Are you feeling overwhelmed by your current loan payments and considering the option of loan forbearance? You're not alone; many individuals find themselves in similar situations, seeking temporary relief from financial burdens. Loan forbearance can provide you with the breathing room needed to regain your footing without losing your assets. If you're curious to learn more about how to request forbearance successfully, keep reading!

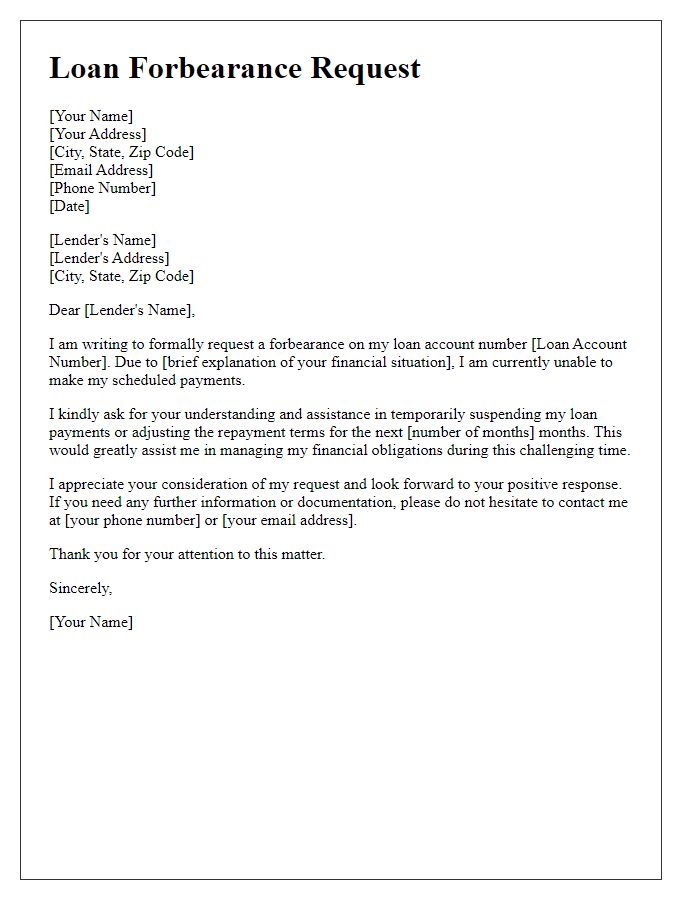

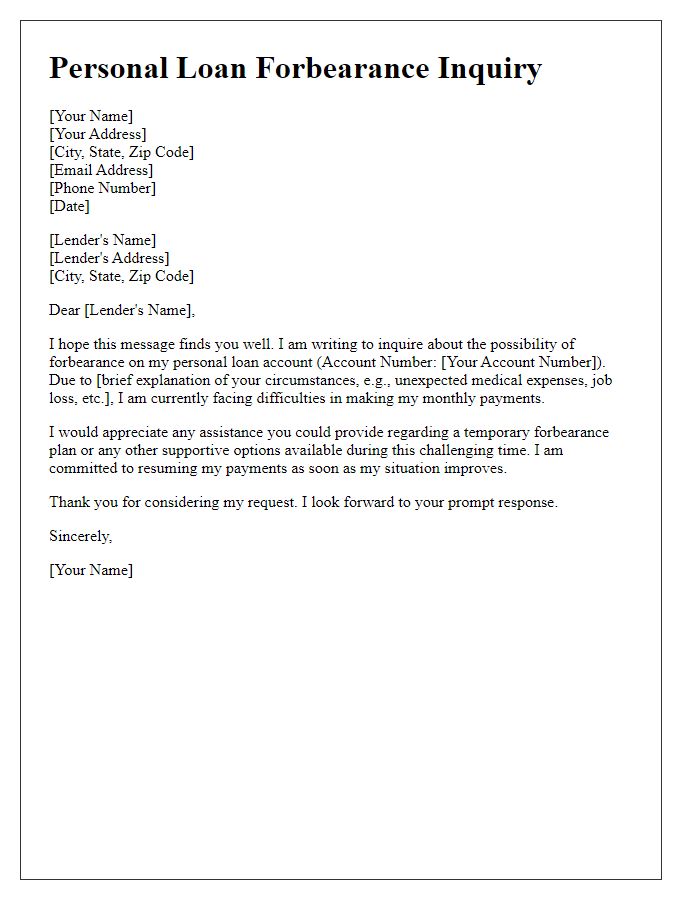

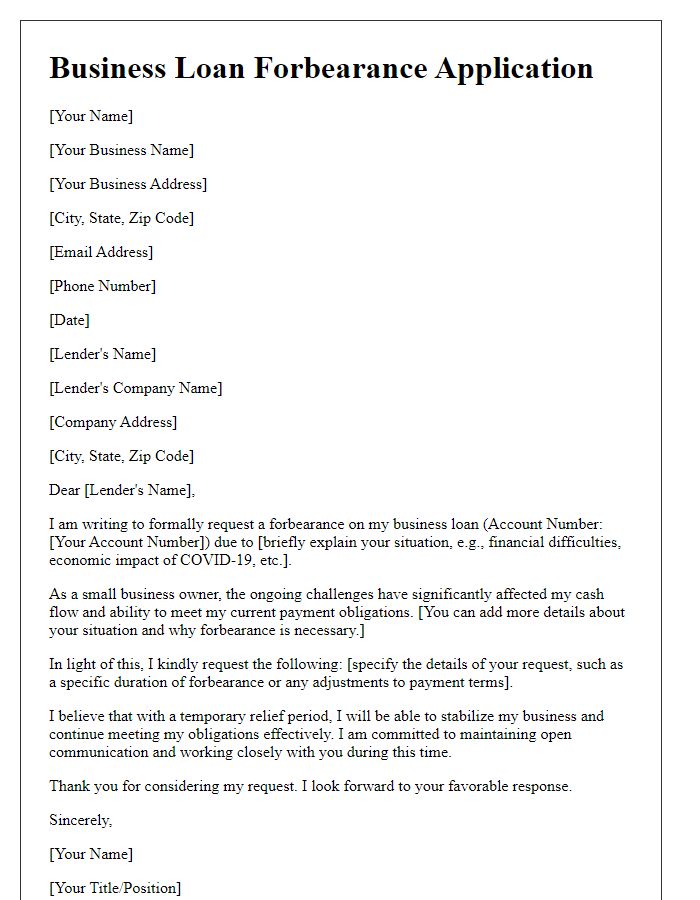

Borrower's Personal Information

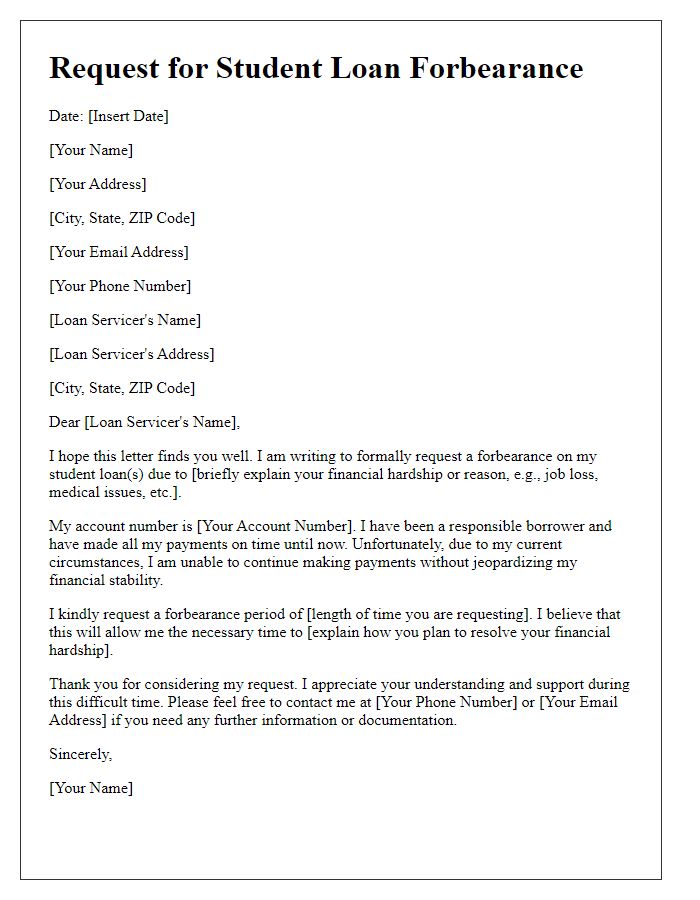

Borrowers seeking loan forbearance, crucial for managing financial hardships, must provide personal information accurately. Full name (including middle initial) should be described for