Are you feeling overwhelmed by your current loan repayment schedule and wondering if there's a way to ease that burden? You're not aloneâmany people seek assistance when financial challenges arise, and understanding your options is crucial. A loan repayment extension can provide you with some much-needed relief, allowing you to regain your financial footing without added stress. If you're interested in learning more about how to draft a compelling letter for your request, keep reading!

Polite and respectful language

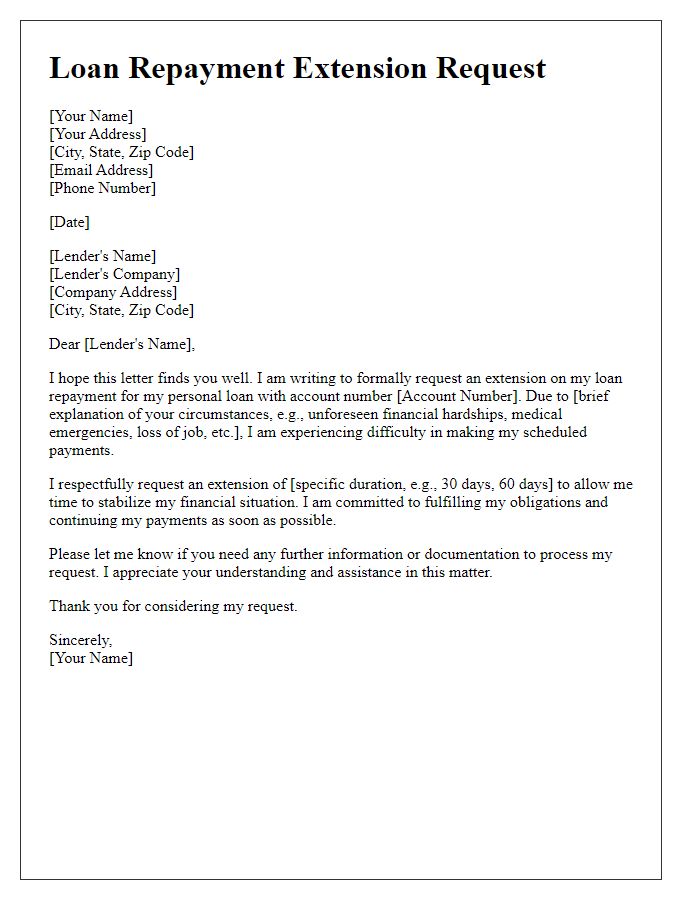

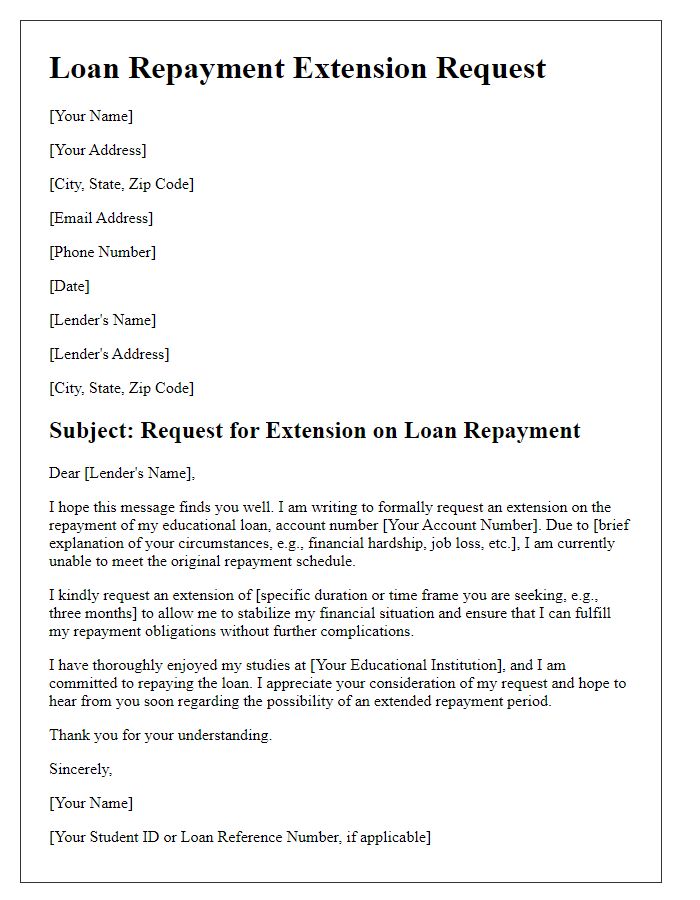

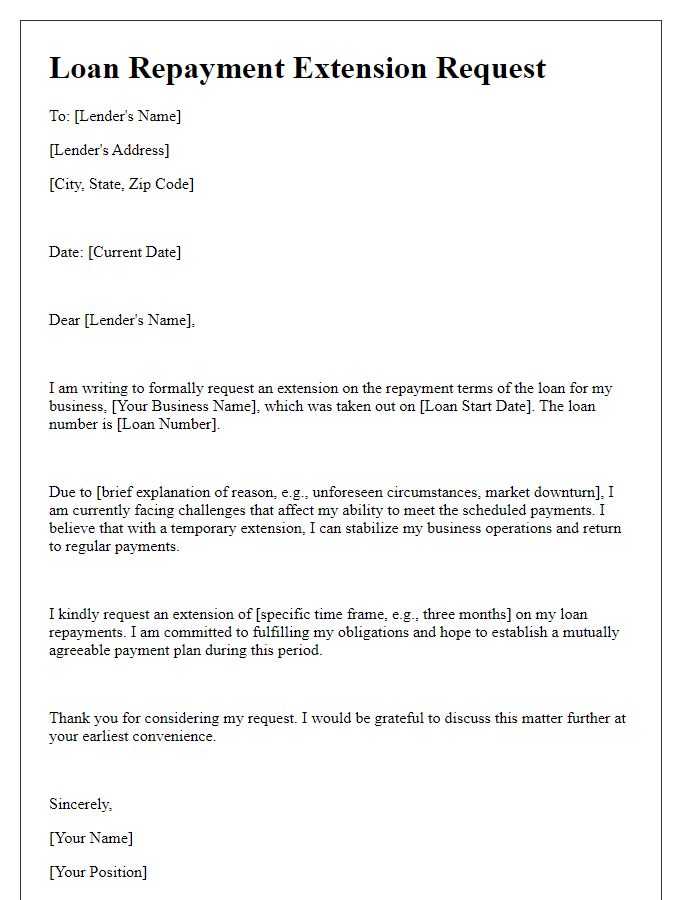

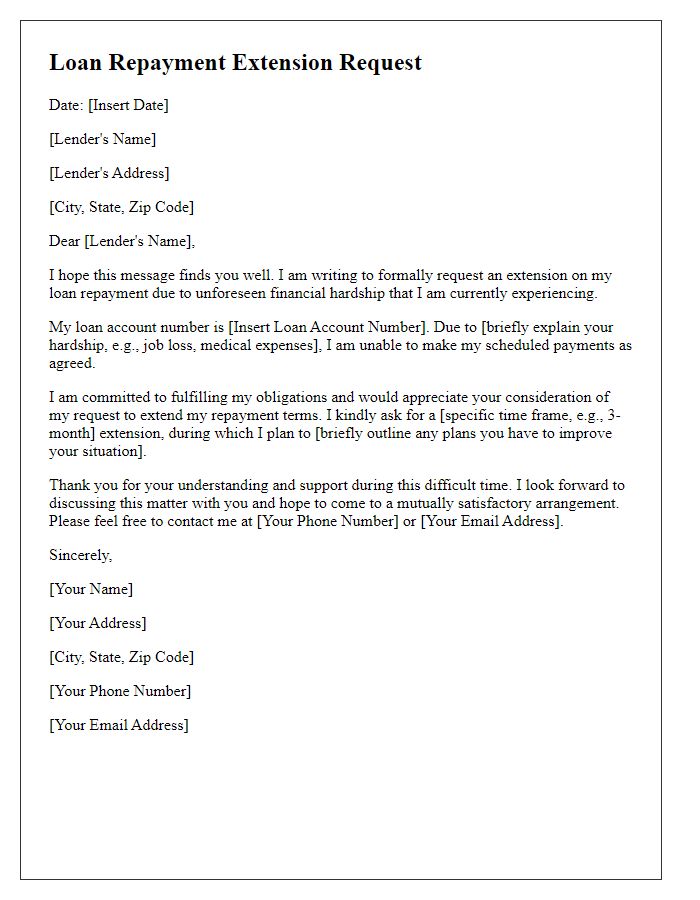

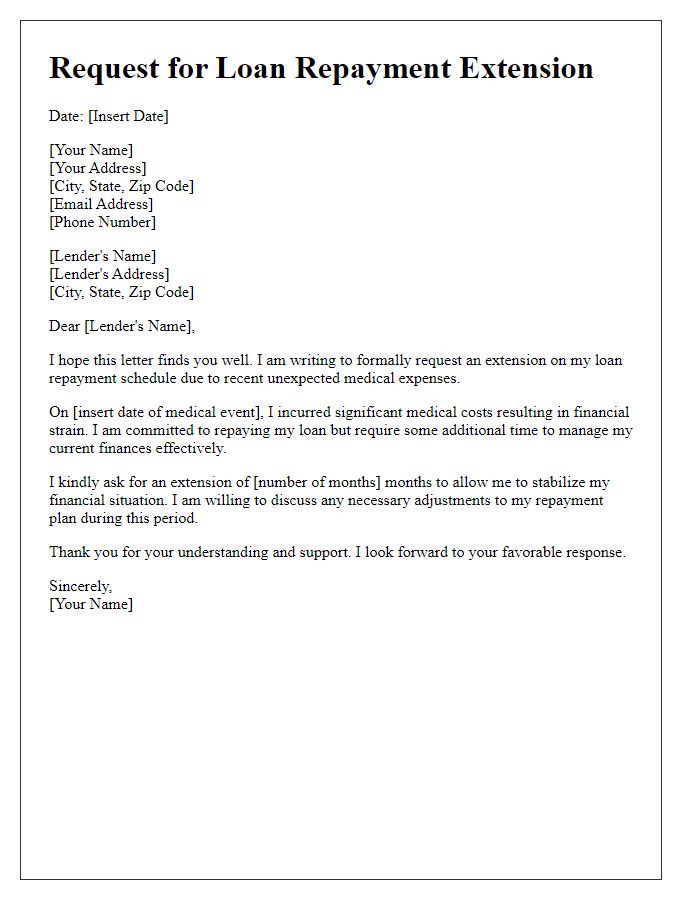

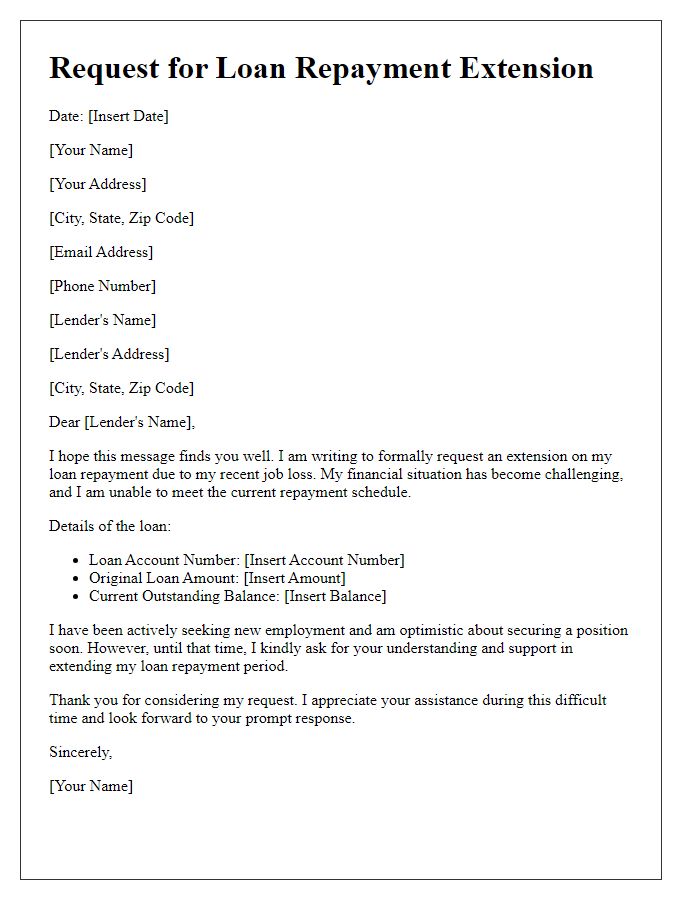

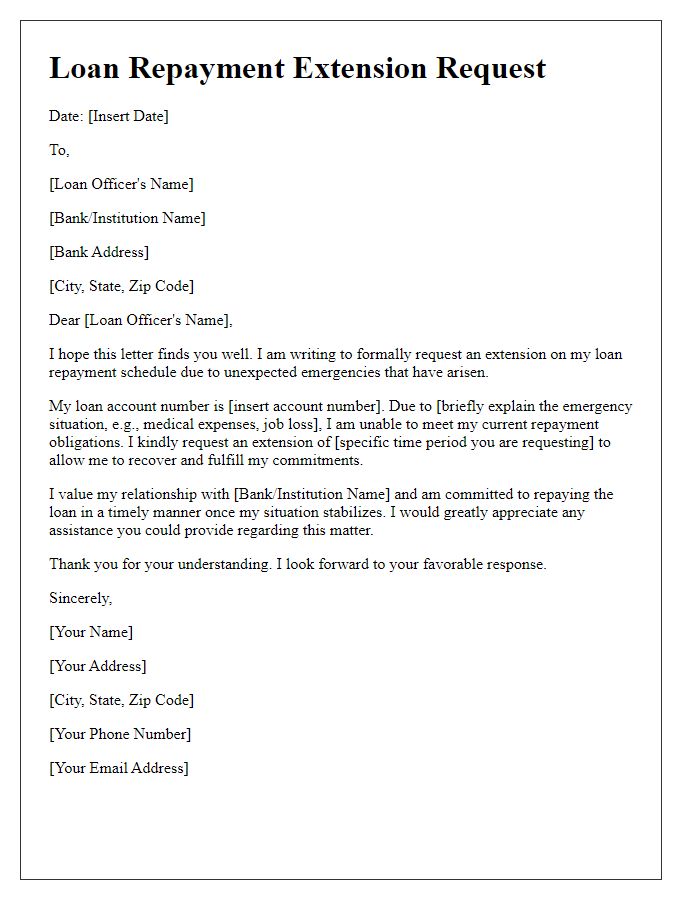

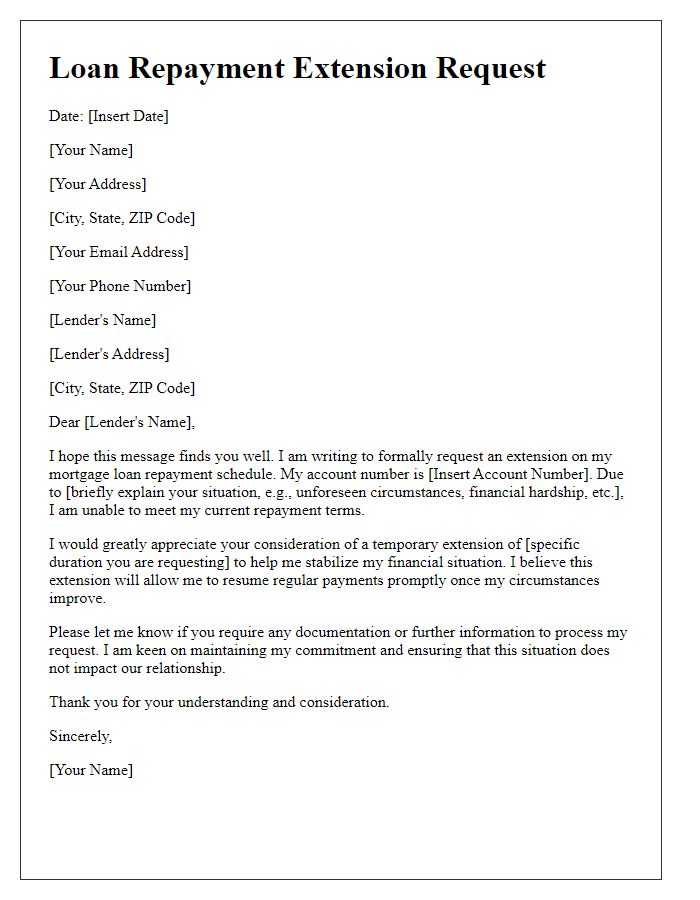

