Have you ever found yourself in a tight financial spot, wondering how to navigate the maze of loan options out there? If so, you're not alone, and we've got just the solution for you! In this article, we'll dive into the ins and outs of unsolicited loan offers, helping you understand what they are and how to assess their potential benefits and risks. So, let's explore this financial landscape togetherâread on to discover more!

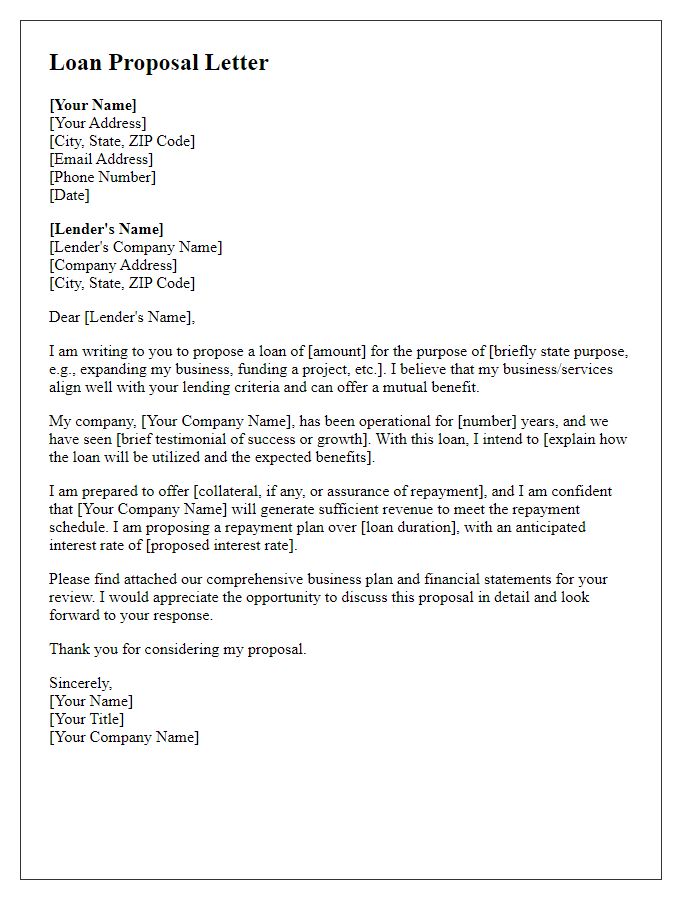

Personalization and Recipient Details

Creating a successful unsolicited loan offer entails personalizing the document for the recipient while providing essential details about the loan product. An effective introduction mentions the recipient's name and acknowledges their potential financial needs, such as home improvements, educational expenses, or debt consolidation. Highlight loan specifics, such as competitive interest rates (for example, 4.5% APR), flexible repayment terms (ranging from 6 to 60 months), and the total loan amount available (like up to $50,000). Communicate trust by referencing reliable sources, such as a past partnership or local community sponsorships, enhancing credibility. Include easy application procedures that allow for rapid online processing alongside contact details for personalized assistance.

