Losing your job can be a devastating experience, and navigating financial obligations during this challenging time can feel overwhelming. If you're seeking relief from your loan payments, understanding the process of deferment can provide a much-needed breath of fresh air. In this article, we'll break down the steps to request a loan deferment and share helpful tips to make the process smoother. So, let's dive in and explore how you can effectively manage your finances during this transition!

Personal and Financial Information

Job loss due to unforeseen circumstances can create financial strain, making it challenging to maintain loan payments. When requesting a loan deferment, providing personal and financial information is crucial. Key details include personal name, contact information, and employment status (recent job termination). Financial information encompasses monthly income (which may have drastically decreased or stopped) and current expenses (including necessities such as rent, utilities, and food). Documentation like termination letters or proof of unemployment can substantiate the request for deferment. It is important to understand that many lenders, including banks, credit unions, and private institutions, may have specific guidelines for deferment requests based on individual circumstances at the time of application.

Explanation of Job Loss Situation

Job loss can significantly impact an individual's financial stability, leading to challenges in meeting loan obligations. Economic factors such as the COVID-19 pandemic have resulted in widespread layoffs across various sectors, including hospitality, retail, and manufacturing, affecting millions in the United States. Anxiety over housing insecurity and unpaid bills can arise, especially when unemployment benefits may not cover existing financial commitments. In some cases, individuals may be eligible for federal assistance programs or relief measures provided by their lenders. It is crucial to communicate proactively with loan servicers to explain the situation, outlining specific details such as the date of job loss, current employment status, and any efforts made to secure new employment. This transparent approach can facilitate a better understanding and potentially lead to favorable loan deferment options.

Request for Deferment Details

Due to recent job loss, individuals often seek loan deferment options to alleviate financial stress during this challenging period. Lenders, including major banks such as JPMorgan Chase or Bank of America, often provide specific programs designed for temporary relief. These programs may offer deferred payments without penalties for a set duration, typically ranging from three to six months. Documentation, such as a termination letter from the employer or proof of unemployment benefits, is usually required to initiate the process. Interested borrowers should contact their lender's customer service or check the website for detailed instructions, eligibility criteria, and specific forms needed to apply for deferment.

Supporting Documentation

Job loss related loan deferment requires comprehensive supporting documentation to verify eligibility. Important documents include official termination letters from employers dated within the last six months, unemployment insurance claim confirmations, and recent pay stubs to illustrate income changes. Financial statements displaying current bank balances and monthly expenses provide insight into financial hardship. It is also beneficial to include a completed loan deferment request form, outlining personal information, loan details, and specific reasons for the deferment request. All documentation must be organized in a clear manner, ensuring easy review by financial institutions. Properly submitted materials can streamline the deferment process and facilitate timely financial relief during unemployment.

Contact Information for Follow-up

Job loss can create significant financial stress, leading many individuals to seek options for loan deferment. In circumstances where employment is terminated, borrowers may contact their loan servicer to discuss available options for deferment, which typically requires documentation like a termination letter or unemployment benefits statement. Financial institutions, such as credit unions or banks, often provide specialized customer service representatives to assist borrowers in navigating their deferment options. Contact information varies by institution, but it usually includes a dedicated phone number, an email address, and a website for online account management. Borrowers should be prepared to provide account details and personal identification during these communications. Access to local support services or community organizations can also provide additional resources for individuals facing job loss and financial uncertainty.

