Are you looking to take charge of your finances by paying off a loan? Writing a loan payoff request letter can be a straightforward way to communicate your intentions with your lender while ensuring that all necessary details are covered. In this article, we'll walk you through the essential components of an effective loan payoff request, so you can feel confident in your approach. Ready to streamline your loan payoff process? Let's dive in!

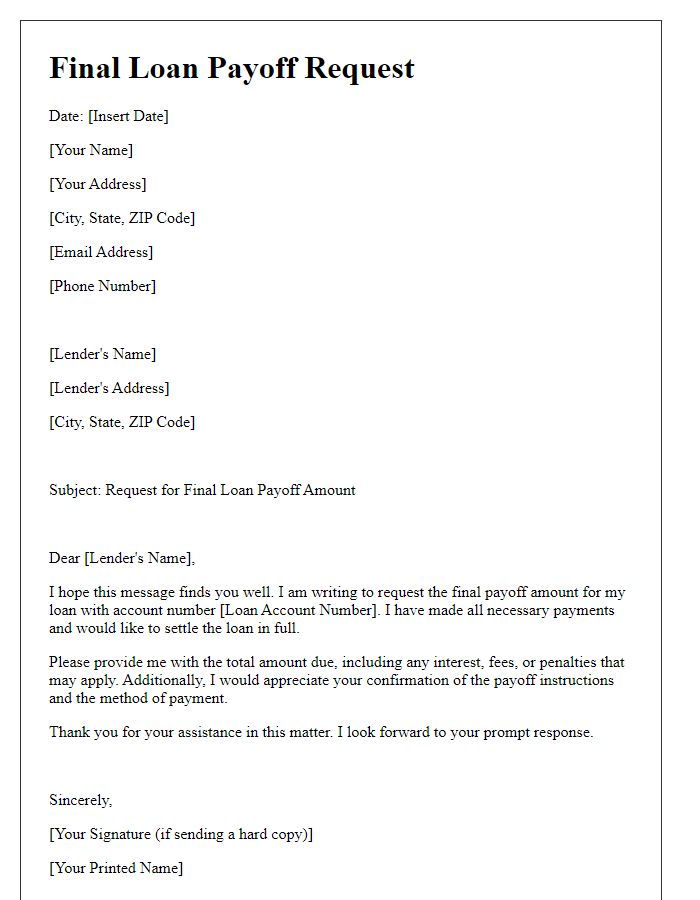

Account Information

Loan payoff requests typically require precise account information. The account number serves as the unique identifier for the loan, ensuring accurate identification of the borrower. The full name of the borrower is crucial for confirming identity and matching it with official records. The type of loan (e.g., auto loan, mortgage, personal loan) clarifies the specific financial agreement being referenced. Additionally, including the current balance can provide an accurate snapshot of the remaining amount owed. Contact details, such as phone number and email address, offer a way for the lender to communicate any important information or updates regarding the payoff process.

