Are you looking for a way to structure your bridging loan repayment letter? A well-crafted letter can make all the difference in communicating your intentions to your lender. In this article, we'll guide you through the essential components of a repayment letter, ensuring clarity and professionalism in your correspondence. So, if you're ready to take control of your financial agreements, read on for expert tips and a comprehensive letter template!

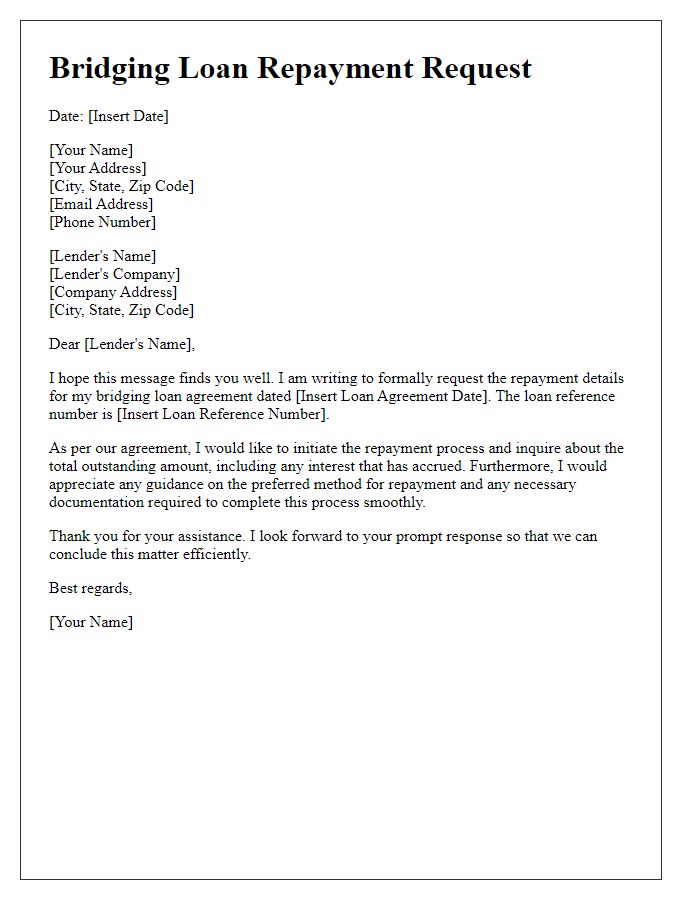

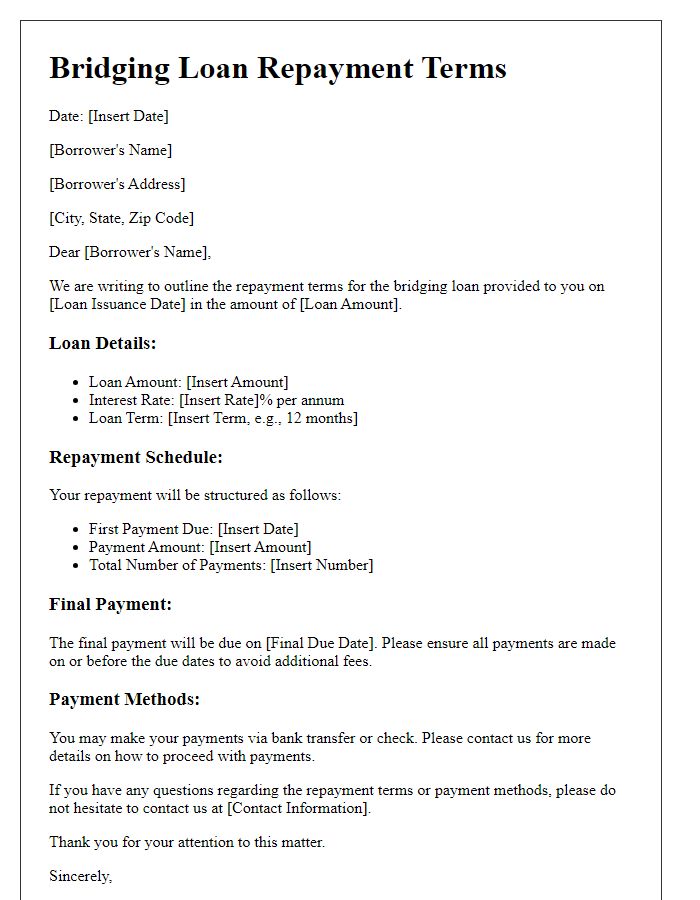

Personal and Loan Information

The bridging loan agreement, typically involving temporary financial assistance, outlines essential details such as the principal amount and repayment schedule. For example, a borrower may receive a bridging loan of $150,000 from a lender for a duration of 12 months to facilitate a property purchase in London, while awaiting the sale of an existing property. Monthly repayments might be structured to fit within the borrower's financial capabilities, ensuring seamless transition during this interim period. Interest rates, often higher than traditional loans, could average around 7%, impacting overall financial planning. Timely repayments are crucial to avoid penalties and maintain a positive credit history.