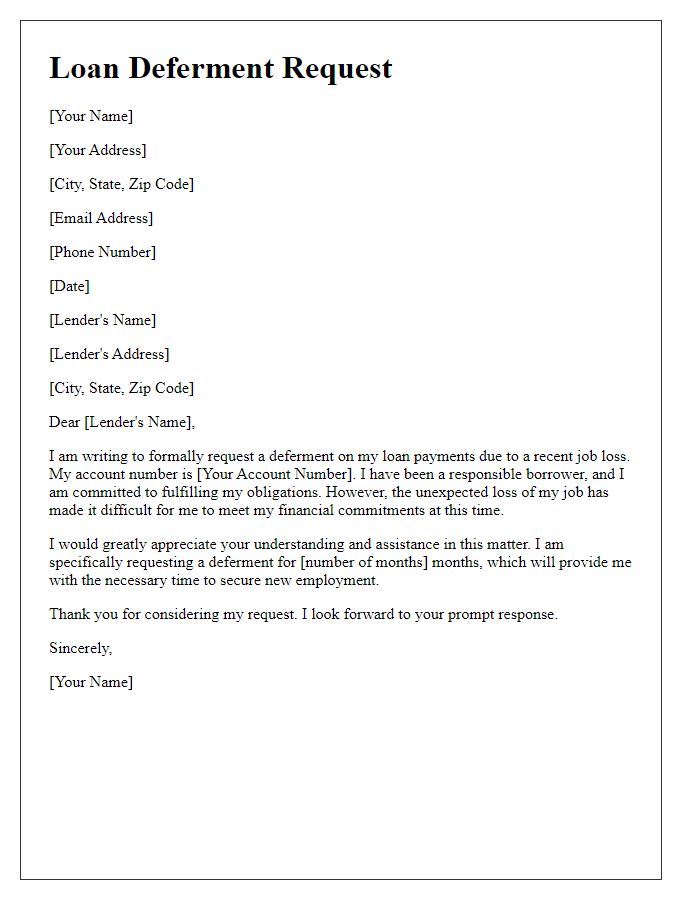

Letter Template For Job Loss Loan Deferment Samples

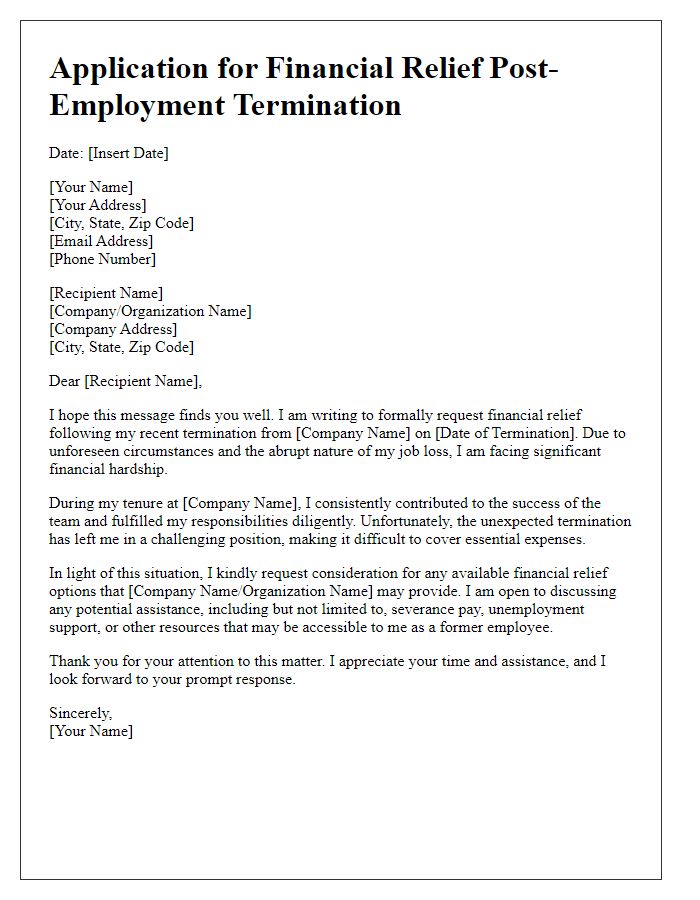

