Are you feeling overwhelmed by the loan application process? Don't worry; you're not alone! A thorough loan documentation checklist can simplify your journey and ensure you have everything you need at your fingertips. Ready to streamline your application and make the experience as stress-free as possible? Let's dive into the essential documents you'll need to gather!

Borrower and Lender Details

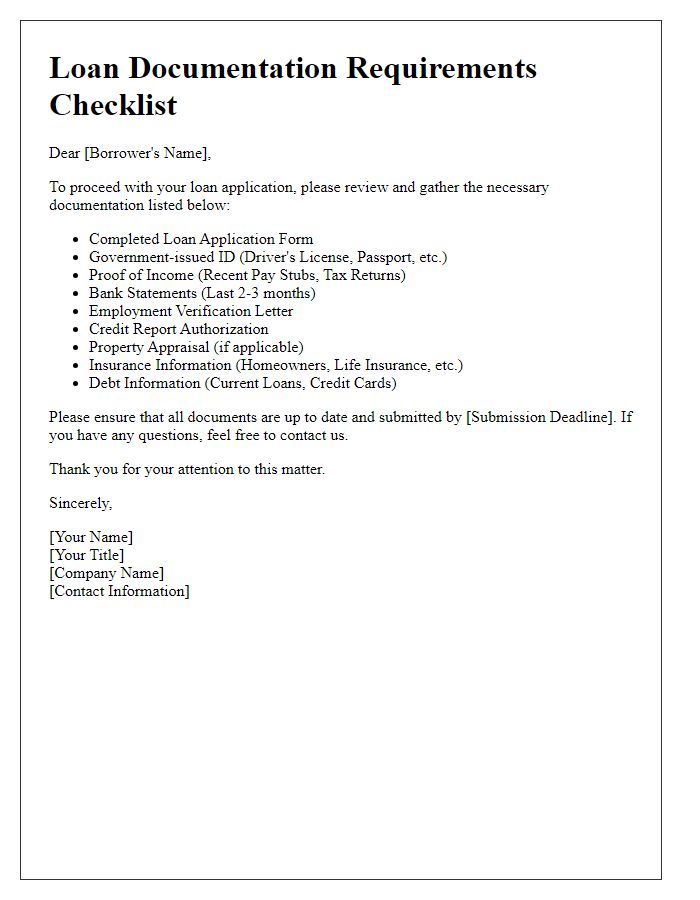

