Have you ever found yourself waiting anxiously for an update on your loan application? It can feel like an eternity when you're eagerly anticipating news that could impact your financial future. Thankfully, reaching out for a loan status inquiry can help ease those worries and provide clarity on where things stand. For tips on crafting the perfect inquiry letter, read on!

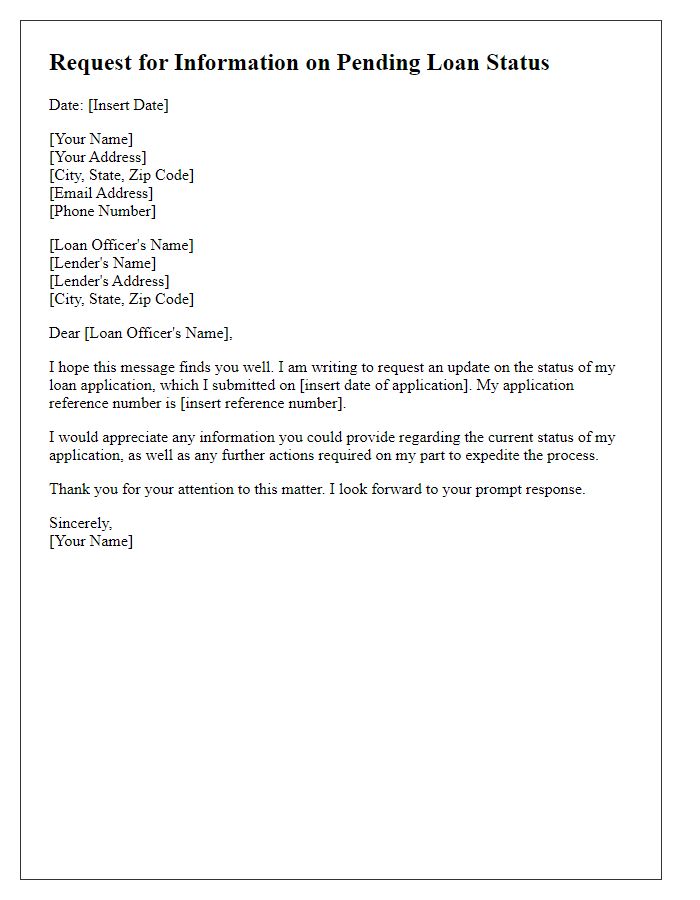

Subject Line Optimization

Subject lines for loan status inquiries should be clear and concise, providing essential details at a glance. An effective subject line may include the loan type, action being requested, and a reference number. Examples: "Inquiry on Mortgage Loan Status - Account #123456," "Update Request for Personal Loan Application - ID 7891011," or "Loan Status Check for Auto Loan - Reference #112233." These subject lines optimize searchability and ensure they grab the attention of the lending institution's customer service team.