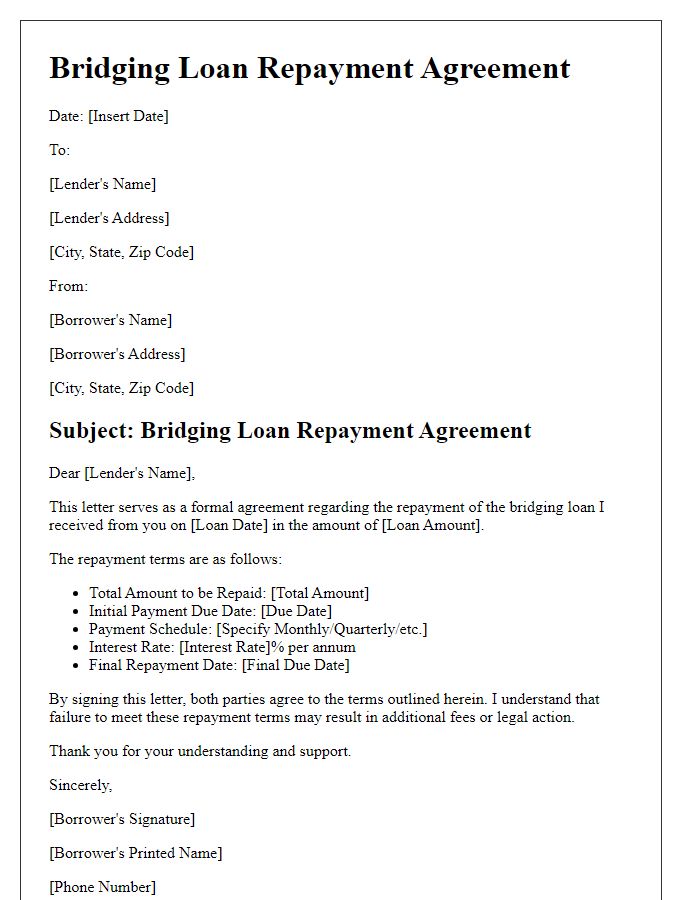

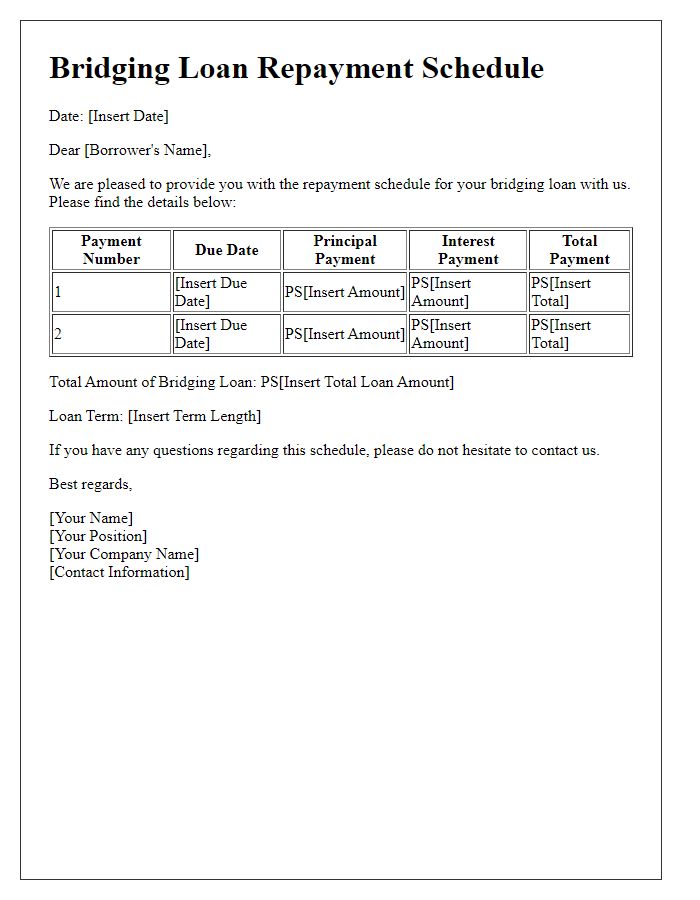

Repayment Amount and Schedule

Bridging loans, typically utilized in real estate transactions, provide short-term financing to bridge the gap between the sale of one property and the purchase of another. The repayment amount is determined by the loan's principal plus accrued interest, usually calculated based on a percentage rate around 1-2% per month. The repayment schedule often spans 6 to 18 months, allowing borrowers flexibility while averting penalties. It is crucial for borrowers to remain aware of their specific lender's terms regarding balloon payments or early repayments, which can significantly influence overall interest paid. Missing scheduled payments may result in additional fees and impact credit scores, underlining the importance of adhering to agreed timelines.