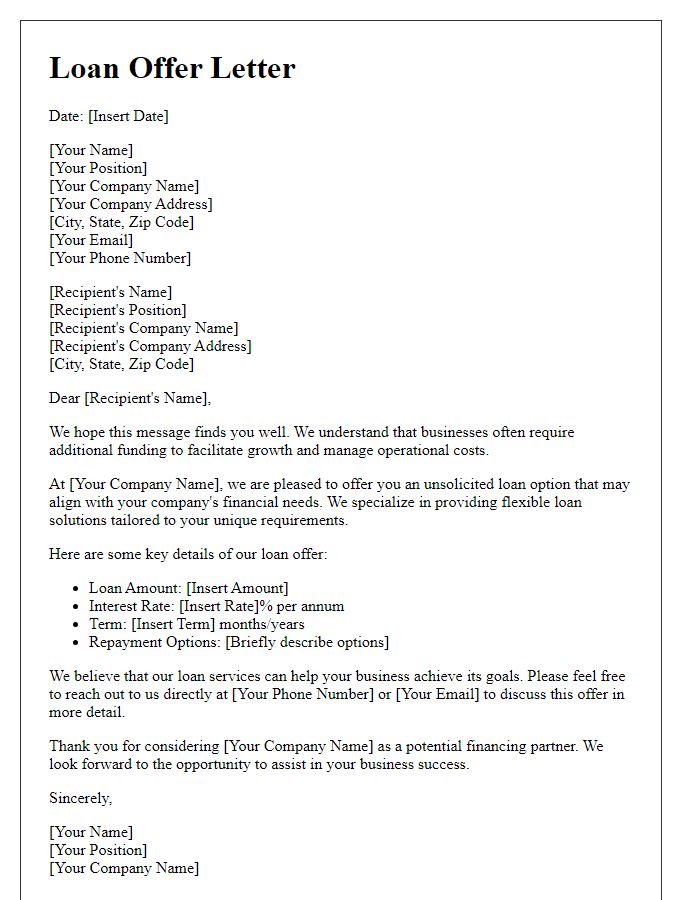

Clear Offer Summary

Unsolicited loan offers can present both opportunities and risks for potential borrowers. Financial institutions, such as banks or credit unions, often extend these offers to individuals with favorable credit profiles. Typically, terms may include fixed interest rates (ranging from 3% to 8%) and repayment periods (commonly 36 to 60 months). Key components of the offer summary should include the total loan amount, monthly payment calculations, and any associated fees (potentially 1% to 3% of the loan amount for processing). It's essential for recipients to review the Annual Percentage Rate (APR) carefully, as it encompasses both the interest rate and additional costs, providing a comprehensive view of the loan's total cost. Understanding these details can facilitate informed financial decisions.

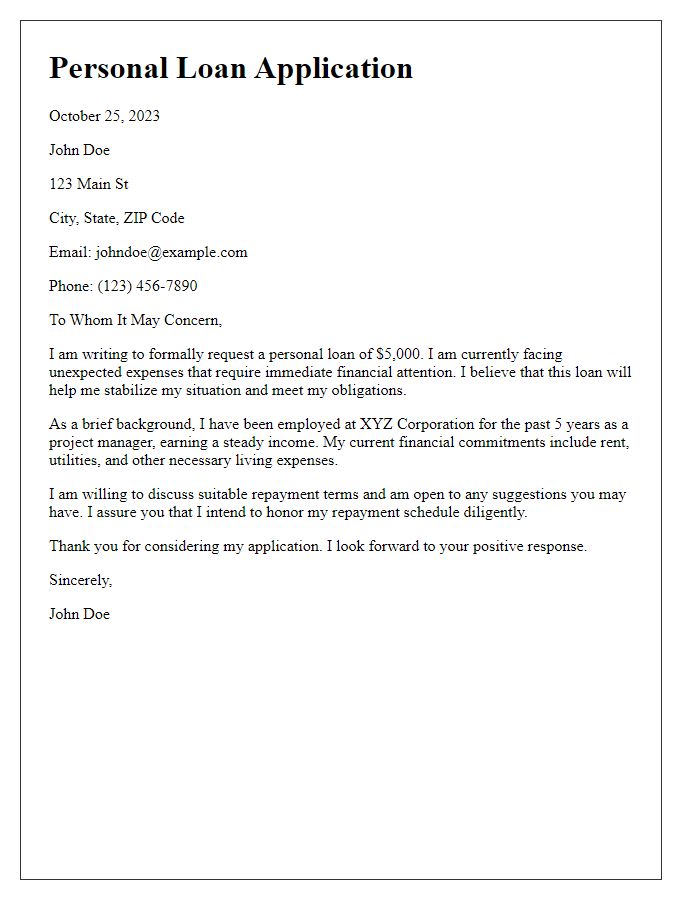

Interest Rates and Terms

Unsolicited loan offers often include key details about interest rates and terms that potential borrowers should consider. Interest rates can vary significantly, commonly ranging from 5% to 30% based on creditworthiness and market conditions. Loan terms may extend from a short period of six months to several years, with monthly repayment options that affect overall repayment amount. Fees such as origination fees (up to 5% of the loan amount) and prepayment penalties might also apply, impacting the total cost of borrowing. Lenders may represent various financial institutions, and potential borrowers should thoroughly review loan documentation before acceptance, ensuring comprehension of all conditions.