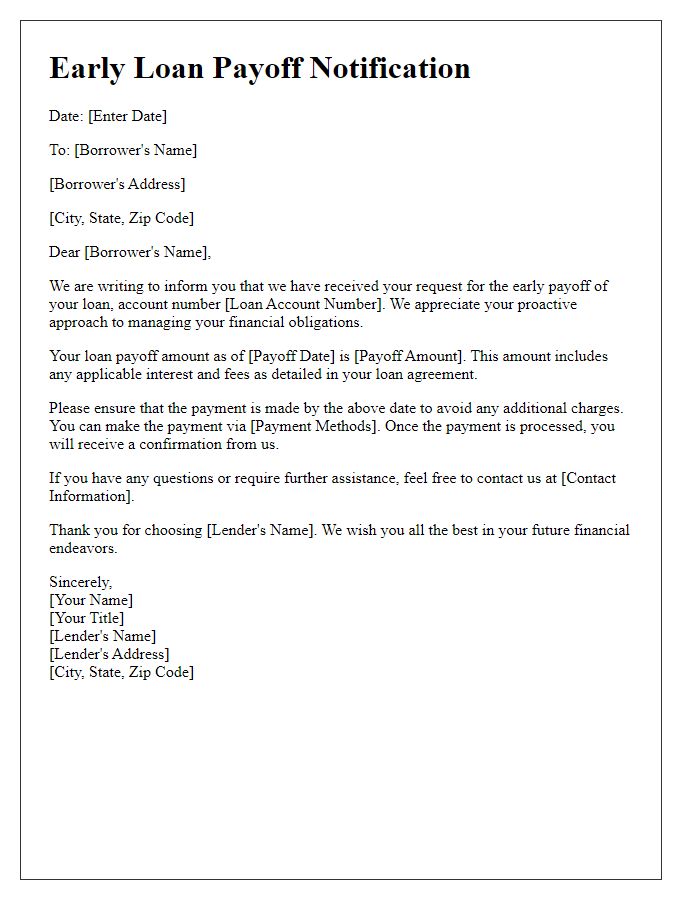

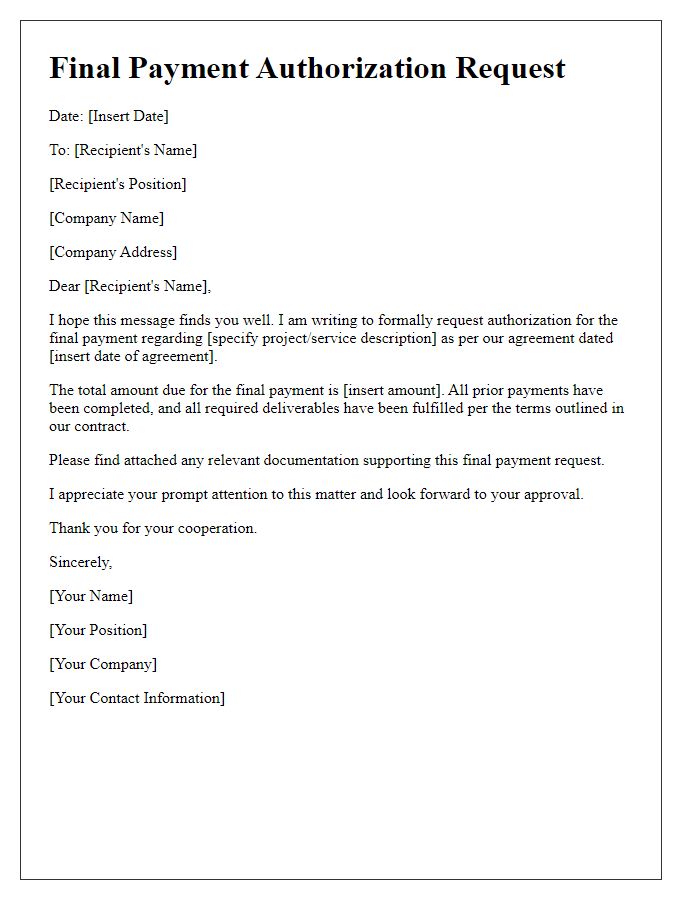

Payoff Amount Request

A payoff amount request involves obtaining the total sum needed to clear a loan, also known as a payoff quote. This request typically includes the borrower's account details, the loan servicer's contact information, and a specific date for the payoff. For mortgage loans, this amount can include interest accrued up to the payoff date, any remaining principal, and potential fees, such as prepayment penalties. In the United States, lenders are mandated to provide this information, which assists individuals in making informed financial decisions when settling their obligations. Timeliness is essential; borrowers often require this amount within a specific timeframe to meet closing dates during a home sale or refinancing process.

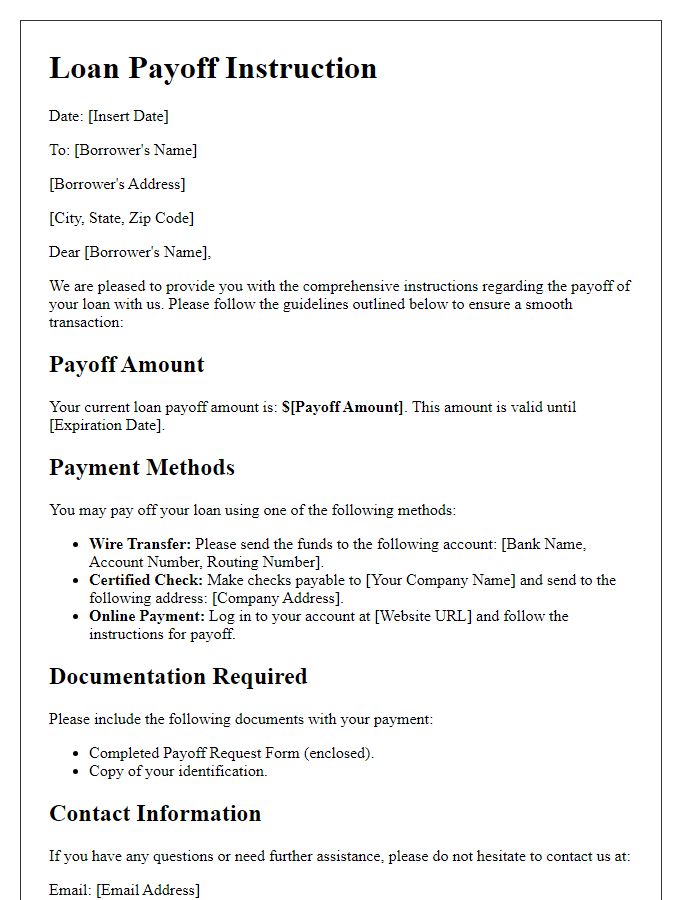

Payment Instructions

Payment instructions for loan payoff request typically require specific details to ensure accuracy and compliance. Borrowers must provide their loan account number, the total payoff amount including any accrued interest, and a deadline for the payment to avoid additional fees. Payment methods include wire transfers, certified checks, or electronic payments, with each method having specific processing times; for instance, wire transfers often process within one business day. Additionally, it is essential to specify whether any overpayments will be refunded or applied to future payments. Borrowers should also request confirmation of the loan payoff from the lender to validate the closure of the account.