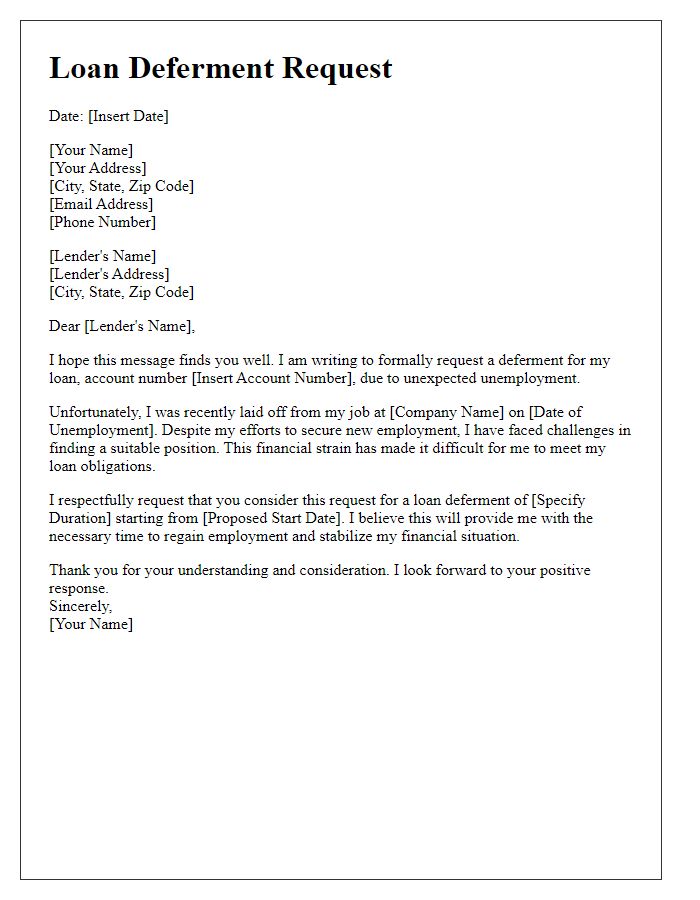

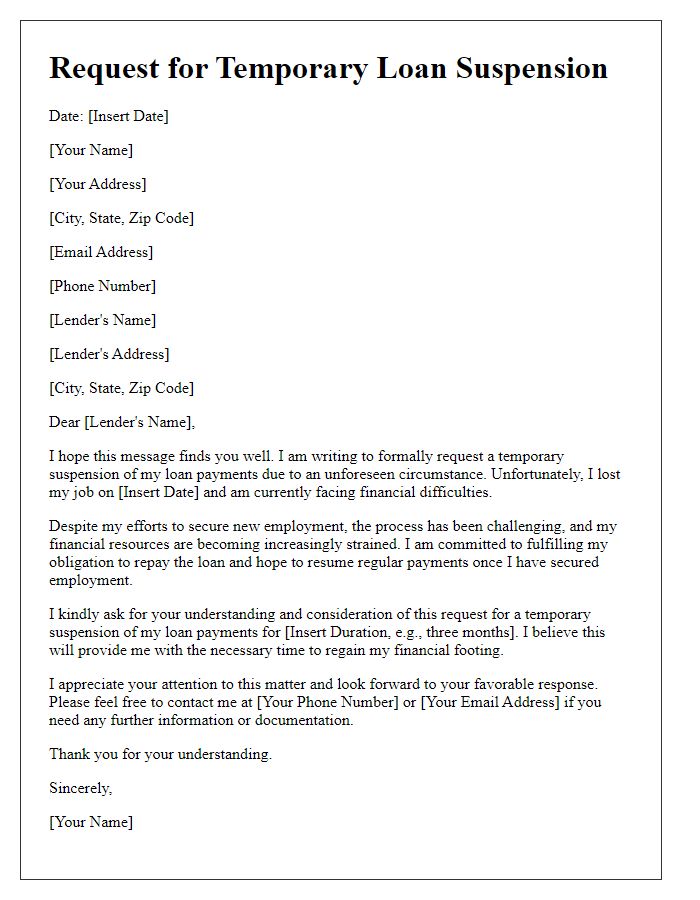

Letter template of application for financial relief post-employment termination.

