When considering a charitable loan, it's essential to understand the terms that will ultimately guide your decision. Crafting a clear letter request helps outline your needs and expectations while fostering transparency with the lender. By highlighting the purpose of the loan and your commitment to leveraging funds effectively, you can establish a solid foundation for a mutually beneficial agreement. Join me as we explore how to structure your request for optimal results and ensure your charitable goals are met!

Clear Purpose Statement

Charitable loans, often utilized by non-profit organizations and community-focused entities, necessitate clear terms to ensure transparent transactions. A purpose statement specifies the intended use of funds, defining objectives like building infrastructure, supporting educational initiatives, or enhancing community health programs. Stakeholders benefit from detailed descriptions of the project timeline, anticipated outcomes, and financial requirements. Articulating the social impact, such as improving literacy rates or providing affordable housing, strengthens the case for the loan by illustrating broader community benefits. Effective communication of these elements fosters trust and ensures alignment between the lender's and borrower's missions.

Detailed Loan Amount

A detailed loan amount in a charitable request typically includes specific figures outlining the total requested sum, which could range from $1,000 to $100,000 depending on the project requirements. The request should clearly indicate the purpose of the loan, such as funding educational programs, supporting community health initiatives, or assisting disaster relief efforts. Additionally, mentioning repayment plans, such as a 2-5 year timeline with zero to minimal interest, could enhance the request's appeal. Providing context on the impact of the loan amount and highlighting past successful projects funded through similar loans can further strengthen the application.

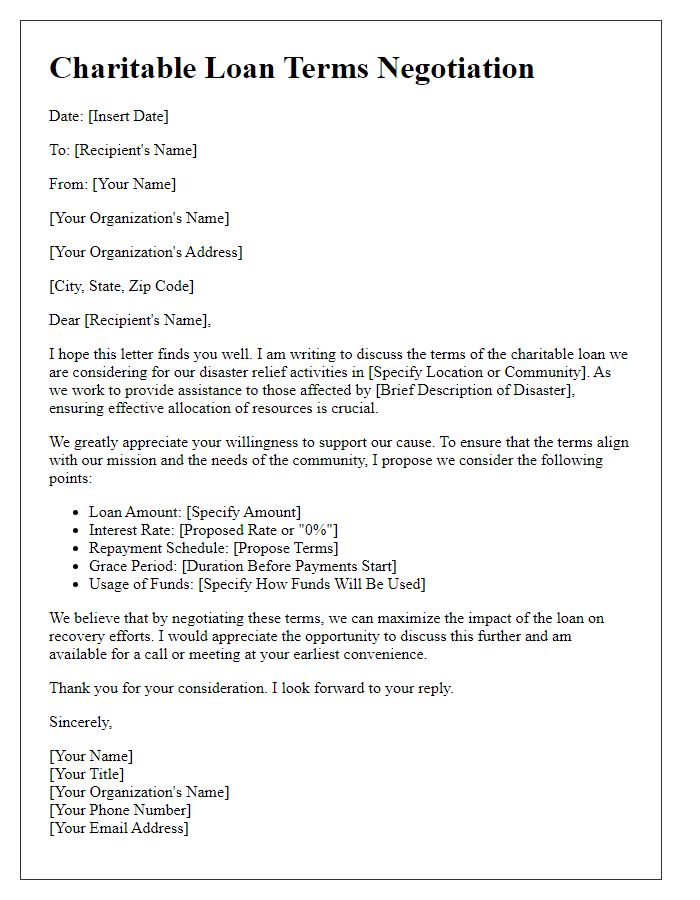

Defined Repayment Terms

Defined repayment terms for charitable loans outline the specific schedule and conditions under which borrowers are expected to repay the borrowed funds. These terms typically include the loan amount, repayment period (often ranging from 1 to 5 years), interest rate (if applicable, sometimes set at 0% for charitable loans), and any grace periods allowing borrowers time before initial payments commence. Furthermore, stipulations regarding late payment fees, options for early repayment without penalties, and the methods of payment (such as monthly bank transfers or online payment systems) are often detailed. Clear communication of these terms ensures financial accountability for borrowers and fosters trust and transparency between charitable organizations and the community they serve.