Contact Details

Financial institutions often require detailed contact information for streamlined communication regarding loan payoff requests. Essential elements include the borrower's full name, which should match the account records, a complete mailing address outlining street name, city, state, and ZIP code, along with a phone number for direct inquiries. An email address, typically associated with the loan account, provides an additional channel for notifications or confirmations. Including the loan account number in correspondence ensures accurate processing and quick reference for bank representatives. This organized information facilitates efficient communication with institutions like credit unions or banks, ensuring that payoff requests are handled promptly and accurately.

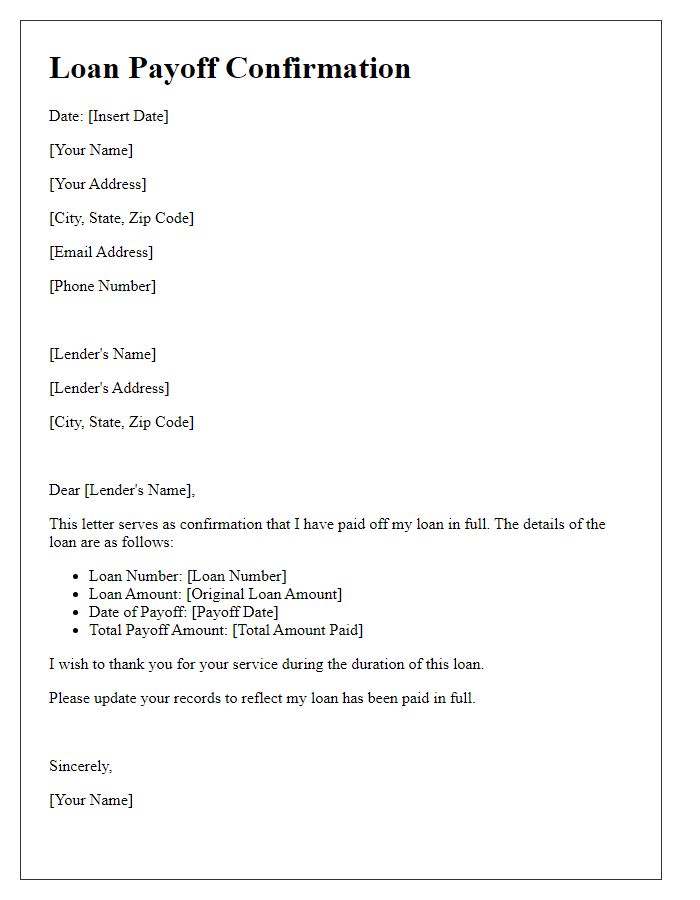

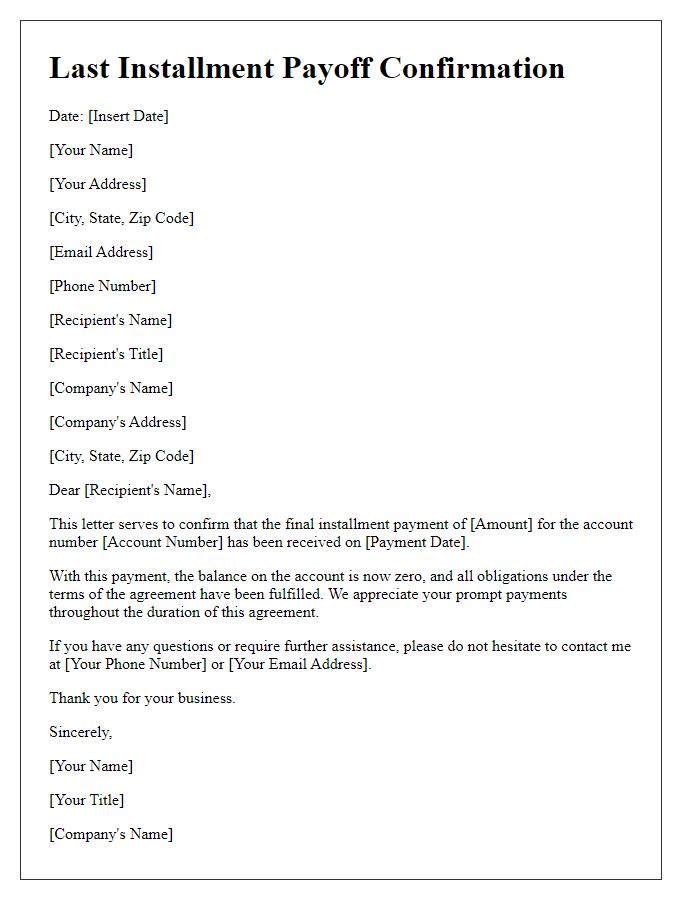

Confirmation of Closure

Loan payoff confirmation is essential for borrowers to validate successful repayment. This document serves as proof that the outstanding balance of a specific loan, typically issued by a financial institution like a bank or credit union, has been fully paid. It is crucial to include the loan account number, original loan amount, and final payment date in the confirmation. Moreover, the lender's name, address, and contact details should be clearly stated on this document. Timely receipt of the confirmation letter can help prevent any discrepancies in credit reports and provide peace of mind regarding the closure of financial obligations.

Comments