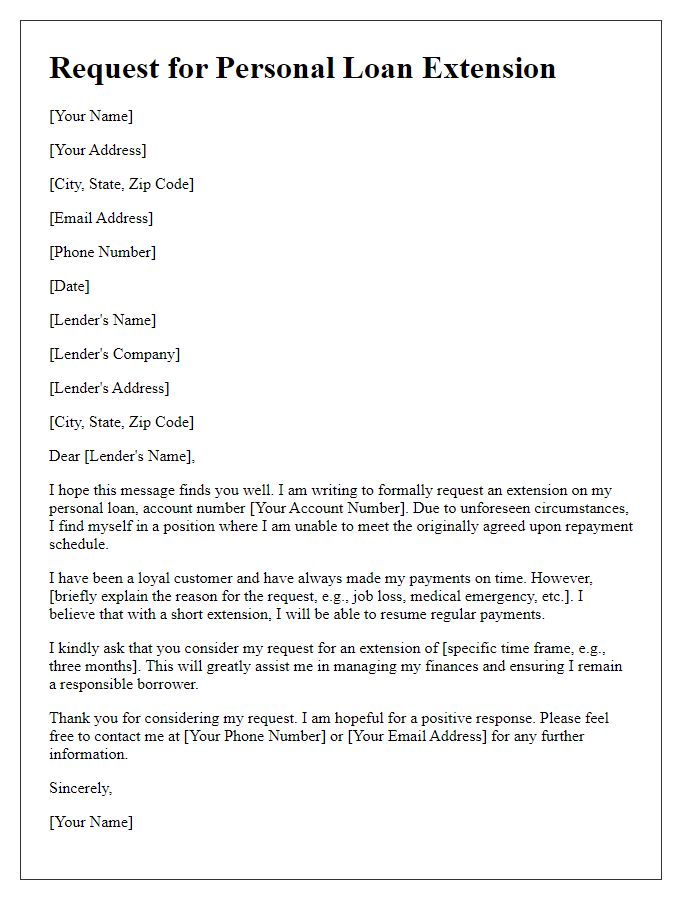

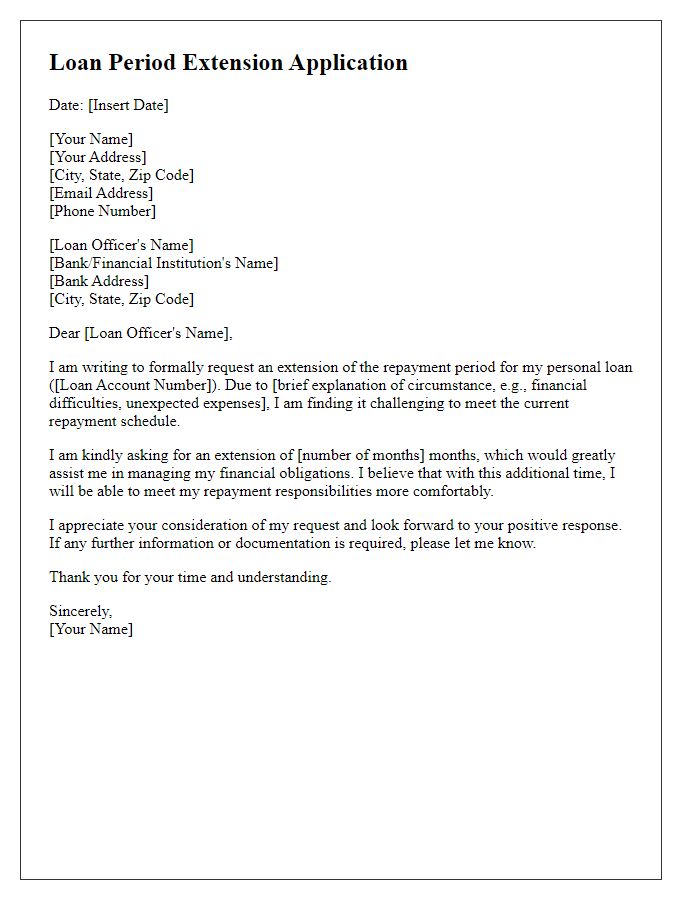

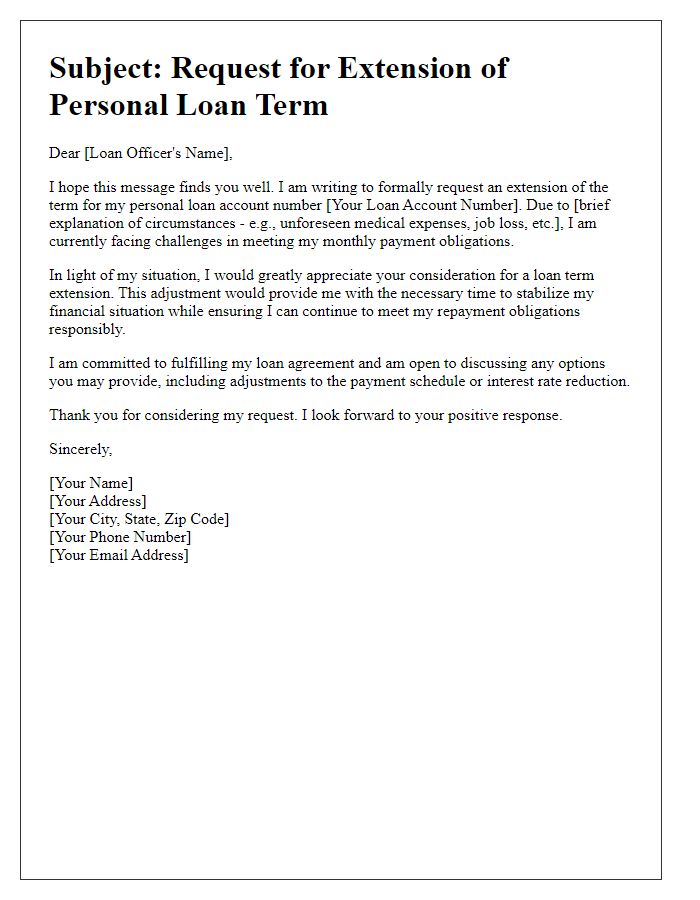

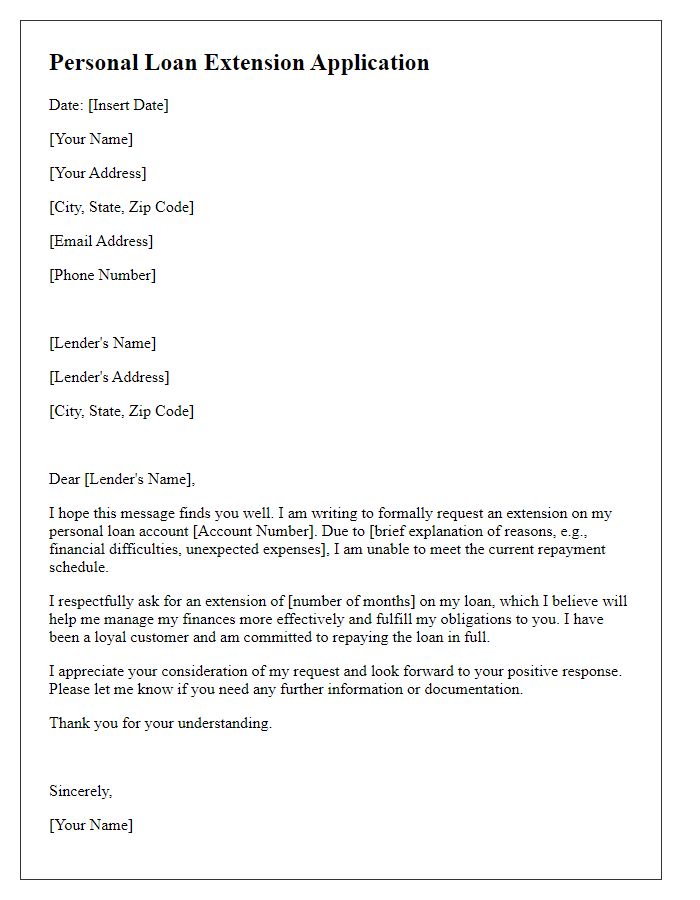

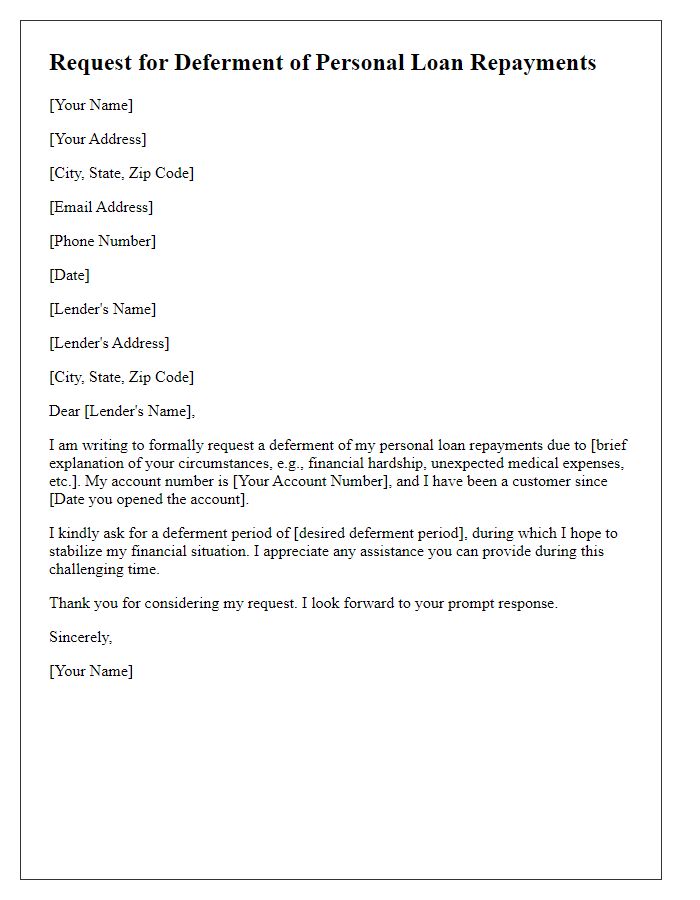

Are you considering extending your personal loan but don't know how to craft the perfect request? Writing a letter for a loan extension can feel daunting, but it doesn't have to be. With the right approach, you can communicate your needs clearly and professionally, ensuring your lender understands your situation. So, if you're ready to take the next step in simplifying your financial journey, keep reading for a helpful template!

Reason for Extension Request

Applying for a personal loan extension becomes essential during times of financial instability or unforeseen circumstances, such as job loss or medical emergencies. It is crucial to demonstrate a clear understanding of the existing loan terms and payment history, including the original loan amount, monthly payments, and the remaining balance. Factors like fluctuating interest rates, economic downturns, or personal challenges can significantly impact financial capacities. Including specific dates, such as the request date and the desired extension period, enhances the request's clarity. Additionally, detailing a proposed repayment plan showcases responsibility and a commitment to fulfilling the loan obligations despite current difficulties.

Current Loan Details

