Are you considering applying for a loan but unsure about your eligibility? Navigating the world of loans can be overwhelming, but understanding what lenders look for can ease your concerns. In this article, we'll break down the key factors that influence loan eligibility and provide you with a handy template for your inquiry. So, grab a cup of coffee and get ready to empower yourself with knowledgeâlet's dive in!

Subject line clarity

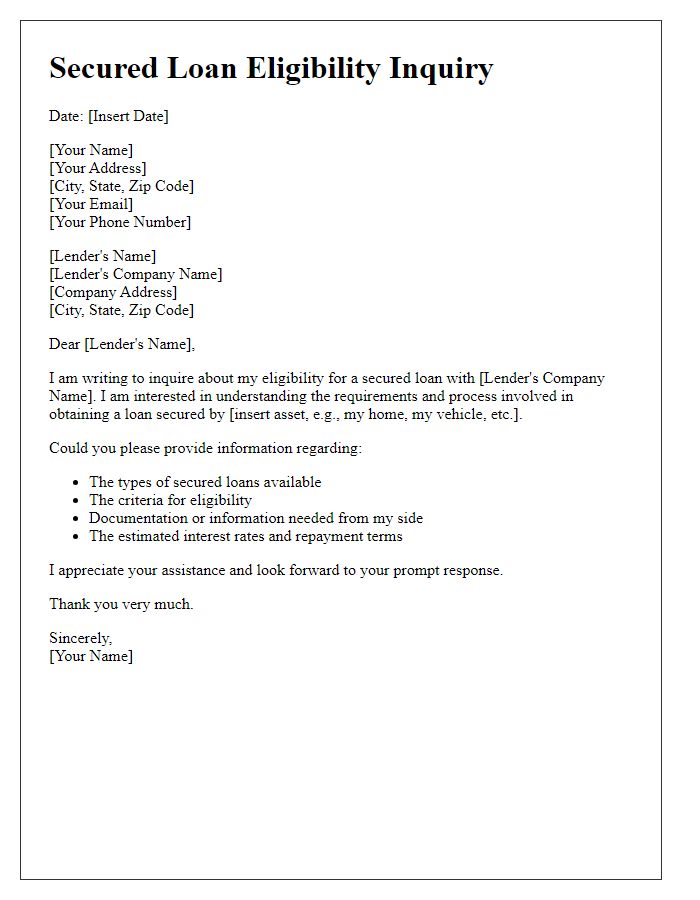

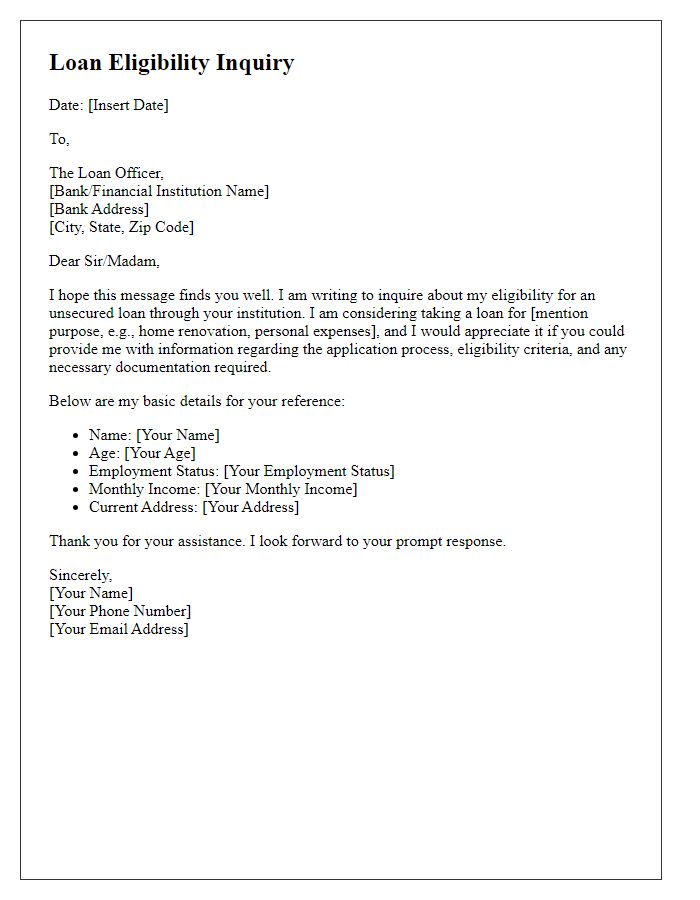

Loan eligibility inquiries are crucial for understanding individual financial options and requirements. A clear subject line often includes essential details, facilitating quick communication with financial institutions. For example, "Inquiry Regarding Personal Loan Eligibility - [Your Name]" immediately informs the recipient of the topic and the individual's identity. Additionally, including a date or specific loan type can enhance clarity, such as "Home Loan Eligibility Inquiry - January 2024 - [Your Name]." Effective subject lines improve email response rates and streamline the application process for potential borrowers seeking accurate financial information.

Personal information accuracy

Loan eligibility checks often require precise personal information verification. Key elements include full name, date of birth, and social security number, crucial for identity verification. Inaccuracies in these details can lead to significant delays in processing or even denial of the loan application. Financial institutions, such as banks (e.g., Bank of America or Wells Fargo), emphasize the importance of accurate contact details, including current address and phone number, which are essential for communication throughout the loan process. Employment information, such as job title and income specifics, must align with official documents to enhance approval chances. Data integrity supports legal compliance with regulations, such as the Fair Lending Act, ensuring equality in loan opportunities.

