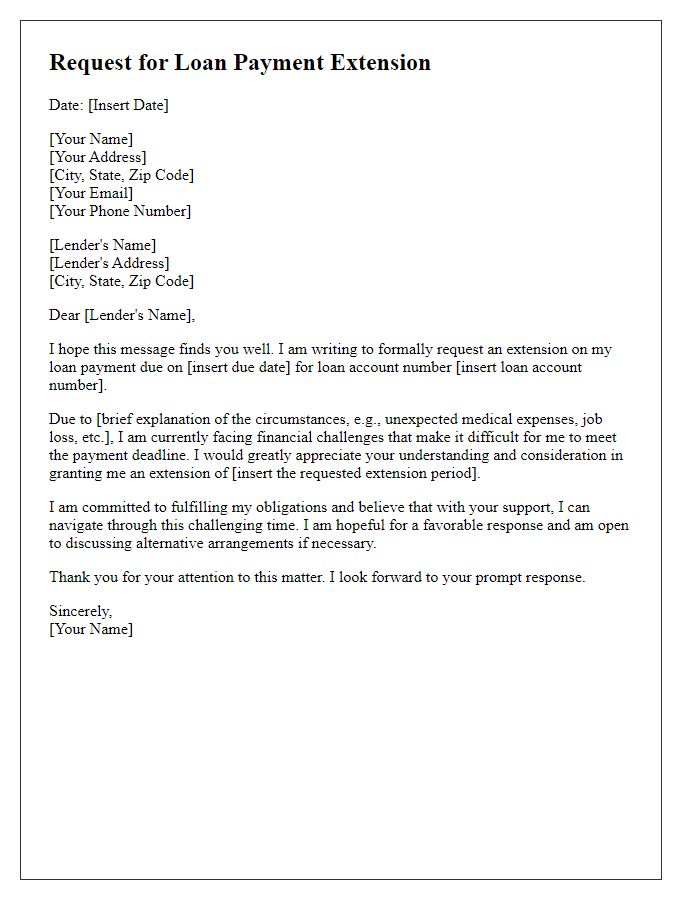

Plan for Repayment

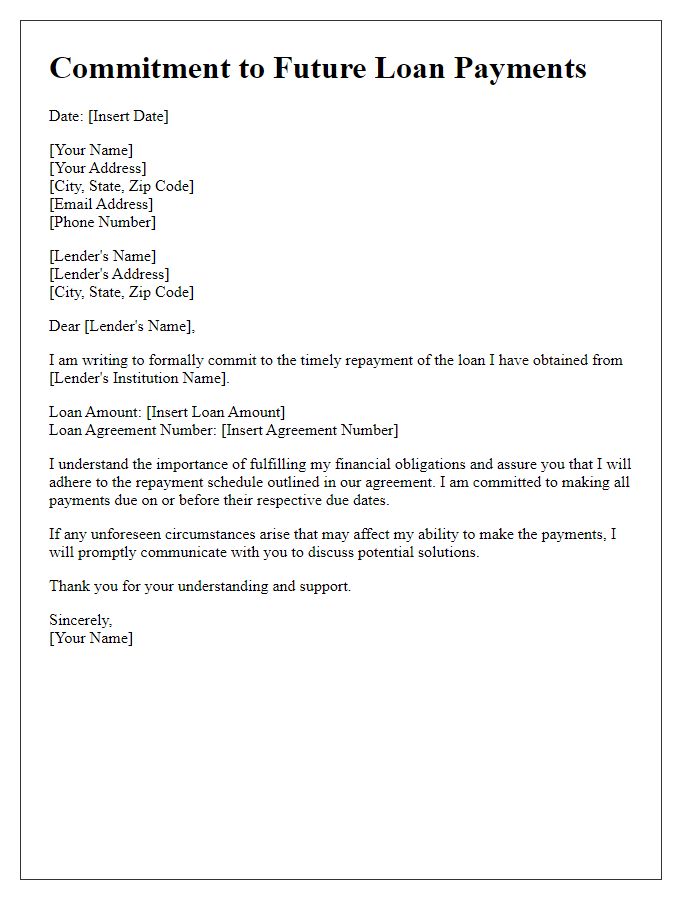

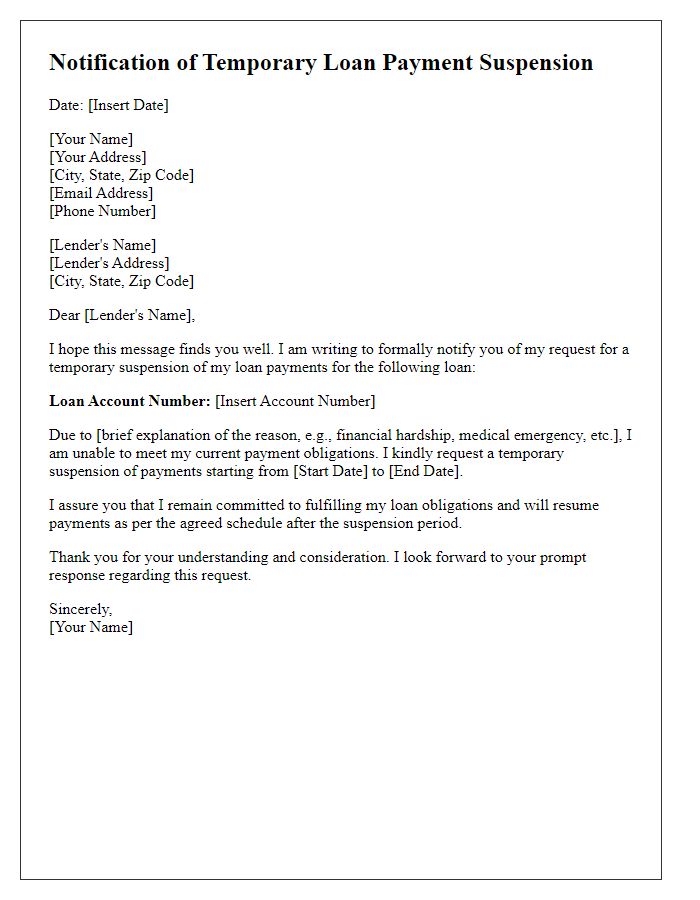

Missed loan payments can negatively impact credit scores, often resulting in penalties and increased interest rates. Communicating with the lending institution is crucial for discussing any unforeseen financial difficulties, such as job loss or unexpected medical expenses. A clear plan for repayment should include specific dates, amounts, and potential adjustments to the loan agreement. For example, offering to pay a higher amount in upcoming months or requesting a temporary deferment can demonstrate commitment to resolving the debt issue. Documenting all correspondence with the lender, including dates and names of representatives, ensures transparency during the repayment process. Timely & proactive communication is vital to restore financial standing and maintain a positive relationship with the lender.

Assurance for Future Payments

Missed loan payments can occur due to unforeseen circumstances, such as medical emergencies or job loss, affecting financial stability. Timely communication with the lender, like a bank or credit union, is essential to explain the situation. Providing specific details, like the exact date of the missed payment and the loan amount, can enhance understanding. Assuring the lender of future payments demonstrates commitment to fulfilling obligations. Offering a revised payment plan or confirming the next payment date can foster goodwill. Lenders may appreciate honesty and increased communication, leading to potential leniency on fees or penalties. Developing a strong rapport with the lender improves chances of receiving support during difficult financial times.