Financial Information

Charitable organizations often assess financial information to evaluate loan terms. Financial statements, including balance sheets and income statements, provide insight into the asset and liability management of the applicant. Funding amounts may vary, influenced by the organization's operational budget, typically ranging from $10,000 to several million dollars. Criteria for determining eligibility may include debt-to-income ratios, often not exceeding 40%, and historical financial performance over the last three years. The lender may also request cash flow projections that illustrate the organization's ability to meet loan repayments. Compliance documentation, such as tax-exempt status verification under IRS 501(c)(3) regulations, strengthens the request. The loan amount, interest rate, and repayment schedule are crucial terms to negotiate for sustainable operations.

Contact Information

A charitable loan request involves specific terms that outline the conditions for borrowing funds, often intended for social or community projects. Key details include the loan amount, typically ranging from $1,000 to $100,000, repayment schedule, which could span from one to five years, and interest rates, usually below market rates, often around 2-5%. The project purpose needs clear articulation, focusing on community benefit, such as education or housing initiatives. Documentation requirements may include a budget outline and project timeline, emphasizing transparency. Contact information must be accurate, including phone numbers and email addresses, ensuring effective communication with charitable organizations involved in the lending process.

Letter Template For Charitable Loan Terms Request Samples

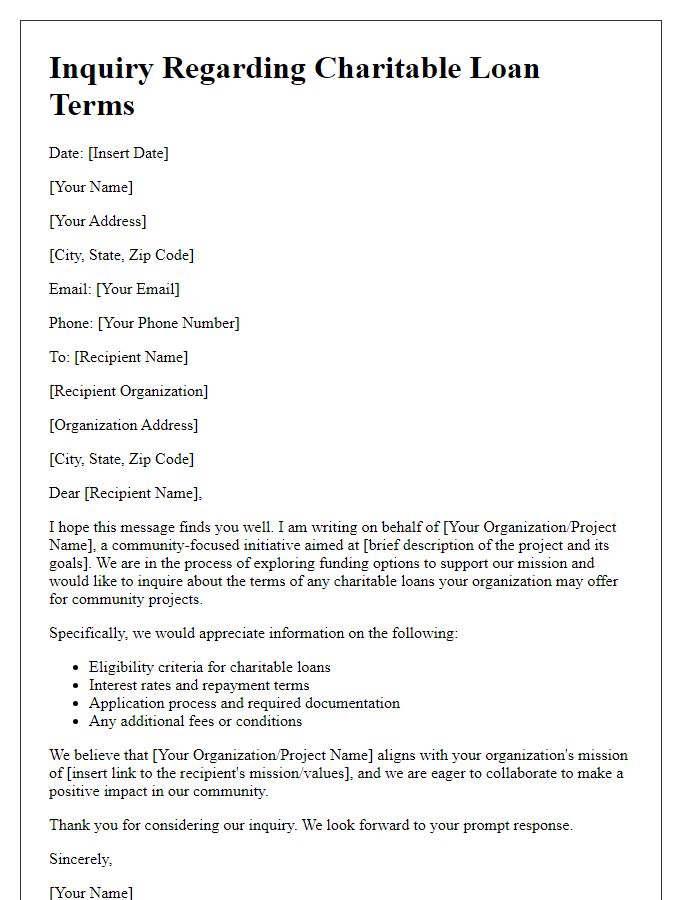

Letter template of charitable loan terms inquiry for community project funding.