identification purposes. Current mailing address requires street number, city, state, and ZIP code specifics to ensure proper communication. Date of birth should be included for verifying identity, typically formatted as MM/DD/YYYY. Social Security number (last four digits only for privacy) serves as a key identifier in financial institutions. Contact phone numbers, including area codes, allow lenders to reach out regarding the request. Email addresses are vital for electronic correspondence, and including existing loan information, such as account number or loan type, facilitates a smoother process for both borrower and lender during negotiations for temporary relief from payment obligations.

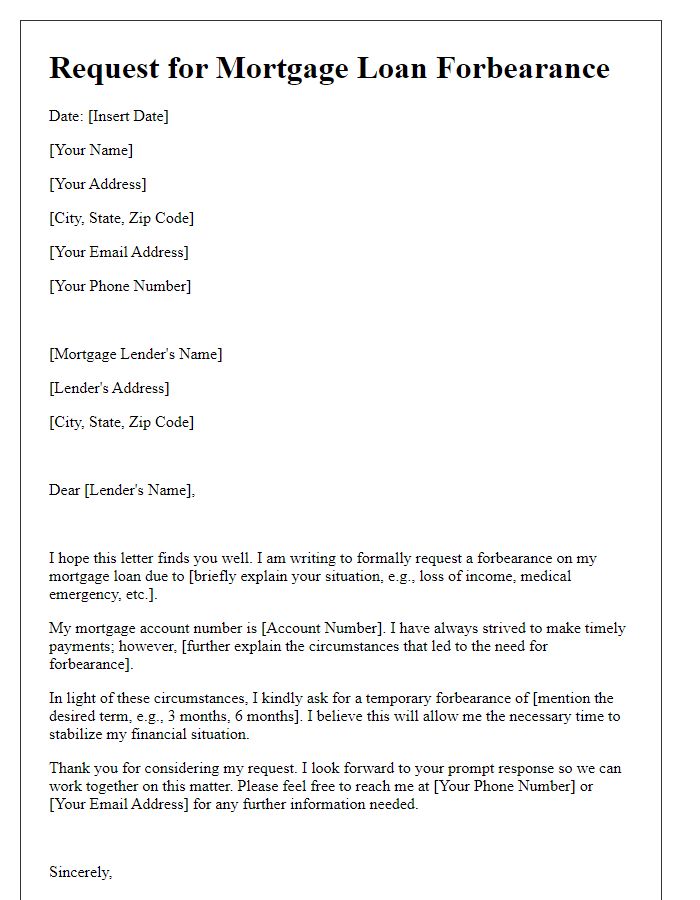

Loan Account Details

Loan forbearance requests often involve significant details related to the borrower's circumstances and the specific loan account. A comprehensive understanding of loan account terms, including the principal amount, interest rate, payment history, and any existing financial hardship, is essential. Borrowers should provide relevant account details such as the loan account number, type of loan (such as mortgage or personal loan), and the lender's name (for example, Bank of America or Wells Fargo) to ensure proper identification and processing. Borrowers may highlight their financial difficulties, which could include loss of employment or medical expenses, demonstrating the need for temporary relief. Clarity in communication regarding the desired forbearance period (for instance, three months or six months) is also crucial to facilitate an understanding between the borrower and the lender.