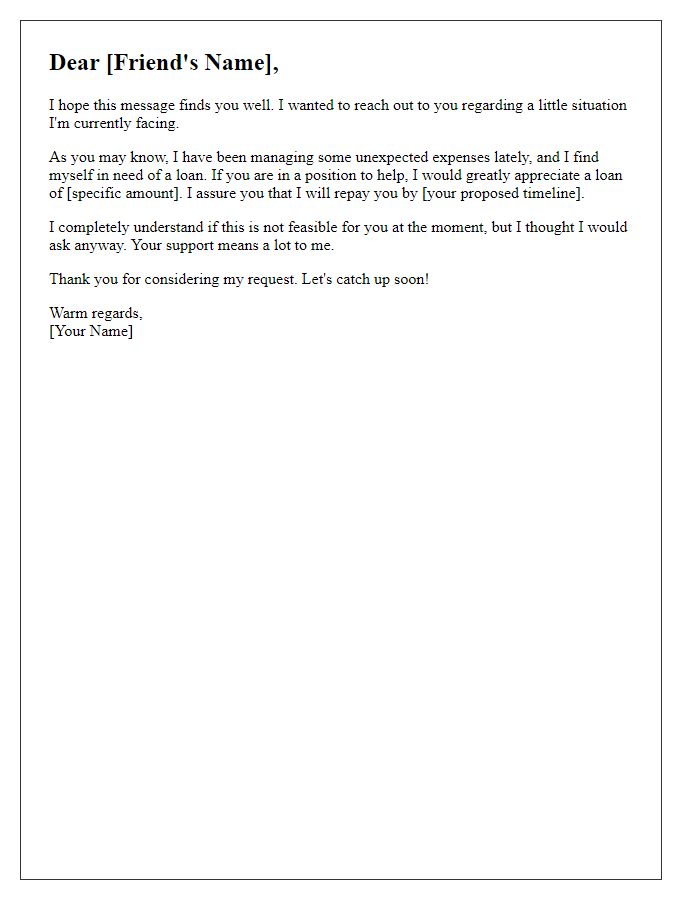

Call to Action and Contact Information

Unsolicited loan offers can create opportunities for individuals seeking financial assistance but may often raise concerns about legitimacy. Before proceeding with an offer, potential borrowers should ensure to verify the lender's credentials, looking for licenses from regulatory bodies such as the Consumer Financial Protection Bureau (CFPB) in the United States. It's crucial to carefully read the terms of any agreement, particularly interest rates and repayment schedules. Additionally, prospective clients should be aware of the importance of directly contacting the lender via verified contact information, which often includes a website and customer service telephone number, to discuss the loan specifics and clarify any doubts regarding the proposal. Opting for reputable financial institutions and checking borrower reviews from trusted websites such as the Better Business Bureau (BBB) can help safeguard against fraud and ensure a positive borrowing experience.

Compliance with Legal and Ethical Standards

Unsolicited loan offers can often raise concerns regarding compliance with legal and ethical standards in the financial industry. Loan companies must adhere to regulations set forth by entities such as the Consumer Financial Protection Bureau (CFPB), ensuring transparent communication and fair lending practices. Ethical standards dictate that loan offers should not mislead potential borrowers regarding interest rates, fees, or repayment terms. Additionally, companies must protect sensitive personal information, aligning their practices with data privacy laws like the General Data Protection Regulation (GDPR) or the California Consumer Privacy Act (CCPA), safeguarding consumer trust while promoting responsible borrowing.

Comments