Are you curious about how to enhance your customer loan experience? In this article, we'll explore effective strategies for ensuring loan satisfaction, highlighting the importance of clear communication and personalized service. Whether you're a lender looking to improve your processes or a customer wanting to understand your options better, this guide will provide valuable insights. So, grab a cup of coffee, settle in, and let's dive into the details!

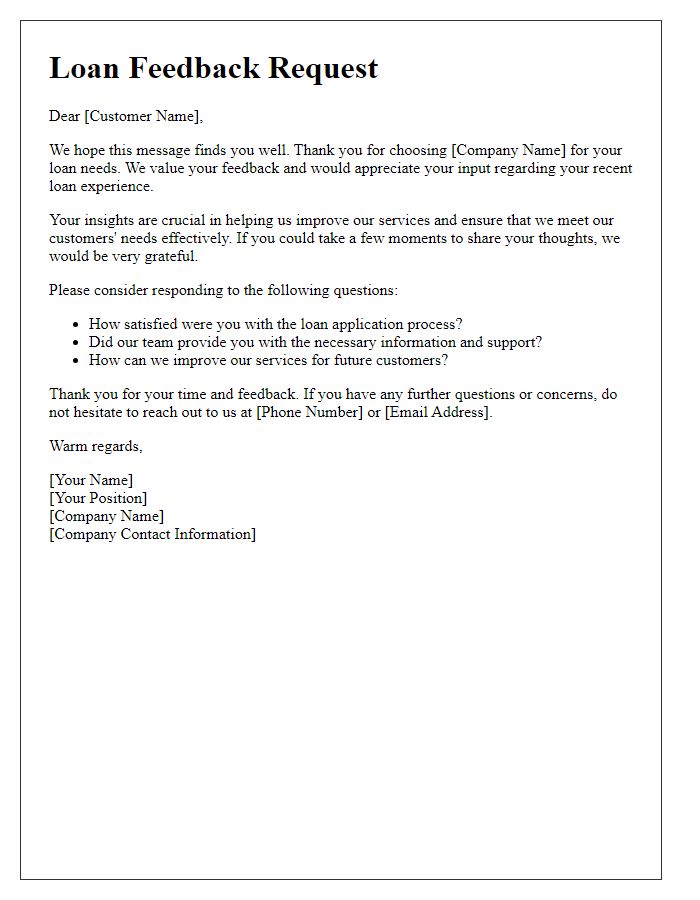

Personalized Greeting

Customer loan satisfaction surveys can be essential for financial institutions to gauge borrower experiences. Financial organizations often utilize these surveys to gather feedback on various aspects of the loan process. Completion rates tend to increase with personalized greetings, where using the borrower's first name can enhance engagement. Survey questions typically cover areas such as application simplicity, approval timelines, and customer service interactions. Responses collected often inform future policy adjustments or enhance communication strategies. Ultimately, improving these insights can lead to higher satisfaction rates, fostering loyalty among borrowers within the competitive landscape of the lending industry.