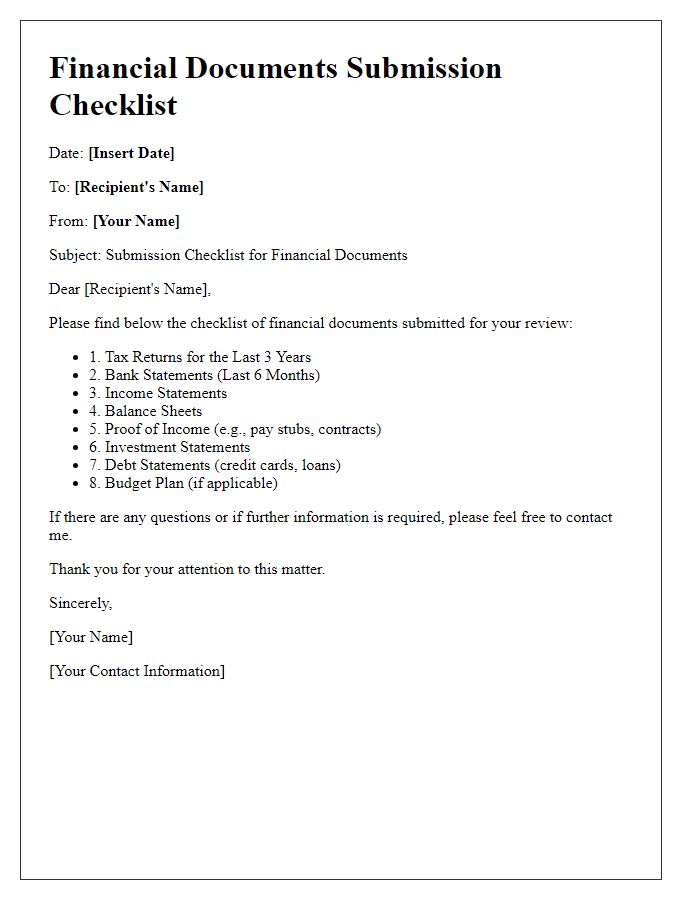

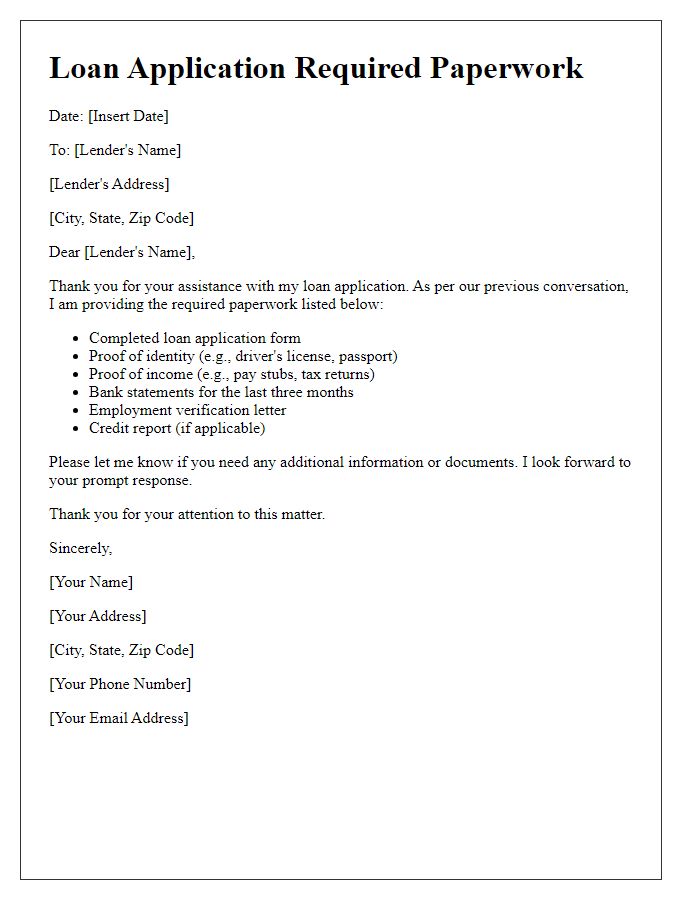

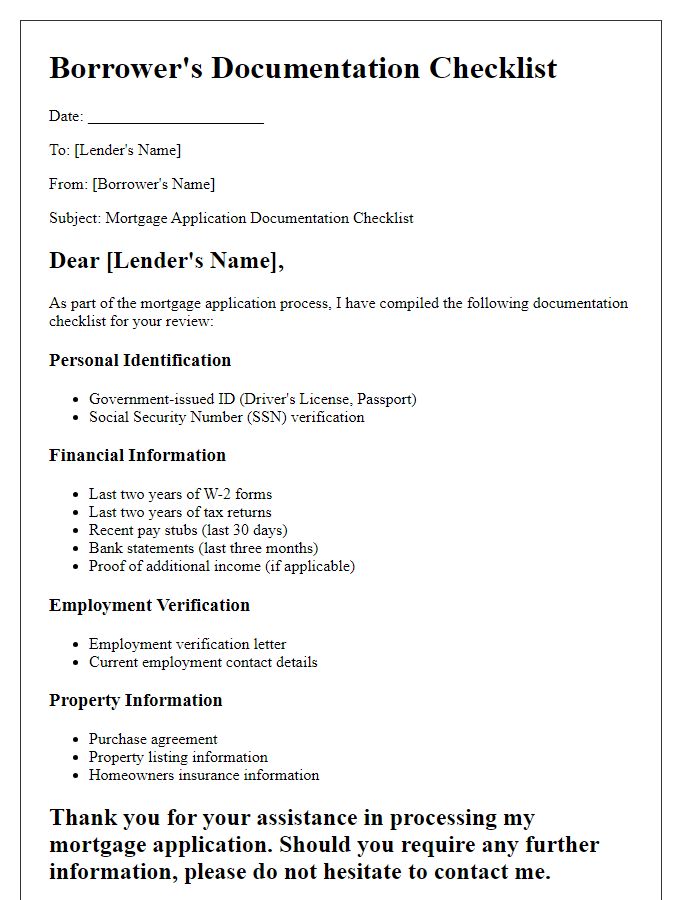

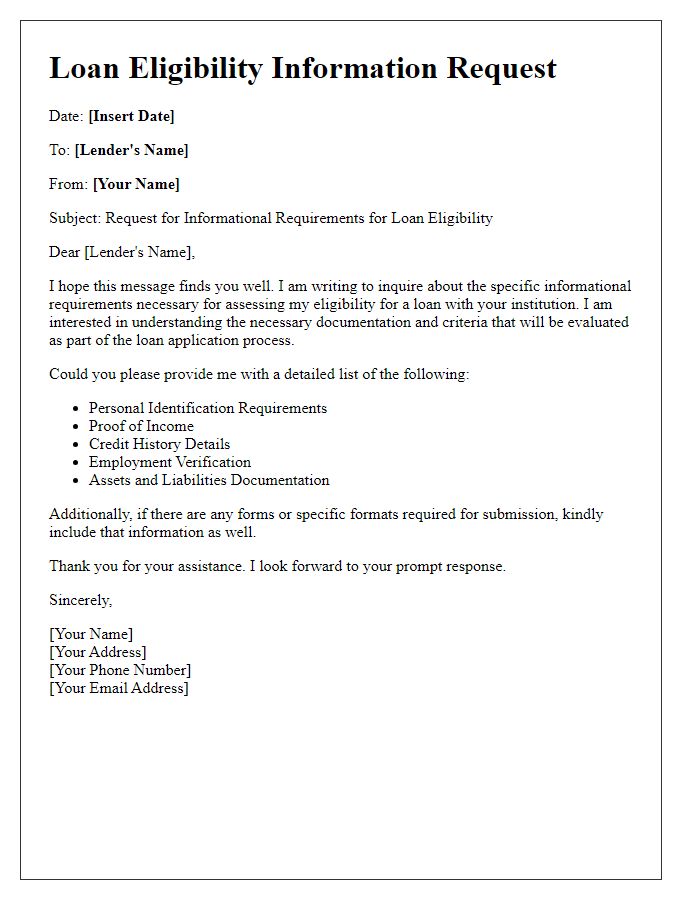

The loan documentation checklist must include critical borrower information, such as full name, contact number, address, and Social Security number for identification purposes. Lenders, typically financial institutions like banks or credit unions, require details about their organization, including the name, address, and contact information of the loan officer handling the application. Additionally, relevant loan details should encompass the type of loan (e.g., personal, mortgage), loan amount requested (numerical value like $50,000), interest rate specifics (fixed or variable), and payment terms (e.g., monthly installments over 30 years). Such documentation ensures both parties understand the obligations and benefits associated with the loan agreement.