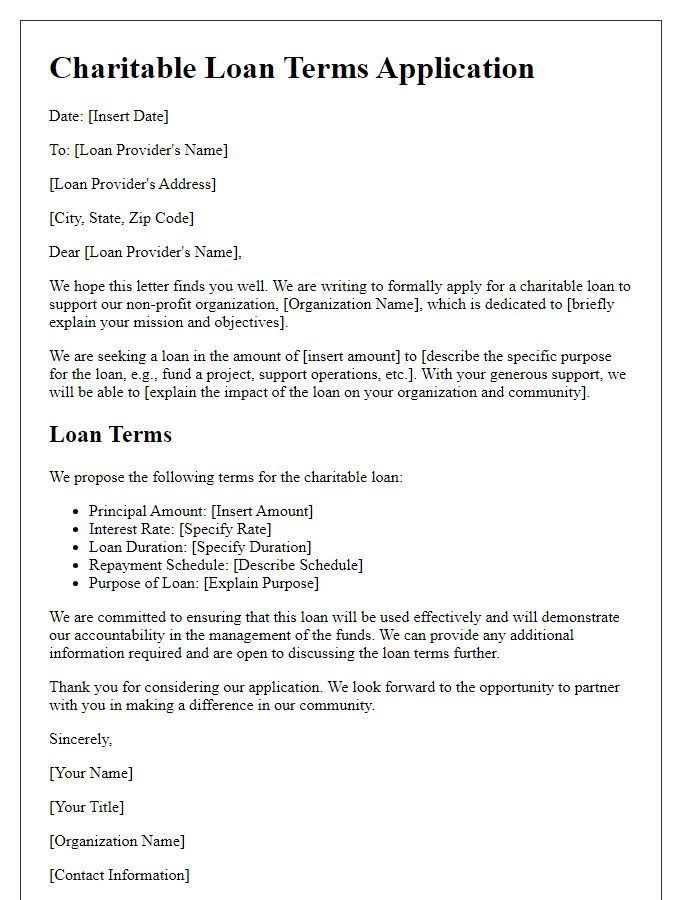

Letter template of charitable loan terms application for non-profit organization support.

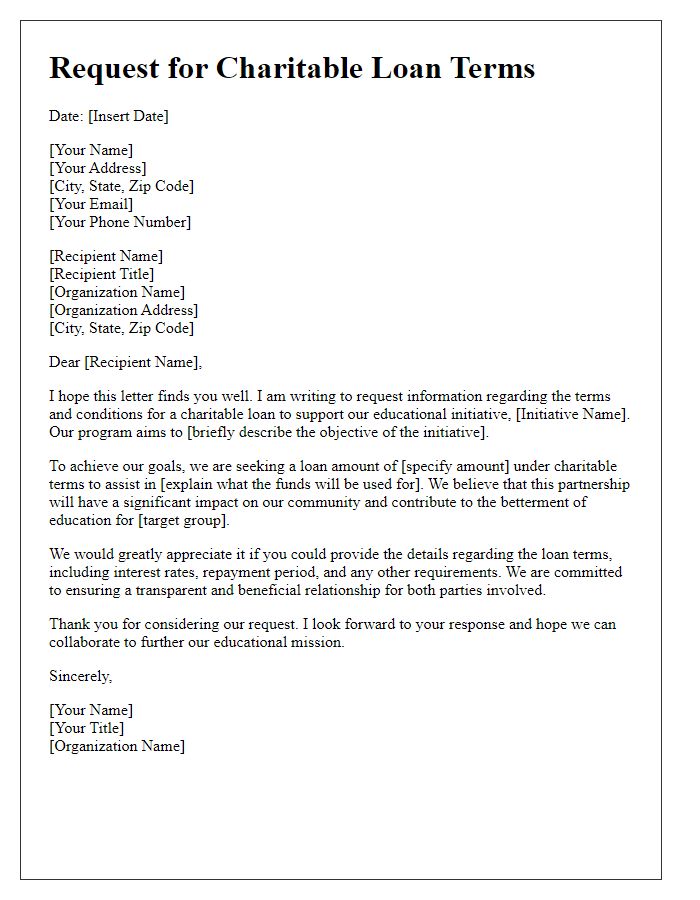

Letter template of charitable loan terms request for educational initiative assistance.

Letter template of charitable loan terms proposal for local business development.

Letter template of charitable loan terms clarification for arts and culture funding.

Letter template of charitable loan terms solicitation for health and wellness programs.

Letter template of charitable loan terms assessment for environmental conservation efforts.