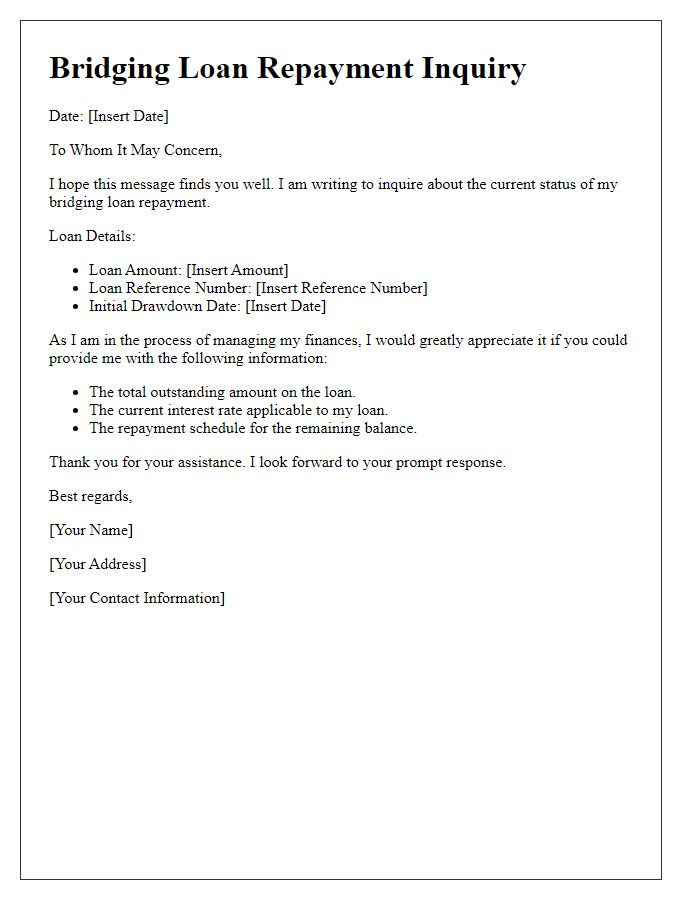

Payment Method and Instructions

A bridging loan, typically employed for real estate transactions, requires specific repayment methods to ensure timely fulfillment of financial obligations. Repayment can be executed through various methods including bank transfers, checks, or online payment systems, contingent upon the lender's accepted practices. Clear instructions detailing payment amounts, due dates, and account information are critical. Borrowers must include their loan reference number to ensure accurate processing. Failure to adhere to these guidelines may lead to penalties or interest accrual on outstanding balances, necessitating clarity in payment documentation. Timely repayment helps maintain good credit standing and facilitates future lending opportunities.