Loan Amount and Terms

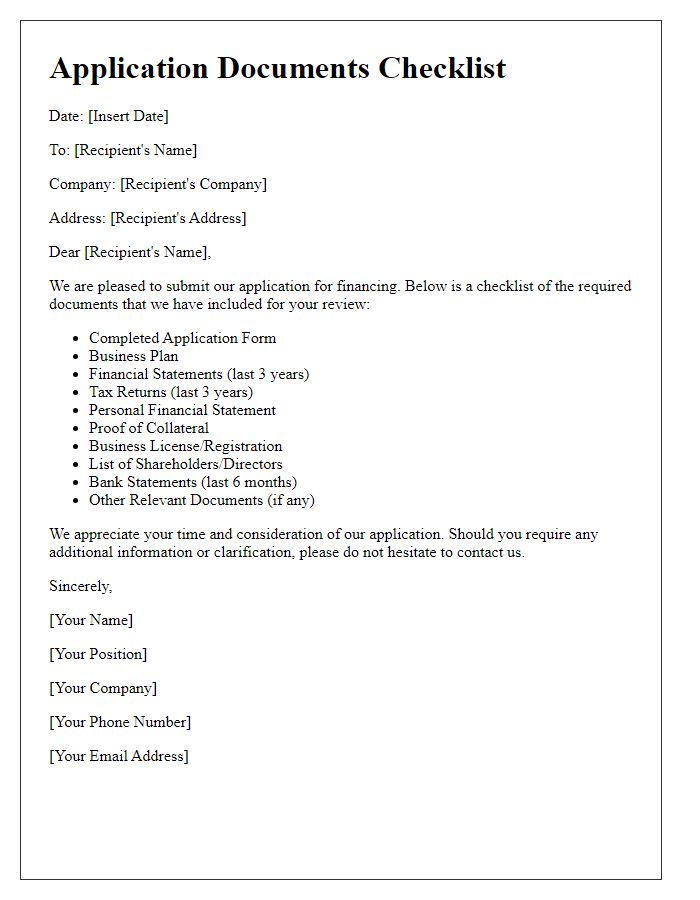

A loan documentation checklist is crucial for ensuring that all necessary information is prepared before applying for a loan. Key details include the loan amount specified in dollars, which represents the total sum being borrowed, and the terms of the loan, defining the duration in months or years, interest rate expressed as a percentage, and any applicable fees. Documentation must also cover repayment plans, detailing monthly payment amounts and due dates, alongside any conditions or stipulations that affect borrowing. Additionally, factors like collateral, which secures the loan, and the applicant's credit score, reflecting financial reliability, play significant roles in the approval process. Properly organized documentation streamlines the review process, increasing the likelihood of loan approval.

Repayment Schedule

A comprehensive repayment schedule is crucial for understanding loan repayment obligations. The schedule typically outlines the total loan amount (e.g., $50,000), interest rate (e.g., 5% annual), and loan term (e.g., 15 years). Each entry includes payment dates, monthly payment amounts (e.g., $395), and remaining balance after each payment. Additionally, it may specify the original loan date (e.g., January 1, 2023) and provide a breakdown of principal and interest for each payment. This information is essential for borrowers to manage their finances effectively and ensure timely payments, thus avoiding penalties and negative impacts on credit scores.

Security and Collateral Information

A loan documentation checklist related to security and collateral information is essential for lenders and borrowers to ensure clarity in the borrowing process. Key elements include, but are not limited to, property deeds, vehicle titles, and inventory lists detailing collateralized assets. Personal guarantees might be required from business owners, confirming their responsibility. Appraisals conducted by certified professionals can ascertain a fair market value of the collateral. Insurance policies should be up-to-date, protecting the lender's interests against potential losses. Additionally, liens and encumbrances should be clearly documented to reveal any existing claims against the collateralized assets, ensuring a comprehensive understanding of the borrower's financial responsibility.

Legal and Compliance Requirements

A loan documentation checklist must include essential legal and compliance requirements to ensure adherence to financial regulations. Documents such as the Uniform Residential Loan Application (Form 1003) are critical for gathering borrower information. Additionally, income verification documents, including pay stubs and tax returns, serve to confirm applicant fiscal stability, particularly the last two years' returns. Credit reports from agencies such as Experian, Equifax, and TransUnion assess borrower creditworthiness, influencing loan approval processes. Property appraisal reports, performed by certified appraisers, provide fair market value assessments, ensuring compliance with federal regulations like the Equal Credit Opportunity Act, which prohibits discriminatory lending practices. Lastly, the Good Faith Estimate outlines estimated loan costs, fostering transparency and regulatory compliance for borrowers.

Comments