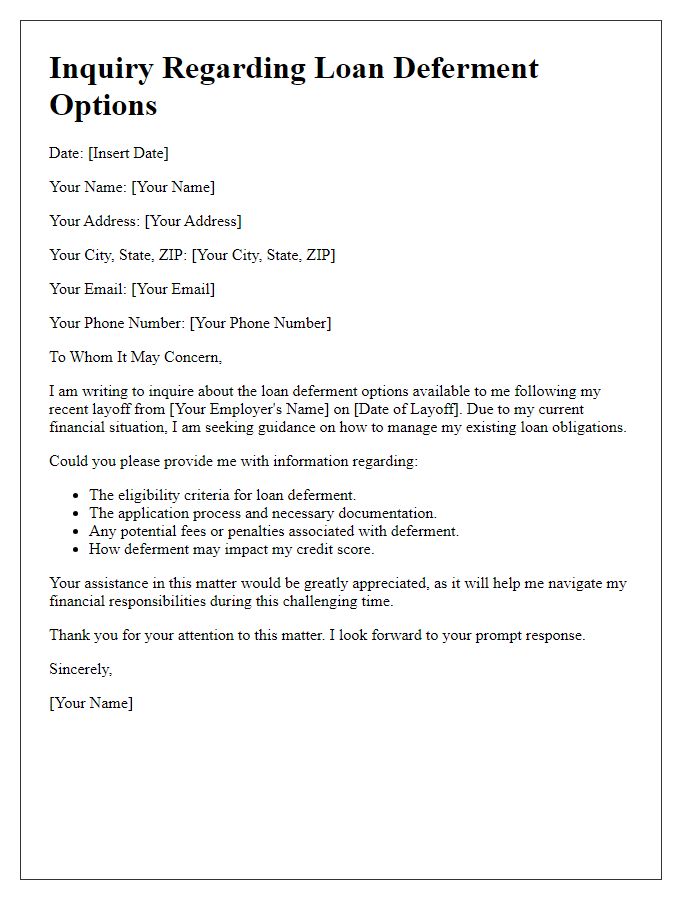

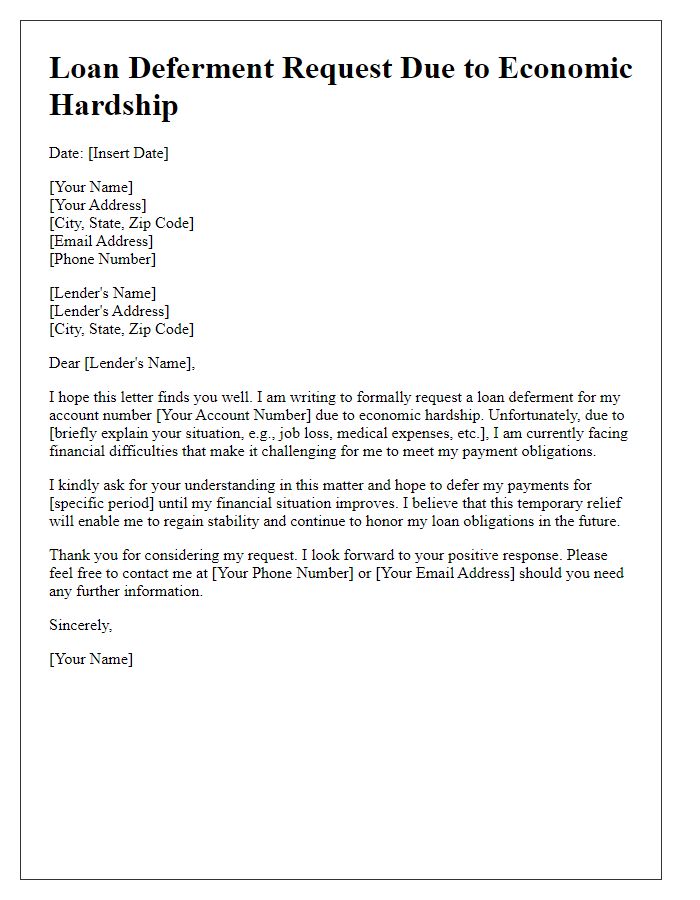

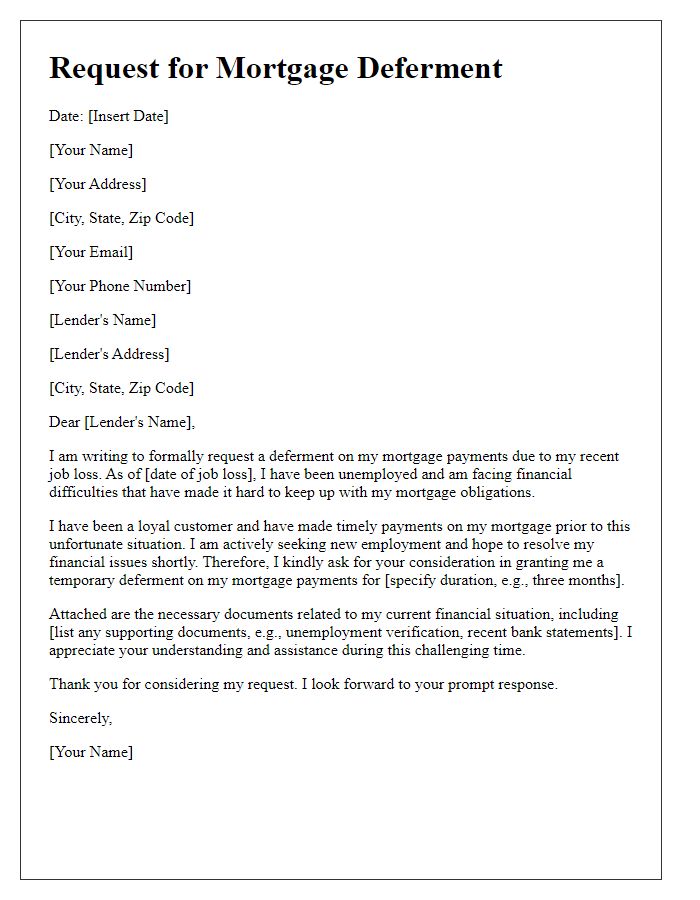

