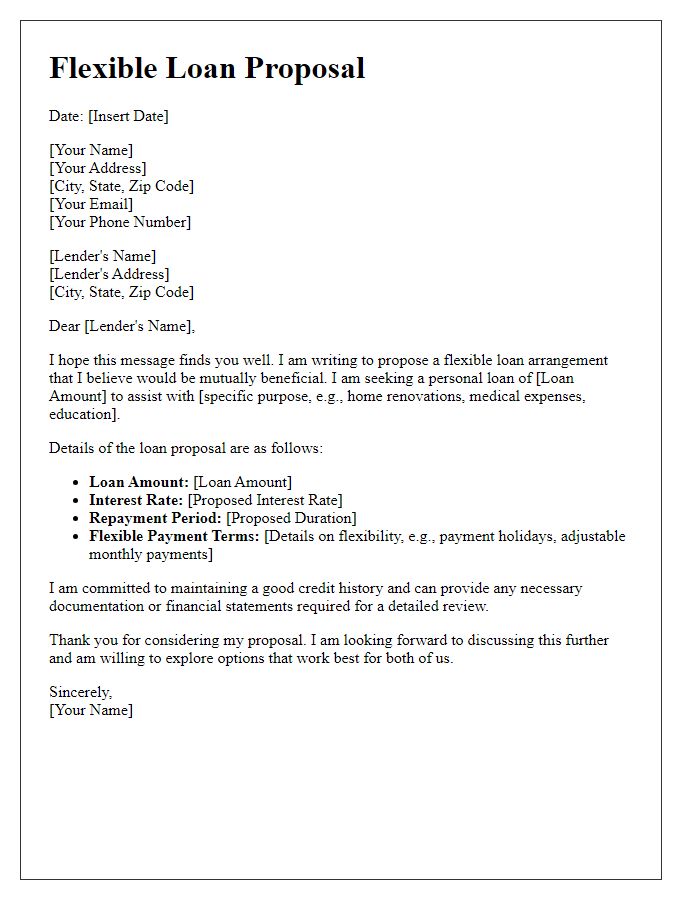

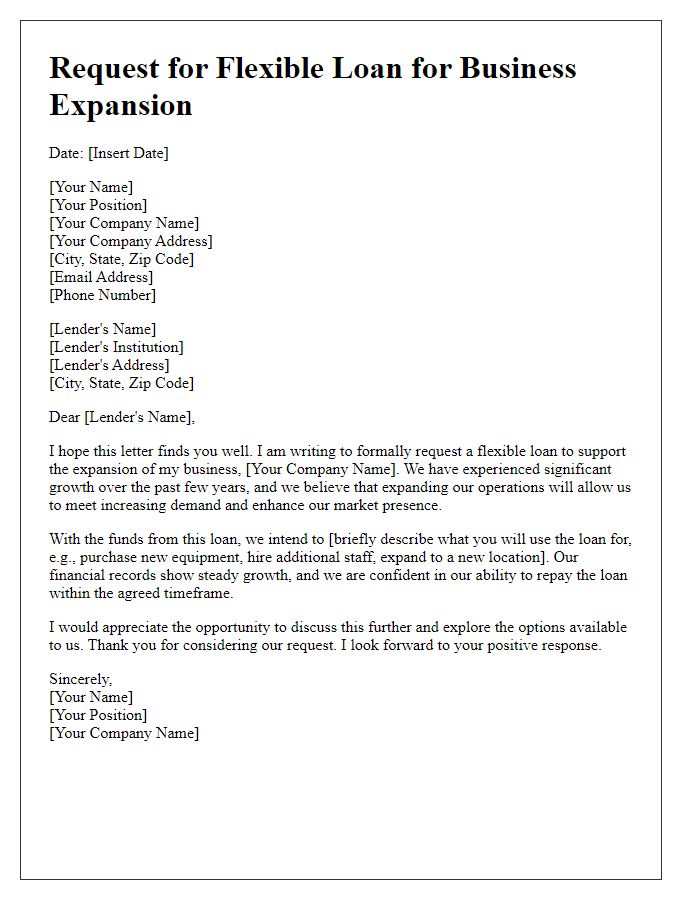

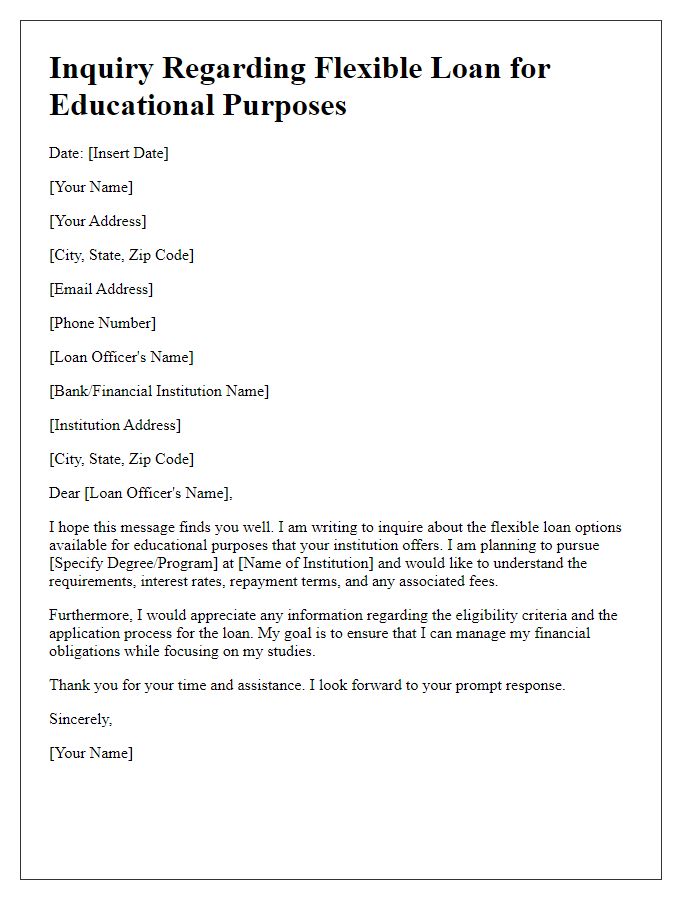

Are you considering a flexible loan arrangement but unsure where to start? You're not alone; many people find themselves in need of financial assistance that adapts to their unique situation. In this article, we'll explore essential tips and a sample letter template that can help you communicate your needs effectively with lenders. So, let's dive in and discover how to make your flexible loan request stand out!

Loan Amount and Purpose

The flexible loan arrangement for a personal budget may include various amounts, typically ranging from $1,000 to $50,000, catering to diverse financial needs. Purposes often span across significant life events such as home renovations, medical emergencies, or education expenses. Each loan comes with tailored terms reflecting repayment capabilities, considering factors like the applicant's credit score and income level, ensuring accessibility for individuals seeking financial support. Adjustable interest rates, based on prevailing market conditions, can influence overall costs over the loan's duration, which may extend up to five years or more. Overall, these arrangements aim to provide borrowers with manageable solutions while addressing their specific financial goals.

Repayment Schedule and Terms

Flexible loan arrangements provide borrowers with tailored repayment schedules designed to accommodate their financial situations. These schedules can vary significantly across different lending institutions, influenced by factors such as the loan amount, interest rates, and repayment duration. For example, a borrower who takes out a $10,000 flexible loan at a 5% annual interest rate may have the option to repay over a period of 3 to 10 years, with monthly payments that could adjust based on income fluctuations. Key performance indicators, like the loan-to-value ratio, are crucial for assessing loan eligibility and terms. Borrowers might also benefit from grace periods or options for refinancing should their financial conditions change. Moreover, penalties for early repayment can vary, with some lenders offering incentives for borrowers to pay off loans sooner. Understanding these terms is essential for effective financial planning and management.

Interest Rates and Fees

