Are you considering an auto loan but feeling overwhelmed by the process? You're not alone; many people find themselves unsure about how to navigate the application. In this article, we'll break down a simple yet effective letter template to help you apply for that dream car with confidence. So, buckle up and read on to discover how you can streamline your auto loan application!

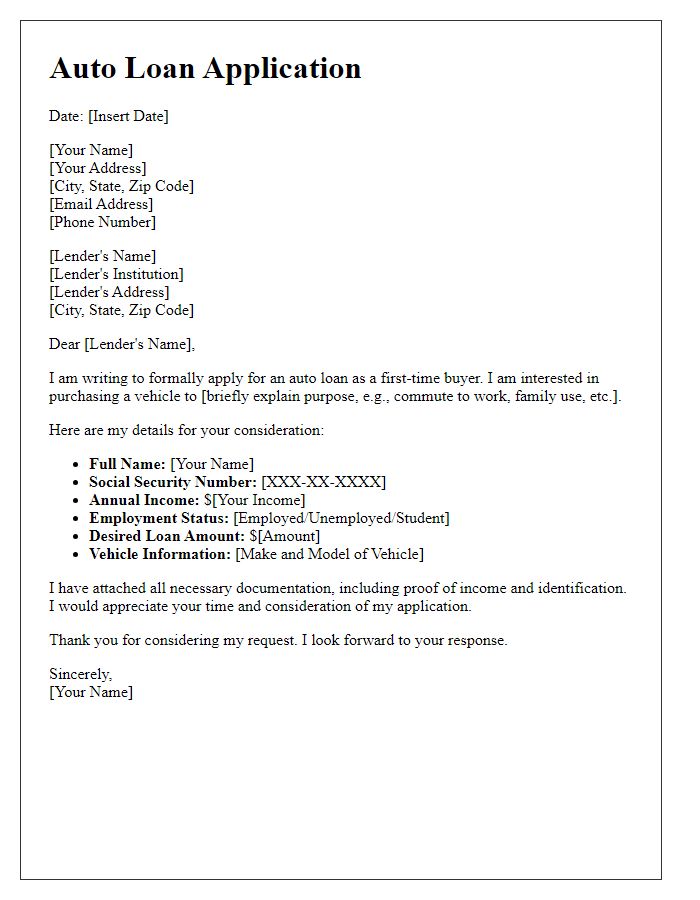

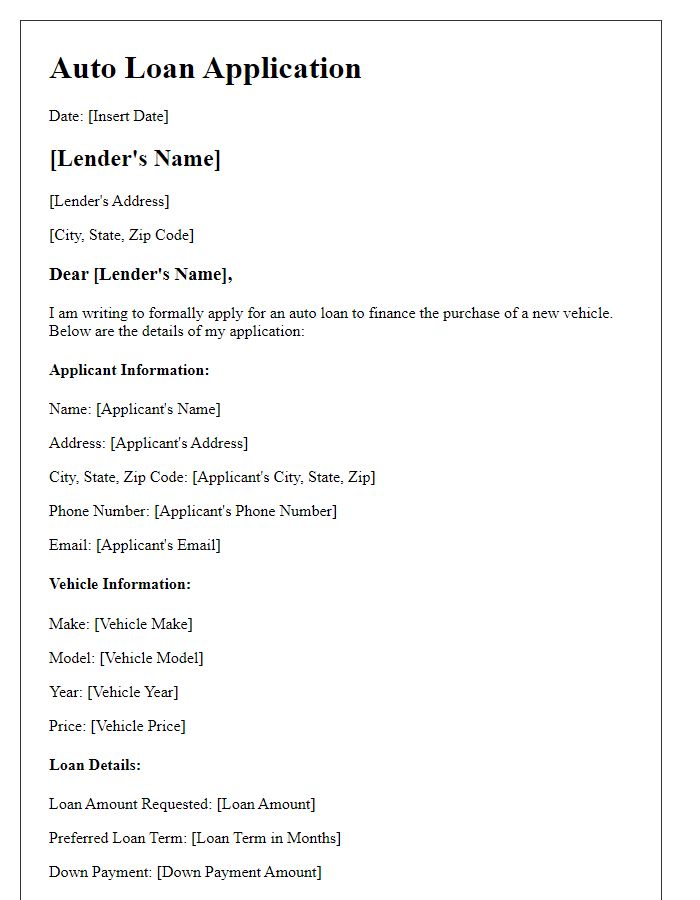

Applicant Information

The auto loan application process requires detailed applicant information to assess creditworthiness and financial stability. Key details include the applicant's full name (first and last name), social security number (nine-digit unique identifier used by the government), date of birth (indicating age), current address (including city, state, and zip code), and contact information (phone number and email address). Employment information is crucial, encompassing the employer's name, position, length of employment (months or years), and monthly income (gross income before taxes and deductions). Additionally, information about existing loans and debts, such as current mortgage or rental payments, credit card balances, and other financial obligations, plays a significant role in determining the applicant's eligibility. Overall, comprehensive and accurate submission of these details can enhance the chances of loan approval and favorable terms.