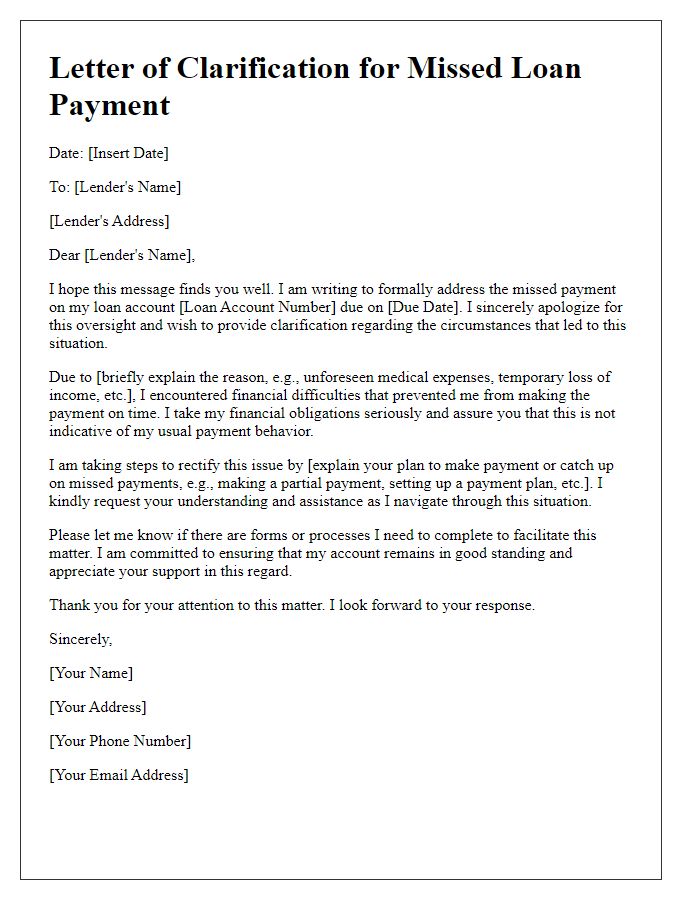

Contact Information and Request for Confirmation

Missed loan payments can lead to significant financial repercussions, affecting credit scores and lender relationships. The communication regarding missed payments should include vital information such as the loan account number, which typically consists of 10 to 15 digits, and the specific payment due date, often correlating to a set day each month. It's important to mention any unforeseen circumstances, such as a job loss or medical emergency, that may have contributed to the delay. Additionally, requesting confirmation of the loan status, possibly via email or certified mail, ensures there is official documentation of the situation, aiding in future correspondence and resolution. Acknowledging the lender's policies regarding late fees or payment arrangements would also demonstrate an understanding of the financial implications involved.