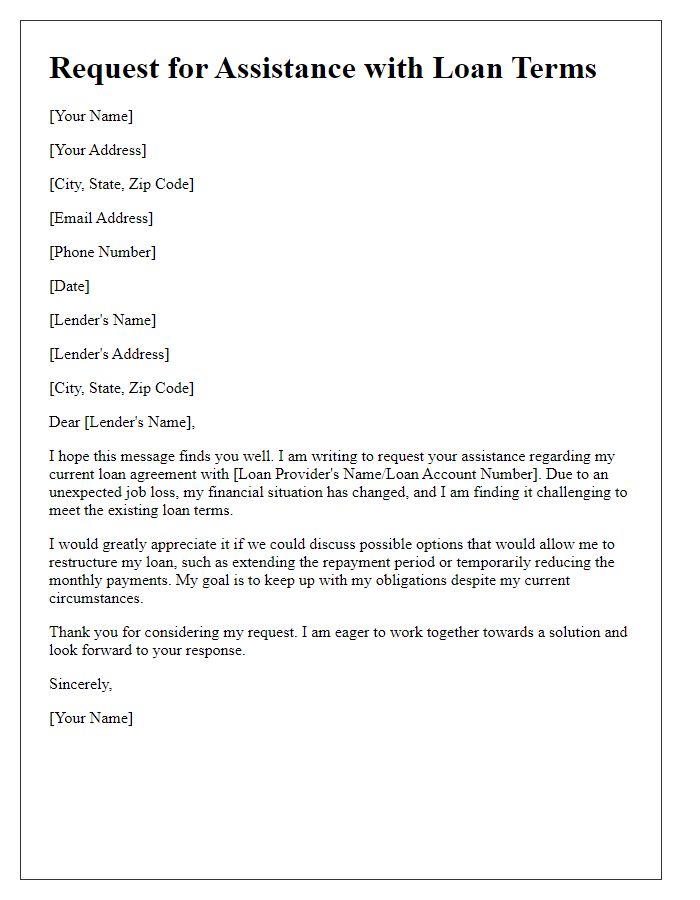

Letter template of inquiry regarding loan deferment options after layoff.

