If you've ever wondered about the ins and outs of your company's employee loan policy, you're not alone! Understanding the guidelines can be a bit overwhelming, but it's essential for making informed decisions about financial assistance. Whether you're considering applying for a loan or simply curious about the terms, getting clarity can make a significant difference. Ready to dive deeper into the details? Let's explore this topic further together!

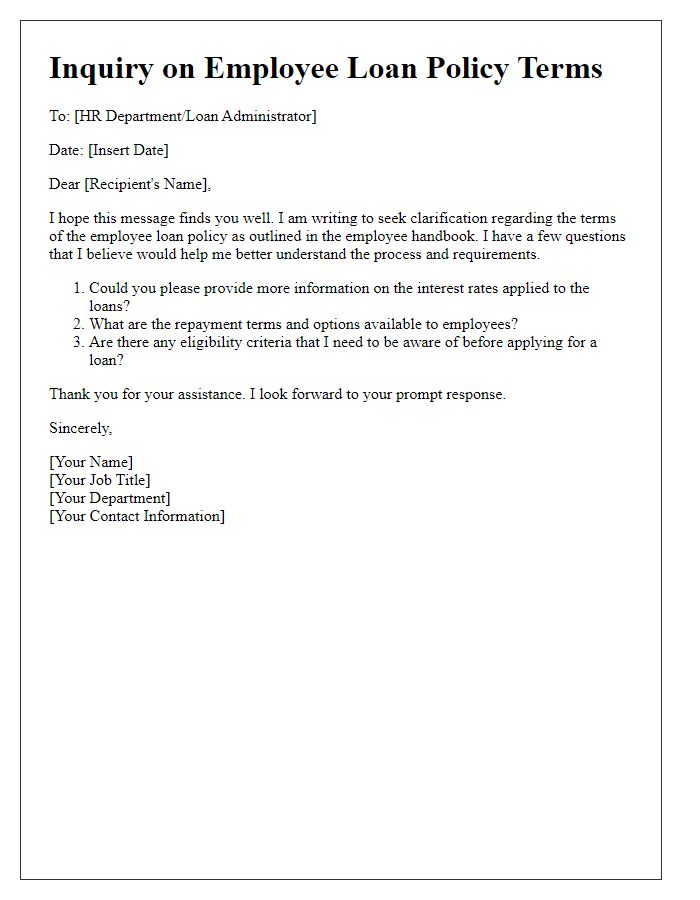

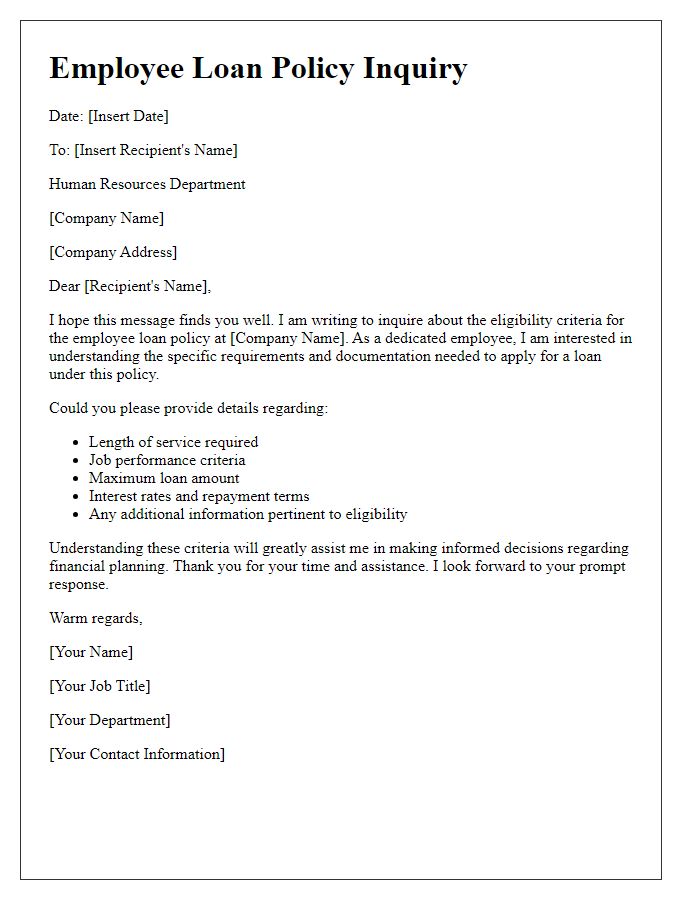

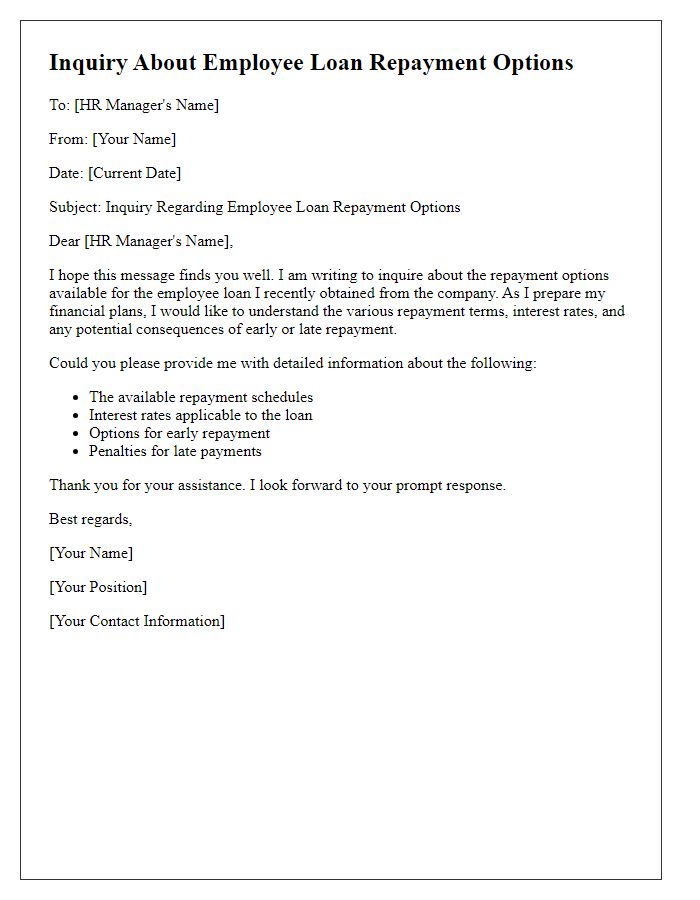

Clear subject line

Employee loan policy inquiries require structured information to maintain clarity. Requests often include details such as interest rates (typically ranging from 5% to 15%), repayment terms (commonly spanning 1 to 5 years), and eligibility criteria (which may include employment duration or salary thresholds). Departments like Human Resources (HR) or Finance usually handle these inquiries. Employees seeking loans should also understand potential impacts on future bonuses or promotions, particularly for larger amounts. Resources like employee handbooks provide essential information about procedures, application forms, and contact points for further assistance.

Appropriate salutation

An employee loan policy inquiry may involve various aspects such as interest rates, repayment terms, eligibility criteria, and application procedures designated by the company's human resources department. For instance, an employee may seek clarification regarding the specific benefits available under the policy, such as whether a loan can cover education expenses or medical emergencies. It is also essential to highlight any documentation requirements or applicable deadlines for submitting loan requests to ensure compliance with the organization's financial guidelines. Additionally, understanding confidentiality and potential impacts on credit ratings would be crucial for employees considering utilizing this benefit.

Purpose of inquiry

Company employee loan policies often aim to assist staff in times of financial need, helping with expenses related to education, medical emergencies, or unforeseen personal circumstances. These policies typically outline eligibility criteria, interest rates, repayment terms, and application procedures. For instance, an employee may inquire about the maximum loan amount allowed, which could range from $1,000 to $10,000, and whether the repayment period spans six months to five years. Understanding the specific documentation required for the application, such as proof of income and employment verification, becomes essential for a swift approval process. Additionally, employees may seek clarity on any potential impacts to their credit score or future employment, ensuring they make informed decisions regarding borrowing from their employer.