Navigating the financial landscape requires clear communication, particularly when seeking extensions on loan repayments. Borrowers often face unforeseen circumstances, such as medical emergencies or job loss, that hinder timely payments. Crafting a request for extension necessitates a concise explanation of the situation, emphasizing commitment to honoring the loan obligations. Including specific details, such as the loan account number and proposed new repayment dates, demonstrates intent to maintain transparency. It is vital to express appreciation for the lender's understanding and willingness to help, fostering a collaborative relationship. Ultimately, a respectful tone and sincere acknowledgment of the lender's support can enhance the chances of a favorable response.

Reason for extension request

Requesting a loan repayment extension often arises from unexpected financial difficulties faced by borrowers. Situations such as job loss, medical emergencies, or significant home repairs can create cash flow challenges. For instance, an individual may lose their job in a bustling city like New York, resulting in a temporary inability to meet monthly obligations. A medical emergency might arise, incurring unexpected expenses that strain the budget; for example, hospital bills after an accident can be substantial. Home repairs, like a roof replacement in an older neighborhood can also add financial strain. In these cases, extending the loan repayment period can provide the borrower with necessary relief, allowing time to regain financial stability without facing penalties.

Proposed repayment plan

When requesting a loan repayment extension, it is essential to outline a proposed repayment plan that demonstrates financial responsibility and commitment. A structured proposal should include the total loan amount, which is often in thousands of dollars, the current interest rate (for instance, 5% annually), and the original repayment term (e.g., 36 months). Clearly state the reasons for the extension request, such as unexpected medical expenses or a temporary job loss. Offer