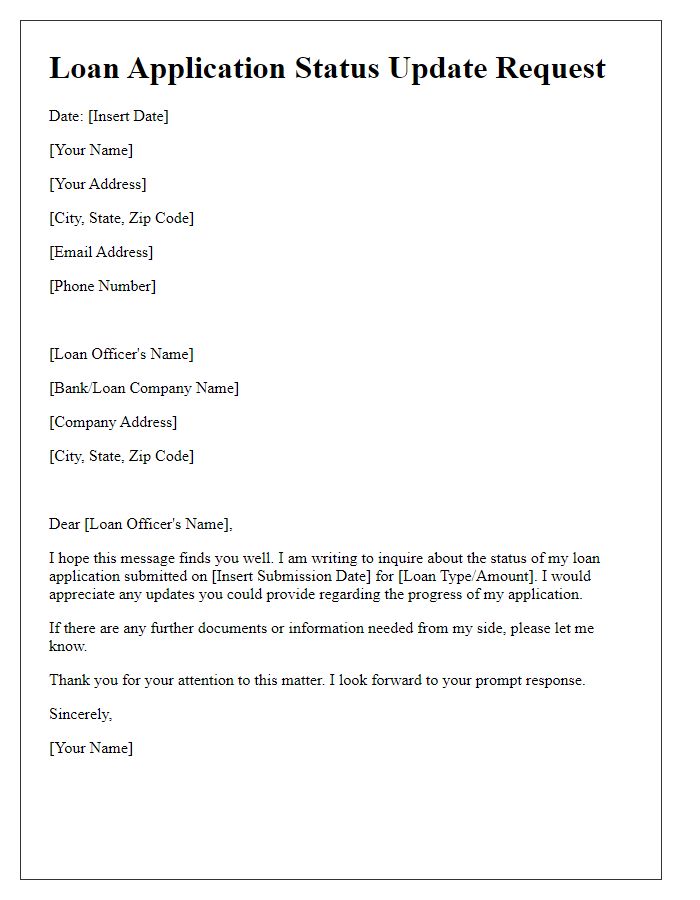

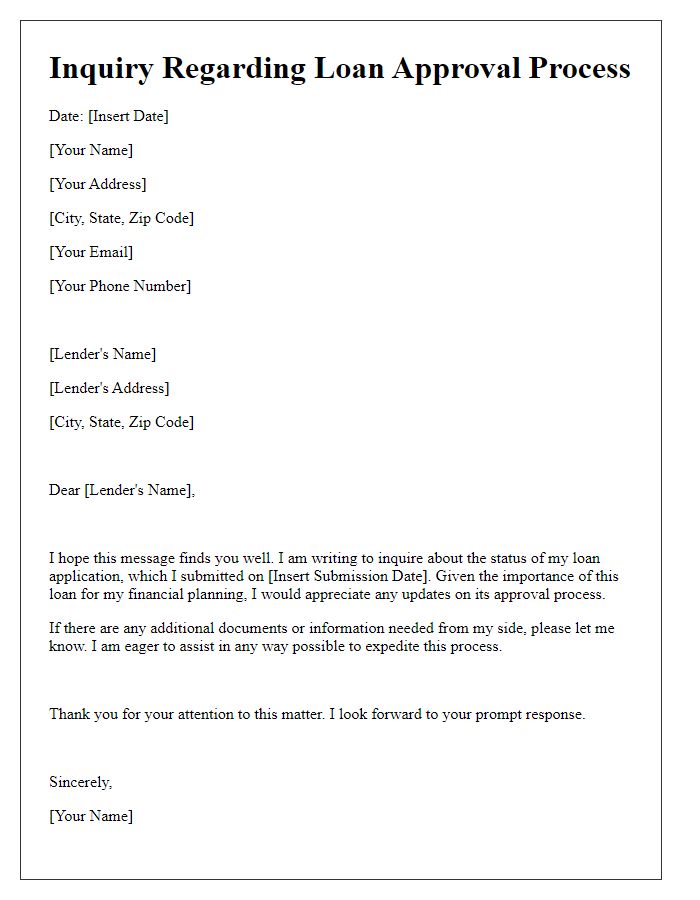

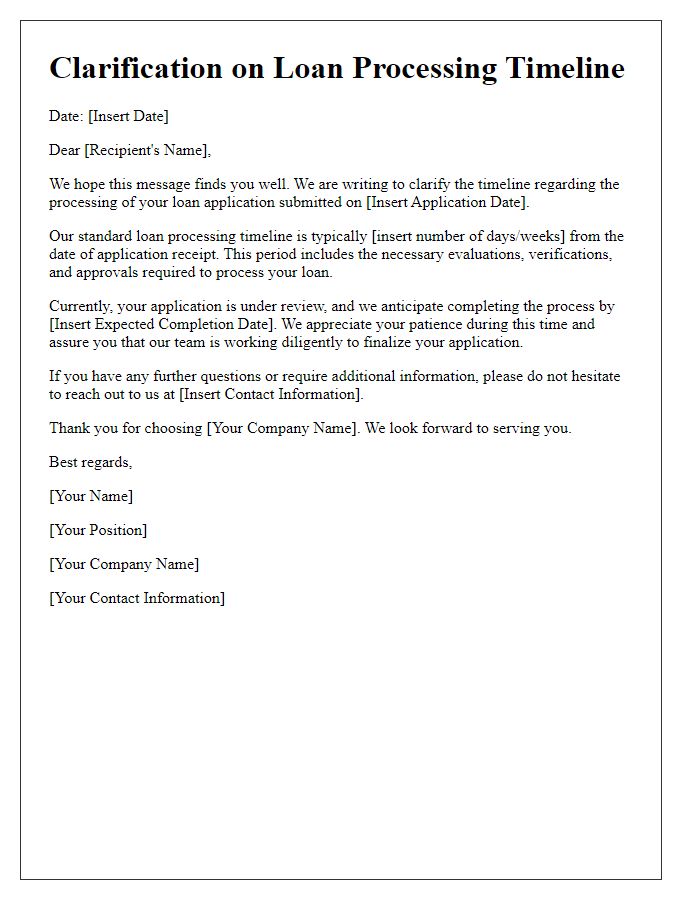

Personalization

Inquiring about a loan status can provide clarity for borrowers in various situations. A personalized inquiry can include specific details such as the loan application number assigned (typically a unique identifier), the date of submission (for example, March 15, 2023), and the specific loan type (like a mortgage, auto, or personal loan). Including the lender's name (such as Bank of America or Wells Fargo) and the expected processing timeframe (often 7-14 business days for pre-approval) can enhance the inquiry's effectiveness. Emphasizing any specific financial need (like home renovation or debt consolidation) may further contextualize the urgency and purpose behind the status request.