Specific details needed

Employee loan policies often vary by organization and can include a variety of terms and conditions. Specific details commonly needed include the types of loans offered (such as personal loans, home loans, or educational loans), eligibility criteria (such as minimum tenure or employment status), interest rates (fixed or variable), repayment terms (duration and method of repayment), any fees involved (processing fees or prepayment penalties), and documentation required for application (pay stubs, identification). Additionally, policies may outline circumstances under which loans may be denied, appeal processes available to employees, and any benefits or incentives for timely repayment. Understanding these elements helps clarify the overall loan structure and obligations for employees seeking financial assistance from their employer.

Professional closing and contact information

The employee loan policy outlines the terms and conditions under which employees can apply for financial assistance from the company. This policy includes eligibility criteria, application procedures, repayment options, and interest rates (typically varying between 5% to 10% depending on the loan amount and duration). Employees seeking information can refer to the HR department, located in Building A, Suite 200, or contact via email at hr@company.com for detailed guidance. A timely response can be expected within 3-5 business days regarding loan status inquiries. Understanding the specifics of the policy is crucial for informed financial decision-making.

Letter Template For Employee Loan Policy Inquiry Samples

Letter template of employee loan policy inquiry for clarification on terms.

Letter template of employee loan policy inquiry regarding eligibility criteria.

Letter template of employee loan policy inquiry about repayment options.

Letter template of employee loan policy inquiry for application process details.

Letter template of employee loan policy inquiry concerning interest rates.

Letter template of employee loan policy inquiry with questions about penalties.

Letter template of employee loan policy inquiry regarding confidential information.

Comments