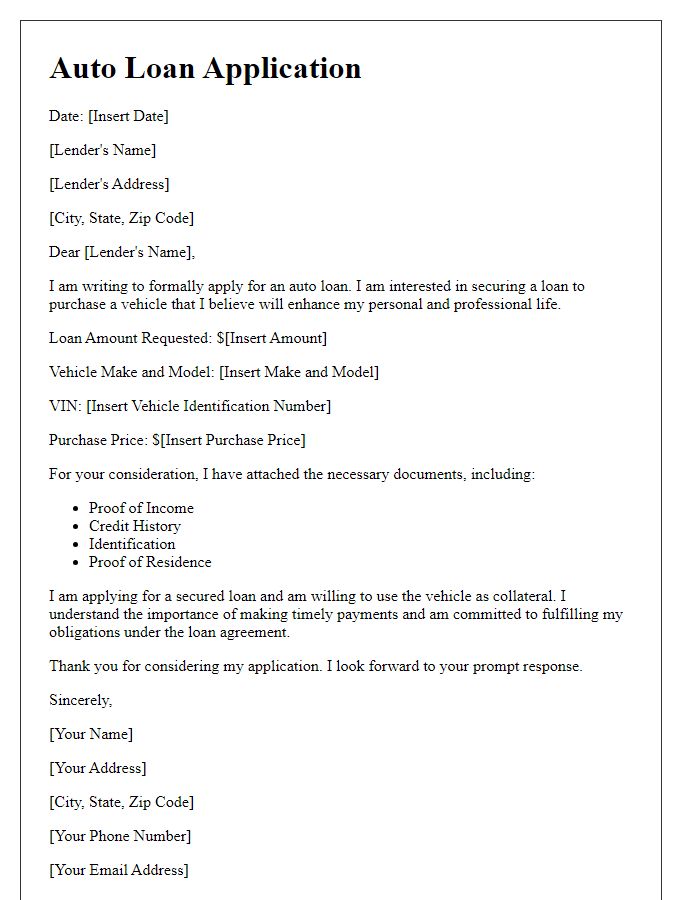

Loan Amount Requested

Individuals seeking an auto loan typically specify the requested loan amount, reflecting the vehicle's price, additional fees, and applicable taxes. The average loan amount for used cars generally ranges from $10,000 to $30,000, while new vehicles may cost between $25,000 and $50,000. Applicants need to consider their financial capabilities, as monthly repayments and interest rates can significantly impact budgets. Providing accurate financial information such as income details, current debts, and credit scores can enhance the chances of approval. Moreover, submitting a well-structured application detailing the desired loan amount is crucial for subsequent financial arrangements with institutions like banks or credit unions.

Employment and Income Details

Employment verification plays a crucial role in auto loan applications. Lenders typically require comprehensive details regarding employment status, including job title, company name (e.g., ABC Corporation), employment start date, and annual income (for instance, $60,000). Documentation such as recent pay stubs and W-2 forms serves as proof of income. Stability of employment is assessed, particularly in industries known for volatility, like retail or hospitality. Additionally, lenders may consider part-time employment or secondary income from side jobs (e.g., freelance work or rental income) to evaluate repayment capacity. Overall, robust employment and income details strengthen the application's credibility, increasing chances of approval.