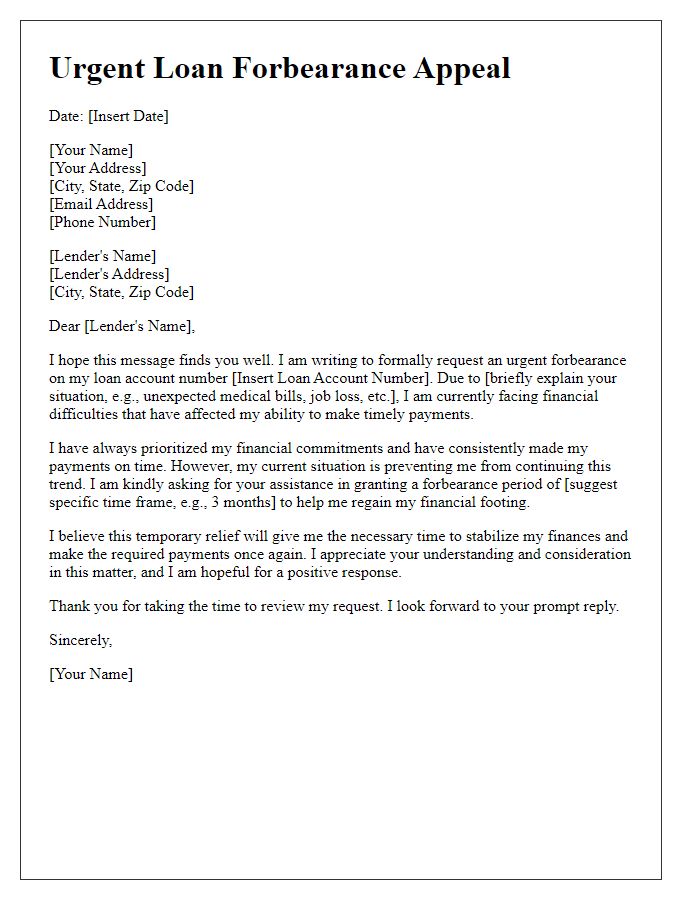

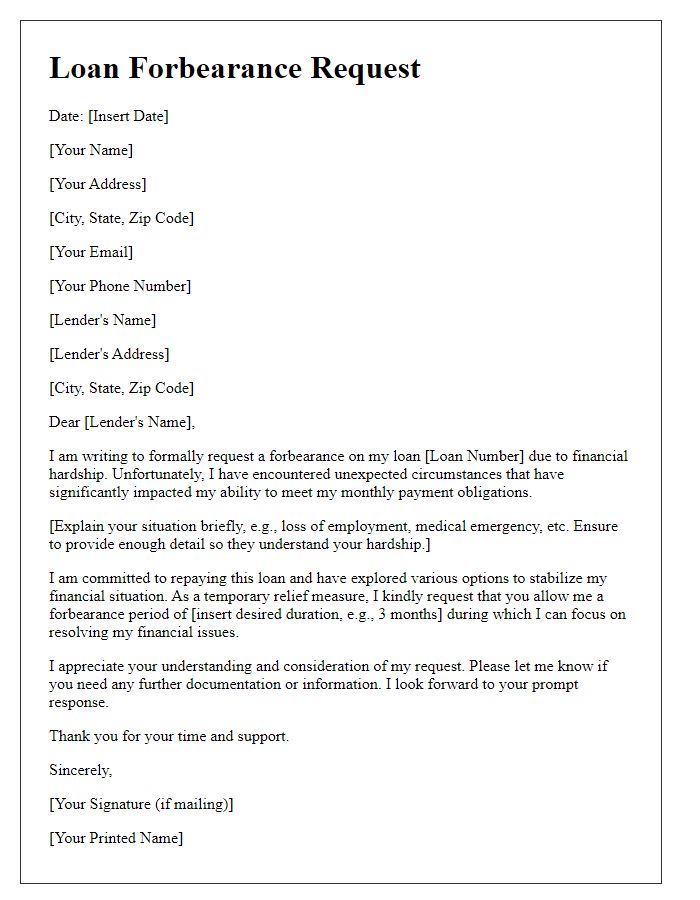

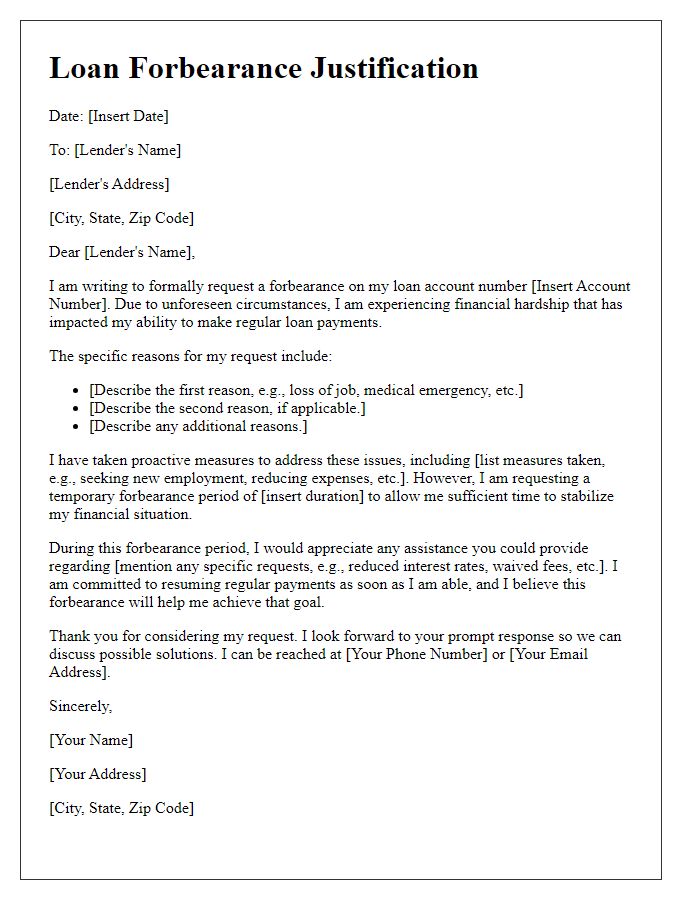

Reason for Forbearance Request

In circumstances where financial hardship arises, individuals may seek loan forbearance to temporarily reduce or suspend their repayment obligations. Common reasons for such a request include unexpected job loss, medical emergencies, or significant repair costs related to essential assets, such as a vehicle or home. Situations may involve accidents leading to injury, which can incapacitate a borrower, or natural disasters, like hurricanes or tornadoes, that may disrupt income streams. Furthermore, economic downturns affecting entire industries, such as tourism during the COVID-19 pandemic, could also initiate forbearance requests. These factors collectively underscore the importance of flexibility in loan agreements, allowing borrowers to navigate unforeseen challenges without facing immediate financial ruin.