a feasible new repayment schedule, detailing monthly payments over the proposed extended term, like extending the term to 48 months for better cash flow. Additionally, emphasize any steps taken to stabilize finances, such as seeking additional employment or reducing monthly expenses, which indicate readiness to honor the loan commitment.

Financial situation explanation

Due to unforeseen circumstances, my financial situation has recently changed significantly. An unexpected medical emergency in January 2023 led to substantial medical expenses, which strained my budget. Additionally, my employer implemented layoffs in March 2023, causing a temporary loss of income. These events have made it challenging to meet my current loan repayment obligations. I have taken proactive steps to address my financial situation, including seeking alternative employment and reducing monthly expenses. However, I am requesting a loan repayment extension to provide me with the necessary time to stabilize my financial position and fulfill my obligations.

Assurance of commitment to repay

In the context of seeking a loan repayment extension, it is crucial to express a strong assurance of commitment towards fulfilling financial obligations. Financial institutions often prioritize borrowers who demonstrate reliability and intention to repay. Highlighting specific figures such as the original loan amount, outstanding balance, and proposed duration for the extension can strengthen the request. Additionally, detailing any unforeseen circumstances, like job loss or medical emergencies, that impacted the ability to meet repayment schedules can provide context. Reinforcing the intention to resume regular payments post-extension, along with a proposed repayment plan, showcases diligence and responsibility. This approach ensures that you maintain a positive relationship with the lending institution and highlights an earnest effort to meet financial responsibilities.