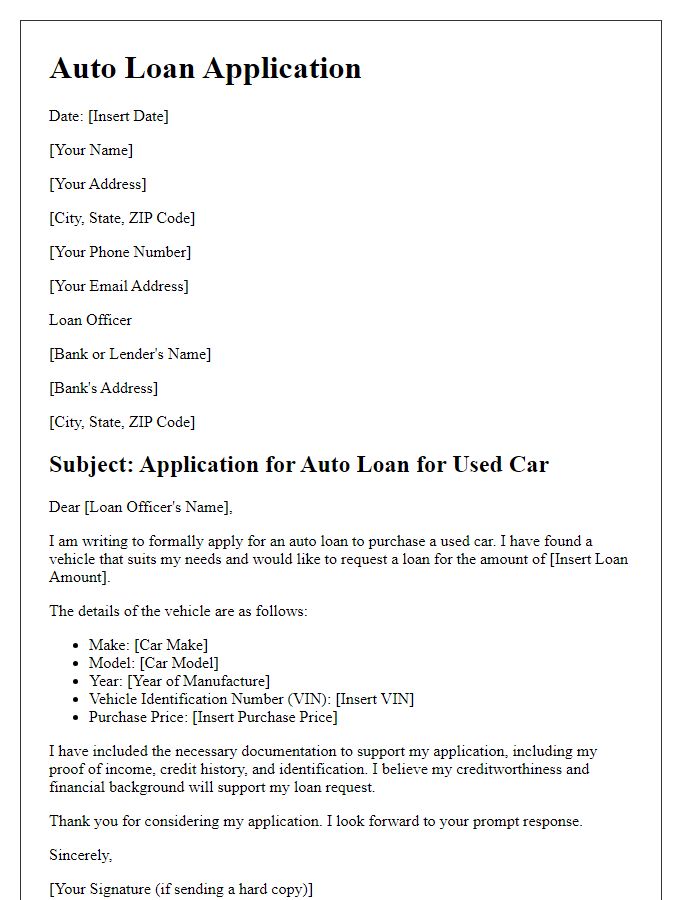

Vehicle Information

The vehicle information section of an auto loan application requires specific details to assess the loan request for financing a motor vehicle. Essential data includes the Vehicle Identification Number (VIN), a unique 17-character code identifying the specific vehicle, the make and model (such as Ford F-150 or Toyota Camry), the year of manufacture (ranging from 2000 to the current year), and the odometer reading (total distance driven in miles or kilometers, usually recorded at the time of the application). Additionally, the applicant must provide information about the vehicle's current market value, which can be influenced by factors such as mileage, condition, and regional demand. Including details about any existing warranties or service contracts may enhance the loan profile by showcasing the vehicle's reliability and potential resale value.

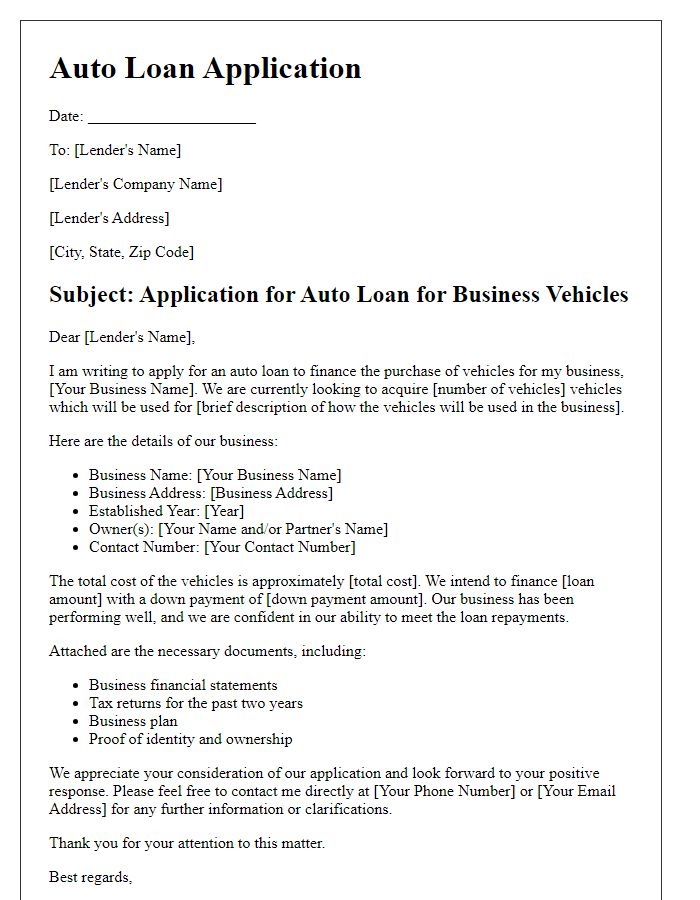

Terms and Conditions Agreement

The **Terms and Conditions Agreement** for auto loans specifies the contractual obligations between the borrower and the lender. The agreement outlines essential elements such as the loan amount, typically ranging from $5,000 to $100,000, interest rates, which can vary from 3% to 15% based on creditworthiness, and repayment duration, generally set between 36 to 72 months. Additionally, clauses regarding late payment penalties, which may incur fees up to $50, and prepayment options, allowing borrowers to pay off the loan early without incurring additional charges, are included. The agreement also details the collateral requirements, usually the vehicle itself, ensuring that the lender retains the right to repossess the asset in cases of default. Furthermore, terms regarding insurance, maintenance responsibilities, and potential additional fees for gap insurance or extended warranties are also specified, creating a comprehensive understanding of the financial commitment involved.