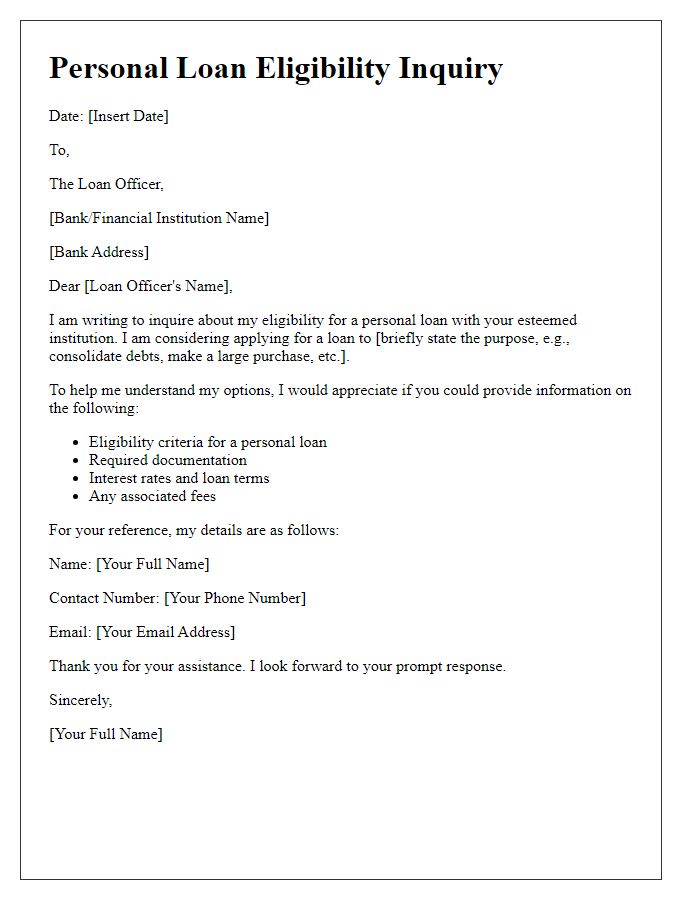

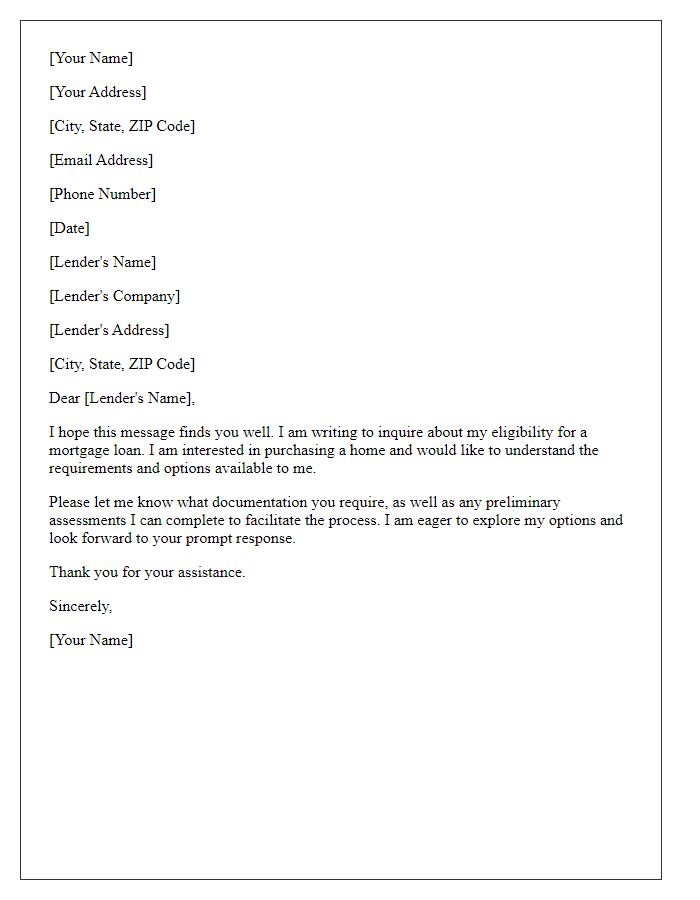

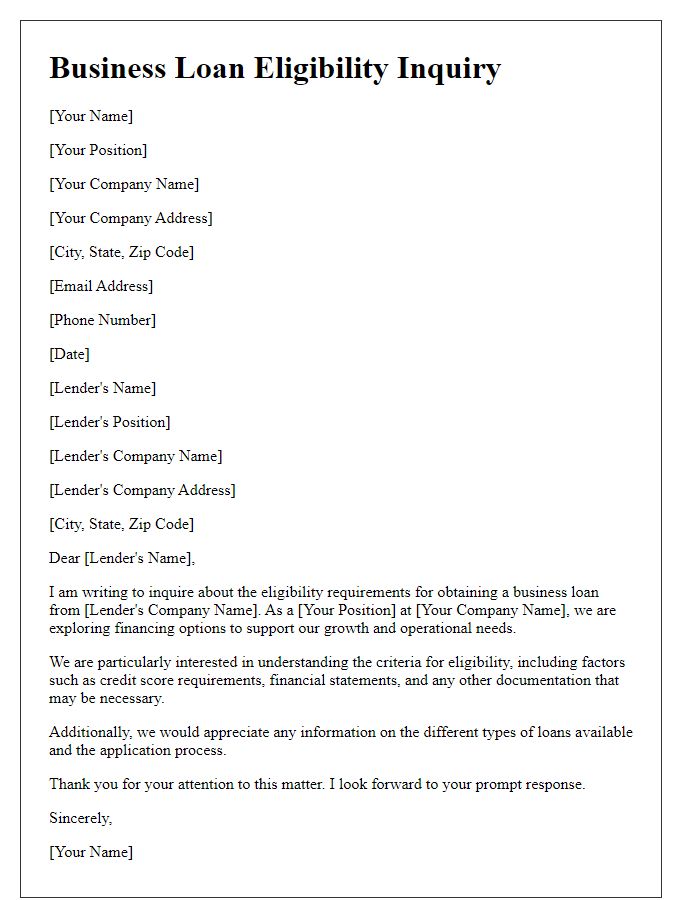

Purpose of inquiry

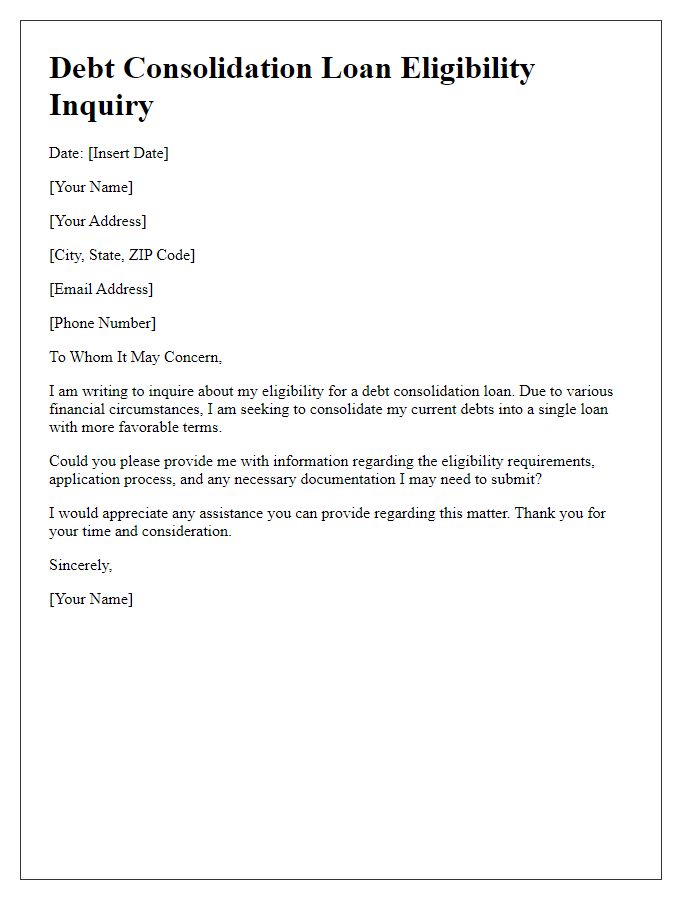

Loan eligibility inquiries often revolve around essential financial considerations necessary for achieving favorable terms in financing. Prospective borrowers, such as individuals or small business owners, seek clarity on specific eligibility criteria required by lending institutions, including credit scores (typically above 650 for conventional loans), annual income levels (often a minimum of $50,000), and debt-to-income ratios (usually not exceeding 43%). By understanding these factors, applicants can better prepare their financial documentation, such as tax returns, pay stubs, or bank statements, which lenders in regions like New York or California typically require. This inquiry serves as a strategic step in navigating the lending landscape effectively, ultimately aiding borrowers in aligning their financial profiles with lender expectations.

Financial details presentation

Loan eligibility inquiries require a comprehensive presentation of financial details, including income, expenditures, debts, and assets. Potential borrowers must prepare a detailed report including monthly income, such as salary from employment or business revenue, typically presented in net amounts (after tax deductions). A thorough disclosure of monthly expenses, like housing costs, utilities, and transportation, should also be included for proper assessment. Outstanding debts, such as credit card balances or student loans, must be accurately reported, showcasing the total amounts owed and monthly payment obligations. Additionally, listing significant assets, including savings accounts, real estate, and investments, is essential to provide lenders with a clear view of financial stability and capacity to repay the loan. Providing this information will facilitate a smoother review process by lending institutions.

Contact information inclusion

A loan eligibility inquiry typically involves assessing personal financial circumstances and the potential lender's requirements. Key details in such inquiries often include the applicant's full name, contact information including phone number and email address, current address, employment status, annual income, credit score, and the desired loan amount. Accurate and complete contact information ensures effective communication and expedites the loan approval process. Providing all relevant details enhances the lender's ability to review the application efficiently and facilitates a smoother borrowing experience for applicants.

Comments