Flexible loan arrangements often involve varying interest rates and additional fees that can impact overall borrowing costs. Typically, interest rates may range from 3% to 8%, depending on the borrower's credit score and the lender's terms. Loan origination fees can be anywhere from 0.5% to 2% of the total loan amount, influencing the initial borrowing budget. Borrowers should be aware of potential fees for late repayments, which can add up to $50 or more per missed payment, or prepayment penalties that could reach 2% of the remaining balance. Understanding these factors is crucial for effective financial planning and managing repayment schedules.

Collateral and Security Requirements

Flexible loan arrangements often require specific collateral and security conditions to mitigate lending risks. Common collateral types include real estate properties valued over $100,000, vehicles with fair market values exceeding $15,000, and liquid assets such as savings accounts with minimum balances of $5,000. Security requirements may necessitate a personal guarantee from the borrower, especially for loans exceeding $50,000, establishing accountability. Additionally, lenders may request a lien on inventory or accounts receivable for business loans, ensuring recovery in case of default. Understanding these components can facilitate smoother loan negotiations and enhance approval chances.

Conditions and Covenants

A flexible loan arrangement often encompasses various conditions and covenants that outline the responsibilities and obligations of both the lender and the borrower. Key provisions include financial covenants such as maintaining specific debt service coverage ratios (often at least 1.25 times), limiting total debt relative to earnings before interest, taxes, depreciation, and amortization (EBITDA), and restrictions on further borrowings without lender consent. Loan terms may require periodic reporting of financial statements to ensure compliance with agreed-upon metrics. Breach of covenants could trigger penalties, including increased interest rates or immediate repayment demands. The borrower might also need to maintain insurance on collateral assets, such as property or equipment, with the lender named as an additional insured. Timely updates on any significant operational changes, such as mergers, acquisitions, or ownership changes, are typically mandated to keep the lender informed of the borrower's financial health and risk profile.

Comments