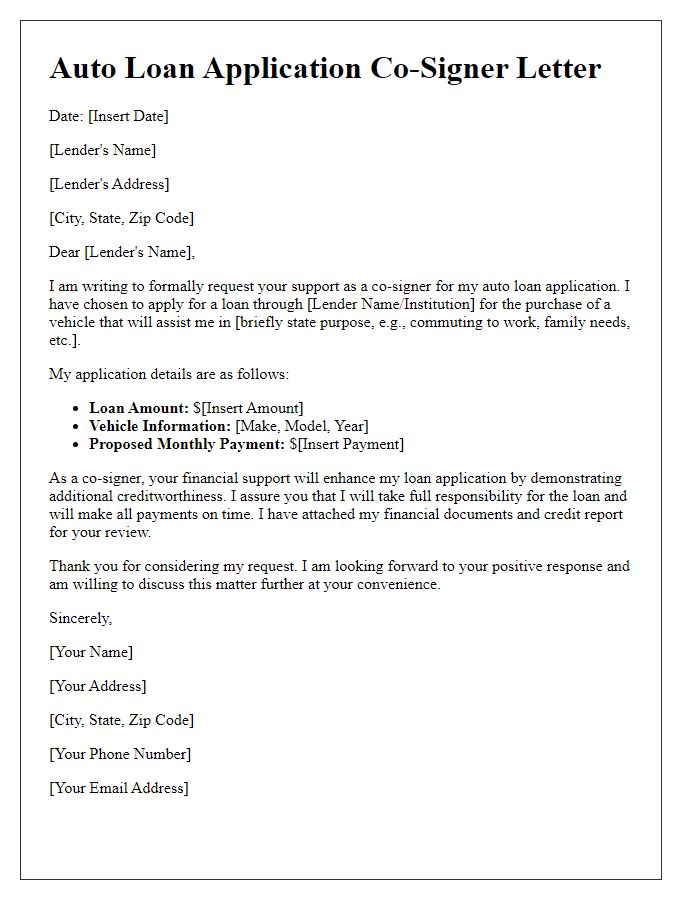

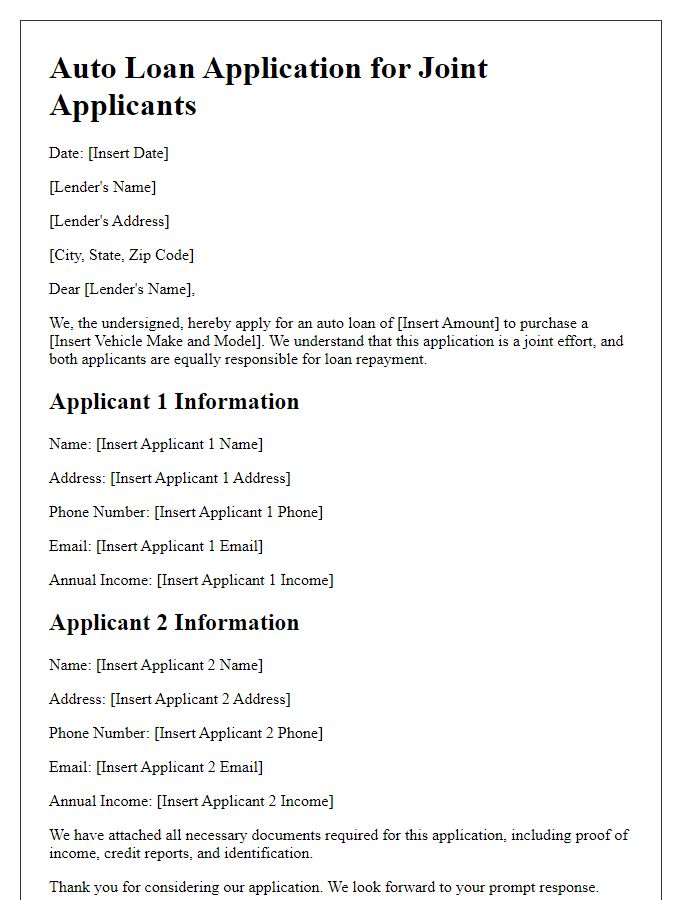

Letter Template For Auto Loan Application Samples

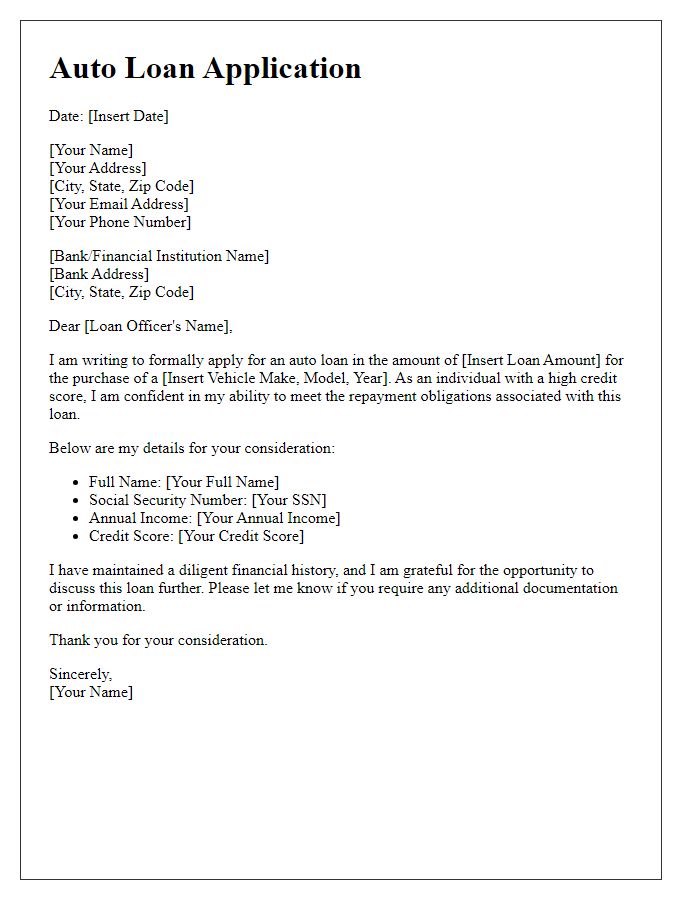