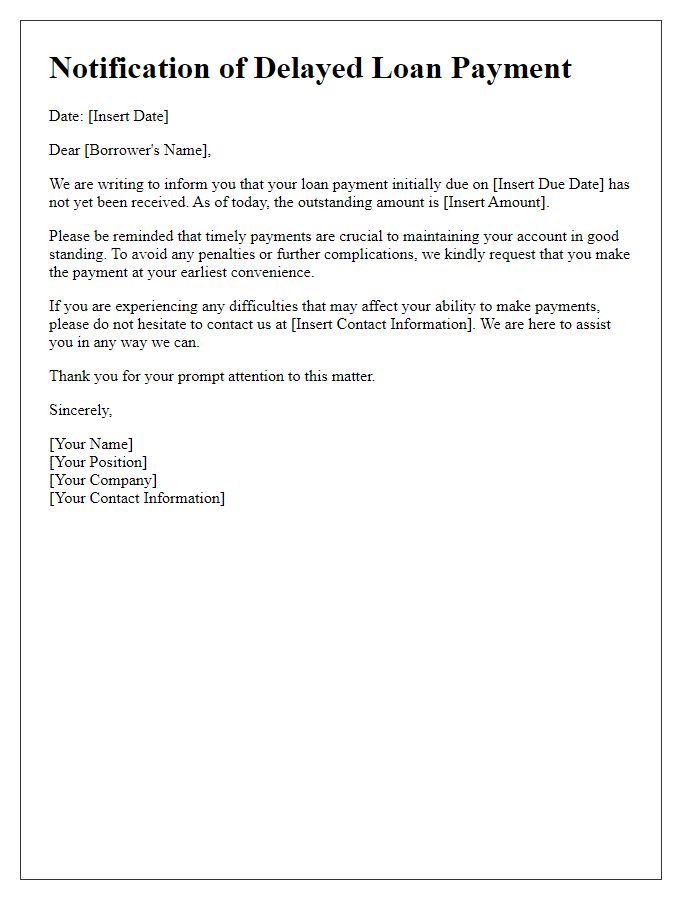

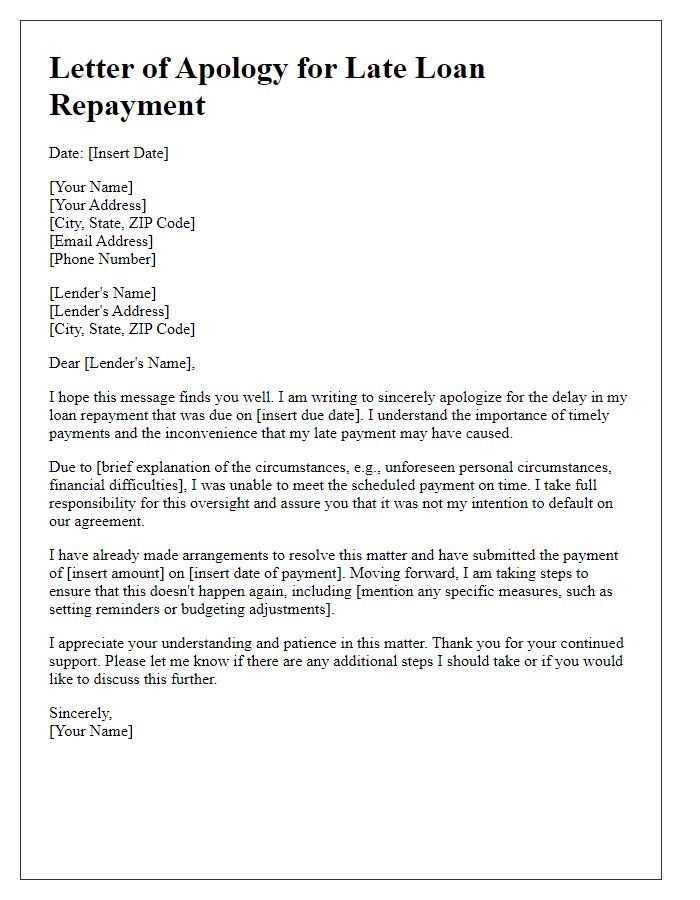

Letter Template For Missed Loan Payment Explanation Samples

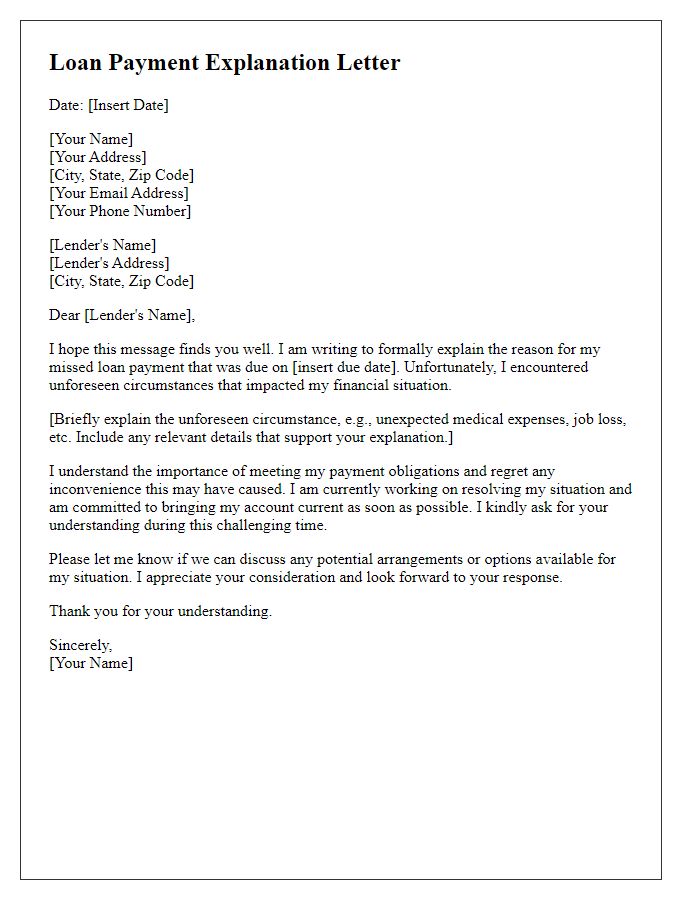

Letter template of explanation for missed loan payment due to unforeseen circumstances