Letter Template For Loan Repayment Extension Samples

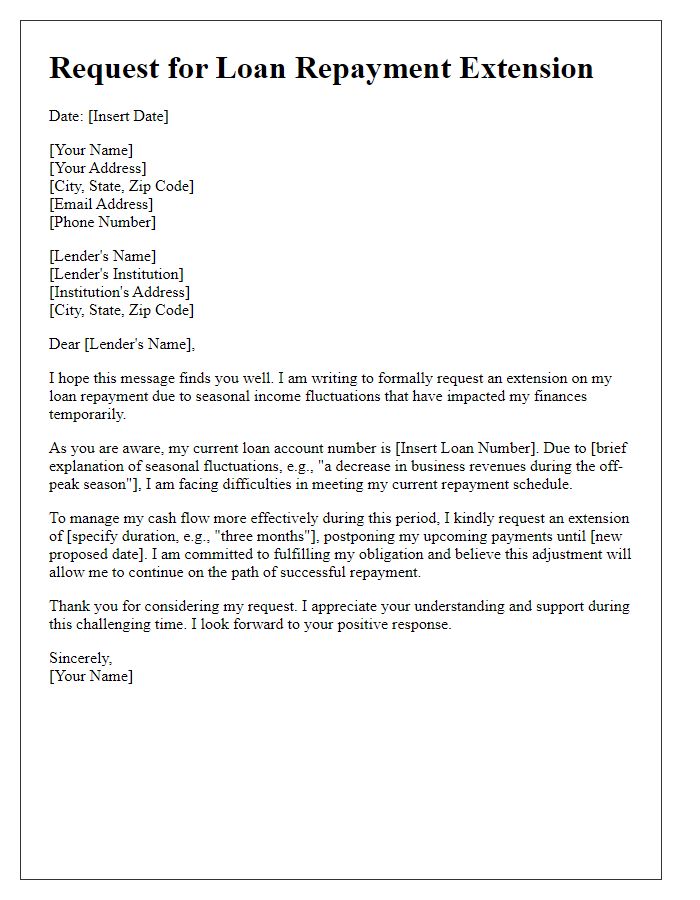

Letter template of loan repayment extension for seasonal income fluctuations.

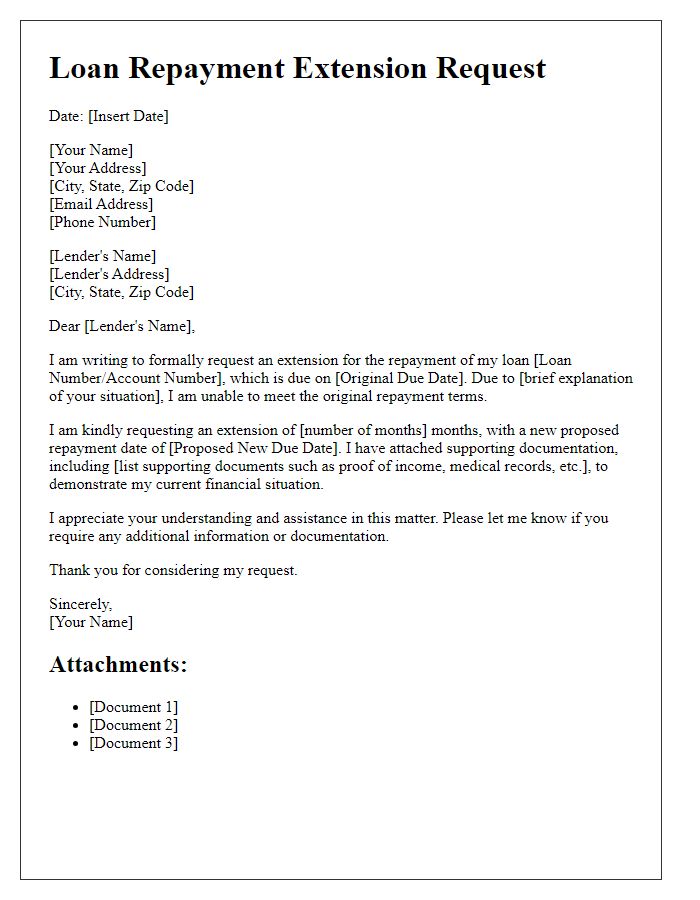

Letter template of loan repayment extension request with supporting documents.

Comments