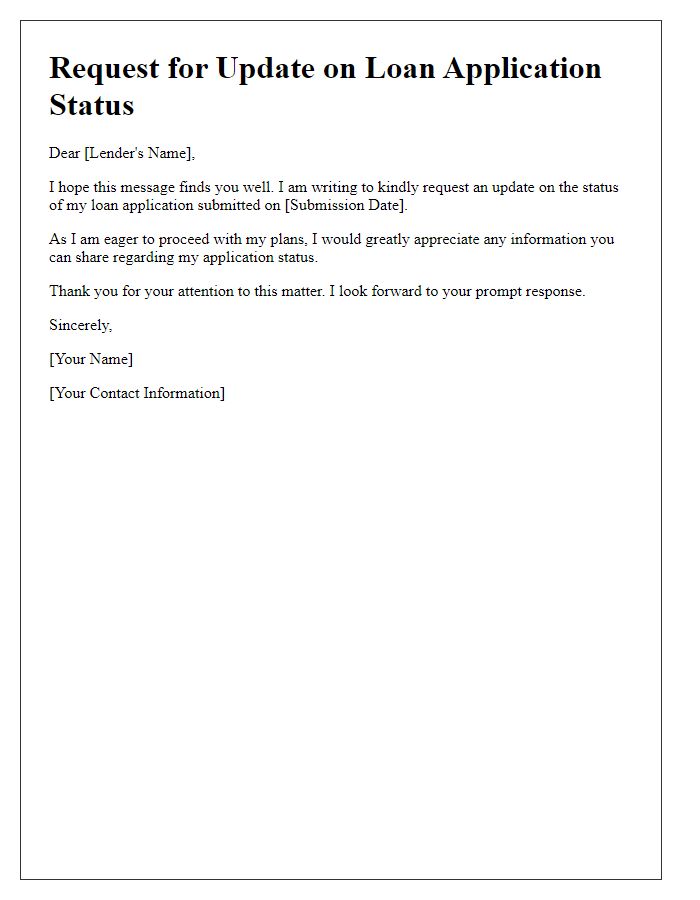

Clear and Specific Request

When applying for a home loan, borrowers often seek updates from financial institutions regarding their application status. A home loan application can take several weeks for processing, typically around 30 to 45 days, depending on the lender's policies. It is essential for applicants to send a concise and professional inquiry to ensure clarity regarding their situation. Key elements include the loan amount requested, the property address associated with the application, and any reference numbers provided during the submission process to facilitate quicker responses. Providing specific details such as the date of application submission and the current stage of processing will help lenders to address requests efficiently.

Contact Information

Inquiries regarding loan status usually involve communication with financial institutions or lenders. People often seek updates on their mortgage applications, personal loans, or student loans. Loan status could pertain to various stages such as approval, disbursement, or repayment. Contact information should include the lender's name, customer service phone number, email address, and physical address. Financial institutions like Bank of America, Chase, or local credit unions often provide dedicated channels for loan inquiries. Accurate details are crucial for prompt responses, including application reference numbers and personal identification information.

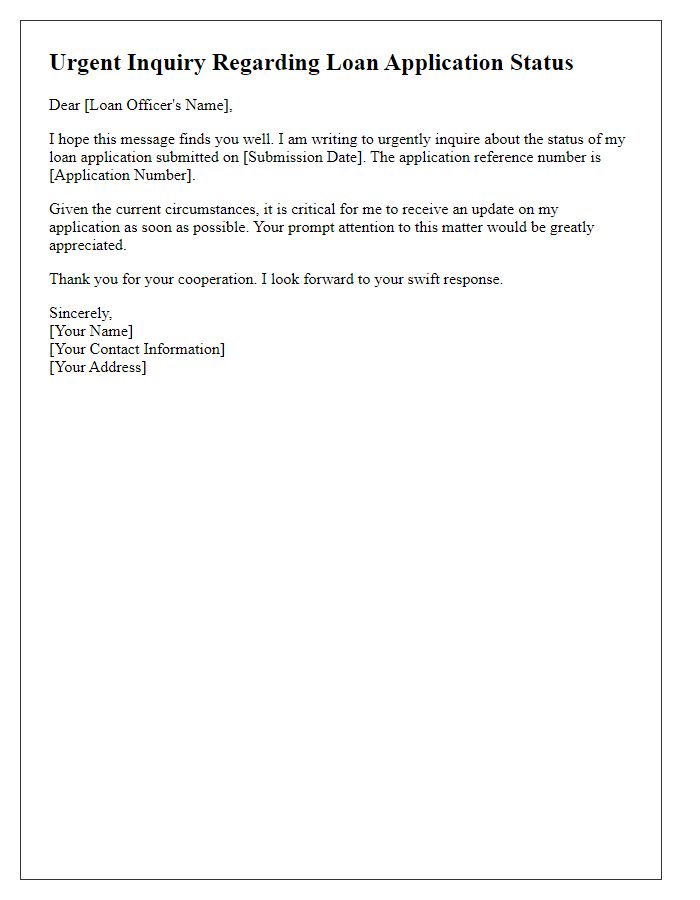

Polite and Professional Tone

Loan application status can significantly impact financial planning. Borrowers often seek updates about their applications to manage expectations effectively. Processing times, particularly for personal loans and mortgage applications, can vary widely, with some institutions reporting durations of up to 30 days. Essential details, such as application number and submission date, can facilitate quicker responses. Accurate inquiries can lead to better communication with lenders while ensuring all necessary documents are organized and submitted timely, thus optimizing borrower's experience and satisfaction in the lending process.

Comments