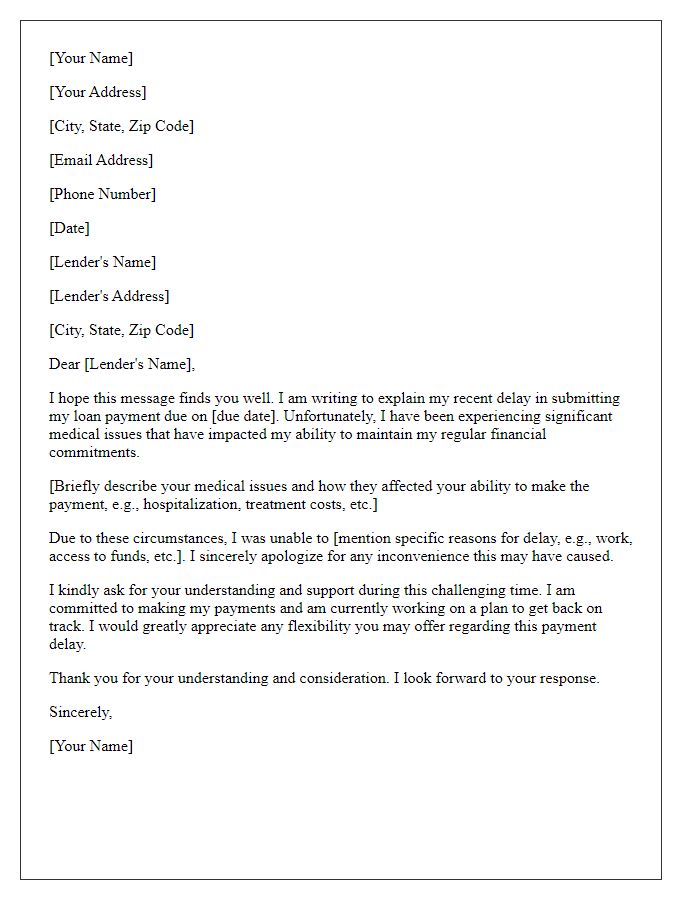

Letter template of explanation for loan payment delay due to medical issues

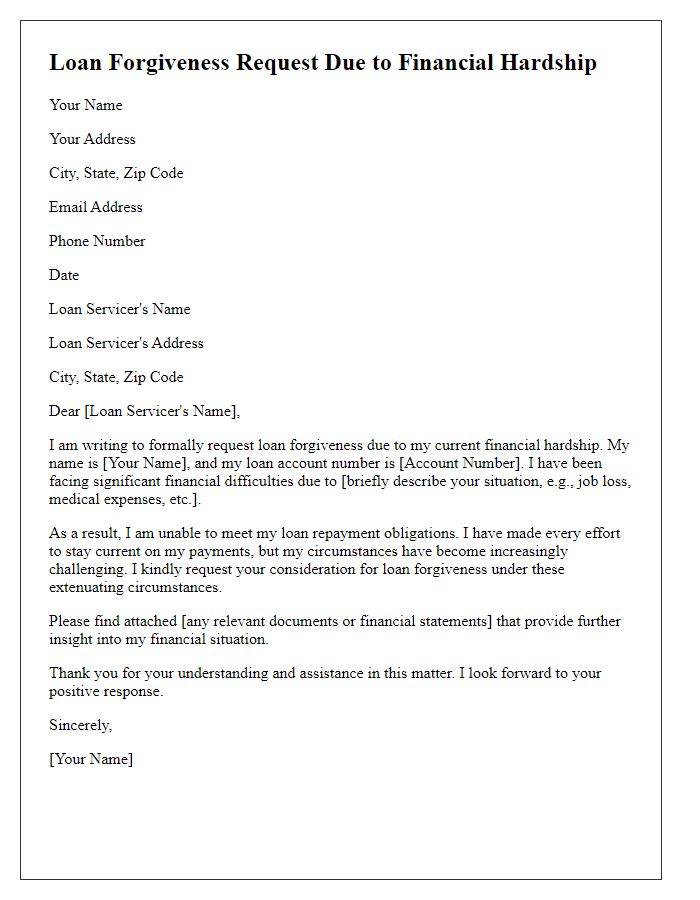

Letter template of request for loan forgiveness due to financial hardship

Comments