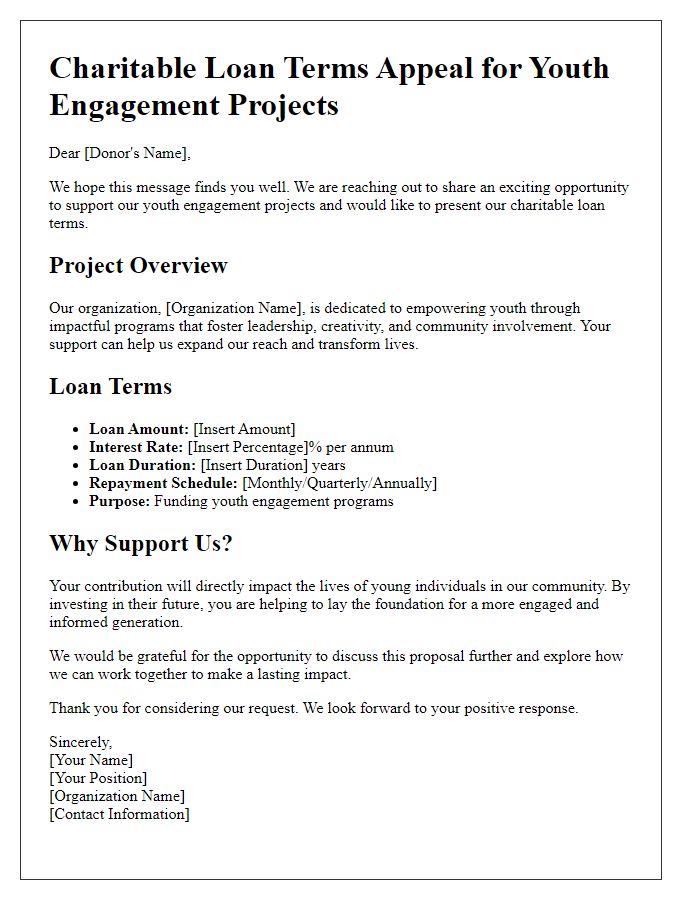

Letter template of charitable loan terms appeal for youth engagement projects.

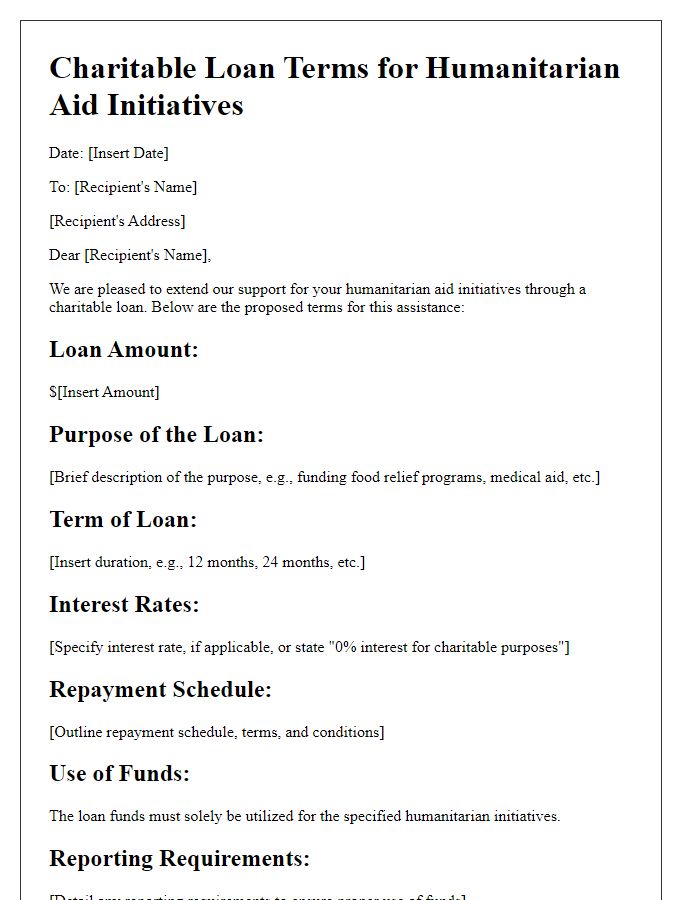

Letter template of charitable loan terms expression for humanitarian aid initiatives.

Comments