Letter template of auto loan application for high credit score individuals

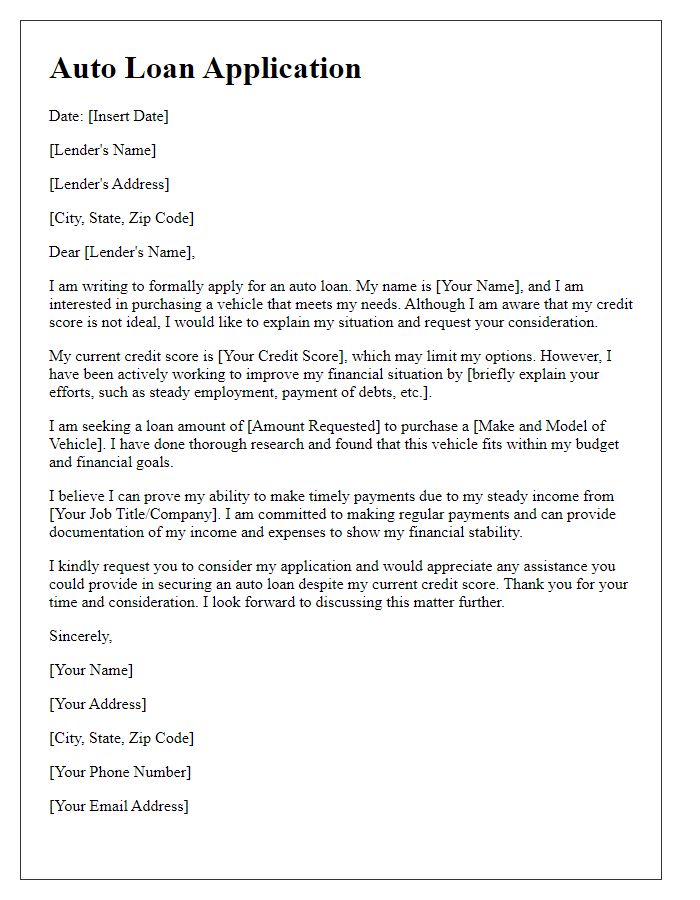

Letter template of auto loan application for low credit score individuals

Comments