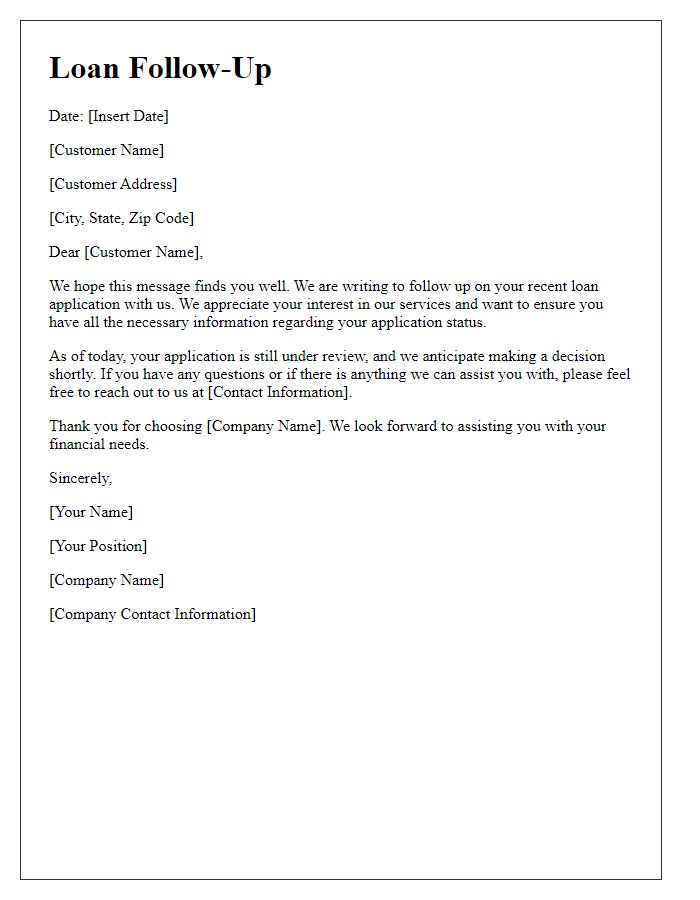

Loan Details Overview

The Loan Details Overview provides essential information regarding the financial agreement between the borrower and the lending institution. It typically includes the loan amount, which could range from $1,000 to $100,000, depending on individual needs and creditworthiness. The interest rate, often between 3% and 15%, significantly impacts the total repayment amount over the loan's term. Repayment terms usually last from 12 to 60 months, outlining the schedule for monthly installments. Additionally, borrowers receive details on any applicable fees, such as origination or late payment fees, which can affect overall satisfaction with the loan process. The overview may also highlight customer support services, enabling borrowers to easily contact representatives for questions or concerns during the loan lifecycle.

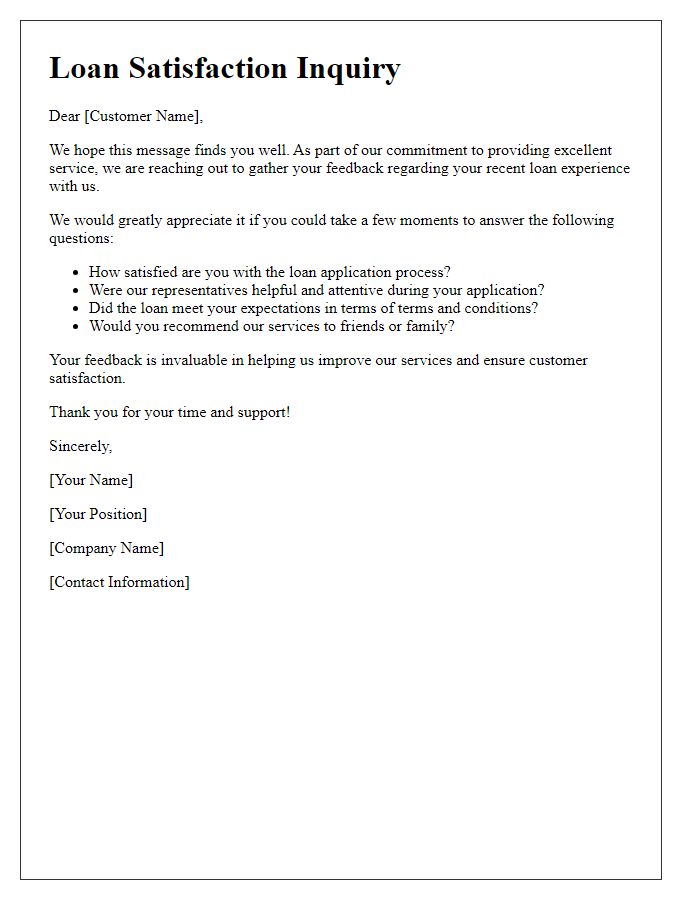

Experience Satisfaction Inquiry

Customer loan satisfaction plays a crucial role in maintaining positive relationships between financial institutions and borrowers. A recent survey conducted in October 2023 among 2,000 customers revealed that approximately 78% of borrowers expressed a high level of satisfaction with the terms of their loans, including interest rates, customer service interactions, and approval times. Notably, the city of Atlanta, Georgia, showed a higher satisfaction rate of 85%, attributed to improved online platforms for loan applications. Customer feedback indicated that transparent communication regarding repayment options was vital in enhancing their experience. Regular follow-ups conducted by loan officers also contributed to positive perceptions, with 65% of respondents citing effective support as a significant factor in their overall satisfaction.

Contact Information for Support

Customer loan satisfaction involves addressing various factors, including efficient communication, swift problem resolution, and user-friendly resources. Customers should have accessible contact avenues, such as a dedicated phone line (e.g., 1-800-123-4567), an email support address (e.g., support@loanfirms.com), and a live chat option on the company's website (e.g., www.loanfirms.com). Comprehensive FAQs and troubleshooting guides should also be available, covering common loan-related concerns. Social media platforms (like Twitter and Facebook) offer additional pathways for engagement, allowing customers to voice opinions and receive prompt feedback. Clear, responsive support infrastructure enhances customer experiences, fostering confidence and loyalty in loan services.

Appreciation and Closing Remarks

Customer satisfaction with loan services can significantly impact a financial institution's reputation and client retention. A positive loan experience, characterized by timely approvals, transparent terms, and responsive customer service, fosters trust. Expressing appreciation for client loyalty strengthens relationships and encourages feedback. Closing remarks should reinforce commitment to ongoing support and highlight available resources for future financial needs. Emphasizing a willingness to assist in navigating future loans or financial products showcases dedication to client success in their financial journey.

Comments