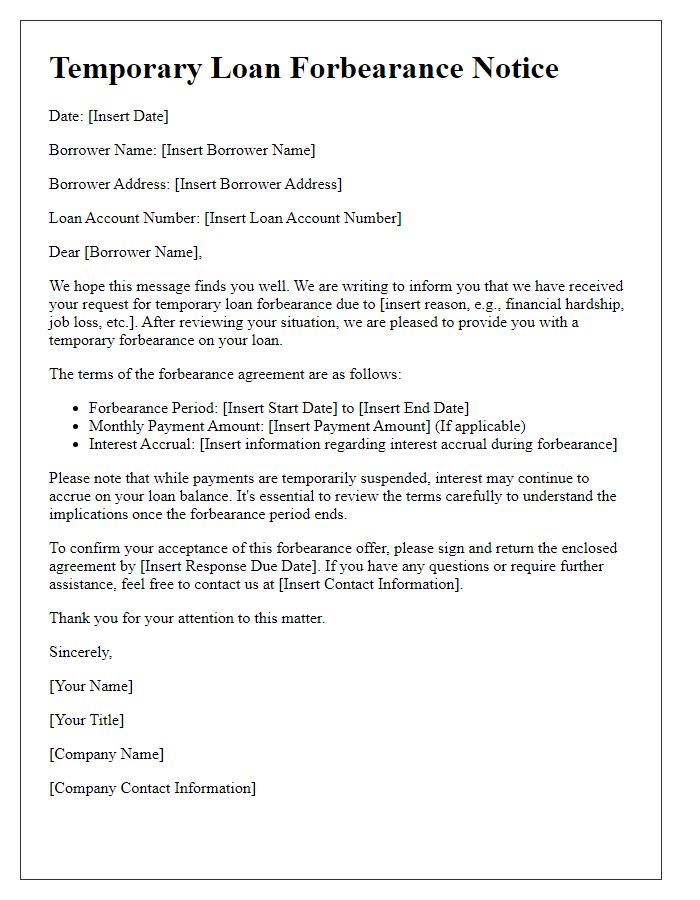

Proposed Forbearance Terms

Proposed loan forbearance terms may include temporary suspension of monthly payments (typically 3 to 12 months), which allows borrowers to manage financial hardship without delinquency. Interest accrual during this period may be deferred or capitalized to the principal balance, impacting total loan repayment. Clear communication on the forbearance agreement should include specific start and end dates, eligibility criteria, and documentation required to maintain clarity. Borrowers are expected to resume regular payments after the forbearance period, with options available for graduated payments to ease transition back to full repayment. Penalties or fees for late payments during the forbearance should also be addressed to safeguard both lender and borrower interests.

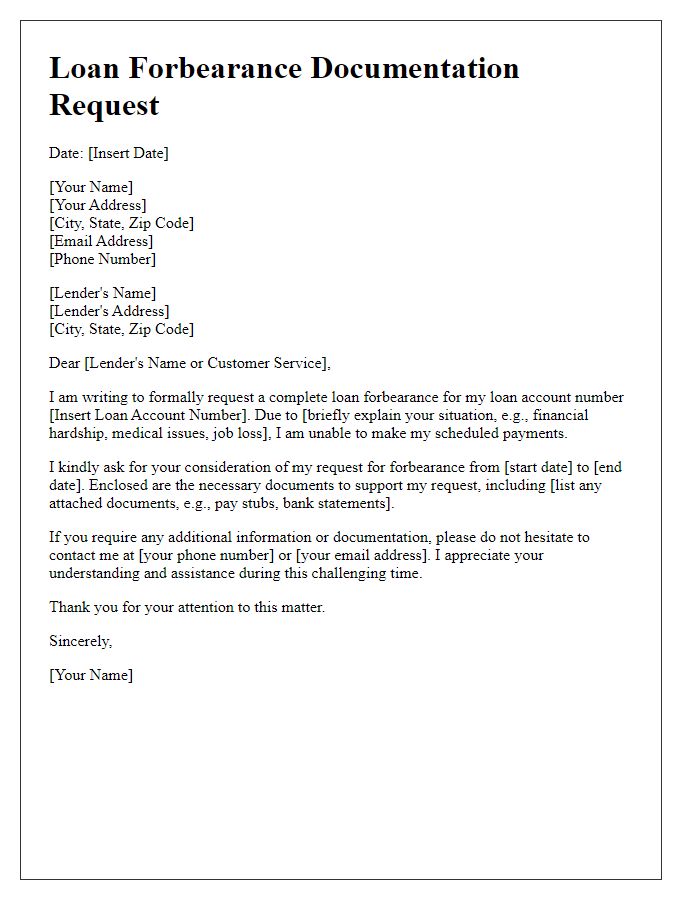

Contact Information and Follow-Up Plan

Loan forbearance requests require effective communication, outlining borrower concerns. A clear contact information section is essential, including the borrower's full name, mailing address, email, and phone number. Follow-up plans should be concise, specifying preferred communication methods (phone calls, emails), timeline expectations (within two business days), and possible alternative arrangements should initial outreach be unsuccessful. Include supportive documentation dates to reinforce urgency, such as application submission on October 1, 2023, and any relevant deadlines. Emphasizing consistent communication bolsters the request's effectiveness while ensuring accountability between borrowers and lenders.

Comments