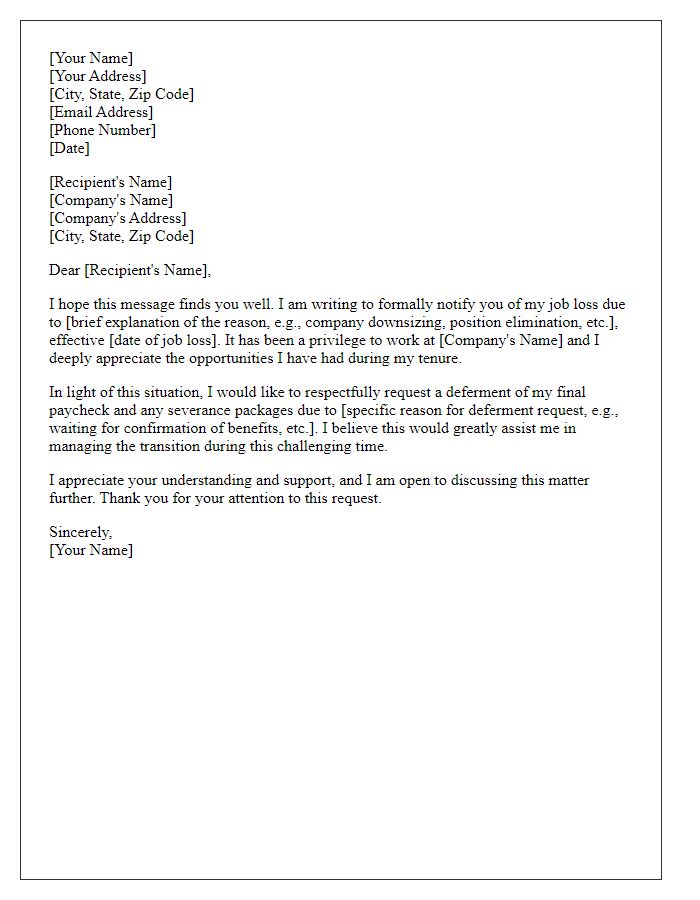

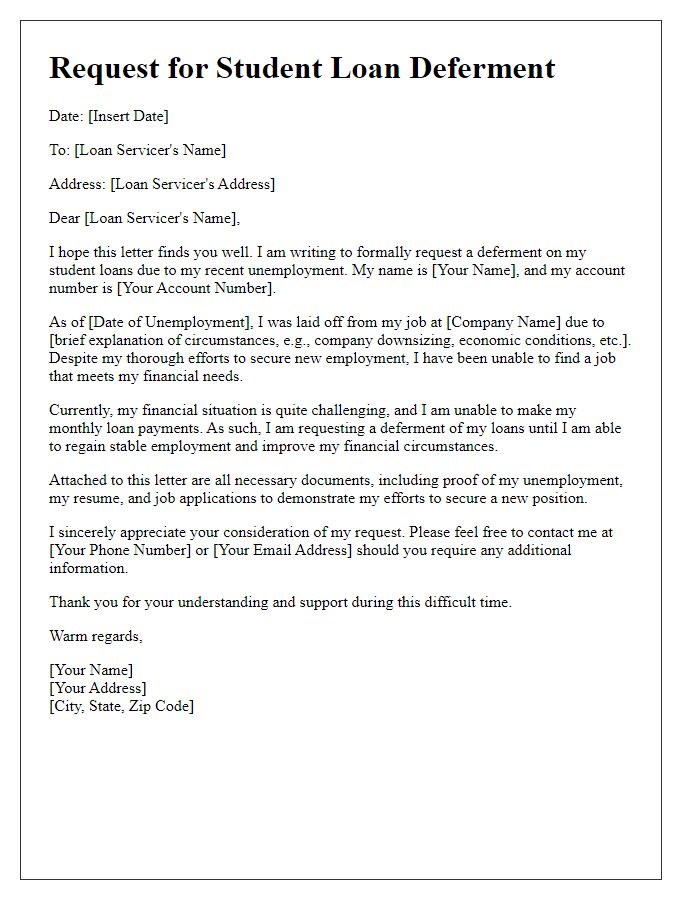

Letter template of formal notification of job loss and deferment request.

Letter template of explanation for loan deferment following unexpected unemployment.

Letter template of notice for seeking loan deferment due to economic hardship.

Letter template of appeal for student loan deferment due to recent unemployment.

Comments