Current personal loans often involve specific terms such as loan amount, interest rate, and repayment duration. For example, a borrower might have a personal loan amounting to $15,000 with a fixed interest rate of 7% for a period of 5 years. The current outstanding balance would typically decrease as monthly payments are made, reflecting both principal and interest. Late payments can incur fees, potentially increasing overall costs. A borrower's credit score (often a crucial factor in loan approval and interest rates) may also affect their eligibility for a loan extension, particularly if their financial situation has changed since the original agreement. Personal loans might be secured or unsecured, impacting the lender's willingness to consider an extension request, especially in cases where collateral is involved.

Proposed New Payment Plan

A proposed new payment plan for a personal loan extension may involve adjusting existing loan terms to make repayments more manageable. For example, instead of the original monthly payment of $500, the new plan could lower it to $350 over an extended term of 60 months instead of 36 months, resulting in decreased financial strain on the borrower. Additionally, details such as interest rates, potentially reduced from 8% to 6%, should be clarified to demonstrate a comprehensive understanding of the revised schedule. Borrowers must also outline their current financial circumstances, possibly including income of $3,000 per month, and any unexpected events, such as job loss or medical expenses, that necessitate this modification. This transparent approach emphasizes responsible financial planning and commitment to fulfilling repayment obligations.

Assurance of Payment Commitment

A personal loan extension can provide financial relief, allowing borrowers to manage their repayment commitments more effectively. Borrowers often seek extensions when facing temporary financial difficulties, such as unexpected medical expenses or job loss. Lenders typically review the borrower's payment history, assessing reliability and commitment to fulfilling obligations. Establishing a clear repayment plan is crucial, detailing the new terms and the timeframe for repayment. Effective communication with the lender can demonstrate the borrower's intent to honor financial commitments, reducing the risk of default and maintaining a positive credit rating.

Contact Information for Follow-up

Personal loan extensions often require communication with financial institutions or lenders. Key details include account number, loan type, and requested extension period. Borrowers should gather personal information like full name, phone number, email address, and mailing address for follow-up inquiries. It's crucial to note the lender's policy on extensions, including any associated fees or interest rate changes that might apply. Documentation like payment history and financial statements may be necessary to support the request, highlighting the importance of organized records throughout this process.

Comments