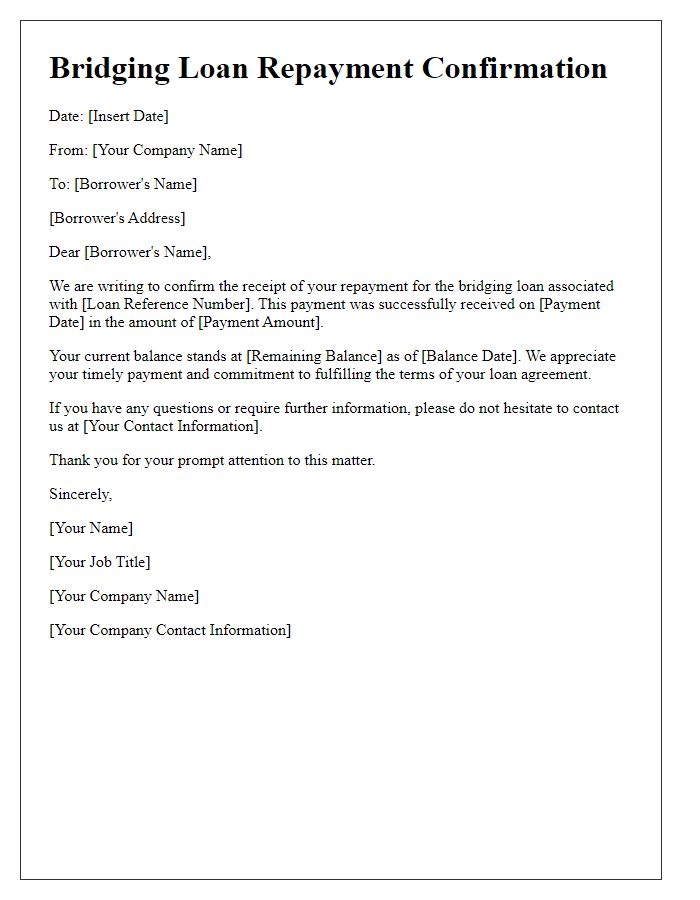

Communication Channels

Communication channels for bridging loan repayment encompass various methods used to facilitate effective interaction between lenders and borrowers during the repayment process. Essential channels include emails, which may contain loan statements, terms, and payment schedules; phone calls, allowing for immediate inquiries regarding payment processes; and online banking platforms offering real-time access to account balances and transaction history. In addition, mobile applications can provide notifications on due dates and reminders for upcoming payments, enhancing user experience. Physical meetings in lender offices may also help address more complex queries requiring personalized attention, reinforcing the connection between financial institutions and clients. Furthermore, customer support services often include chatbots and live assistance available through lender websites, responding to borrower concerns around the clock.

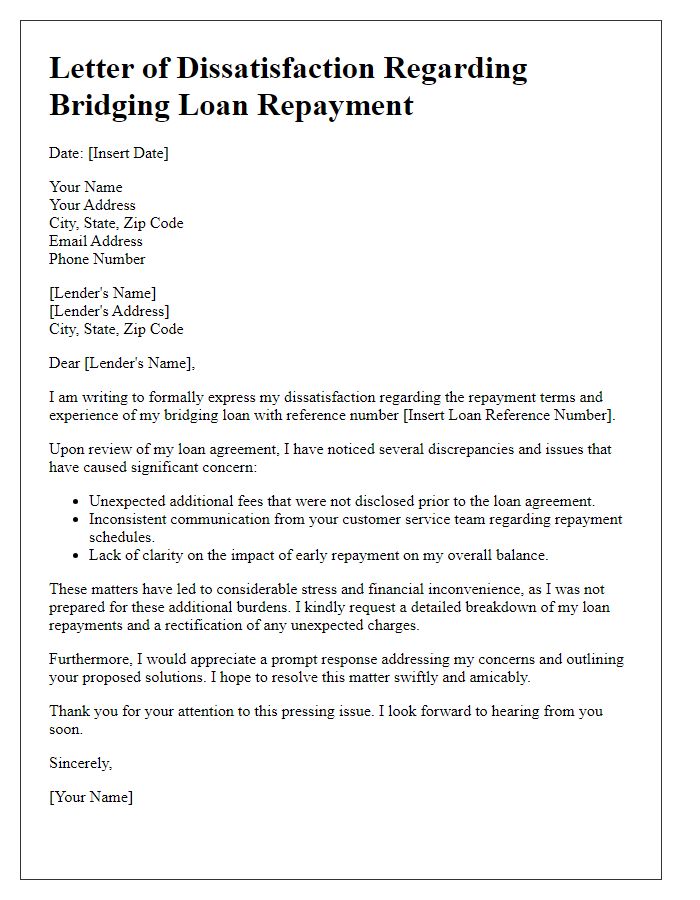

Acknowledgement and Confirmation Request

A bridging loan repayment serves as a critical financial obligation undertaken by borrowers, often utilized in real estate transactions where immediate funding is necessary. This type of short-term loan, typically lasting from a few weeks to a couple of years, assists homeowners or investors in securing a new property while awaiting the sale of an existing one. The repayment confirmation request, sent to the lending institution, often includes vital details such as the loan number (e.g., BL123456) and repayment amount, which may encompass both principal and interest. It is also essential to specify the payment method--such as bank transfer or check--along with the due date of the installment (e.g., October 15, 2023), ensuring a clear acknowledgment of the financial transaction and maintaining accurate records for both parties involved.

Comments