Are you feeling the pinch of rising loan interest rates? You're not aloneâmany borrowers are seeking ways to ease their financial burdens. Negotiating a lower interest rate on your loan can be a challenging yet rewarding process. If you're wondering how to get started, keep reading for useful tips and strategies that can help you secure a better deal!

Clear Purpose Statement

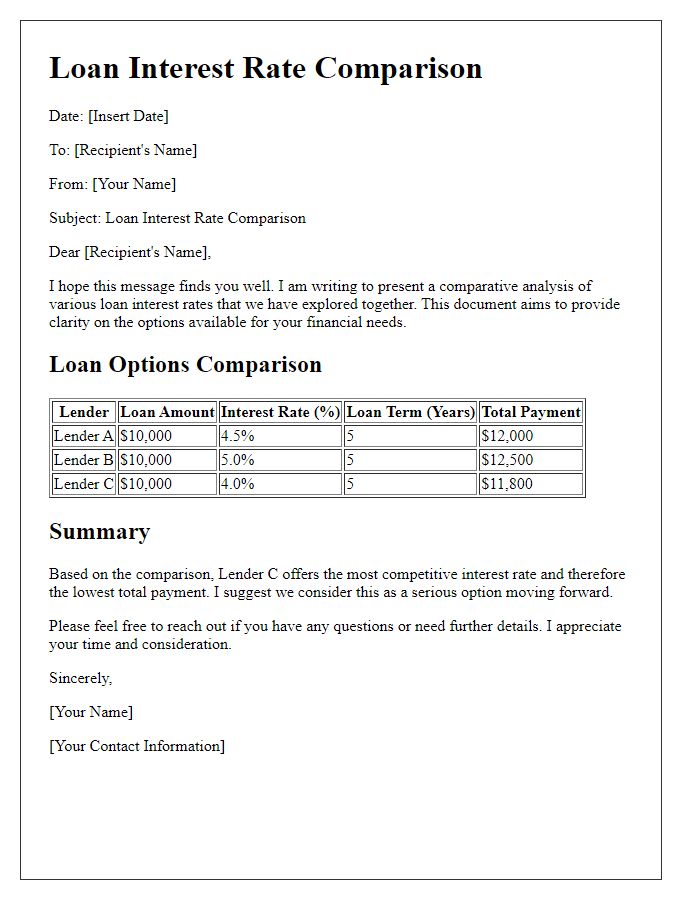

Negotiating loan interest rates can significantly impact financial obligations, especially for borrowers with loan amounts exceeding $20,000. High interest rates (often above 5% for personal loans) can lead to increased monthly payments, straining budgets. By clearly stating the purpose of the negotiation, borrowers can communicate intentions effectively, fostering a constructive dialogue with lenders. Accurate financial documentation, such as income verification and credit scores, can support the request for lower rates, while market comparisons revealing lower rates from competing lenders (potentially between 3% to 4%) may bolster the case. Demonstrating a solid repayment history (e.g., no late payments over the past year) can enhance the likelihood of achieving favorable terms.

Financial Overview

Negotiating loan interest rates requires a clear understanding of your financial overview. Start by compiling essential financial documents, including recent tax returns (for the last two years), income statements outlining your current income sources--such as employment wages, rental income, or dividends--and a comprehensive list of existing debts detailing outstanding balances, monthly payments, and interest rates. Assess your credit score, typically ranging from 300 to 850, as a higher score can significantly impact your negotiation power. Create a budget reflecting your monthly expenses, including housing costs, utilities, groceries, and discretionary spending, to demonstrate your financial capability to lenders. Consider market conditions by researching current interest rates from reputable sources like the Federal Reserve or financial news reports, as this information can strengthen your position during negotiations.

Justification for Request

Negotiating loan interest rates can be crucial for financial well-being. When seeking a reduced interest rate on a loan, individuals should prepare compelling justifications rooted in their financial history. Acknowledging timely payments over the past five years showcases reliability, while an increase in credit score (e.g., rising from 650 to 720) demonstrates improved creditworthiness. Mentioning the current market interest rates, which might have decreased (several points below previous rates), provides a solid foundation for the request. Furthermore, highlighting changes in personal circumstances, such as a higher stable income or a new job position at a reputable company, reinforces the argument for a lower interest rate. Ultimately, presenting a comprehensive case, backed by factual data and specific timelines, can enhance the chances of successful negotiations with lenders.

Proposed Terms

Negotiating loan interest rates is crucial for borrowers seeking more favorable repayment terms. Interest rates significantly affect the overall cost of loans, impacting monthly payments and total repayment amounts. For example, a 5% interest rate on a $100,000 loan over 30 years results in approximately $193,000 paid back, while a 4% rate decreases the total to about $177,000. Borrowers should consider factors such as their credit score, market conditions, and the lender's policies while proposing new terms. Highlighting consistent repayment history, loan refinancing opportunities, and competitiveness in prevailing interest rates can strengthen the negotiation position. Providing documentation of improved financial status or lower risk profiles may also persuade lenders to reconsider interest terms.

Polite Closing and Follow-up

Negotiating loan interest rates can greatly impact overall financial health. Clear communication with financial institutions, like banks (such as Bank of America or Wells Fargo), is essential. A well-crafted closing statement, expressing gratitude for their consideration and reaffirming commitment to maintaining a good relationship, fosters goodwill. Following up within one week of sending the request ensures that your proposal is on their radar. Documenting communication dates, responses, and outcomes helps track progress related to your negotiation efforts. This structured approach often leads to better interest rates, positively influencing monthly payments and total loan cost.

Comments